FotografiaBasica

By Anu Ganti

Lessons from the SPIVA Latin America Mid-Year 2022 Scorecard

The semiannual S&P Indices Versus Active (SPIVA) Scorecards1 measure the performance of actively managed funds against their corresponding benchmarks in various markets around the world. According to the latest SPIVA Latin America Mid-Year 2022 Scorecard, the YTD performance among active managers across Latin American countries varied significantly.

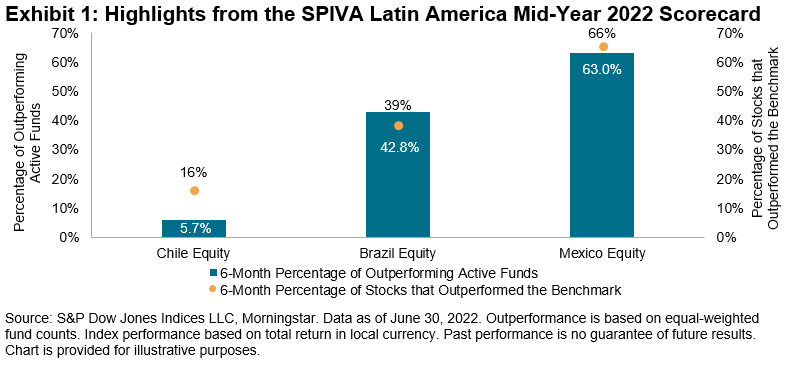

Chilean equity managers fared the worst in the region, with only 6% of actively managed funds outperforming the S&P Chile BMI. Brazilian Equity managers fared a bit better, with 43% of funds outperforming. Meanwhile, Mexico was a rare bright spot, with 63% of funds beating the local benchmark. One explanation for the stark range in outperformance rates is provided by the overall environment for stock selection. Only 16% of stocks in the S&P Chile BMI outperformed the capitalization-weighted S&P Chile BMI itself, while a higher proportion, 39% of constituents in the S&P Brazil BMI outperformed their benchmark, and a full 66% of constituents in Mexico’s S&P/BMV IRT outperformed. Exhibit 1 compares these figures to the percentage of outperforming actively managed equity funds, illustrating a correspondence that suggests in Chile especially, the outperformance of the largest names made it harder for stock pickers to beat the benchmark.

Author

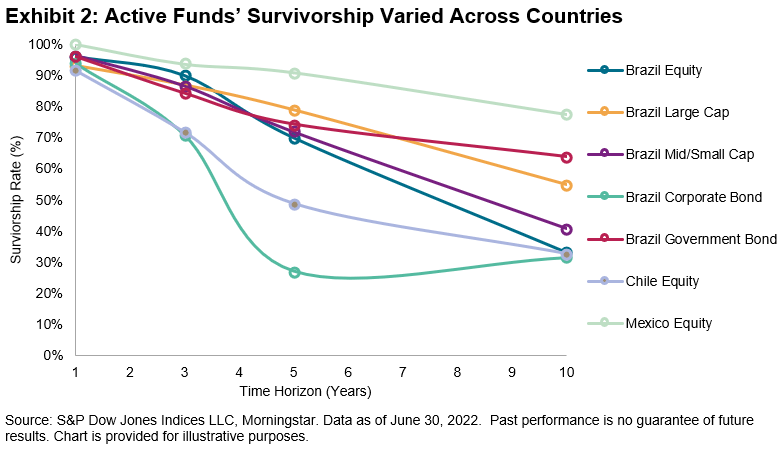

In addition to mixed performance results, Latin American countries also differed in their survivorship rates, as shown in Exhibit 2. After 10 years, approximately 70% of Brazil Equity, Brazil Corporate Bond, and Chilean Equity funds no longer existed, with Brazil Corporate Bonds experiencing a steep downward trend after year five. In contrast, Mexico Equity Funds fared much better, with 78% of funds still in existence after 10 years, mirroring their relatively lower long-term underperformance rate compared to the other categories.

Author

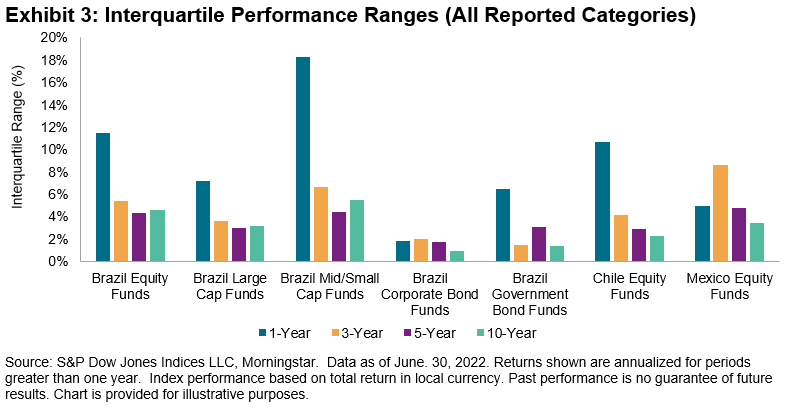

Accompanied by the higher volatility in the region, higher stock-level dispersion across countries also led to greater fund selection risk this year, particularly in the Brazil Equity category and especially among Brazil mid-/small-cap funds, with one-year interquartile ranges of 11% and 18%, respectively, as Exhibit 3 illustrates. In these categories, the performance of the “average” fund is perhaps a poor representation of the experience of most funds – some did much better, and others much worse.

Author

The divergent performance of equities across Latin American countries is consistent with the divergent performance of active managers within these countries, highlighting the unique challenges faced in each region.

1 For more information, see SPIVA Scorecards: An Overview. SPIVA® Scorecards: An Overview – Education | S&P Dow Jones Indices

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment