gesrey

There were so many great suggestions leading up to week 80 that my watchlist is overflowing with ideas for new positions. After careful consideration and scanning through research STORE Capital Corporation (STOR) and Vornado Realty Trust (VNO) have found their way into the Dividend Harvesting Portfolio. The Dividend Harvesting Portfolio now has a projected annual income of $576.45 from 80 positions, yielding 7.25%.

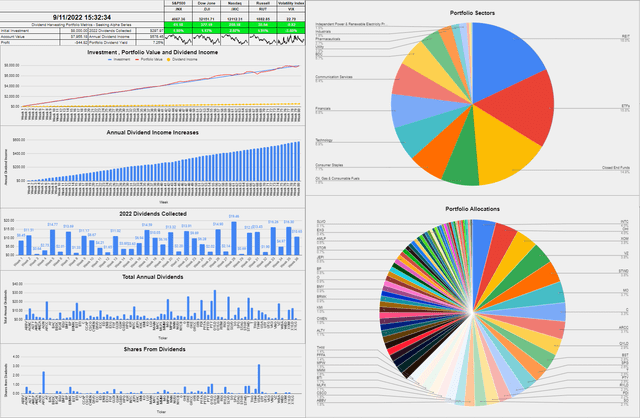

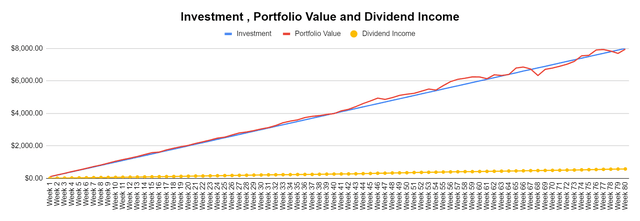

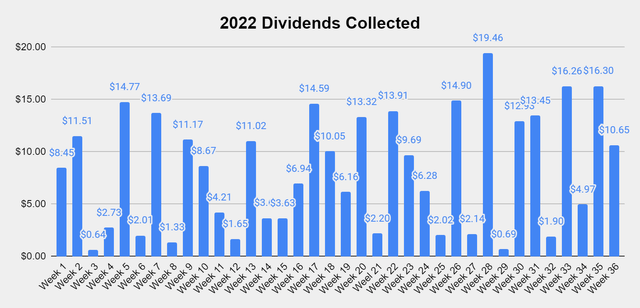

What a difference a week makes. At the close of week 79, the Dividend Harvesting Portfolio was down -2.62% (-$206.97), and in week 80, it’s almost back to even. In week 80, the Dividend Harvesting Portfolio closed with an account value of $7,955.18, which left it in the red by -0.56% or -$44.82. After 80 consecutive weeks, The Dividend Harvesting Portfolio has closed in the black 87.5% (70/80) of the time and has trended close to its baseline of invested capital. In week 80, I collected $10.65 of dividend income which increased my total dividends collected in 2022 to $297.97. The new positions have increased the never-ending cycle of dividends as there are now 592 individual dividends being produced annually within this portfolio. As the next several week’s progress, I plan on dollar cost averaging into several positions, and unless something really catches my eye, I am not planning on adding new investments to the Dividend Harvesting Portfolio.

I allocate capital toward big tech, funds, dividends, and growth outside of my retirement accounts. These are not my only investments, but I did open a separate account, so I could easily track and document this series. I intentionally created broad diversification throughout the Dividend Harvesting portfolio so I could benefit from sector rotations and mitigate my downside risk. Investors who are too exposed to growth companies or large-cap tech have gotten crushed as the investment landscape changes. On the growth and tech side of my investments, I am feeling the pain as some of my favorite companies, including Alphabet (GOOGL) (GOOG), Amazon (AMZN), and Meta Platforms (META), have been taken to the woodshed.

I am going to address a question that continues to surface. I am not trying to beat the market with this portfolio. I love index funds and am invested in several index funds. I love dividend investing due to the stream of cash flow it generates. I don’t want 100% of my assets outside of real estate tied to an S&P index fund. I have created a personal investment strategy that works to achieve my investment goals, and having a stream of income generated from dividends is part of my investment strategy. Low-cost index funds are one of the best investments anyone can make in my opinion, and the Dividend Harvesting portfolio is not meant to be a substitute for an index fund. I have read many questions about dividend investing and wanted to start a portfolio from the ground up and document its progress to disprove many misconceptions, including that you need a large amount of seed capital to make dividend investing work for you.

This series has never been about hitting a target yield, generating a certain amount of profit, or beating the market. I had two specific goals with this series. The first was to create a blueprint for constructing a dividend portfolio by documenting the journey starting from the beginning. The second goal was to illustrate how allocating capital each week toward investing, regardless of the amount, would be beneficial in the long run.

Too many people are under the illusion that you need tens of thousands or even hundreds of thousands to benefit from investing. Instead of using my real dividend portfolio as an example, I decided to start a new account, fund it with $100, and add $100 weekly, providing a step-by-step guide to dividend investing. This methodology doesn’t have to be used for dividend investing, and it could be as simple as an S&P index fund or a Total Market fund. Hopefully, this series is inspiring people to invest in their future to attain financial freedom.

A Historical Recap of the Dividend Harvesting Portfolio’s Investment Principles and Historical Performance

Investment Objectives

- Income generation

- Downside mitigation through diversification

- Capital appreciation

Below are the fundamental rules I have put in place for this Portfolio:

- Allocate $100 weekly to this Portfolio

- Only invest in dividend-producing investments

- No position can exceed 5% of the Portfolio

- No sector can exceed 20% of the Portfolio

- All dividends & distributions are to be reinvested

Below is a chart that extends from week 1 through the current week to illustrate the Dividend Harvesting Portfolio’s Progression

- Blue line is my initial investment $100 in week 1, $1,000 in week 10, etc.

- Red line is the account value at the end of each week

- Yellow line is the annual dividend income the Dividend Harvesting Portfolio was projected to generate after that week’s investments and dividends reinvested

The Dividend Harvesting Portfolio Dividend Section

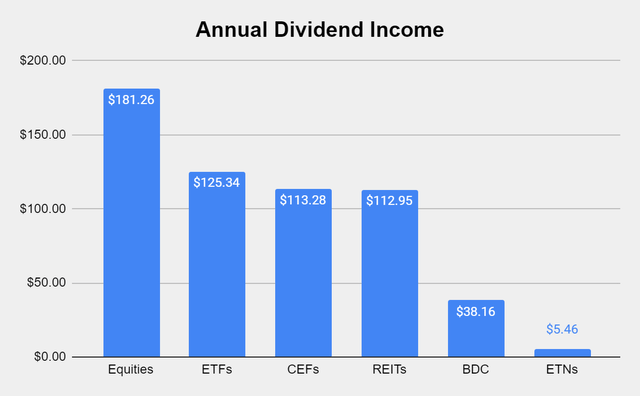

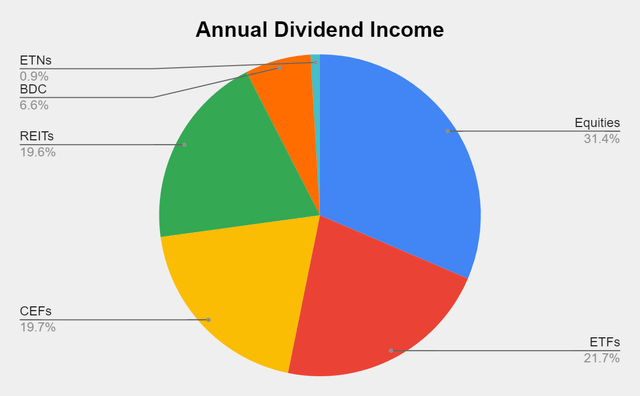

Here is how much dividend income is generated per investment basket:

- Equities $181.26 (31.44%)

- ETFs $125.34 (21.74%)

- CEFs $113.28 (19.65%)

- REITs $107.75 (19.59%)

- BDC $38.16 (6.62%)

- ETNs $5.46 (1%)

Steven Fiorillo Steven Fiorillo

Collecting dividends can serve many functions in a portfolio. Some investors utilize dividends to supplement their income and live off. I am building a dividend portfolio for myself 30 years into the future. Since I am reinvesting every dividend, they serve multiple purposes today. In 2022 alone, I have collected $297.97 in dividend income from 350 dividends across 36 weeks. This has allowed the Dividend Harvesting portfolio to stay in the black while growing the snowball effect.

These dividends allow me to gain additional equity in my investments while increasing my future cash flow in down markets. This style of investing isn’t for everyone, but if you’re looking to generate consistent cash flow while mitigating downside risk, this method has worked for me. I am hoping to collect between $450 and $500 in dividends in 2022, which will be reinvested, and finish the year generating >$700 in annual dividends.

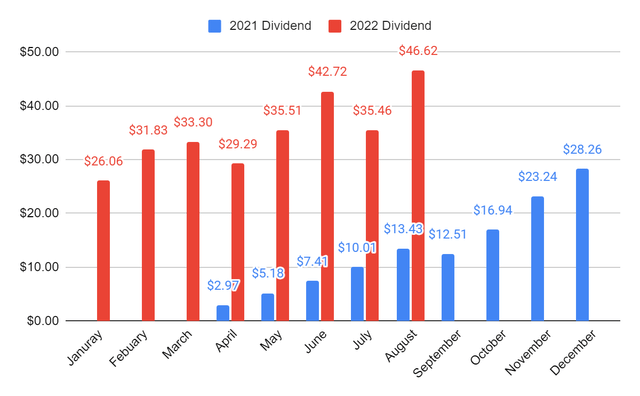

This next chart illustrates my monthly YoY dividend income progression. Since I started this series in April of 2021, that is where the dividend income starts, illustrated by the blue bars. My dividend income has increased substantially as April’s income has grown by 886.2% YoY, March 585.52% YoY, June 476.52% YoY, and July’s by 254.25% YoY.

The month of August has finished, and $46.62 of dividend income was generated and reinvested. This is a YoY increase of $33.19 or 247.13%. It will be interesting to see what happens as the years progress. I will continue plotting this chart at the end of every month, and at the end of March, I will show the annual YoY progression in dividend income generated.

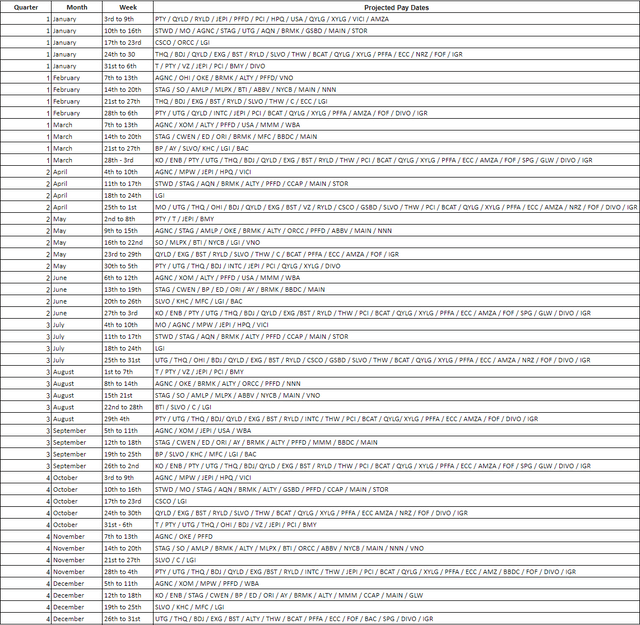

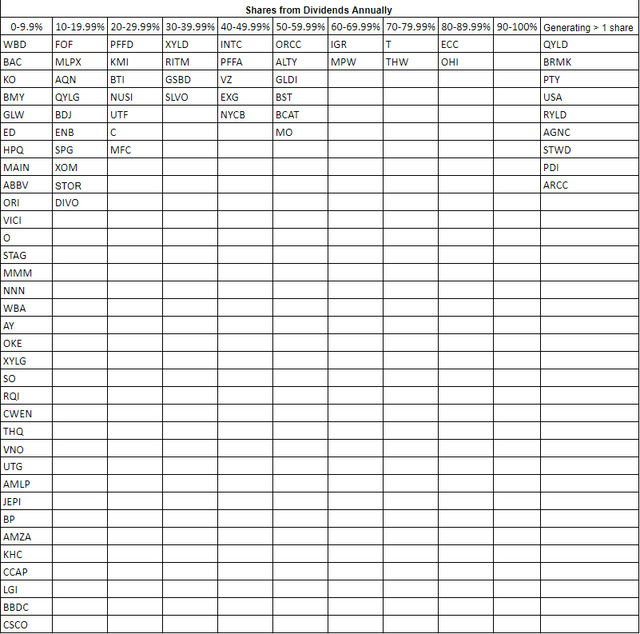

I changed this portion a bit. I am trying a new graphic to make this easier to read. Please let me know if you like the new graphic or the old graphic better.

I added STOR and VNO in week 80, which increased my annual dividends produced from 584 to 592. Each week income comes rolling in, and the snowball effect amplifies little by little. I am starting to wonder how many individual dividends will be produced over the next several years.

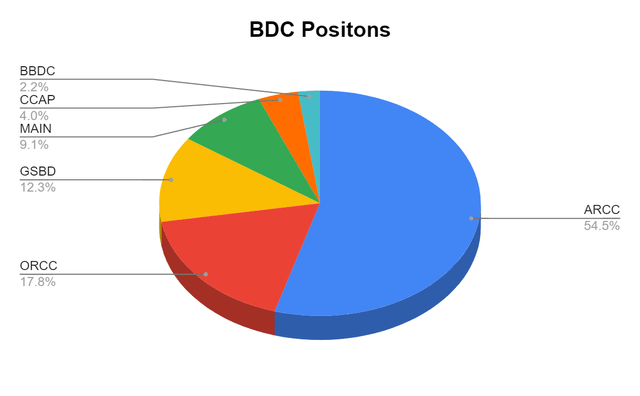

The goal of generating enough income from the dividends to purchase an additional share per year has been the never-ending project of this portfolio. There are now 9 total positions generating at least 100% of their share value in dividends within the Dividend Harvesting portfolio. By adding to ARCC and USA, these have become the newest addition to positions generating at least 1 share annually through their dividend income.

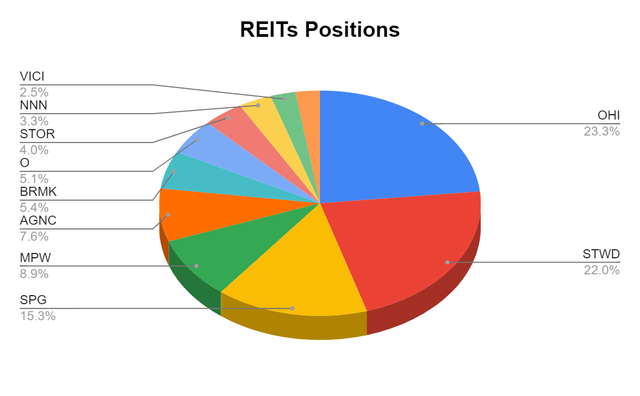

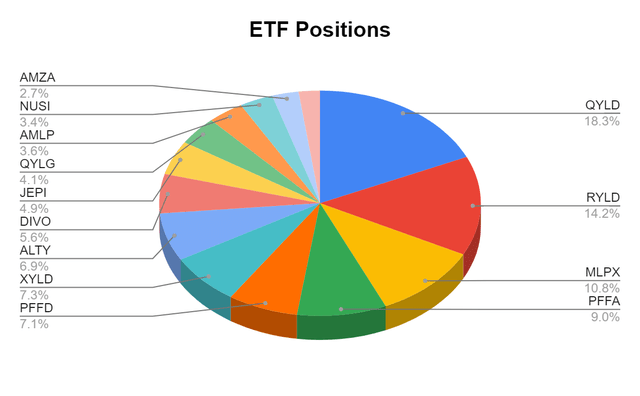

The Dividend Harvesting Portfolio Composition

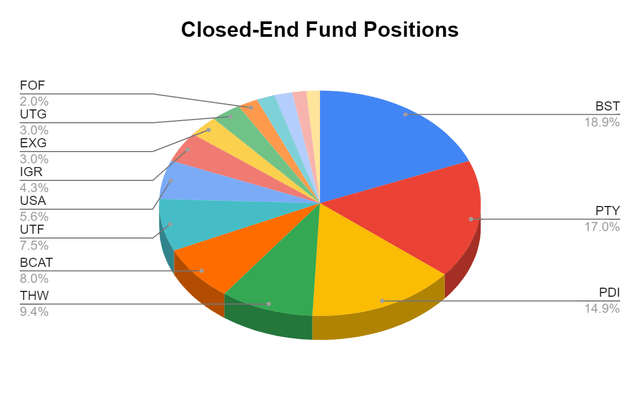

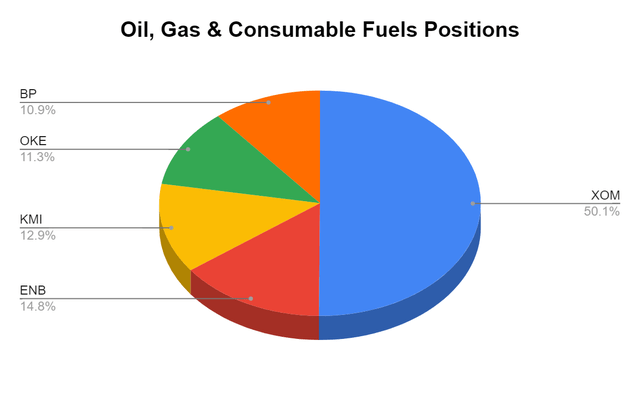

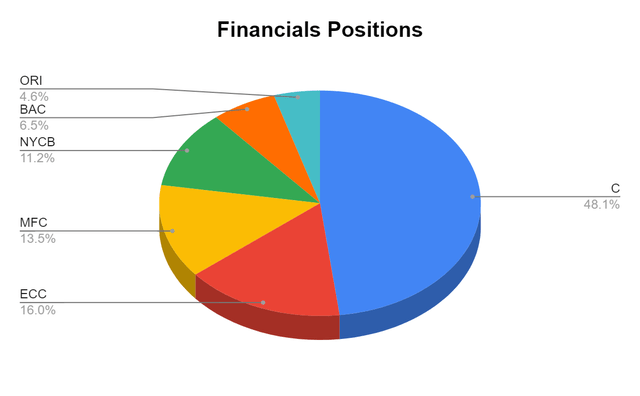

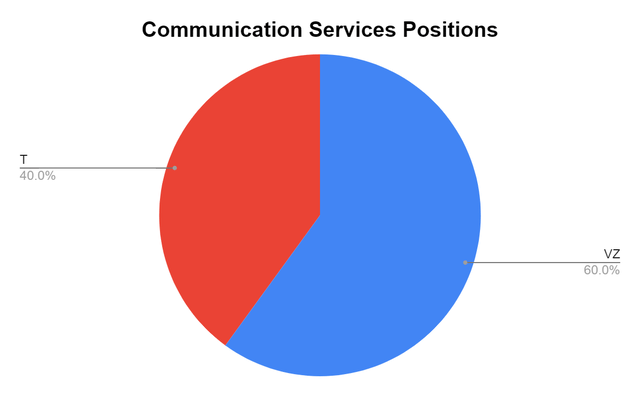

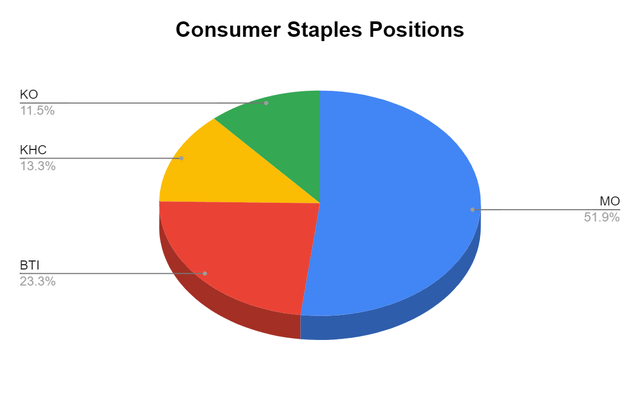

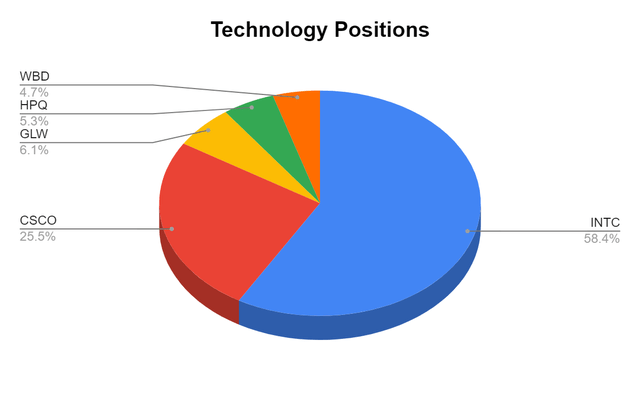

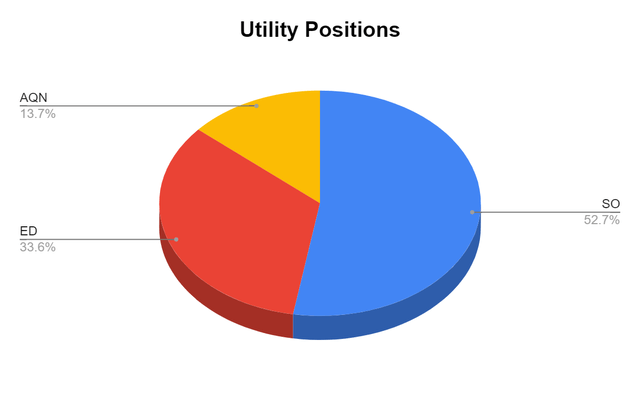

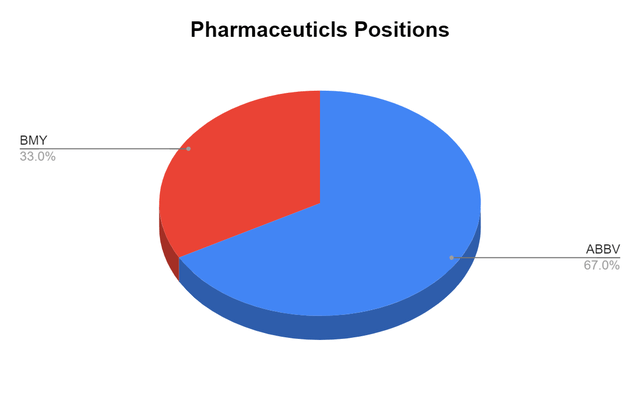

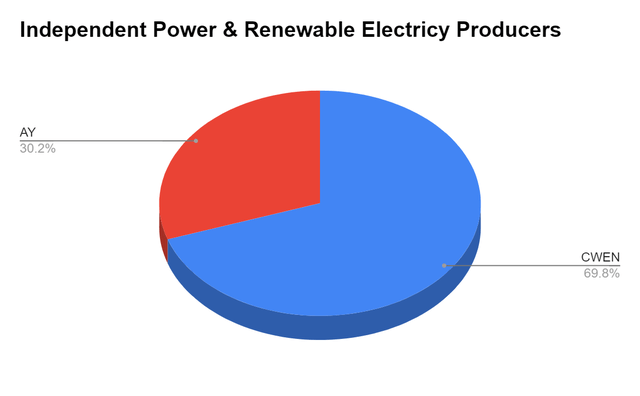

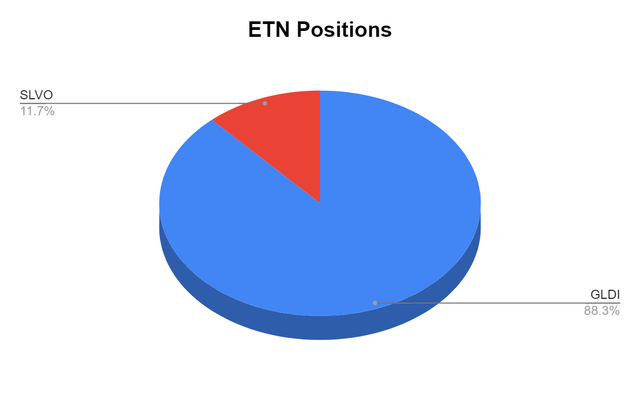

Many of the readers have asked if I could break down the individual positions within these sectors. I created pie charts for each individual sector and have illustrated how much each position represents of that sector of the Dividend Harvesting portfolio. Since I only have 1 position in Food & Staple Retailing and Industrials, I did not make a chart for those. 3M (MMM) and Walgreens Boots Alliance represent 100% of those sectors. The charts will follow the normal portfolio total I have constructed. Please keep the ideas coming, as I am happy to add as much detail to this series as I can.

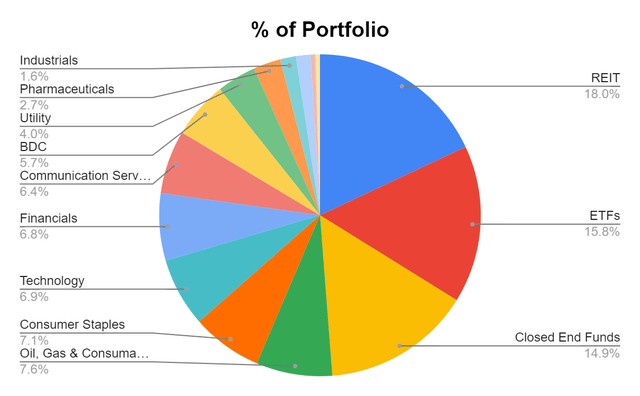

In week 80, REITs remained as the largest sector of the Dividend Harvesting portfolio as I added STOR and VNO to this side of the portfolio. REITs had a 17.97% portfolio weight, while ETFs maintained 2nd place, accounting for 15.78%. Individual equities make up 44.91% of the portfolio and generate 31.44% of the dividend income, while ETFs, CEFs, REITs, BDCs, and ETNs represent 55.09% of the portfolio and generate 68.66% of the dividend income. I have a 20% maximum sector weight, so when a singular sector gets close to that level, I make sure capital is allocated away from that area to balance things out. In 2022, I will make an effort to even out these portfolio percentages. As more capital is deployed, the bottom half of the portfolio weighting will increase.

|

Industry |

Investment |

Portfolio Total |

% of Portfolio |

|

REIT |

$1,429.84 |

$7,955.18 |

17.97% |

|

ETFs |

$1,255.43 |

$7,955.18 |

15.78% |

|

Closed End Funds |

$1,185.38 |

$7,955.18 |

14.90% |

|

Oil, Gas & Consumable Fuels |

$606.33 |

$7,955.18 |

7.62% |

|

Consumer Staples |

$563.58 |

$7,955.18 |

7.08% |

|

Technology |

$549.02 |

$7,955.18 |

6.90% |

|

Financials |

$537.25 |

$7,955.18 |

6.75% |

|

Communication Services |

$505.94 |

$7,955.18 |

6.36% |

|

BDC |

$454.61 |

$7,955.18 |

5.71% |

|

Utility |

$313.81 |

$7,955.18 |

3.94% |

|

Pharmaceuticals |

$217.22 |

$7,955.18 |

2.73% |

|

Industrials |

$125.69 |

$7,955.18 |

1.58% |

|

Independent Power & Renewable Electricity Producers |

$117.56 |

$7,955.18 |

1.48% |

|

Food & Staple Retailing |

$36.24 |

$7,955.18 |

0.46% |

|

ETN |

$37.79 |

$7,955.18 |

0.47% |

|

Cash |

$19.53 |

$7,955.18 |

0.25% |

Steven Fiorillo Steven Fiorillo Steven Fiorillo Steven Fiorillo Steven Fiorillo Steven Fiorillo Steven Fiorillo Steven Fiorillo Steven Fiorillo Steven Fiorillo Steven Fiorillo Steven Fiorillo Steven Fiorillo

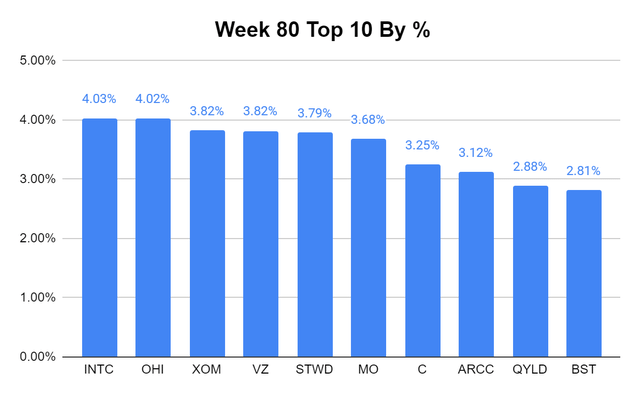

In week 80, Intel Corporation (INTC), and Omega Healthcare Investors (OHI) remained the largest individual positions within the Dividend Harvesting Portfolio. The portfolio is starting to round out and move away from having any positions close to my 5% threshold for an individual position.

Week 80 Additions

In week 80 I added the following reader suggestions to the Dividend Harvesting Portfolio:

STORE Capital Corporation

- I have been interested in STOR for some time, and even though Berkshire started selling shares I like the value proposition. STOR has increased its quarterly dividend 7 times since the close of 2014. STOR trades at a price to FFO ratio of 12.66x, which is well below the majority of equity-based REITs. I like many things about STOR and plan on doing a dedicated article about them.

Vornado Realty Trust

- I am not betting against New York City real estate, and that’s one of the reasons I added VNO. VNO has been pummeled in 2022, as shares have declined -36.73%. Looking at the chart, shares seem to have been leveling off, and VNO now trades at a price to FFO ratio of 8.99x. VNO also has a modest EBITDA to Total Debt ratio of 10.78x and yields 7.65% with a 1.45x dividend coverage ratio. VNO has ownership and management interests in nearly 20 million sq feet of office assets in NYC. I am taking a long-term view on this investment and plan on adding to it with the idea that NYC doesn’t become a ghost town.

Week 81 Gameplan

I will try and refrain from adding to any of my REIT positions for the next several weeks, with the hopes of leveling off some of the sector percentages. I am interested in increasing my position in many of the current holdings, but Cisco Systems (CSCO), and the JPMorgan Equity Premium Income ETF (JEPI), which was a suggestion for week 80, are at the top of my list. We will see what occurs.

Conclusion

The markets held their own this week and shrugged off Powell’s speech from the week prior. I am interested to see where interest rates go and how the markets react going into Q3 earnings and the midterms. I believe there are many opportunities in the market, and I am excited to see how the Dividend Harvesting Portfolio progresses into the end of 2022 and throughout 2023. Rome wasn’t built in a week, and I am very happy with the progress that’s being made. Maybe in week 81, the Dividend Harvesting Portfolio starts a new streak of closing in the black.

Be the first to comment