Philip Steury/iStock via Getty Images

I became a dividend growth investor at the end of the Great Recession. Having watched my portfolio devastated multiple times over the years as I struggled with finding the correct strategy, dividend growth investing just made sense. The part that challenged me most was understanding my end goal – should I try to accumulate $1 million, $10 million, as much as possible?

Investing without a clearly defined goal in mind wasn’t working for me. I needed something I could measure and see progress to keep me motivated. Thinking of my goals from a wealth standpoint didn’t cut it. Once I shifted to a cash flow mindset, everything began to fall into place.

At the time, I had a well-paying, high-stress job. I don’t have expensive tastes and recognized that replacing my work income with passive income would allow me to live the lifestyle I want on my terms. Finally, I had a goal that made clear sense and was easy to measure. I began exploring ways to create passive income and dividend growth investing became a key component.

This portfolio has been closed to new capital since 2016. I found that constantly adding new funds made it difficult to measure the overall success of the strategy. Although dividend growth investing has been a raging success for me by probably the most important metric – I sleep well at night! I don’t worry even the tiniest amount about possible market crashes. The lack of stress is probably the best sign that dividend growth investing is right for me.

Portfolio Goal

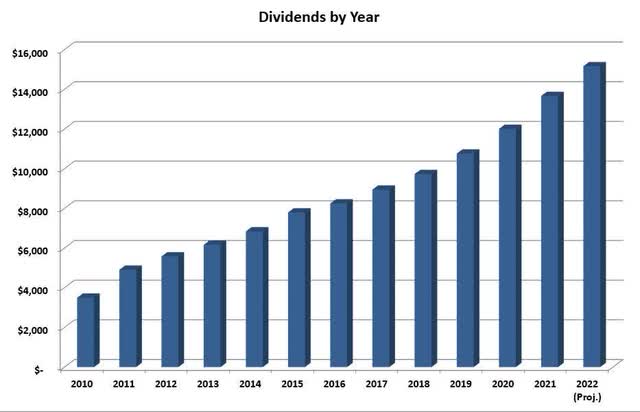

The portfolio goals are simple: Grow the income by 10% annually with dividends reinvested and 7% annually without reinvesting. This goal allows my income to double approximately every seven years while I am reinvesting and every ten years once I begin withdrawing the dividends. The table below shows the steady progress of income growth.

Portfolio Guidelines

I use guidelines to achieve my goals rather than rules. Rules imply something hard and fast, whereas guidelines are flexible but give a general direction to follow. I keep these simple, as I have found that complexity adds time without any real benefit. These have evolved over the years, the most recent being the addition of selling covered calls in certain circumstances.

- Invest in companies from the Champions and Contenders list with at least 15 years of dividend growth.

- Look for companies with a 3% starting yield and the potential to maintain a 7% dividend growth for decades. The growth is critical as it’s impossible to continue growing income at 7% without reinvesting unless companies raise distributions by at least that amount.

- Replace (or sell covered calls against) significantly overvalued positions if the opportunity exists to reduce risk and increase income. In practice, this usually means higher quality at a higher yield.

- I want to see flat to mild payout ratio creep. A payout ratio growing from 30% to 35% over ten years is acceptable. One that has gone from 30% to 60% is not. I want companies to grow the dividend with earnings, not by increasing the payout ratio.

- Unless it is well-diversified across industries, no single sector should account for more than 20% of the income. I was burned by this in 2016 when several energy companies cut dividends.

Again, these are just guidelines and are flexible to accommodate what makes sense to achieve my overall goals. I follow a few other items but don’t see them as integral to my investing. Instead, these tend to be more personal preferences. They include avoiding foreign companies because I don’t enjoy accounting for the taxes and FX rates causing fluctuating dividends.

How is 2022 Finishing up?

One month into the fourth quarter, the year’s final numbers are starting to take shape. Most new purchases will impact next year, and many of the upcoming raises will take effect in 2023 as well. At this point, I can confidently say that 2022 was a massive year for income growth! The current income projection is $15,553, a whopping 13.8% increase from 2021! Below is a chart of the dividends collected by year in this portfolio.

Dividends by year (Wyo Investments)

While the goals of this portfolio are strictly income related, many readers are interested in knowing how the total return is doing. Through the end of October, this portfolio is down 6.9%, trouncing the total return of the S&P500.

October’s Dividend Increases

October had a healthy amount of dividend raises. Many of them are significant to the portfolio because of both position size and the income they bring in. Of the four expected raises last month, Blackstone (BX), AbbVie (ABBV), and Visa (V) are all top 10 holdings by market value, and Blackstone and AbbVie are both top 5 income producers in the portfolio.

Blackstone

For the year, Blackstone will finish with total dividends of $4.94, a 12.8% increase over 2021’s distribution of $4.38. I generally compare BX’s income to previous year’s same quarter vs. this year’s. Using that method, BX had a nearly 27% reduction from Q42021 to Q42022. I missed my projection by a mile!

I had never looked into the variable dividend policy of Blackstone that closely before, but I dug into it a little deeper following this miss. Had I done my research, I would have known that BX uses an 85% of distributable income for dividends. Their distributable income number requires a bit of voodoo to predict; however, it loosely ties to adjusted earnings. It should have been apparent that the 4th quarter dividend was likely to be lower. In the future, I will pay a little more attention to this one.

AbbVie

Initially acquired in the spin-off from Abbott Labs (ABT) in 2013, AbbVie has been a robust dividend grower in this portfolio. AbbVie announced a 5% raise last month, slightly below my expectations but not by much. It isn’t easy to know if a company will reduce dividend raises by looking forward to future events or waiting for them to occur. AbbVie appears to be looking ahead to the patent cliff with Humira.

The 5% increase is well off the 5-yr average growth rate of 18% but was not a surprise given the steady decrease in the dividend growth rate and the loss of the Humira patent.

Visa

As expected, Visa had another blowout increase! The company easily exceeded my expectation with a 20% increase at the end of the month. Visa has a 5-year dividend growth rate of above 17%, and this year’s increase was the best in several years.

The new dividend on Visa brings some good buying opportunities based on yield. The company rarely exceeds a 1% yield, so when it happens, it’s a great time to load up!

A.O. Smith Corporation (AOS)

As a small-cap company, AOS doesn’t get the love many big names do. However, this dividend champion will extend its growth streak to 29 years with this year’s increase of 7%. The increase was in line with my expectations but well off the 10-year average of 17%. However, it’s a tremendous increase in light of the current housing conditions and other economic challenges.

November’s Expected Increases

This month is a lull between the rush of increases in September and October and the first quarter 2023 increases in December.

Aflac (AFL)

On November 7th, Aflac announced a 5% increase in the dividend. While this is well below the last two increases of 21 and 18%, it wasn’t unexpected.

Aflac has increased the dividend for 40 years and has managed to do so without expanding the payout ratios significantly. This is because they match the dividend growth closely with earnings growth. This matching leads to very lumpy raises, but the 10-year dividend growth rate is about 8%. The next couple of years are projected to be slower growth for the company, so we can expect smaller increases.

Aflac is an average-sized position in the portfolio at about 2.5% and accounts for 1.8% of the income. The company was first added to the portfolio in 2014, with additional purchases in 2020 and 2021. I will continue to add to the position above a 3% yield.

Automatic Data Processing (ADP)

ADP is a dividend champion with 46 years of increases and still gives healthy raises. It has 5 and 10-year dividend growth rates above 10%. ADP is another company that does a good job of keeping payout ratios consistent by matching increases to earnings growth. Fortunately, it tends to grow earnings in the double digits. I expect another healthy increase this year, well in the double-digit range.

Note: ADP announced a 20% increase on November 9th!

This company rarely goes on sale. Having followed it for years, 2020 was the first time it offered a real bargain since the Great Recession. However, it never made my buy list during the flash crash, as there were many great opportunities. Fortunately, the company recovered slower than others, and a second buying chance came in September of 2020 when it was by far one of the best available bargains.

Today the company is a relatively small position in the portfolio at 1.6% and accounts for 0.7% of the income. I would love to add more, but I have the first buy point at a 2.5% yield and the second buy point at 2.85%. This one is not looking likely any time soon.

Snap-On (SNA)

Snap-On has twelve years of consistent, rapid dividend growth. It has 3, 5, and 10-year dividend growth rates close to 15%. Early this month, they announced a 14.1% increase, exceeding my expectations by quite a wide margin. I was conservative going in with the cratered earnings of Stanley Black & Decker (SWK) and was surprised by Snap-On’s continued strength.

The company is a micro position in the portfolio at less than 0.5%. I have been actively trying to expand the position since establishing it in late 2021. However, it has remained stubbornly overpriced relative to other dividend growth stocks. I consider it in the buy range with a yield above 2.8% currently.

November Special Dividend

Diamond Hill Investment Group (DHIL)

Earlier this year, when Blackstone (BX) acquired Preferred Apartments, I used a portion of the proceeds to take a flyer on Diamond Hill Investment Group as a high-yield play. The company had a reasonable number of years of dividend increases and had transitioned to a regular distribution plus an annual special distribution.

Early in November, the company announced the special distribution at $4. This announcement was disappointing as it represents a total annual dividend for the company of $10, well below the last couple of years’ payouts. However, it was not unexpected for an asset manager, as the state of the markets primarily drives their income.

DHIL is a micro-position in the portfolio at about 0.5% of the total. I’m not currently looking to add new shares, as I have several asset managers across all my accounts. I may reconsider if the price falls significantly below its 52-week low.

Sales in October

I buy companies with the intent to hold them forever. However, I constantly review the prospects and alternatives for overvalued positions, specific high-yield positions, and micro-positions. During October, there were no sales to report; however, I am currently reviewing my Healthcare Services Group (HCSG) position as the estimates are ugly, and the dividend growth is slow.

Regular Purchases in October

The early part of October brought some great bargains, and I put more capital to work than I have all year. I still hold an above-average cash position as I expect a capitulation event in 2023. Of course, the market could just as well have put in lows, and we are off to new highs. For this reason, I am constantly purchasing bargains, even if it is just nibbling. Here is a summary of the purchases for October (average price is shown):

- Broadcom (AVGO) 5 shares @ $439.76

- Best Buy (BBY) 4 shares @ $64.41

- BlackRock (BLK) 3 shares @ $535.28

- CME Group (CME) 2 shares @ $171.65

- Intercontinental Exchange (ICE) 1 share @ $90.85

- Texas Instruments (TXN) 2 shares @ $157.19

- Visa (V) 1 share @ $179.60

What Else Am I Looking at?

Since this is a closed portfolio, I can only buy some of the companies that look interesting. I use this section to cover what I purchase and consider in my other portfolios. My other portfolios have different goals and rules but are also dividend growth portfolios.

The market bounced hard off the October lows. Many bargains still exist, but only somewhat to the extent that mid-October offered. For this reason, I’ve pulled back on my buying. At this point, I’m bottom fishing, looking for high-quality companies at or near 52-week lows. I am, however, still making small daily purchases of Schwab U.S. Dividend Equity ETF (SCHD).

Of the companies I track, telecoms still look good. I prefer Verizon (VZ) above a 7% yield as a high-yield play, but just under is a good entry point as well. I follow Comcast (CMCSA) and Nexstar (NXST) for dividend growth in this space. Nexstar is a good but not great buy. I would prefer to see the yield push closer to 3% before buying. In contrast, Comcast is a fist-pounding buy at close to $30.

All asset managers were good bargains in mid-October, but BlackRock (BLK) has skyrocketed since then and is barely scratching my first buy point of a 2.9% yield. On the other hand, T. Rowe Price (TROW) is still firmly above my third buy point. While TROW may not have the future prospects of BlackRock, I don’t think it’s in trouble either.

While industrials, as a whole, have a long way to fall, Snap-On’s (SNA) recent increase pushed the yield into my first buy range. However, I think there’s a good chance we will see a 3.5% yield on it ($185) next year. I may start buying at close to $200, however.

Finally, I’d like to mention Medtronic (MDT). The company is still making new lows and is offering the highest yield in its history at over 3.4%. It’s worth noting that the valuation isn’t near as low as it was in the early 2010s when it hit single digit PEs. The change in dividend yield is a function of the payout ratio doubling since then, which is still relatively low at about 45%. I’m a buyer of Medtronic at this yield, but a 30% drop in price to single-digit PEs isn’t out of the question.

Final Thoughts

Just like the rest of the year, I am cautiously buying bargains. You can never go wrong buying quality dividend growth companies on sale. However, I’m still holding high cash levels, expecting an actual capitulation event. And if it never occurs, that’s ok too. Even during 2021, the occasional pocket of value could be found at record market highs.

I’m a little later than usual getting this published. On November 10th, the market had a massive move up. Apparently, inflation is gone, interest rates are going back to zero, and the economy is booming. I am skeptical that a new bull market has started. The economy doesn’t seem healthy to me, but the market will do what the market is going to do. For me, I’ll take a pause in buying and may trim some of my lower conviction positions in other portfolios.

Be the first to comment