Andrii Yalanskyi

Digital World Acquisition (NASDAQ:DWAC) is still trying to take Trump-backed social media startup Truth Social public after repeatedly running into a wall in the form of the SEC. DWAC owners late last month voted in favour of extending its merger agreement deadline to September 8, 2023, after delaying the vote six separate times. From the proposed go-public transaction of Apex Clearing to eToro, the SEC is no stranger to delaying until the deadline or stopping SPAC mergers. Hence, the clock is ticking for DWAC with the SEC still investigating pre-merger announcement trades and what could have been substantive communications among executives and board members that were not disclosed to the public.

DWAC lawyers are currently making the case to the SEC that the supposed substantive discussions did not take place. Whether or not the SEC will approve the deal is up in the air. The current uncertainty is a risk to retail owners of DWAC with the stock currently trading at $21.66, more than double the $10 SPAC reference price. This implies a more than 50% downside was the deal to be scrapped and cash to be returned to shareholders. Fundamentally, blocking the deal without concrete grounds would harm retail investors and go against the SEC’s purpose. That said, some might argue that allegations of this being political theatre are misplaced with the go-public SPAC transaction of Truth Social’s cloud service provider Rumble (RUM) going through with little friction. Rumble will also double up as a revenue driver for Truth Social with the social media site set to join Rumble Ads to host advertisements.

Digital World

It’s important for DWAC holders to be aware that the core bull thesis for their investment has now been materially weakened and for them to come to a conclusion on the next steps. Critically, Truth Social is gearing up for a battle with Twitter for users that now likely prefer Twitter substantially more than when the merger was announced.

Digital Public Town Squares And Elon’s Twitter

Tesla CEO Elon Musk’s acquisition of Twitter presents a significant headwind to the theoretical base for buying DWAC. Truth Social built its value proposition around First Amendment protections. The company sought to appeal to what it alludes to as a disenfranchised base who did not feel represented by the social media orthodoxy.

Digital World

However, the extent to which the company will be able to appeal to its core demographic will be seriously challenged by Elon Musk’s Twitter. Since closing his acquisition, which he initially walked back on, there have been significant changes to the platform which have greatly enhanced its appeal to Truth Social’s core target users.

The operational changes made have all but nullified the points Truth Social made when it went public with a presentation that mentioned Twitter multiple times. Firstly, permabans have been overturned. This has seen thousands of previously de-platformed accounts brought back to the fold including that of Donald Trump who is yet to tweet from his reinstated account. There have also been huge layoffs with all of the previous Twitter executives no longer with the company. Fast Company described this as an “executive red wedding” referencing a harrowing Game of Thrones event where one of the main houses suffers huge losses in a single evening.

Most important for DWAC holders, Twitter’s content moderation policies are shifting to facilitate what Musk has described as a digital town square where users are able to read and engage with diverse viewpoints. Twitter now fully reflects the free-speech absolutism that is Truth Social’s main value proposition. So what’s next for holders of the commons?

The Bull Case Pivots To A Twitter Failure

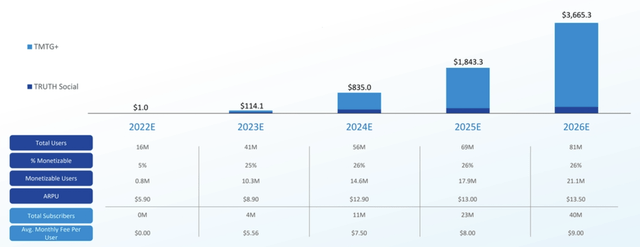

Truth Social’s target user base has broadly embraced the new Twitter. Hence, even if the SEC waives through the deal, it will be hard to see the startup grow to capture the initial buoyant estimates of monetizable users as stated in its go-public SPAC presentation.

Digital World

Truth Social is aiming for at least 81 million users by 2026 with around 26% of these being monetizable to drive revenue of at least $3.67 billion for fiscal 2026. Hence, with Twitter, Gettr, and Parler all now occupying the First Amendment space, it’s hard to see what Truth Social’s exact pull factor beyond Trump will be. The network effect is brutal to new social media companies. Users drive content creation for social media sites and will gravitate to where they can consume the most content, a feedback loop that creates a nearly unassailable moat for a large platform like Twitter.

This means the bull case for DWAC has to slightly pivot to Twitter potentially collapsing under the burden of an ongoing advertising exodus and its $13 billion in debt used by Elon Musk for the leveraged buyout. It’s important to note that Twitter was largely unprofitable before the buyout that added $1 billion in annual interest payments. While most of these advertisers could return, Twitter is likely under some financial stress and DWAC bulls will be hoping for a level of discombobulation that reignites Truth Social’s flagging battle. Bears would be right to state that this is unlikely with Twitter looking to refinance its debt, its cost-cutting, and small overtures to bring back advertisers. DWAC holders should consider their positions against this.

Be the first to comment