AzriSuratmin

One of the small, growing, under-covered gems of a company that I wrote about last year on Veterans Day is a federal government contractor called DLH Holdings Corp. (NASDAQ:DLHC). In that article I discussed that DLH was named one of the fastest growing companies in Georgia in 2020, and the federal government had just passed a Covid vaccine mandate, boosting the contract awards for DLH with agencies such as FEMA, VA, and CDC. Those awards were generally tied to healthcare and human services work in support of health care initiatives at those and other agencies. The company had already recently completed an acquisition (their third in 3 years) in 2020 of a privately held company called Irving Burton Associates, improving their DOD contract opportunities.

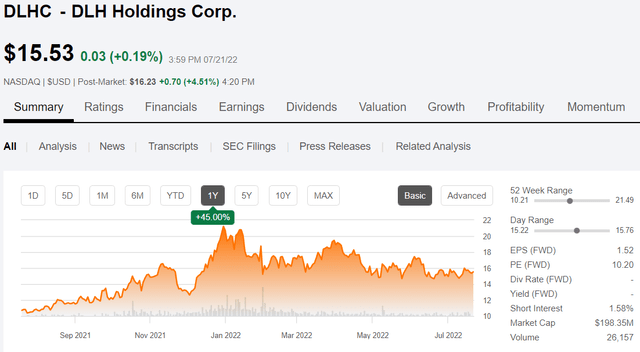

The price action for DLHC (the stock) has been mostly sideways in the past 9 months. I rated the stock a Strong Buy in November when it was trading at $16.21, and it rose to a 52-week high of $21.49 in January, before retreating to the mid-$15 range where it is now. At the current price of $15.53 as of the close on 7/21/22 with a forward P/E of 10.2, I still rate this stock a Strong Buy.

DLHC 1-year price chart (Seeking Alpha)

Since my last article in November, they have reported two more quarters of earnings reports. On January 31, 2022, they reported Q1 earnings (they operate on a fiscal year ending in September, to coincide with federal fiscal year). During that quarter they beat earnings estimates by $0.07 with $0.55 EPS and missed revenue estimates coming in with revenue of $152.8M, just $5.2M shy of estimates, but representing 164% YOY growth. At that time, the company management felt that they were in good shape going forward in 2022 as well and that perspective was summarized by the management discussion from the January earnings report:

“We delivered another solid quarter of growth at the start of fiscal 2022, resulting in outstanding performance that reflects the contribution of two short-term contracts, awarded by the DHS’ FEMA organization, for COVID-19 countermeasures and contingency assistance in Alaska,” said DLH President and Chief Executive Officer Zach Parker. “Excluding these programs, revenue rose almost $4.0 million year-over-year or approximately 7%. While timing for the federal budget remains uncertain – and another continuing resolution is certainly possible – we feel confident that our array of offerings, and recent wins, position us well for fiscal 2022.”

The company continued the beats in the fiscal second quarter (quarter ending in March) of 2022 based on the earnings report in May. The earnings reported of $0.50 exceeded estimates by $0.17 and revenues of $108.7M beat estimates by $13.5M. The focus for the quarter was on paying down debt and improving the balance sheet, while the uncertainty over future contract opportunities remained. Term debt was reduced during the quarter to $37.5M. Excluding short-term revenue from the Alaska FEMA contracts, the overall business expanded by 12% YOY. Also, progress was made on the prospects for additional work in the remainder of 2022 as explained in this comment from the Q2 earnings report:

“With passage of the fiscal 2022 omnibus appropriations bill in March, contract decision-making should accelerate – at the same time DLH is expected to benefit from obtaining FedRamp authorization for its Infinibyte® data analytics solutions. We are pleased with the progress we are making to strengthen and diversify our capabilities across the key federal markets we serve. While focused on paying down debt and improving the balance sheet, we continue to actively look at potential acquisitions that may enhance and broaden our portfolio of technology-enabled applications. It’s an exciting time at DLH, with many opportunities ahead of us – leveraging our leadership position in innovative, healthcare-related services and solutions to build a unique, customer-centric enterprise that, at the same time, creates value for our shareholders.”

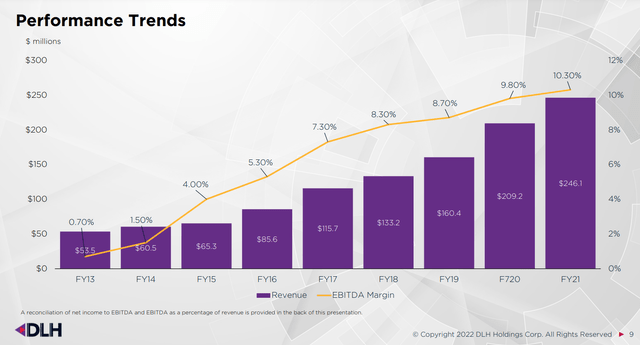

Revenues and margins have been improving for most of the past 9 years as illustrated in this slide from the April investor presentation.

DLHC financial performance (April investor presentation)

With at least 4 consecutive quarters of earnings beats and the fiscal 3rd quarter coming up, DLH is poised to continue to outperform the broader market, despite the recent unsteady price action in the stock.

Outlook for 2022 Government Contract Opportunities

Given the geopolitical environment, shifting initiatives between the war in Ukraine, climate change, inflation, rising gas prices, and so on, government contractors need to be agile and have the ability to shift resources to adjust. According to one source, the outlook for 2022 government contracting is likely to remain uncertain but with opportunities to pursue additional work.

Government contractors find themselves in a period being shaped by significant geopolitical conflict, collaboration among allied nations, and heightened alert to protect the homeland. Defense contractors are juggling current domestic and international demand while positioning for the future of defense. Many civilian agencies, meanwhile, are strategizing around future opportunities that align with the Biden administration’s climate and public health priorities.

One way that DLH is pursuing new business opportunities is through the Infinibyte Cloud solution that received FedRAMP authorization in March. The FedRAMP program provides a standardized approach to security and risk assessment for cloud technology adoption in government agencies. The Infinibyte solution is a PAAS (Platform as a Service) offering that provides virtual servers that can support web hosting, databases, and applications in a flexible, secured, highly available cloud environment.

Recent Contract Awards

Since the March quarter, DLH has received 3 significant contract awards. On April 21, 2022, DLH announced award of the contract renewal with NIDDK:

National Institute of Diabetes and Digestive and Kidney Diseases (“NIDDK”). NIDDK is an institute of the National Institutes of Health (“NIH”). DLH has held this work since this contract was first awarded in 1987. The contract includes a base period of one year with four one-year options, for a total value of approximately $14 million. Under this award, DLH will support NIDDK led research into diabetes, digestive, kidney, and other chronic diseases through epidemiological research and biostatistical consultation, data management, statistical programming, data analysis, cloud computing, machine learning, and natural language processing. DLH will also collaborate and coordinate with the National Center for Health Statistics (“NCHS”) in planning, developing, and implementing surveys.

Then on May 25, 2022, DLH announced that they were awarded an ID/IQ contract with the DOD. The company will have to compete for individual task orders for military medical research and development as part of the overall contract that is not to exceed $10B. Task orders to be awarded under this contract umbrella represent potentially significant sources of future revenue.

And most recently, the company announced on July 11 that they were awarded a new contract with the National Cancer Institute’s Division of Cancer Epidemiology and Genetics. Another ID/IQ contract with a cap of $320M for all awardees, DLH was selected by way of their Social and Scientific Systems, Inc. subsidiary, to bid on every task area covered by the contract.

Ratings and Growth Potential

There is only 1 Wall Street analyst following DLHC, and they give it a Strong Buy rating.

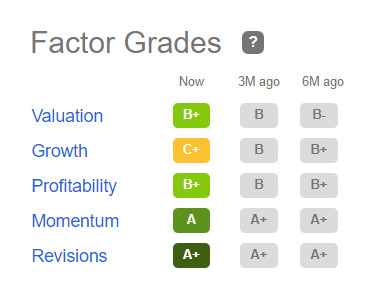

The SA quant rating also suggests a Strong Buy with very good factor grades in all but the Growth category.

DLHC quant factor grades (Seeking Alpha)

It is possible that growth is slowing somewhat, possibly due to the current market and geopolitical environment that we find ourselves in this year. But in my estimation, DLH is well positioned to leverage existing and recently awarded contracts to keep the growth pipeline flowing for at least the remainder of 2022 and most likely into 2023, depending on what happens with federal budget negotiations for the next fiscal year.

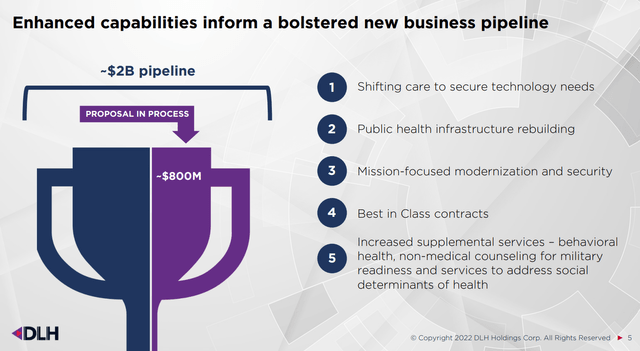

I think that this slide from the April earnings presentation sums up the growth potential succinctly.

DLH business pipeline (April 2022 investor presentation)

Conclusion and Summary

In my opinion, DLHC is a Strong Buy at current prices below $16 and represents an excellent opportunity for growth-oriented investors to buy into a small but growing and financially strong company that has excellent long-term potential. For the remainder of 2022 and into early 2023 the pipeline for new work is robust and federal spending is not likely to slow down unless we enter a full-blown recession, and the brakes are applied to all aspects of the economy.

The current geopolitical and market environments are volatile and do pose risks to a small company that is highly dependent on federal agency budgets. To be successful, the DLH business needs to remain agile and able to adapt to changing conditions both within the federal agencies they work with, as well as the broader community at large. As long as they do that and keep on bringing in new business and continue to provide high-quality services to existing contracts, the stock should outperform over the coming years.

Be the first to comment