Joe Raedle

Following a better-than-expected quarter, The Walt Disney Company (NYSE:DIS) still faces the fundamental issues facing the streaming business. In fact, Dan Loeb of the Third Point hedge fund wants the company to exit parts of the streaming business. My investment thesis remains Neutral on the business, especially after the rally along with animal spirits in the stock market.

Painful Shift

While the market once rewarded the stock with a nearly $200 stock price, people have finally caught up to the direct-to-consumer plan as not necessarily beneficial to Disney. Previously, the media giant collected monthly fees from cable services and sold millions of tickets for movies without all of the costs of a DTC service.

The DTC video streaming services have become a disaster because consumers spend vastly fewer dollars on a monthly basis for the services and viewers can more easily cancel services. The latest report from Antenna has nearly 20% of subs to premium streaming services canceling at least 3 services in a 2-year period.

All the while, streaming services like Roku (ROKU) have still collected a cut of the streaming revenue similar to cable. All Disney has done is transfer locked-in monthly fees for easily cancellable streaming services.

For the June quarter, the market was excited about the results due to a rebound in the Disney Park segment from a fully reopen economy. The division grew revenue 70% to $7.4 billion with operating income surging to $2.2 billion.

The key to the business is that the “core” Disney+ subscriber count isn’t expected to reach initial growth targets. The goal now is that total subs will only reach 215 to 245 million, down about 15 million from prior estimates. One of the major issues is that the loss of the IPL cricket rights could reduce subscribers in India for the Hotstar service and highlights the problem with a reliance on external content.

Disney now forecasts spending a whopping $30 billion on content annually after stepping away from the IPL Cricket rights along with dropping bidding on the NFL Sunday Ticket when prices rose to nearly $3 billion annually. Again, ESPN is being outbid for sports rights while still having to recently hike the monthly cost for ESPN+ to cover additional rights fees, such as the NHL and La Liga soccer deals.

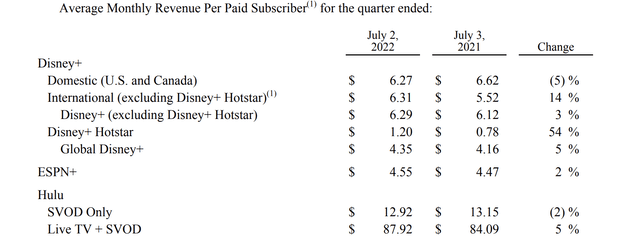

As discussed before, Disney doesn’t generate the prescribed high fees for the DTC streaming services. The ARPU is only $6.29 for Disney+ and just $4.55 for ESPN+.

Disney FQ3’22 Earnings Release

The DTC division already produces quarterly revenues of $5.1 billion, but the amount led to a massive loss of $1.1 billion. The trouble is that DTC has already reached a massive scale, with Disney+ at 94 million subs and the sports-focused ESPN+ at 23 million subs. The company still needs massive DTC growth in order to turn from large losses to large profits.

Activist Disruptions

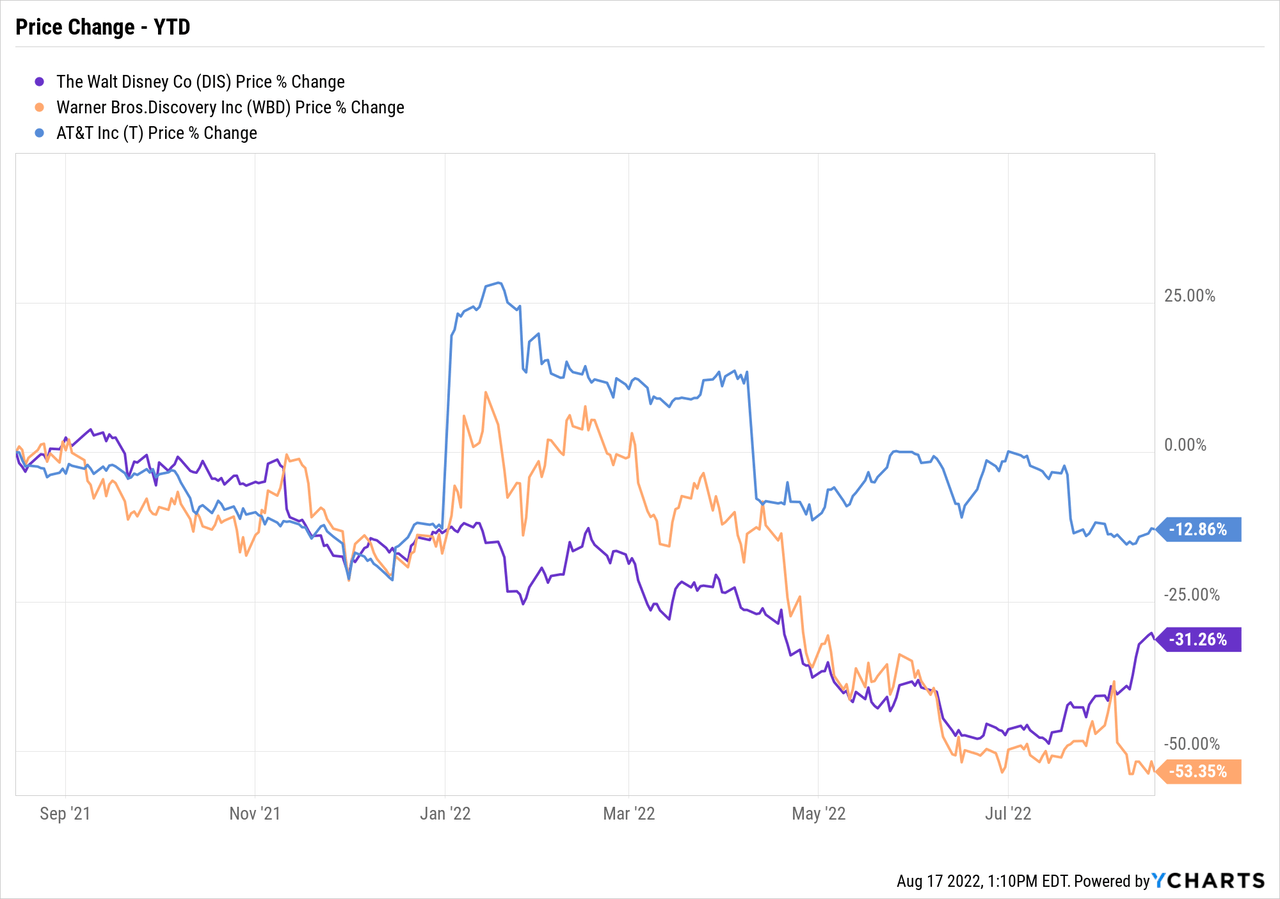

As someone signed up to the Disney+ bundle, spinning off ESPN could easily lead to reduced subscribers. Activist Third Point is again pushing for Disney to spin off the live sports network, but any investor signing up for this view needs to understand what happened with the AT&T (T) spin-off of WarnerMedia into what is now Warner Bros. Discovery (WBD).

The company would need to provide investors with the total subs signed up for the Disney+ bundle and highlight how many would depart with the ending of the bundle. The Disney business could definitely end up better without the tie into competitive sports content, but the general video streaming business faces massive competition for talent. Investors need to be careful thinking a disruptive plan is the solution versus solving what is causing the DTC division to still lose so much money.

The only case Third Point made for the spin-off of ESPN is sports betting. Considering ESPN covers sports, the company shouldn’t even be involved in the gambling portion of the business outside of TV shows focused on independent analysis. ESPN should be no different than CNBC, covering the financial news while staying out of the business of providing investment analysis or financially benefitting from investment trades touted on the network.

In these regards, ESPN isn’t likely to see any major financial benefit from covering sports betting. Any move to spin off ESPN with substantial debt to alleviate the burden of Disney would only reduce the value of the spin-off similar to Warner Media.

Over the last year, Disney has far outperformed the results of Warner Media. If anything, the merger disruptions are what has led to Disney making the recent steps higher while Warner Media has fallen to a 50% loss in the last year. AT&T hasn’t exactly performed much better, losing nearly 13% in the last year.

Analysts are forecasting Disney continues to recover earnings, with a forecast for the FY23 EPS jumping up to $5.42. Third Point hasn’t made any case for the media giant being any better off spinning off the sports division. The bigger fears are that the fundamental issues in the video streaming business haven’t been resolved.

Takeaway

The key investor takeaway is that Disney is just too expensive here at 23x FY23 EPS estimates that appear aggressively pricing in a 40% growth rate next year. The company continues to face a difficult road back as the DTC streaming business is still struggling and activists aren’t helping with disruptive proposals.

Be the first to comment