Sitthiphong/iStock via Getty Images

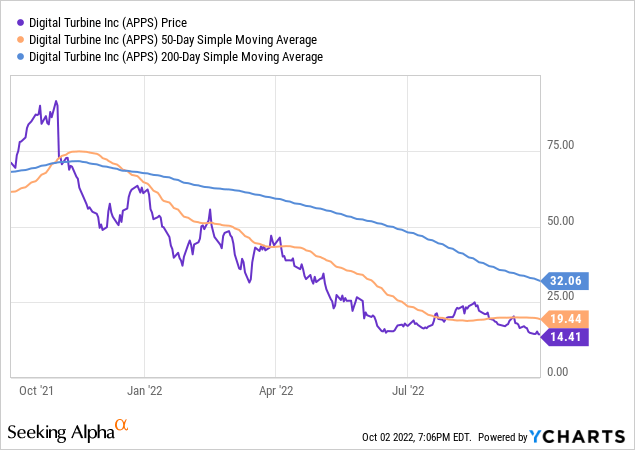

On the surface, Digital Turbine’s (NASDAQ:NASDAQ:APPS) chart looks like a typical bubble stock. Year-to-date, the stock is down 77%. But there are several differences from the other hype stocks: APPS has a working business model, is profitable, and is even cheaply valued. So why this sharp sell-off? What is bothering the market? Or is APPS just getting pulled down in the general maelstrom and offering a long-term buying opportunity? That’s what we want to find out in this article.

Introduction

First, I would like to note that it is hard for me to stay neutral on this company. This is because I have been reading a lot of very bullish articles on Seeking Alpha for more than a year now, and at times when the share price and valuation were much higher. So I also invested some time ago; since then, I am 50% down. And we all know that uncomfortable feeling and the doubts and questions that may arise. Is this a value trap? Should I buy more? Does the market know something I don’t? And so on. Just as a note so that the reader knows we are in the same boat. I want to try for this article to focus on facts and ignore my previous loss.

The bright side: What makes the stock attractive?

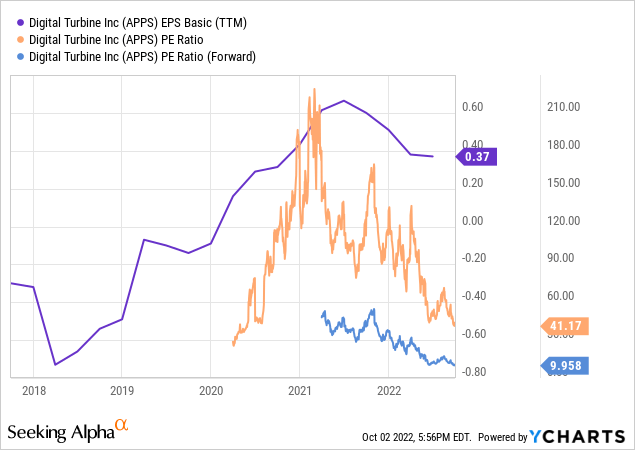

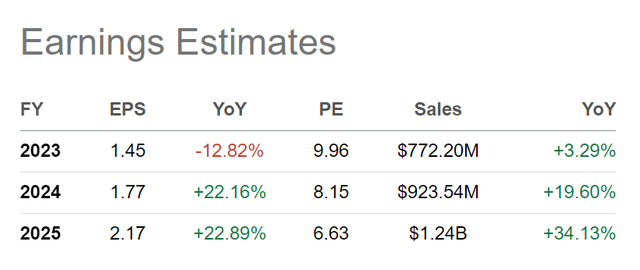

In Seeking Alpha´s Quant Rating, the stock gets a B+ on growth, which is well deserved. The 3Y average revenue growth is 91%. The company has been cashflow positive since 2020. For this reason, and in the context of the general tech stock hype, the stock has risen to absurdly high valuations, most of which have now been reduced again. The forward PE ratio is even in single digits. However, estimates suggest that EPS in the fiscal year 2023 (of which the first quarter has been completed) will be 13% less than in the previous year.

Seeking Alpha

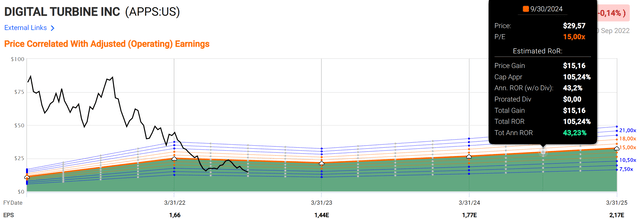

Analysts and the company itself assume that this year will be weaker and that in the future, the synergy effects of the past company acquisitions will take effect more and more. According to fastgraphs, a very high annualized return would be possible with this EPS estimate.

The dark side: What is pressuring the stock?

Several factors come into play here. A very superficial look at the valuation and revenue growth does not reveal this. But all these factors combined explain the pressure on the share in recent months (of course, further intensified by the general sell-off and the interest rate policy).

Non-GAAP vs GAAP

The forward P/E is below 10, but I think it’s important to remember that these are non-GAAP EPS numbers. Investors may not get the complete picture looking at the non-GAAP numbers because this removes the relatively high share-based compensation. GAAP income is significantly lower, here´s a statement from the last earnings report:

GAAP net income for the fiscal first quarter of 2023 was $15.0 million, or $0.15 per share, as compared to GAAP net income of $14.3 million, or $0.14 per share for the first quarter of fiscal 2022. Non-GAAP adjusted net income1 for the first quarter of fiscal 2023 was $38.6 million, or $0.38 per share, as compared to Non-GAAP adjusted net income of $33.4 million, or $0.34 per share, in the first quarter of fiscal 2022.

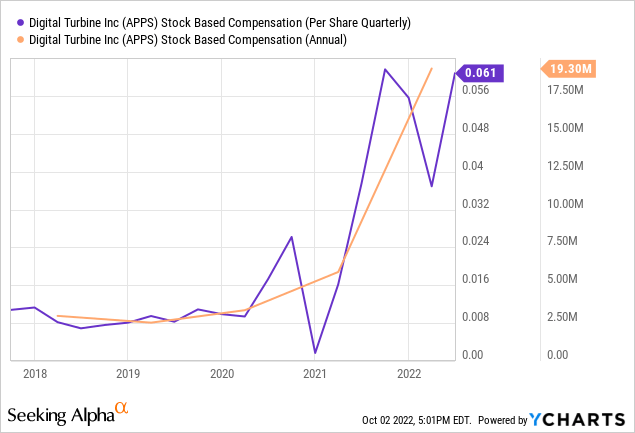

Stock-based compensation

Earnings per share (non-GAAP) in the fiscal year ending March 2022 were $1.66. Note that the $0.06 SBC per share is quarterly. This is a lot in relation to the profit. Another problem is that further SBCs would now take place at a significantly lower share price; in other words, if you want to give the same share-based compensation to a new employee, they would now receive considerably more shares, which could accelerate further share dilution.

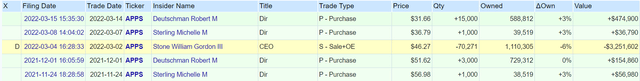

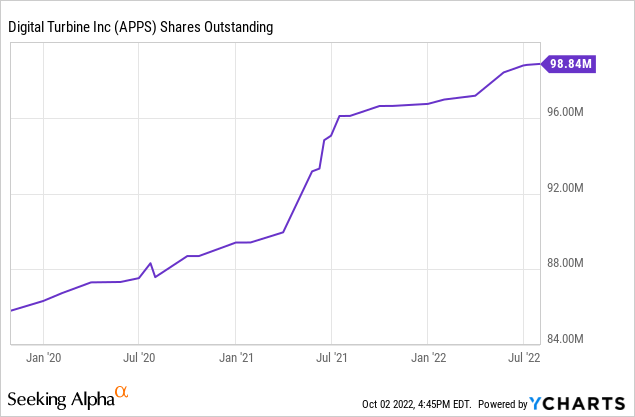

Share dilution and insider selling

I always want to look at stock dilution and whether there is insider selling. There were some small purchases, but the last insider transaction was in March this year. At least there were no sales at significantly higher prices, but sometimes you see increased insider buying when a stock is undervalued. That is not the case here. The outstanding shares have increased by 15% over the last three years. Diluted shares outstanding are about 104M.

openinsider.com

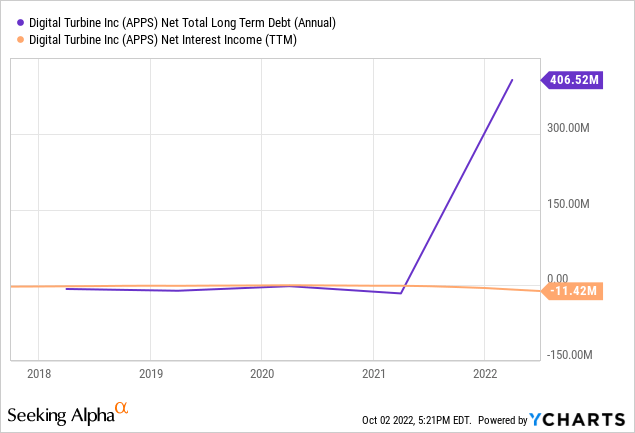

Rising debt

At about the same time as the SBCs and the number of shares outstanding have been rising, they have also been taking on a lot of new debt. That has cost $11.4M in interest payments over the past 12 months, which is significant relative to the net income in the same period (+$36M).

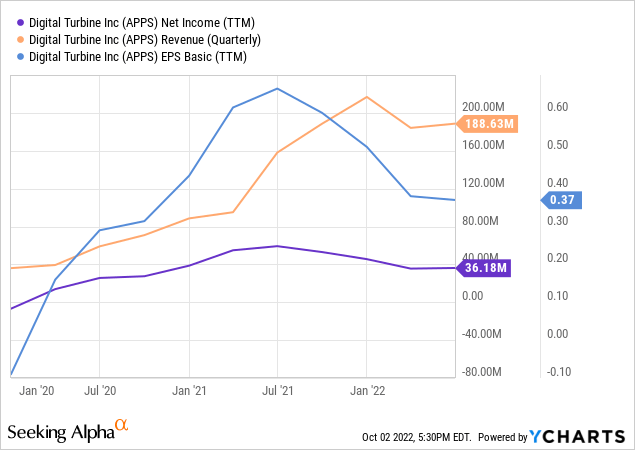

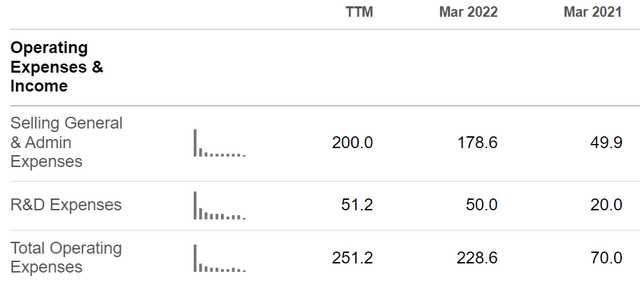

Slowing growth

The new debt, SBCs, etc., had to do with several acquisitions that Digital Turbine made in 2021. And these also immediately contributed to growing revenue. However, growth seems to slow down and has stagnated for several quarters. Given the additional burden of interest payments and generally sharply rising costs, this is causing income and thus EPS to stagnate or fall. It is too early to read a trend here – one would have to look at it again in a few quarters. Nevertheless, this clear upward trend of the past is no longer recognizable.

Seeking Alpha

Effects of a recession

Another market concern is that, as the recession looms, companies will cut back on their advertising spending. This may already be the reason for falling sales during this year. The company speaks about “challenging macro conditions” in the Q1 2023 press release; otherwise, only optimistic descriptions of further growth can be read.

In the aftermath of the last recession in 2008, ad spending in the U.S. dropped by 13%. Broken out by medium, newspaper ad spending dropped the most at 27%, radio spending dropped by 22%, followed by magazines with a decline of 18%, out-of-home by 11%, television by 5% and online by 2%.

However, the company is also benefiting from the long-term trend that advertising money is being used increasingly digitally. Overall, you can’t say precisely in numbers how big the effect of a recession would be. Even in 2008, advertising spending fell by only 13%, so I don’t give too much weight to this risk.

Conclusion

Looking at all this, I have to say that the crash in the share price is justified. The company has spent a lot of money making acquisitions, and now it has to show whether it can continue to provide sales growth and EPS growth in the post-pandemic period. But the pressure has increased due to the current debt and interest burden. At the same time, there is a share dilution, and it remains to be seen how expenses will develop. These have risen just as explosively as sales, so there are no positive net income developments so far. On the contrary, falling EPS this year is a red flag in my opinion.

Overall, I have to say I have very mixed feelings about the stock. On the surface, it seems cheap, and the company is making profits, which is very positive. However, digging a little deeper, we discover several negative aspects. I would not be surprised if, given the coming recession, the share price falls even further. The downward trend is still clearly intact. If you are interested in buying, I recommend waiting for a real bottom to form.

For my part, I will bite the bullet and do what no one likes, namely, realize a significant loss. Overall, I don’t have enough confidence at the moment that the bottom has already been found, and the general outlook of the company, I think the market wants to see that now, in the post-pandemic period, earnings are rising sustainably. And since I am not entirely convinced of the investment, I prefer to sell and invest elsewhere because I think there are more attractive stocks. Or at least some that I am more convinced of overall.

Be the first to comment