Ekaterina Belova

Having spent 10 years studying emerging markets, I know that you have patterns repeated over and over again. A bubble is like a fire which needs oxygen to continue; when you see there is no oxygen, things change. – Nouriel Roubini

Product profile and risks

At the outset of this article, I would like to state that the Direxion Daily MSCI Brazil Bull 2X Shares (NYSEARCA:BRZU) should only be pursued by those who understand the dynamics of the daily reset feature of this product. For the uninitiated, BRZU is a leveraged ETF that seeks to provide twice the returns of the MSCI Brazil 25/50 index on a “daily basis”. Returns of BRZU beyond a day will invariably be more than 2x the return of the benchmark index so do trade cautiously if you ever decide to take the plunge.

Also consider that access to this product does not come cheap, as not only do you have the standard management fees, which work out to 0.75%; you also have other ancillary expenses that work out to another 0.51%, taking the total annual fund operating expenses to a steep figure of 1.26%!

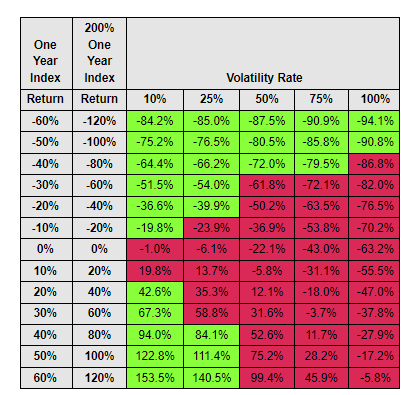

Finally, I also want to touch upon the relationship between volatility and returns, something that investors often tend to overlook; as noted in The Lead-Lag Report, Brazil stocks have had a very volatile year; at the start of the year, they were on fire, but in recent months, they’ve given up all their gains and are back at square one. Looking ahead, say the index ends up delivering no returns at all this year. All things considered, that’s probably not the worst thing for the unlevered product, given how difficult conditions have been in the financial markets. But for BRZU? Well, that’s a different matter altogether.

As you can see from the image below, at a 25% volatility rate, BRZU could end up delivering negative returns of -6%, even if the benchmark delivers no returns. The worrying aspect of BRZU is that a passively managed ETF that tracks the MSCI Brazil 25/50 Index (EWZ) has typically witnessed volatility that is a lot higher than the 25% threshold; to be more precise you’re looking at a volatility figure closer to the 40% mark. This means that even in a scenario where the index sees flat returns, the levered product could end up delivering double-digit losses!

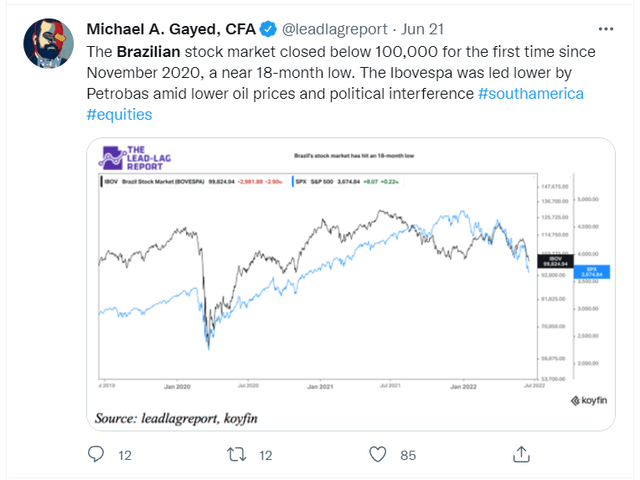

Last month, I put out a tweet on The Lead-Lag Report timeline flagging the collapse of the Brazilian benchmark index, below the psychological landmark of 100,000; it continues to trade well below those levels and it is difficult to see any major upside catalysts for Brazilian stocks at this juncture.

A lot has been made over the country’s inordinately high inflation levels (10 successive months at double-digit levels) despite the central bank hiking the Selic rate to well over 13% levels.

Last week, I wrote a detailed piece on the worrying levels of emerging market public debt, and whilst the upper tier of that top 50 list largely comprised of some small EMs, Brazil was one of the larger EMs that figured in the top 15 list. Just to elaborate even further, this is an economy where public debt to GDP is close to 100% and the interest bill is only getting more difficult to meet. What I found particularly damning was the fact that out of the 50 odd EMs, only Egypt had a larger “interest expense as a % of GDP” figure than Brazil! The ruling Brazilian regime has been wily enough to incorporate a bill that would enable the government to delay payments on its interest bill but this reflects poorly on the credibility of the government.

I don’t believe it would be unreasonable to have any concerns over the country’s credit rating, particularly given the relentless upward trajectory of the dollar. As noted in the ‘Leaders-Laggers’ section of this week’s report, a red-hot dollar could prove to be a key catalyst in igniting a potential EM debt crisis across the board, and this becomes even more worrisome when you consider how exposed the global banking sector is, to these government bonds.

Finally, there’s the onset of elections in Brazil in October, and whilst it looks all but likely that we will see a change of guard at the top, there are likely to be plenty of twists and turns, which will only add to the volatility quotient of Brazilian stocks; it is difficult to see these conditions ebb until the outcome of the elections. As covered earlier in this article, it is probably not the most optimal time to pursue a product such as BRZU when volatility is likely to be on the higher side.

To conclude, treasuries have started exhibiting their traditional risk-off behavior and when one sees this sort of behavior, it would be best to not load up on any high-beta offerings. Sitting on the fence with BRZU.

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment