InfinitumProdux/iStock via Getty Images

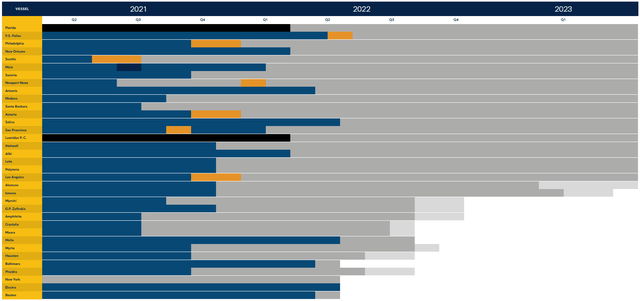

In my previous articles I have written why I believe Diana Shipping (NYSE:DSX) had all the necessary ingredients to benefit from the freight rate rally, while maintaining a status of a defensive play in the dry bulk sector. The company has no exposure in the spot market and all of its vessels are time chartered to various charterers with varying contract time durations. From this standpoint, it will be beneficial to take a look at the company’s time charter schedule and try to arrive at conclusions regarding its appeal as an investment.

Current situation

In my previous article about the company, I had outlined the increased number of time charter renewals and the bottom line was that Diana should definitely be a defensive holding in a portfolio of shippers. Fortunately, this was also Mr. Market’s view, as the shares provided shareholders with almost 25% total return since (including the recent slump), outperforming the S&P 500 by far. Do we have what it takes for such a move to repeat itself? Let’s see.

As of June 28th 2022, the company owns and has already chartered a total of 35 vessels, ranging from Kamsarmaxes to VLBCs, at an average daily rate of $23.4k. From a vessel type – specific perspective, we can see that panamaxes and post – panamaxes are chartered at an average daily rate of $23.5k, while Capesizes run at an average of $22.65k per day. Knowing this information, it would be interesting to see for how much would a typical panamax and capesize got chartered today?

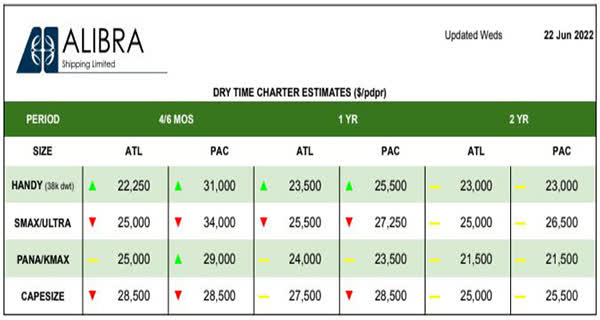

Data from Hellenic Shipping News show that a panamax would require approximately $24k per day for a single year contract, while a capesize would reach $28k per day. By comparing these figures with the averages mentioned in the previous paragraph, we can reach two separate conclusions, which are interconnected, up to a certain extent.

Daily time charter rates across different vessel types (Hellenic Shipping News)

Firstly, we can see that despite the fact that for Panamaxes the observed rates are in line with what the company has up and running, there is a large charter rate differential in the Capesize category. We’re talking about $5k per day, or a difference of more than 20%. This leads us to the second conclusion, which is also obvious: It is abnormal for Capesizes to be chartered at lower daily rates than Panamaxes. However, we can see that this is the case with Diana Shipping.

The reason for both these discrepancies lies with the inherent risk of longer time charter contracts. Just like a long property lease, a long time charter can make you or break you. It makes you when rates fall rapidly but breaks you when rates rise rapidly. If we look closely in the company’s time charter contracts in the Capesize segment, we will see that:

- M/V Capesize “Baltimore”, made in 2005, generating just $16k per day, was recently sold to OceanPal (OP), Diana’s spot market subsidiary, for $22 million. The vessel is expected to move to its new owner in Q3 2022.

- The company chartered its m/v Santa Barbara, made in 2015, to Cargill, until May 2023 at least, for a daily rate of $17.25k.

- The company’s m/v Boston, which was time chartered for $13k per day is currently without a contract.

From the data listed above, and assuming a daily charter rate of $22k for the m/v Boston, the updated average T/C rate almost reaches $24k per day. While still significantly lower than the current prices, it is still pretty reasonable, given the stability of future cashflows that it offers. It could be substantially higher, if it wasn’t for that longer than usual time charter with Cargill for m/v Santa Barbara. This is something that I had written in my previous article as well.

Diana Shipping’s vessel time charter schedule (Diana Shipping Website)

What is interesting, though, is that as it is shown in the graph listed above, many of the company’s time charters expire until the end of summer or early autumn. While there are some nice deals in there, there are also some not so nice ones. I do hope however, that in the rise of global economic uncertainty, the company will avoid the extra lengthy time charter contracts and sign 12 – 15 month ones.

Conclusion

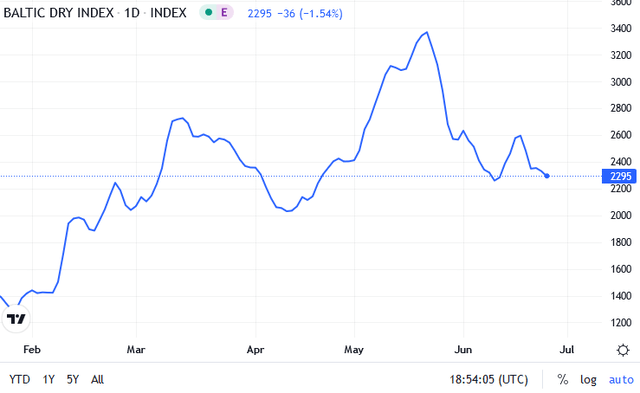

Shipping is a very volatile market, and this is reflected by the moves of the Baltic Dry Index. We can see that, for various economic and geopolitical reasons, the BDI has failed to find a bottom during the last few months. Traditionally, though, third and fourth quarters are the strongest ones, as demand is quite seasonal.

Baltic Dry Index (Trading Economics)

I have addressed this issue and its implications in one of my previous articles. What this means for a pure time charter company such as Diana, is that they will renegotiate their expired charter rates in the beginning of their strong period. In addition, given that typically Diana Shipping signs time charter contracts of at least one year length, this strategy will move the company smoothly towards a more bumpy 2023. From this standpoint, I believe that an investor still looking for exposure in the shipping market should definitely look into Diana Shipping as a defensive holding.

Be the first to comment