howtogoto

Shares of midcap biotechnology company Exelixis (NASDAQ:EXEL) have risen by just 44% since I called the stock a compelling buy in 2016. Performance is a dismal 31% loss since my 2017 update, and so far in 2022 shares are flat.

While it’s true the stock has done little but fall or consolidate over the past few years, the underlying company has done anything but stay stagnant. An ongoing patent fight with Teva Pharmaceutical (TEVA) continues as the large pharmaceutical firm wants to market its generic drug before the 2032 expiry of U.S. Patent No. 11,298,349. Q2 update showed that Cabometyx revenues continued to grow at a healthy 22% rate, while multi-faceted pipeline continues to make progress with multiple studies ongoing. While it does not yield much fruit upfront, I am a fan of management’s approach to partnering with innovative private biotech companies possessing complementary technology platforms (low upfront payments with majority of economics being success-based and backend-weighted in nature).

Let’s take a closer look to see how the story has progressed and whether this one is ready for the Core Biotech portfolio.

Chart

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares bounce around in the mid-teens to mid-twenties range over and again throughout the past few years. It would seem that the stock was a good buy each time it hit relative lows, and my initial take is that long-term investors would do well to accumulate dips in the second half of this year ahead of clinical momentum set to take place in the 2023-2025 timeframe (especially for the early-stage pipeline).

Overview

Founded in 1994 with headquarters in California (954 employees), Exelixis currently sports enterprise value of ~$3.7 billion and Q2 cash position of $2 billion providing them operational runway for quite some time (actually added $100M to its balance sheet during the quarter).

For those familiar with this midcap biotech company, the quarterly call is more than sufficient to get caught up to speed with the current snapshot.

The simple version is that the cabozantinib franchise continues to see commercial growth both domestically in the US and internationally, while Exelixis works hard to bring forward next-generation TKI XL092 in the clinic for life cycle extension as the specter of generic competition looms for cabozantinib. Additionally, the company has a deep yet very early-stage pipeline consisting of next-generation antibody drug conjugates (ADCS) as well as inhibitors of multiple novel targets – the issue is that in the near term at least, such early data readouts (however promising) are not likely to shift Wall Street’s attention from fears of generic competition (as early as 2026, more likely out to 2030).

Management highlights strong performance for Cabometyx in Q2 as leading TKI of choice for renal cell carcinoma (RCC), with sales growing 22% year over year (7th consecutive quarter of growth). Interestingly, they’ve seen a near doubling of new patient starts at the 40mg dose since CheckMate 9ER launch in January of last year. As for competition versus other TKIs (Inlyta, Sutent, Votrient, Lenvima), Cabo’s market share has increased every quarter since Q1 2021 and was 37% for Q2 2022 (impressive considering how fiercely competitive this space is). In HCC, Cabo continues to be the most prescribed TKI in the 2nd line setting for patients treated with immunotherapy containing regimens in first line.

In July, the company reported positive topline data for COSMIC-313 (evaluating cabozantinib in combination with nivolumab and ipilimumab in intermediate and poor risk renal cell carcinoma). The combo reduced risk of disease progression of death compared to ipi/nivo with hazard ratio of 0.73, p=0.01. Conversely, interim analysis of secondary endpoint of overall survival did not demonstrate significant benefit over comparator arm and so trial continues to the next analysis of OS.

Another expansion effort is the phase 3 pivotal study of cabozantinib in combination with atezolizumab versus docetaxel in patients with metastatic NSCLC (non-small cell lung cancer) who have been previously treated with immune checkpoint inhibitor and platinum-containing chemotherapy. It was recommended that the study remain blinded at pre-planned interim analysis and so it will continue to final analysis of overall survival by the end of 2022. Similarly, for the CONTACT-03 study of cabozantinib in combination with atezolizumab in PD-1 experienced renal cell carcinoma, readout is expected on the progression-free survival endpoint in the next quarter or two. For CONTACT-02 (phase 3) study of cabozantinib in combination with atezolizumab in metastatic castration-resistant prostate cancer, enrollment should finish up by mid 2023.

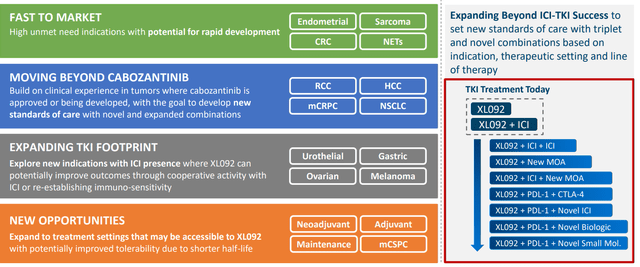

Moving on to the multi-faceted pipeline, next gen TKI XL092 (potentially improved tolerability versus cabozantinib due in part to shorter half-life) was the subject of a phase 3 study in non-MSI-high colorectal cancer initiated in June. The drug candidate is also being explored in combination with several checkpoint inhibitors and IO combinations with additional registrational studies planned.

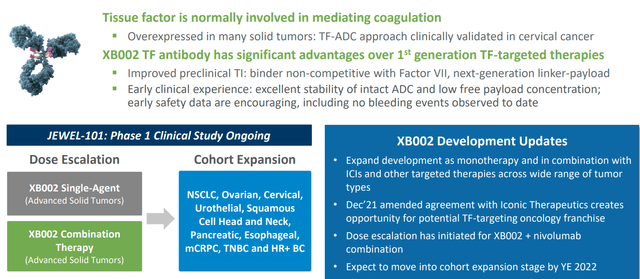

Moving outside these efforts, XB002 is the company’s first ADC (targets tissue factor, which readers may recall is also the target of Seagen’s ADC Tivdak which was granted accelerated approval in cervical cancer). XB002’s point of differentiation is its ability to target tissue factor without interfering with the coagulation pathway, and so far in dose escalation no bleeding events have been observed. The company expects to move into multi-cohort dose expansion phase later this year so perhaps we’ll finally get some noteworthy data from this asset in the 2023 to 2024 timeframe.

Moving on to a lesser-known candidate, the company’s oral CDK7 inhibitor XL102 is the subject of a phase 1 study and expected to move into monotherapy and combo expansion cohorts after recommended phase 2 dose is determined.

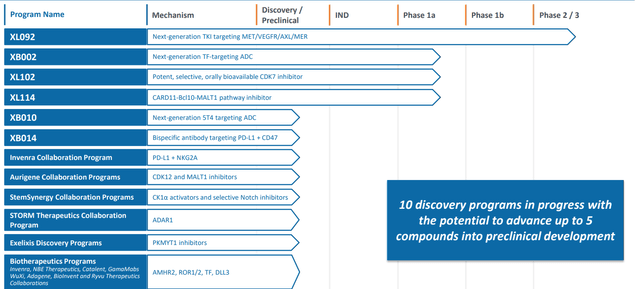

On the whole, we are reminded that the pipeline consists of both internal and collaboration-derived candidates with over 10 programs in progress and potential to progress up to 5 compounds into preclinical development this year with more to come in 2023. While such compounds are unlikely to assuage Wall Street’s concerns about dependence on Cabo revenues given how early stage these assets are, they do look quite novel (not “me too” drugs). This includes XB010 (novel ADC targeting 5T4) moving into preclinical development and their first bispecific XBO014 targeting PD-L1 and CD47 moving into preclinical as well.

2 recent deals are synonymous with management’s partnering approach, one that infuriates (or at least gets no respect from) Wall Street given that programs arising from collaboration efforts are not likely to generate needle-moving data for years to come. I, on the other hand, am a fan of such deals as they are backend-weighted with low upfront commitment of cash resources. One of these recent deals was the agreement with BioInvent to identify novel targets and antibodies with their platform (uses primary human tumor material as a starting point for parallel tumor-specific target identification and antibody discovery). Under the agreement, Exelixis can select 3 targets to license upon identification of development candidates against those targets. In a similar manner, the Ryvu deal allows for access to their proprietary STING agonists which Exelixis intends to utilize and construct novel immunostimulatory ADCs (I note that multiple next generation ADC companies like Mersana Therapeutics and Sutro Biopharma are also pursuing this path). In June this year Sutro (STRO) received $90M upfront from Astellas for its next-gen tech enabling immunostimulatory ADCs plus is eligible for over $400M in milestone payments for each candidate arising from these efforts (and of course royalties).

Let’s move on to recent news and how it’s affected the investability of Exelixis in the near to medium term.

Select Recent Developments

On September 2, Exelixis filed a complaint in the United States District Court for the District of Delaware for patent infringement against Teva Pharmaceutical asserting infringement of U.S. Patent No. 11,298,349 arising from Teva’s amendment of its Abbreviated New Drug Application. The short version is that Teva filed an ANDA to the FDA for a generic version of Cabometyx tablets (covering 20mg, 40mg and 60 mg doses) and Exelixis received notice on July 29th about the large company’s intention to market a generic version of Cabo before the expiration of U.S. Patent No. 11,298,349. Exelixis wants the patent to stand with its expiration date in 2032. It will be interesting to see how court proceedings and associated drama pan out in coming years (hard to have an edge in determining who has the edge). The weak chart for Exelixis’ stock suggests some credence of these generic fears is being given by Wall Street analysts. This follows Exelixis’ July lawsuit against MSN Pharmaceuticals similarly asserting infringement of U.S. Patent No. 11,298,349 expiring in 2032 (contends no generic approval should become valid until then). When in doubt, I prefer to use worst case scenario as my baseline investment case so let’s assume composition of matter patent holds up but polymorph patent does not (thus allowing for protection only until 2026 and thus we could see a generic launch in 4 years). Again, Exelixis still has multiple avenues of dispute to pursue and no expert can say with certainty how this will play out.

Moving on to September 10th, Exelixis announced results from the ongoing phase 1b study evaluating XL092 as a single agent and in combination with atezolizumab in patients with locally advanced or metastatic solid tumors. The highlight was activity in heavily pretreated RCC patients who received prior treatment with immunotherapy and/or VEGF-targeting TKIs, including 70% of patients who received cabozantinib as a prior treatment. Maximum tolerated dose was 120mg and go-forward dose was determined to be 100mg for both single agent and combination with atezolizumab. Tumor reduction was observed in 71% of patients on single agent XL092 and 56% of combo patients, while ORR was 10% for single agent and 4% for combo.

Other Information

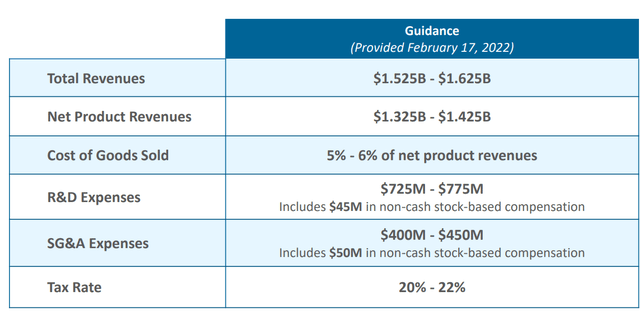

For the second quarter of 2022, the company reported cash and equivalents of $2 billion (up $100M from prior quarter). Total revenues were $419M, while net product revenues rose from $284M to $347M. Research and development expenses rose by about 30% to $200M, while SG&A similarly rose to $123M. Accumulated deficit is just $216M, showing that leadership in general has done a good job of resource allocation and management as Cabo revenues help fund pipeline development.

From the conference call, I liked management commentary on XB002 considering recent approval of Seagen’s Tivdak and growing interest in Tissue Factor as a target. 20% of patients in Tivdak pivotal trial had ocular adverse events leading to dose reduction and 5% of patients discontinued treatment. Management states that for XB002, there are a number of differentiating factors they consider compelling. The antibody is not the same and binds to a different epitope on tissue factor. It was very carefully selected so that the epitope does not interfere with Factor VII binding and thus does not interfere with coagulation at all. Second is the payload linker, using a ZymeLink payload from Zymeworks (modified oral statin, not standard MMAE and has been heavily modified with different linker). Preclinically on dosing, they see very low levels of free circulating payload while still maintaining good levels of intact ADC. The promise of 002 could be its ability to dose higher than what Tivdak could do and thus have increased efficacy.

As for institutional investors of note, I see very few specialist healthcare funds here and more in the way of generalists such as Vanguard Group with a 9.5% stake. As for insiders, history of sales and lack of buying does not inspire confidence.

As for relevant leadership experience, EVP Product Development & Medical Affairs Vicki Goodman served prior as VP Clinical Research at Merck. CFO Christopher Senner served prior as VP Corporate Finance at Gilead Sciences.

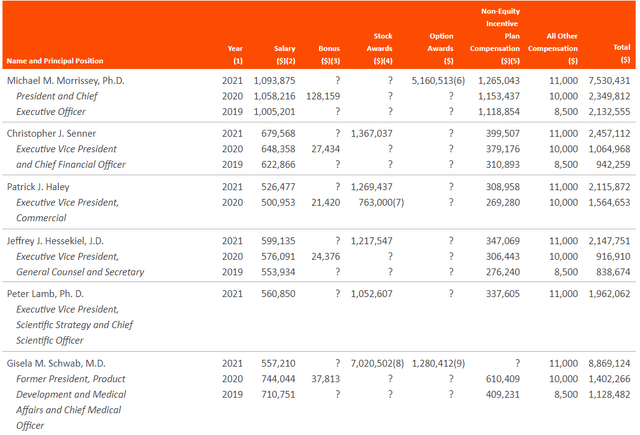

Moving on to executive compensation, cash portion of salaries seems excessive especially for CEO at over $1M (couple that with over 5M of option awards for what has been a meandering stock price for over the past 5 years and that does not sit right with me). Salaries for other executives seem reasonable on the whole, though again Former President of Product Development received over 7M of stock awards in 2021 which leaves a bad taste considering how poorly shareholders have done here over the past few years.

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

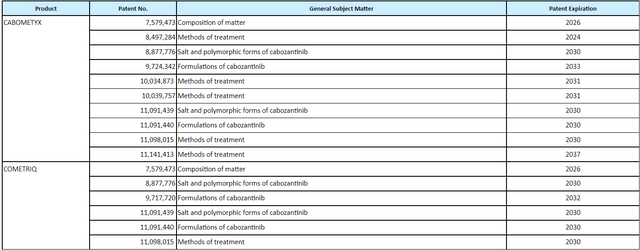

As for IP, cabozantinib is covered by over 15 issued patents in the US including composition of matter (expires September 2024 but has been granted term extension to August 2026). Table below shows IP covering polymorphic forms of cabozantinib (expires 2030), methods of treatment (out to 2037) and other assorted patents that hopefully help the company extend the life of this franchise farther out. Again, the key risk here is that by 2026 a generic alternative comes to market via MSN, Teva or other competitors.

As for other useful nuggets from the most recent quarterly filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), Exelixis provides further clarity on a very confusing patent situation that I’m still trying to get a handle on. Bench trial in connection with February 2022 MSN ANDA complaint has been scheduled for May 2023. A trial has not yet been scheduled in connection with the July 2022 MSN ANDA Complaint. On July 29th, the company received notice from Teva that it amended its ANDA to assert additional Paragraph IV certification (now requests approval to market generic version of Cabometyx BEFORE expiration of previously-unasserted patent listed in Orange Book). I expect the drama will continue to play out over the next year and beyond, with decisions and news sparking outsized volatility in share price each go round as has been the case so far.

Final Thoughts

To conclude, cabozantinib sales continue to grow in an encouraging manner while market share in key indications such as kidney cancer remains steady. Unfortunately, it seems like near term upside could be capped as the market focuses overly on the potential for generic competition to occur at an earlier time point than originally thought possible. I’m very much a fan of management’s penchant for collaborating with innovative companies sporting novel platform technologies (especially in the ADC space), but these efforts will take significant time to yield fruit (in some cases 5 to 8 years or more).

Looking at the stock chart, EXEL has perhaps been a great name for swing traders who buy the pessimism and sell the highs when optimism returns for brief periods. While I do believe long term investors should do well here, in the near term my expectations for upside are lower.

For readers who are interested in the story and have done their due diligence, EXEL is a Buy only for long term investors (3-to-5-year timeframe or more).

From a Core Biotech perspective (emphasis on next 3 to 5 years), I am likely to remain on the sidelines and revisit in late 2023 to 2024 to check back in on how the early-stage pipeline is progressing.

As for key risks, the main one that comes to mind and has been touched on a few times above is current IP concerns including potential generic competition from the likes of Teva, MSN and others (I confess I have little edge in determining how courtroom proceedings will play out including how long timelines could extend out to). Disappointing clinical data for key pivotal studies of cabozantinib as well as its successor XB010 would weigh on share price, as would any delays in clinical efforts for the early-stage pipeline. Another unstated possibility is that management decides to get more aggressive in acquiring a late-stage drug or commercially approved product, and in such a case the big question is whether the price tag would be advantageous or their desperation leads to excessively overpaying for such an asset.

OTHER LINKS OF INTEREST

Will Exelixis’s Cabometyx face generic competition when the 30-month stay ends in November?

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Be the first to comment