Vertigo3d/E+ via Getty Images

It feels somewhat surreal that 57 weeks have passed since I began this series on Seeking Alpha. I started by investing $100 in dividend-producing investments and allocated an additional $100 each week. Over the past 57 weeks, the markets have experienced pockets of volatility, new variants of Covid-19 emerged, the supply chain was severely impacted, inflation rose and turned out not to be transitory, a war in Ukraine erupted, energy sustainability in the EU has been threatened, possible food shortages may be on the horizon, geopolitical tensions have escalated to extreme levels, and the FED started raising interest rates. It hasn’t been the best environment for individual stock pickers, as access to information and the 24-hour news cycle have turned many in the investment community into part-time economists.

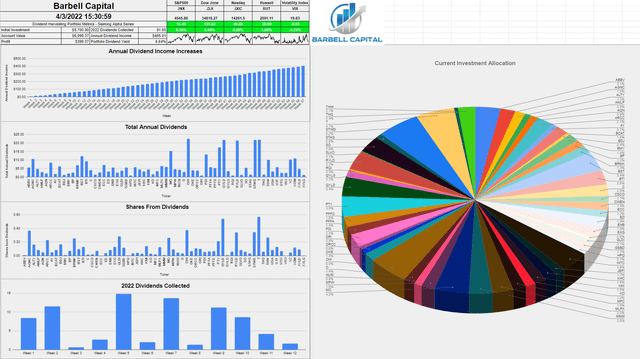

Throughout volatility and adversity, the Dividend Harvesting portfolio has performed well. Currently, the portfolio is worth $6,099.37, putting me in the black by $399.37 or 6.55%. Over the previous 57 weeks, the Dividend Harvesting portfolio has finished 56/57 weeks (98.25%) in the black.

I receive a lot of criticism about having 63 positions with such a small amount of capital on a continuous basis, but I believe it’s the broad diversification that has led me to a 98.25% track record of finishing in the positive column week in and week out. I don’t care who you are, nobody has a crystal ball, and nobody gets everything correct. If investing was simple, nobody would lose money, and everyone would be an investing guru.

I certainly don’t get everything correct, and 27 positions (42.86%) in the Dividend Harvesting portfolio are in the red. Having broad diversification has allowed me to mitigate my downside and benefit from secular rotations, causing 36 positions (57.14%) to be in the black.

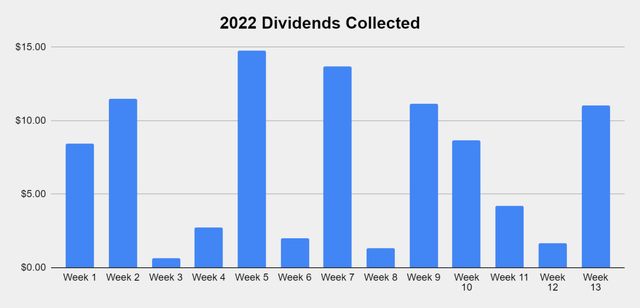

I am now sitting on a portfolio that’s diversified, has a proven track record of navigating volatility, and is churring out dividends. My projected annual dividend income is now $405.01 as the Dividend Harvesting portfolio’s yield is now 6.64%. If you look at the dividend yield on my invested capital ($5,700), it’s 7.11%. In 2022, I have collected $91.85 from 126 dividends. I am pleased with the Dividend Harvesting portfolio’s performance and feel that its foundational goals are being accomplished. It’s not about the amount of capital invested, as that’s subjective to an individual, but rather creating an investment plan and sticking to it while having positive results. I am excited for the future and where this portfolio will be on its 2nd anniversary.

This series has never been about hitting a target yield, generating a certain amount of profit, or beating the market. I had two specific goals with this series. The first was to create a blueprint for constructing a dividend portfolio by documenting the journey starting from the beginning. The second goal was to illustrate how allocating capital each week toward investing, regardless of the amount, would be beneficial in the long run. Too many people are under the illusion that you need tens of thousands or even hundreds of thousands to benefit from investing. Instead of using my real dividend portfolio as an example, I decided to start a new account, fund it with $100, and add $100 weekly, providing a step-by-step guide to dividend investing. This methodology doesn’t have to be used for dividend investing, and it could be as simple as an S&P index fund or a Total Market fund. Hopefully, this series is inspiring people to invest in their future to attain financial freedom.

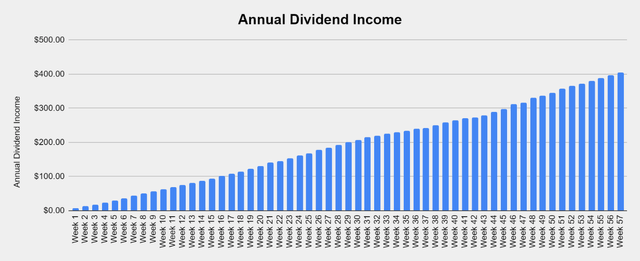

The Dividend Harvesting Portfolio Dividend Section

After 57 weeks, the annual dividend income from the Dividend Harvesting portfolio has breached the $400 level and is now generating $405.01. This chart represents exponential dividend growth as the snowball effect is still in its infancy. By making weekly investments in income-producing investments and reinvesting the dividend income, the annual income continues to grow at a rapid pace. Originally, the first week’s allocation of $100 allowed me to generate $7.44 in annual dividend income. Since the start of week 2, I have added 60 positions which have grown my annual dividend income by $397.57 (5,344%). By making these investments, I have created my own source of additional cash flow, which is the real premise of this portfolio.

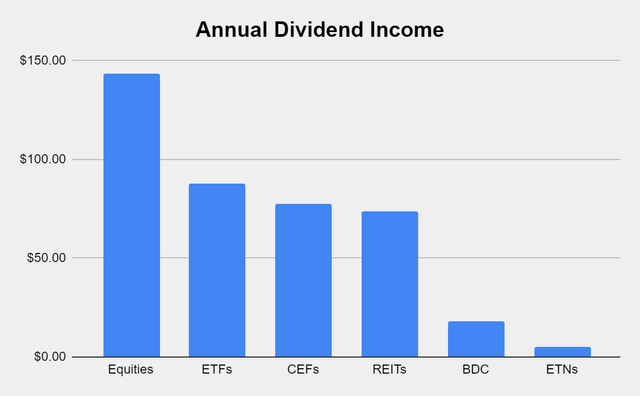

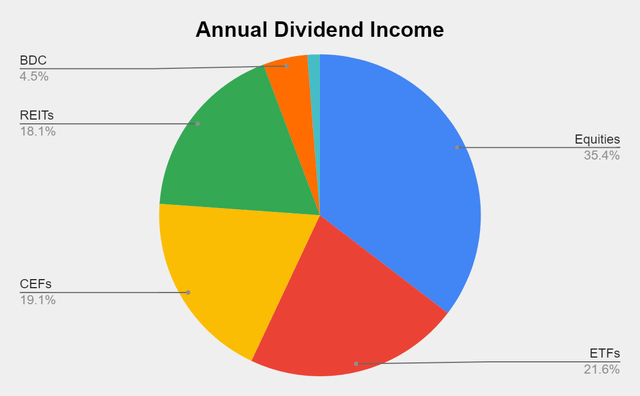

Here’s how much dividend income is generated per investment basket:

- Equities $143.33 (35.39%)

- ETFs $87.54 (21.61%)

- CEFs $77.46 (19.13%)

- REITs $73.48 (18.14%)

- BDC $18.04 (4.45%)

- ETNs $5.15 (1.27%)

Steven Fiorillo Steven Fiorillo

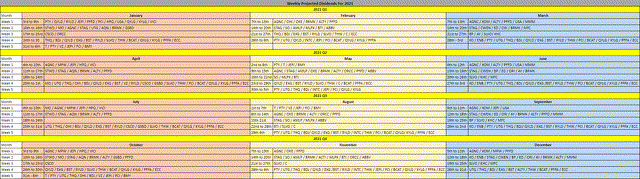

Collecting dividends can serve many functions in a portfolio. Some investors utilize dividends to supplement their income and live off. I am building a dividend portfolio for myself 30 years into the future. Since I am reinvesting every dividend, they serve multiple purposes today. In 2022 alone, I have collected $91.85 in dividend income from 126 dividends across 13 weeks. This has allowed the Dividend Harvesting portfolio to stay in the black while growing the snowball effect. In down markets, these dividends allow me to gain additional equity in my investments while increasing my future cash flow. This style of investing isn’t for everyone, but if you’re looking to generate consistent cash flow while mitigating downside risk, this method has worked for me. I am hoping to collect between $450 – $500 in dividends in 2022, which will be reinvested, and finish the year generating >$700 in annual dividends.

In week 57, I didn’t add new positions to the portfolio, so I didn’t pick up any additional weeks of dividend income. Week 60 is coming, and I am not sure if I will add new positions prior to the investments inspired by reader suggestions, but there are some companies at the top of the list.

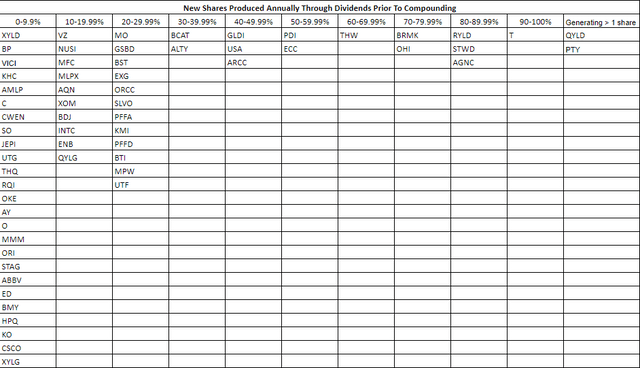

The goal of generating enough income from the dividends to purchase an additional share per year has been the never-ending project of this portfolio. As the PIMCO Corporate & Income Opportunity Fund (PTY) and the Global X Nasdaq 100 Covered Call ETF (QYLD) have already crossed over the threshold for generating an additional share, I am trying to get more of the current positions over the finish line. Eventually, more positions will generate one share per year in dividend income.

The Dividend Harvesting Portfolio Composition

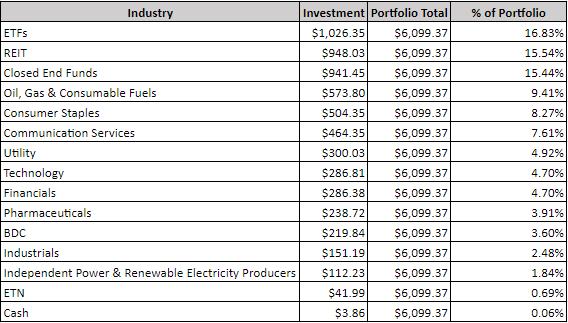

ETFs remain the largest segment of the Dividend Harvesting portfolio. Individual equities make up 47.84% of the portfolio and generate 35.39% of the dividend income, while ETFs, CEFs, REITs, BDCs, and ETNs represent 52.16% of the portfolio and generate 64.61% of the dividend income. I have a 20% maximum sector weight, so when a singular sector gets close to that level, I make sure capital is allocated away from that area to balance things out. In 2022, I will make an effort to even out these portfolio percentages. As more capital is deployed, the bottom half of the portfolio weighting will increase.

Steven Fiorillo

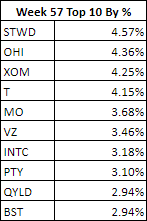

For the moment, Exxon Mobil (XOM), and AT&T (T), have been dethroned from the top 2 positions in the Dividend Harvesting portfolio, as two REITs have taken these positions. Starwood Property Trust (STWD) and Omega Healthcare Investors (OHI) have become the Dividend Harvesting portfolio’s largest positions. I have been watching the top allocations closely and am working on making sure I don’t exceed a 5% portfolio weighting again in any of my positions. Overallocation is dangerous, and by doing this, I’m capping my risk. If one of my investments goes under, the most I can lose is 5% of my capital.

Steven Fiorillo

Week 57 Additions

In week 57, I added 1 share to each of the following positions:

I decided to do it again and add another share of STWD just days prior to its ex-dividend date. STWD has been one of my favorite REITs for years as I believe their CEO Barry Sternlicht is best in breed. I have been a shareholder of STWD for years, and this has been a consistent dividend payer and was one of the REITs that didn’t cut or suspend its dividend during the pandemic. Since 1991, STWD has operated throughout numerous real estate cycles and has deployed over $83 billion in capital with record investments of $17 billion across its business lines in 2021. Over the past 2 years, Mr. Sternlicht has positioned STWD to benefit from strategic capital allocation, and I believe shareholders will benefit in the years to come.

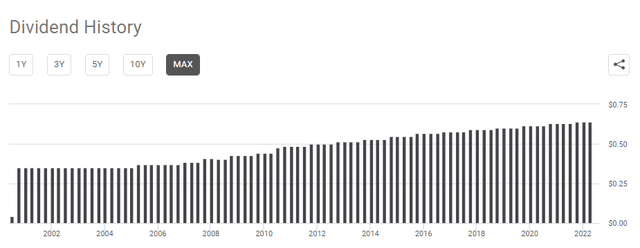

VZ hasn’t had a great year as it’s down -11.47% and relatively flat YTD (-0.61%). Maybe VZ doesn’t have a runway of exponential growth ahead of it, but it’s a cash cow. In the TTM, VZ has generated $22.07 billion of net income and $19.25 billion in FCF. VZ will always have a growing position in the Dividend Harvesting portfolio as its currently yielding 4.91%, has a payout ratio of 46.94%, and has grown its dividend for 17 consecutive years.

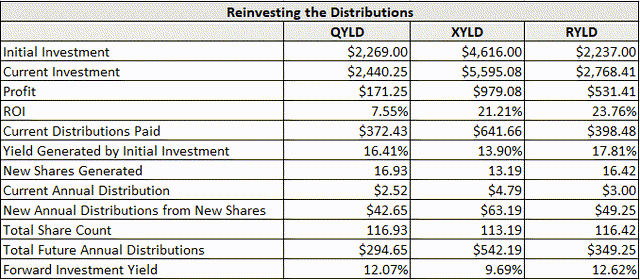

In my recent article on the Global X Nasdaq 100 Covered Call ETF (QYLD) I compared it to RYLD to see how it was performing against Global X’s other covered call ETFs. I used an investment of 100 shares at the beginning of 2021 as my base and reinvested every distribution. Overall RYLD has been a better investment, as when I did the analysis, RYLD had an ROI of 23.76% compared to QYLD’s 7.55%. Compared to QYLD, RYLD has been a superior investment that had a forward investment yield of 12.62% and generated a 17.81% yield on the original invested capital. I decided to add to RYLD as it’s a strong income producer with a proven track record.

Week 58 Gameplan

Citigroup (C) has become my largest loser. I plan on doing some research to see why, but over the past year, shares of C have declined by -28.07%. This has pushed the yield to 3.9%. I am probably going to add a share and dollar cost average into the position. As far as the rest of the capital, I am not sure what I plan on investing in.

Conclusion

Week 60 is approaching fast, and there are several names on my watchlist from the reader community. Please continue to provide investment ideas as week 60’s capital will be allocated to reader suggestions.

Thank you to everyone who continues to read this series. Creating a passive income fund isn’t an investment approach that everyone believes in, but it’s one of my investment cornerstones. I have a comprehensive investment approach where I invest in growth companies, value companies, and dividend companies/funds. I also utilize an indexing approach with funds for my retirement accounts. Income generation is just one aspect that I focus on when planning for the future. The passive income I’m generating will act as additional income in retirement. I look at this as a Barbell approach because I utilize several aspects of investing in my overall approach.

Be the first to comment