This article was highlighted for PRO subscribers, Seeking Alpha’s service for professional investors. Find out how you can get the best content on Seeking Alpha here.

Investment Thesis

I was long Disney (DIS) a couple years ago and sold way too early then. At that time, I never thought I would be short Disney. However, given the statistics we are seeing in Europe and the measures taken there, Disney looks extremely exposed if the current trajectory of COVID-19 continues. There are few signs to the contrary.

COVID-19 in Europe

South Korea is the only country with reliable data which has gotten the COVID-19 growth rate under control, from being in the exponential growth stage. I am not counting China because I don’t have reliable data and Singapore for example never saw the same growth rate as South Korea. We are now seeing similar growth rates in Western Europe as we saw in South Korea.

Keep in mind that a daily growth rate of 26%, doubles in 3 days and will increase by 10 times in just 10 days. One argument is that the case count doesn’t match the actual spread, but we are just capturing previously undiagnosed cases.

That might be true, but unless you start to test a much larger portion of the population, those undiagnosed cases will continue to spread until tested. So, I think the case count is a decent reflection of the growth of COVID-19. I was forwarded an article from Sweden, which I used Google to translate, where people without symptoms will no longer be tested, which is the opposite to what South Korea did to get the growth rate down.

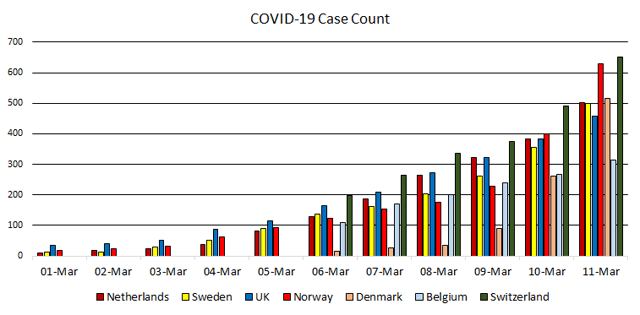

The data is primarily based on the Johns Hopkins University Dashboard, but some of the daily data has been collected elsewhere. The quality of the early daily data for example might not be perfect, but the more recent data has been verified in a couple of places.

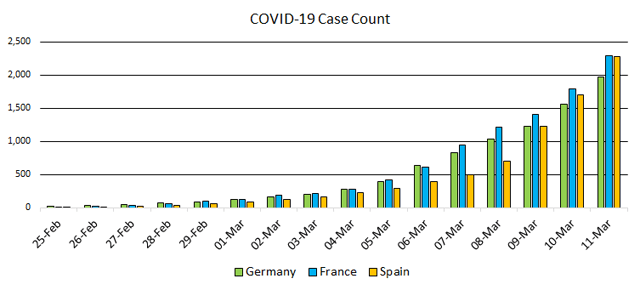

Figure 1 – Source: Johns Hopkins University Dashboard

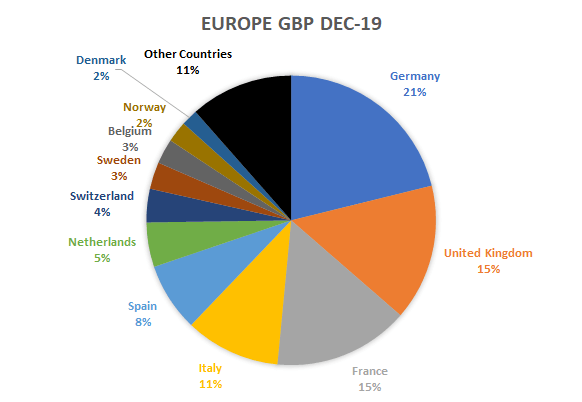

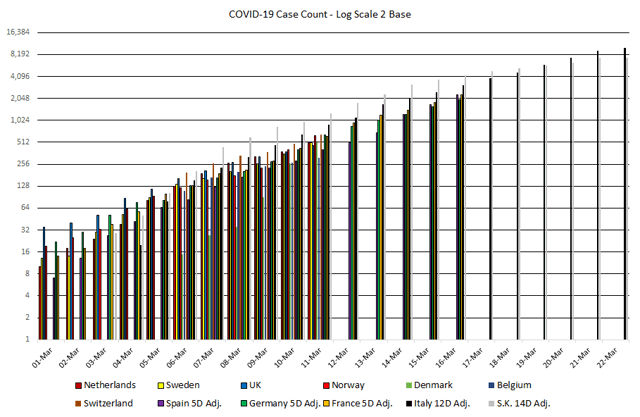

The Northern European countries and Switzerland in the first chart is about 12 days behind Italy in terms of case count. Germany, Spain, and France are somewhere in the middle, where the data can be seen in the second graph. The countries are more or less on the same trajectory as seen in the third graph, we will definitely see some deviations going forward as some lessons learned from Italy and the differences in population will start to matter more as well.

Figure 2, 3 & 4 – Source: Johns Hopkins University Dashboard

There are certainly some exceptions like Portugal and Finland which looks better, but the charts above include most of the Western European countries that account for the vast majority of GDP in the region.

Figure 5 – Source: TradingEconomics

We are now seeing social distancing and large gatherings avoided. Even smaller events, travel, and corporate meeting are now being cancelled everywhere.

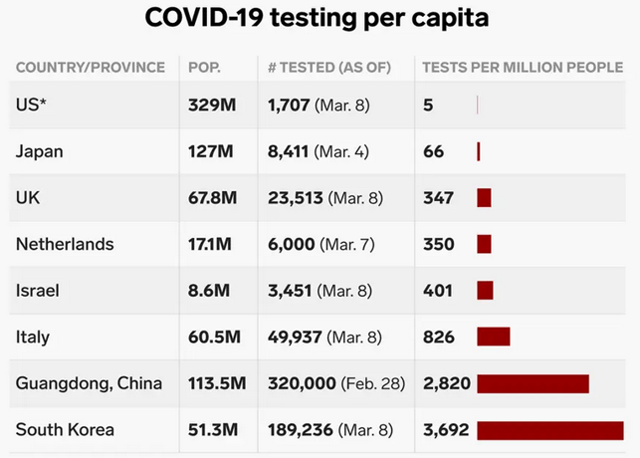

Whether this trajectory will be true for the U.S. as well, remains to be seen, but given the low testing frequency up until this point, it is fair to say it is likely to be the same or potentially worse.

Figure 6 – Source: Business Insider

Disney Exposure

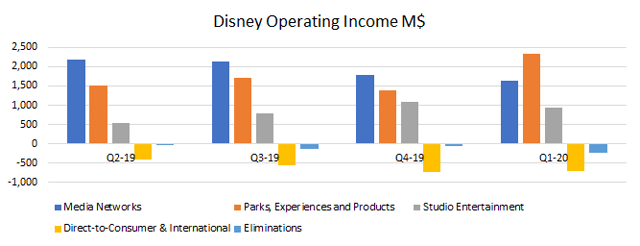

I assume Disney’s Parks, Experience and Products segment will be heavily affected which accounted for 48% of operating income during the last quarter, but less in previous quarters.

However, it doesn’t stop there. The COVID-19 measures have yet to be reflected in the box office data and will likely take some time before we see this. Year-on-year comparisons are at least in the very short term heavily affected by title launches, but within a month or so I expect we will see a drastic drop in year-on-year data, in both the U.S. and Europe. The Studio Entertainment is consequently not going to save the day which accounted for 24% of operating income last quarter.

If the various countries don’t get this under control, we could also be looking at sporting events being cancelled as we have now seen in Italy and other places in Europe. This is still some ways off, but things are moving very quickly, which could in extension also affect Media Networks where ESPN is a significant contributor to operating income.

Figure 7 – Source: Quarterly Reports

Conclusion

There is certainly the possibility that the Fed manages to levitate the market regardless how bad things get, which doesn’t look to be the case right now at least.

Some would argue COVID-19 will not get that bad in the U.S., which I have hard time seeing based on European data and lack of testing.

Disney is naturally valued based on years of cash flows and will not be that heavily affected by one or possible two quarters of very negative earnings growth. I don’t think Disney is looking at negative earnings growth, but more likely substantial losses during the next couple of quarters. I also think it has the potential to drag on longer than many believe.

Long term, this might be decent entry price, but I think the market will be surprised of how exposed Disney really is to COVID-19 and will likely trade down more over the next few months, which is why I am short the stock to hedge part of my other market exposure.

If the measures taken now in large parts of Europe remain for just a couple of quarters and we get the spread under control, there is also the risk that the fear of large gatherings could persist for longer even when the spread is under control.

Disclosure: I am/we are short DIS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment