PeopleImages/iStock via Getty Images

The Investment Case for CLOs

In our current low interest rate environment, collateralized loan obligations (CLOs) may be attractive to investors seeking higher yields than traditional fixed income investments. Investors who are familiar with CLOs and their active management style value a manager’s ability to capitalize on volatility in the credit markets. During the 2008 financial crisis, for example, the integrity of the CLO structure was tested, but CLOs and their managers proved resilient according to Moody’s research cited on page 3. More recently, the CLO structure demonstrated its resilience during the COVID-related market dislocation in the spring of 2020 followed by a strong recovery in the pricing of the highest rated tranches of CLO debt investments. CLO equity investments continued to generate cash flows for investors and have also experienced improved pricing off market lows in March 2020. When considering an investment in CLOs, it is important that investors understand how they work. CLOs may offer opportunities for yield and attractive returns in both rising and flat interest rate environments. They do, however, pose risks associated with leverage and illiquidity.

CLOs Invest in Senior Secured Loans

A CLO is a type of structured credit that invests in a diverse pool of senior secured loans. Senior secured loans—also referred to as floating-rate loans or senior loans—are issued by banks to below-investment-grade corporations.1 Senior loans have several distinctive and highly attractive features, particularly when compared to fixed-rate high yield corporate bonds.

First, senior secured loans are floating-rate credit instruments. When interest rates exceed the loan’s reference rate floor, the interest paid increases. By contrast, fixed income is by definition fixed, so when interest rates rise, the value of a corporate bond portfolio is adversely affected. Senior loans have typically used the one-month London Interbank Offered Rate (“LIBOR”) as reference rate, and CLOs have typically used three-month LIBOR; both of which are currently being phased out. In July 2021, market participants began adoption of CME Group’s Term Standard Overnight Financing Rate (“SOFR”) as the replacement rate for LIBOR. New loans and CLOs now typically utilize SOFR- with existing instruments required to transition to a new reference rate by June 30, 2023.

Secondly, senior loans are senior collateralized assets, which further distinguishes them from high yield corporate bonds. As their name implies, senior loans have the highest priority in receiving payments, ahead of both bondholders and preferred stockholders. In addition, senior loans are typically secured by collateral. Since the year 2000, senior loans have an average default rate of 3.1%, while high yield bonds averaged 3.2% over the same time-period. The recovery rate following default for senior loans averaged 64 cents on the dollar the past 24 years. By comparison, over the last 25 years, high yield bonds averaged a recovery rate of 40 cents on the dollar.2

Senior Secured Loans Compared to High Yield Bonds

|

Senior Secured Loans |

High Yield Bonds |

|

|

Collateral |

Secured |

Unsecured |

|

Coupon |

Floating Rate |

Fixed Rate |

|

Covenants |

Maintenance |

Incurrence |

|

Call Protection |

Limited |

Moderate |

|

Recovery Prospects |

High |

Low |

|

Investor Base |

Concentrated |

Diverse |

|

Secondary Market Volume |

~$3 billion per day3 |

~$6 billion per day4 |

Source: Citi Research, June 2022

1 Issuers of below investment grade securities (that is, securities below Baa3- by Moody’s Investors Service, Inc. or below BBB- by S&P Global Ratings or Fitch Ratings Inc.) are not perceived to be as strong financially as those with higher credit ratings. These issuers face ongoing uncertainties and exposure to adverse business, financial or economic conditions and are more vulnerable to financial setbacks and recession than more creditworthy issuers, which may impair their ability to make interest and principal payments. Below investment grade securities, which are commonly referred to as “high-yield” securities or “junk” bonds, are regarded as having predominantly speculative characteristics with respect to capacity to pay interest and to repay principal. 2 Historical averages for defaults and recovery rates. J.P. Morgan Default Monitor, June 2022. 3 LSTA Trade Data Study, 12/31/2021. 4 FINRA, 3/31/2022.

Understanding the CLO Structure

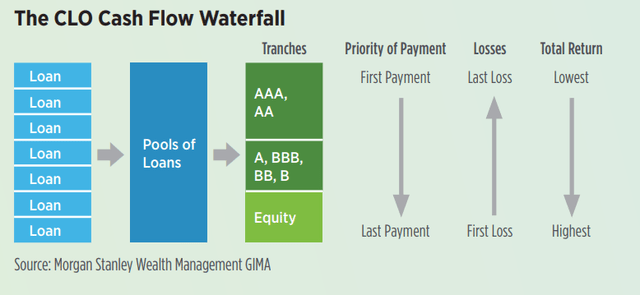

CLOs are operated by professional credit managers who actively buy and sell senior loans. The CLO finances its investment in the pool of loans by issuing debt and equity.

At the top of the CLO cash flow waterfall are the CLO debt tranches, AAA and AA are the most senior. The debt issued by the CLO to pay for its purchase of the loans is divided into different tranches, each with different risk/return profiles. Each debt tranche is given a credit rating by a national rating agency. The more senior the debt tranche, the higher its priority on any cash payment received by the CLO and the higher its rating. The highest rated tranches, rated AAA and AA, have the lowest current yields but have never defaulted.* CLO debt is designed to have lower risk than CLO equity, but CLO equity compensates for its higher risk profile by offering the potential for higher returns.

The CLO Marketplace

The U.S. market for CLOs has expanded in recent years and now stands at $768 billion.1 CLOs represent approximately 55% of the $1.390 trillion in senior secured loans outstanding in the institutional market.2 By contrast, retail investors – typically through loan funds – currently represent approximately 13% of the outstanding loan market.3

CLO Debt Historically Outperformed Similarly Rated Corporate Credit

|

Default Rate |

U.S. CLO Debt |

U.S. Corporate Credit |

||

|

Sector |

1994–2013 |

5 Year |

10 Year |

15 Year |

|

AAA |

0.0% |

0.4% |

0.9% |

1.3% |

|

AA |

0.0% |

0.5% |

1.2% |

1.7% |

|

A |

0.5% |

0.8% |

2.1% |

3.2% |

|

BBB |

0.3% |

2.4% |

5.3% |

7.6% |

|

BB |

1.7% |

9.2% |

16.7% |

20.5% |

|

B |

2.6% |

21.4% |

29.9% |

34.1% |

Source: Standard & Poor’s Ratings Direct “Twenty Years Strong: A Look Back at U.S. CLO Ratings Performance from 1994 through 2013” (January 31, 2014). Please note that this is the latest information available from S&P. Past default rates are not indicative/a guarantee of future default rates.

Includes all U.S. cash flow CLO tranches rated by Standard & Poor’s as of year-end 2013. Default rate is calculated as the number of rated tranches that had ratings lowered to D divided by total number of rated tranches. Loss rate is calculated as the sum of losses divided by the sum of issuance amounts. When necessary, market values from trustee reports were used to estimate tranche losses.

- Barclays Credit Research, “CLO & Leveraged Loan Monthly Update, April 2022” (May 2, 2022). 2 Source: LCD, an offering of S&P Global Market Intelligence as of 3/31/22. 3 S&P Global Market Intelligence, “Investor Technicals” (December 31, 2020). 4 Source: Citi Research.

*The last comprehensive study of CLO performance was conducted in January 2014 by Standard & Poor’s Ratings Direct described in the report “Twenty Years Strong: A Look Back at U.S. CLO Ratings Performance From 1994 Through 2013.” Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

CLO Equity — The Residual

CLO equity represents a residual stake in the CLO structure and first loss position in the event of defaults and credit losses. CLO equity investors receive the excess spread between the CLO assets and liabilities and expenses.

To better understand how CLO equity may generate attractive returns for investors, we can make a rough comparison between owning CLO equity and owning a house purchased with a mortgage and renting it out. For the homeowner, the difference between the rent payments received and the mortgage payments owed is equivalent to the spread.

For CLO equity, this spread can be quite wide; when underlying loan payments exceed CLO debt payments, CLO equity may have the opportunity to

generate high returns. Even in a market environment with increasing interest rates, CLO equity securities can produce attractive cash flows when senior loan returns continue to exceed the cost of debt. While CLO debt indices exist to benchmark performance, there are no established indices for benchmarking CLO equity performance.

“CLOs, which represent approximately 60 percent of the leveraged loan market, are long-term vehicles that are not marked to market. Consequently, under the governing

terms of market CLOs, neither ratings agency downgrades nor continued downward pressure on loan prices would force CLOs to sell loan assets or to liquidate a CLOs portfolio of individual loans.”

Loan Syndications and Trading Association, June 13, 2022

Integrity of the CLO Structure

CLOs have certain protections built in to reduce risk of default, features which partly explain their historical performance. Not only is a CLO subject to performance-based tests that seek to ensure its cash flow distribution obligations are met, an overcollateralization test confirms that the underlying loan pool’s principal value will exceed the value of CLO debt. If the principal value declines below the test’s trigger value, cash will be diverted from equity and junior CLO tranches to senior debt tranches. A

skilled CLO manager may help mitigate risks by making portfolio changes to avoid reaching the trigger threshold or purchasing more bank loans.

A CLO’s debt financing spread to the reference rate is locked in for the life of the CLO and is therefore favorable relative to other forms of financing where reference rates and spreads may change over time.

Understanding the Drivers of CLO Equity Returns

CLO equity is different from the CLO debt tranches. The equity residual is not rated, nor does it have a set coupon. It is also the first to absorb losses. To compensate for these higher risks, CLO equity offers the potential for higher returns.

Typically, CLO equity benefits over time from both volatility in the underlying loan market — which creates opportunities for active management— and low-cost financing. Alternatively, in the short term, CLO equity tranches may experience significant market value decline during times of volatility. CLO equity outperformance is therefore driven largely by a combination of manager skill and market opportunities. When CLO managers pay less for liabilities associated with the CLO debt tranches, CLO equity holders may receive increased profit from the residual cash flow. Additionally, newly issued CLO equity can benefit if credit spreads widen because of a CLO’s ability to reinvest the repayment proceeds of its underlying loans.

There are additional benefits of investing in CLO equity. CLO equity investors may elect to either call or unwind the CLO or capitalize on decreasing

liability costs by refinancing the underlying bank loan portfolio and increasing current income. As such, CLO equity investors may benefit from the lower cost of liabilities and see higher levels of cash flows.

Active Management May Generate Attractive Returns for CLO Equity

The CLO manager actively manages the diversified portfolio of loans in the CLO. When the leveraged loan market experiences volatility, a capable CLO manager may capitalize on such volatility by minimizing credit losses and purchasing assets at discounts to par. Doing so can enhance current income for CLO equity and increase total return through capital appreciation. Hence, CLO equity may benefit from volatility or severe dislocations in the loan market, especially when the CLO is managed with great skill.

Active management is an important driver of historical CLO equity performance. Unlike passive investments, the manager of a CLO can find new investment opportunities in times of market stress and may refinance at advantageous rates in times of market calm.

A Case Study: The 2008 Financial Crisis

Strong CLO Performance Sets CLOs Apart from Other Structured Credit

CLOs are some of the few structured credit products that performed as intended during the financial crisis. As shown in the chart below, the performance of senior debt tranches of CLOs highlights the unique levels of protection and structural resilience that may make CLOs attractive to investors.

When senior secured loans held by CLOs were called or refinanced by the issuer during the crisis, the loans were typically paid out at par, and the cash was reinvested by the CLOs in new senior loans for the CLOs’ underlying loan pool. Opportunistically turning over the loans and reinvesting at higher spreads and lower prices allowed many CLO managers to generate strong returns over this period.

CLOs vs. CDOs: Often confused but notably different

Not all structured credit held up well during the financial crisis. Collateralized debt obligations (CDOs), often confused with CLOs, are a case in point. Other than a similar name and acronym, these two investment products have little in common.

Historically, CLOs have outperformed asset-backed CDOs (ABS CDOs) because of active management and the diverse nature of senior secured loans and their underlying collateral. In contrast, the underlying collateral for ABS CDOs are typically static pools of residential mortgages. The default rate of underlying mortgages in ABS CDOs demonstrates that the fundamental collateral is as important as the structure. During 2008 and 2009, the underlying collateral of ABS CDOs consisted of mortgages with very high default rates and very low recovery rates.

CLOs Compare Favorably to CDOs

|

CLOs |

CDOs |

|

|

Collateral |

Senior secured loans |

Asset-backed security tranches |

|

Management |

Active management |

Static securitizations |

|

AAA 20 Year Cumulative Default Rate |

0.0% |

35.1% |

|

AA 20 Year Cumulative Default Rate |

0.0% |

43.2% |

Source: Moody’s Investor Services, Special Comment: Default and Loss Rates of Structured Finance Securities: 1993–2017. June 12, 2018. For illustrative purposes. Performance data quoted represents past performance. Past performance does not guarantee future results. Current performance may be lower or higher than the performance data quoted.

Investments in different asset classes have different types of risks, which may provide higher returns but also greater volatility. See below for a summary or risks associated with these asset classes.

In addition to the general risks associated with credit instruments, CLOs and CDOs are structured credit securities and often involve risks that are different from or more acute than risks associated with other types of credit instruments. The credit quality of CDOs depends primarily upon the quality of the underlying assets and the level of credit support and/or enhancement provided. CDOs are subject to risks associated with the possibility that distributions from collateral securities will not be adequate to make interest or other payments; the quality of the collateral may decline in value or default; and the complex structure of the security may produce disputes with the issuer or unexpected investment results.

Life of the Typical CLO

|

Pre-closing |

|

|

Month 1 to Month 6 |

Warehouse Period Underwriting bank provides CLO manager with financing to begin acquiring assets in advance of CLO closing. Equity investors provide first loss capital during the warehouse period. |

|

Closing CLO comes into legal existence. |

|

|

Post-closing |

|

|

Month 1 to Month 3 |

Ramp-Up Period Post-closing, proceeds from CLO debt issuance used to repay warehouse and purchase additional assets. |

|

Month 4 to Year 4 |

Non-Call Period Post-Year 2, the equity investor(s) may direct original CLO liabilities to be refinanced (prepaid at par) and replaced with new liabilities in order to reduce interest expense. |

|

Reinvestment Period

|

|

|

Year 5 to Maturity |

Amortization Period A portion of cash flows from asset amortization, prepayments/repayments, and sales are used to pay down outstanding CLO debt in order of seniority. |

Key Benefits and Risks

|

Benefits |

|

|

Income |

CLOs may generate high levels of current income. |

|

Short Duration |

CLOs are floating rate instruments, which generally leads to shorter interest rate durations. |

|

Active Management |

CLOs are actively managed and may benefit from volatility in the loan market. |

|

Structural Integrity |

Strengths of the CLO structure include stable financing and various credit enhancements that may protect debt holders. CLO financing is typically set for the life of the CLO. And, the structure has various features that are designed to protect the interests of debt holders. |

|

Risks |

|

|

Below Investment Grade Securities Risk |

Certain tranches of loans and CLOs may be below investment grade credit instruments, which are commonly referred to as “junk” bonds and involve substantial risk of loss. Securities of below investment grade quality are considered predominantly speculative with respect to the issuer’s capacity to pay interest and repay principal when due and therefore involve a greater risk of default or decline in market value due to adverse economic and issuer-specific developments. Issuers of below investment grade securities are not perceived to be as strong financially as those with higher credit ratings. Securities of below investment grade quality display increased price sensitivity to changing interest rates and to a deteriorating economic environment. The market values for securities of below investment grade quality tend to be more volatile and such securities tend to be less liquid than investment grade debt securities. |

|

CLO Risk |

CLO investing poses new and different risks than stock or bond investing. CLOs often involve risks that are different from or more acute than risks associated with other types of credit instruments. CLOs are leveraged investments that may be volatile and may be illiquid in certain market environments. Additionally, the underlying loans of a CLO are senior secured, below investment grade credit and they carry the possibility of default, a risk that increases as the credit cycle progresses. Generally, there may be less in- formation available to investors regarding the underlying investments held by CLOs than if investors had invested directly in credit securities of the underlying issuers. The market value of CLO securities may be affected by changes in the underlying collateral, including shifts in market value or changes in distributions, defaults and recoveries, capital gains and losses, prepayments and the availability of new investment opportunities, prices and interest rates. CLOs are a type of structured credit instrument. Holders of structured credit instruments bear risks of the underlying investments, index or reference obligation as well as risks associated with the issuer of the instrument, which is often a special purpose vehicle, and may also be subject to counterparty risk. |

|

CLO Equity Risk |

CLO equity (subordinated notes) is subject to a higher risk of total loss. There can be no assurance that distributions on the assets held by the CLO will be sufficient to make any distributions to CLO equity holders. CLO equity securities are illiquid investments and subject to extensive transfer restrictions, and no party is under any obligation to make a market for subordinated notes. Investments in CLO equity may have complicated accounting and tax implications. |

|

Liquidity Risk |

CLOs and loans may be restricted, as well as thinly traded securities, which at times may only be liquidated, if at all, at disadvantageous prices. An investor may be required to hold such securities despite adverse price movements. Privately issued securities have additional risk considerations than investments in comparable public investments. |

|

Risks (continued) |

|

|

Reference Rate Risk |

Senior secured loans are generally floating rate instruments and investments in senior secured loans through CLOs are sensitive to interest rate levels and volatility. Although CLOs are generally structured to mitigate the risk of interest rate mismatch, there may be some difference between the timing of interest rate resets on the assets and liabilities of a CLO. Such a mismatch in timing could have a negative effect on the amount of funds distributed to CLO subordinated notes. In addition, CLOs may not be able to enter into hedge agreements, even if it may otherwise be in the best interests of the CLO to hedge such interest rate risk. Furthermore, in the event of a significant rising interest rate environment and/or economic downturn, loan defaults may increase and result in credit losses. Because CLOs generally issue debt on a floating rate basis, an increase in reference rates will increase the financing costs of CLOs. Many of the senior secured loans held by CLOs have rate floors such that, when the rate is below the stated floor, the floor (rather than the reference rate itself) is used to determine the interest payable under the loans. Therefore, if LIBOR or SOFR increases but stays below the average stated floor rate of the senior secured loans held by a CLO, there would not be a corresponding increase in the investment income of such CLOs. The combination of increased financing costs without a corresponding increase in investment income in such a scenario would result in smaller distributions to holders of the CLO subordinated notes. CLOs and bank syndicated loans have traditionally used LIBOR as an interest rate benchmark, which is being phased out, with new instruments typically being issued with SOFR as the alternative rate and existing instruments required to transition by June 30, 2023. Replacement of LIBOR may adversely affect the market value or liquidity of CLO securities and/or loans, and pose tangential risk for markets and assets that do not rely directly on LIBOR. It is possible that different markets might adopt different rates, resulting in multiple rates at the same time and a potential mismatch between CLO securities and underlying collateral, the effects of which are uncertain at this time, and could include increased volatility or illiquidity An increase in reference rates will increase the financing costs of securities that issue debt at floating rates, like loans and CLOs. The loan and CLO industry’s transition from LIBOR to a new reference rate (typically SOFR) could adversely affect the market value or liquidity of CLO securities and/or loans. It is possible that different markets might adopt different rates, resulting in multiple rates at the same time and a potential mismatch between CLO securities and underlying collateral, the effects of which are uncertain at this time, and could include increased volatility or illiquidity. Additional operational and technology challenges during the transition may also result in delayed investment analyses and reduced investment opportunities |

The information in this publication is provided as a summary of complicated topics for informational and educational purposes and does not constitute legal, tax, investment or other professional advice on any subject matter. Further, the information is not all-inclusive and should not be relied upon as such. CLOs are a type of structured credit instrument. Holders of structured credit instruments bear risks of the underlying investments, index or reference obligation as well as risks associated with the issuer of the instrument, which is often a special purpose vehicle, and may also be subject to counterparty risk. Senior loans may not be fully secured by collateral, generally do not trade on exchanges, and are typically issued by unrated or below-investment grade companies, and therefore are subject to greater liquidity and credit risk. Illiquid investments are designed for long-term investors who can accept the special risks associated with such investments. An investment in illiquid investments involves risks, including loss of principal. Past performance does not guarantee future results. Current performance may be lower or higher than performance data quoted. Diversification does not eliminate the risk of experiencing investment losses. You should not use this publication as a substitute for your own judgment, and you should consult professional advisors before making any investment decisions. This publication may contain “forward looking” information that is not purely historical in nature, including projections, forecasts, estimates of market returns. There is no guarantee that any forecasts will come to pass. This information does not constitute a solicitation of an offer to sell and buy any specific security offering. Such an offering is made by the applicable prospectus only. A prospectus should be read carefully by an investor before investing. Investors are advised to consider investment objectives, risks, charges and expenses carefully before investing. Financial advisors should determine if the risks associated with an investment are consistent with their client’s investment objectives.

Be the first to comment