PhonlamaiPhoto/iStock via Getty Images

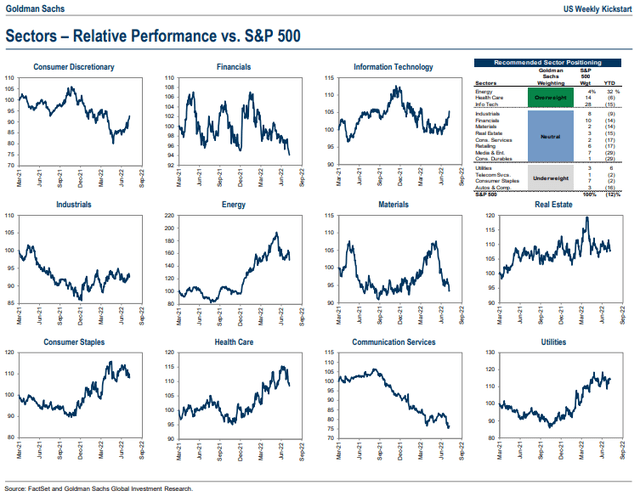

The ugly stepchild of the “Tech, Media, and Telecom” (TMT) supersector is undoubtedly Communication Services (CS). According to Goldman Sachs Investment Research, the sector has experienced the largest EPS cuts this reporting season among all 11 market groupings. Moreover, price-action has been downright dreadful in CS for the last year. The below graphic from Goldman illustrates relative sector performances. While growth sectors like Consumer Discretionary and Information Technology have bounced back sharply over the last few months, CS just keeps lagging.

S&P 500 Sector Relative Performances: Communication Services Keeps Lagging

Goldman Sachs Investment Research

DISH Network (NASDAQ:DISH) is one CS company that is down huge over the last year. Shares fell from the mid-$40s in August 2021 to a low just above $16 when the S&P 500 bottomed out in June. Is there value in this household name? Let’s dig in.

According to Bank of America Global Research, DISH Network provides television service in the US to 12 million customers. The company also holds valuable wireless spectrum assets including 600MHz, 700MHz, AWS, and mmWave. DISH bought part of Sprint’s prepaid wireless business and plans to build out its wireless network.

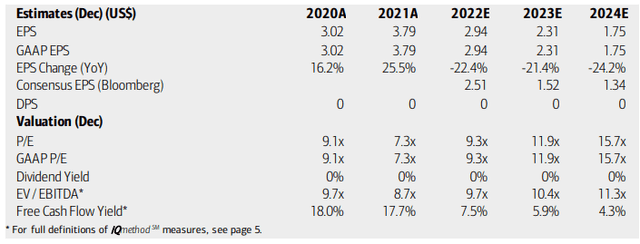

Analysts at BofA expect earnings to decline in the years ahead – as does the Bloomberg consensus forecast. While the stock trades at an exceptionally low trailing 12-month P/E ratio near 6, per The Wall Street Journal, the $10.2 billion market cap company based in Colorado does not pay a dividend and is arguably pricey given such a weak fundamental outlook. Its EV/EBITDA multiple is a bit high on an absolute basis and the firm’s free cash flow yield is set to drop. On the bright side, DISH crushed earnings estimates last week.

DISH: Earnings, Valuation, Free Cash Flow Forecasts

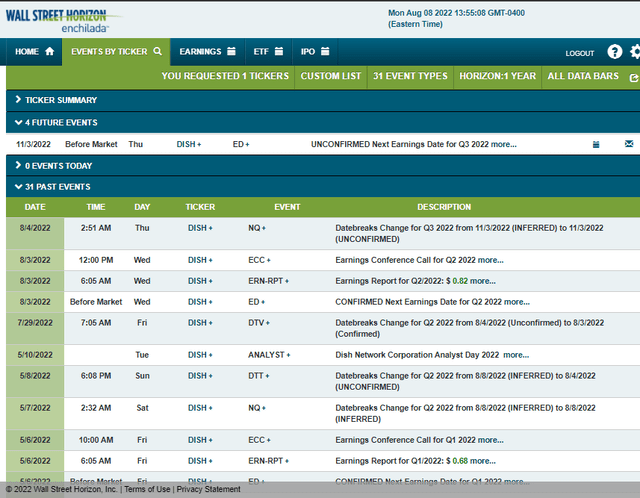

After reporting $0.82 vs. the $0.65 consensus expectation, DISH’s corporate event calendar is light until the next quarterly earnings report date of November 3, BMO, according to Wall Street Horizon.

Corporate Event Calendar Light Through Q3

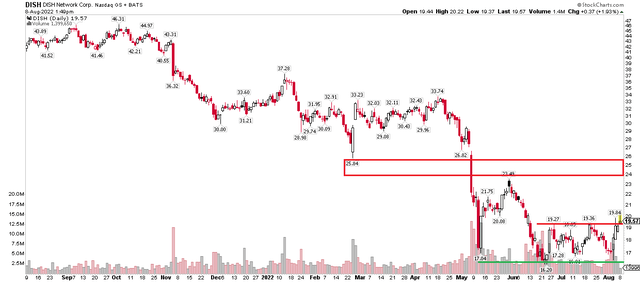

The Technical Take

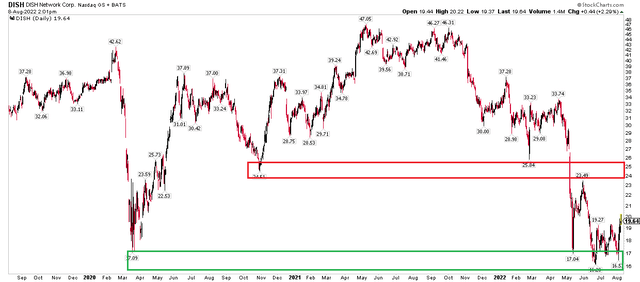

While the fundamental backdrop is quite soft for DISH and its valuation looks like more of a value trap than a bargain, the technical story actually looks somewhat favorable right now. Shares have rallied to their highest level since mid-June, climbing above resistance in the low $19s. The stock is up four straight sessions as of this writing. There’s still work to be done though. DISH remains precariously close to the noted support price, so a drop back below it would be worrisome.

On the upside, $23.50 is the first resistance point – the high from late May.

DISH Near-Term Chart: Breaking Above Resistance, Q2 Highs Next Key Spot

The $24 to $26 range is longer-term resistance. So long as the $19 to $19.50 range hangs on, shares could have some technical upside from here.

DISH 4yr Chart: Resistance In The Mid-$20s, Support $16-$17

The Bottom Line

Long-term investors might want to steer clear of DISH right now. The CS and telecom areas continue to be weak. Short-term traders eyeing the charts might see an opportunity at current levels, but bulls must defend it here.

Be the first to comment