JillianCain

The retail sector has been crushed this year, but DICK’S Sporting Goods (NYSE:DKS) continues to produce chart topping results due to transforming the business during covid lockdowns. The sporting goods market hasn’t been ideal this year either with the company forecasting negative comps, yet DICK’S has near record profits due to a large capital return program. My investment thesis remains Bullish on the stock, even up near $115 following the rally on hiked guidance for 2022.

New Era

DICK’S just reported FQ3’22 comps increased 6.5% on top of a 12.8% increase in FQ3’21. The sporting goods retailer reported FQ3 revenues of $2.96 billion versus only $1.86 billion back in FQ3’19 for amazing 50% growth.

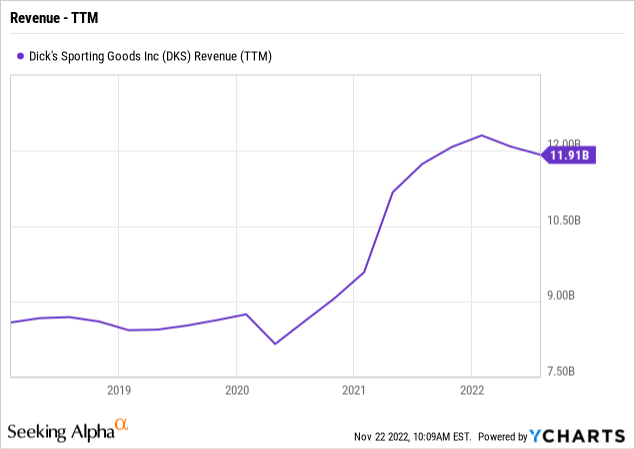

As this chart highlights, DICK’S hasn’t given up much of the strong revenue growth off the covid lows. The company now has nearly 10% of the $120 billion sporting goods market providing substantial growth opportunities ahead with new store concepts.

The management team has fundamentally changed the business with a stronger online business building a true omni-channel model to eliminate previous donations to online retailers. DICK’S now fulfills 90% of sales through stores due to ship from store, curbside pickup and BOPIS options. Customers now get key sporting goods much faster.

In addition, the company has improved the in-store experience and grown the Scorecard database to 150 million athletes. The top 25 million loyalty members are driving over 70% of sales cutting of the impact of competition from key customers.

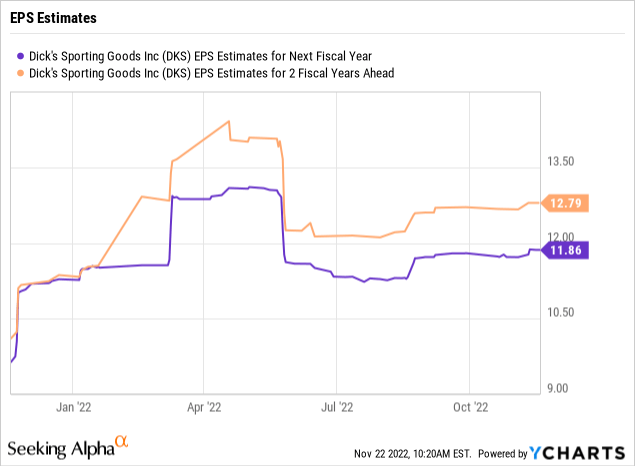

Despite all of these promising metrics, the company predicts comp sales to fall 3.0% to 1.5% for the year. Despite this headwind, DICK’S still forecasts 2022 EPS of $11.50 to $12.10 leading to near record profits.

Inventories are a slight concern with the balance up 35% YoY to $3.4 billion. The company suggests inventory levels are healthy and easily beat FQ3 forecasts despite heading into the quarter with inventory numbers up over 40%.

In the quarter, merchandise margins declined 438 basis points over last year, but the overall gross margins importantly were 34.2%, up 463 basis points over FQ3’19. Unlike most retailers, DICK’S has held onto sales gained during covid shutdowns. The higher sales levels are requiring an increase in inventory in order to continue strong sales levels.

Still Cheap

DICK’S has rallied back close to $115, but the stock definitely doesn’t reflect a business with an EPS stream now approaching $12. The market is naturally tepid in this environment to start valuing the stock based on growth above these levels, though this appears the path now. The consensus analyst estimates only forecast an EPS of $11.86 in 2023 and $12.79 in 2024 for limited growth in the years ahead.

DICK’S management has aggressively repurchased shares providing a boost to EPS. During FQ3’22, the company repurchased 4.4 million shares at an average price of only $82.80 and a cost of $361 million.

Most importantly, the share count has fallen from 113.7 million last FQ3 to only 96.7 million shares now. DICK’S reduced the share count by an impressive 17.0 million shares in the last year, or a reduction of 15%.

The sporting goods retailer has $1.5 billion in remaining share repurchase authorizations and pays a dividend yield of nearly 1.8%. Investors will see substantial capital return benefits with the stock holding around these levels with a $12+ annual EPS stream.

Takeaway

The key investor takeaway is that DICK’S is too cheap to ignore. The stock was definitely a better buy when our previous research highlighted the bargain value below $80, but DICK’S is an attractive long-term story here.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market during the 2022 sell-off, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts, and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the outsized risk of high-flying stocks.

Be the first to comment