PixelCatchers

Introduction

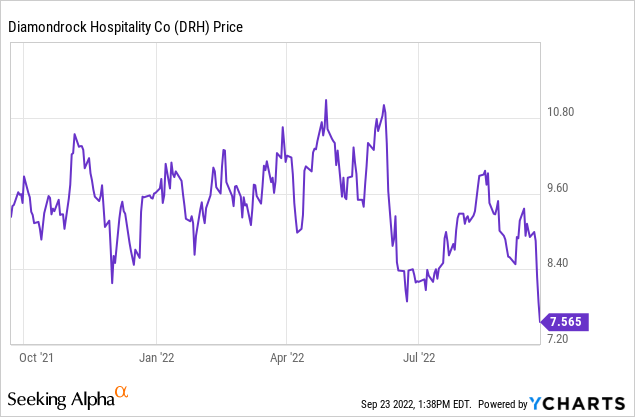

Less than three months ago, I thought the preferred shares of DiamondRock Hospitality (NYSE:DRH) were a good bet. Although they were trading at a premium to the par value, the yield to call was still a very respectable 7.3% which I thought offered a good risk/reward ratio given the robust balance sheet and the substantial amount of common equity, which ranks junior to the preferred shares.

As the interest rates continued to increase throughout the summer, the preferred shares, trading as (NYSE:DRH.PA) are now trading below par, making them even more attractive from an income perspective.

The second quarter was strong, and the cash is now pouring in

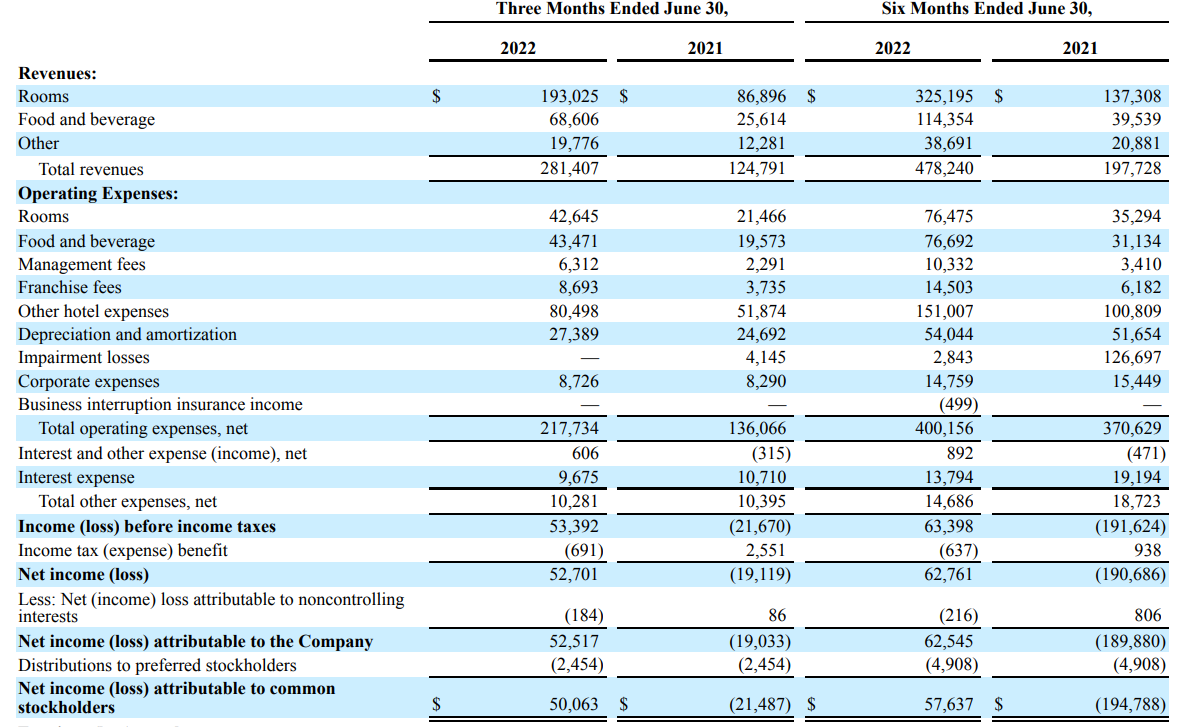

Although the FFO and AFFO calculation is obviously more important than net income for a REIT, I always like to have a look at the income statement anyway as it does provide useful information. It also helps to understand how the FFO is put together as the net income usually is the starting point for the FFO calculation.

DiamondRock Hospitality Investor Relations

The income statement clearly shows DiamondRock is profitable and that’s a good starting point to assume the FFO will be even higher considering the net income wasn’t boosted by non-recurring items like the gain on the sale of assets.

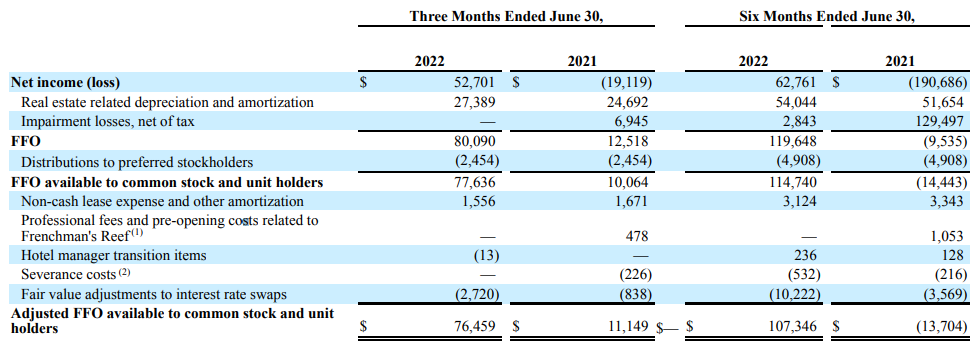

The FFO and AFFO calculation below indeed shows a very strong result. The FFO came in at $80.1M before making the preferred dividend payments and after covering the quarterly preferred dividend, the FFO attributable to the shareholders of DiamondRock was $77.6M. This means the REIT only needed about 3% of its FFO to cover the preferred dividends.

DiamondRock Hospitality Investor Relations

The Adjusted FFO was slightly lower but still pretty high at $76.5M so the preferred dividends are very well covered. Of course, we cannot simply ‘annualize’ the Q2 results as the hotel business is pretty seasonal (with Q2 and Q3 usually as the best quarters for DiamondRock) but even if you look at the H1 2022 FFO and AFFO (which includes the traditionally ‘weak’ first quarter) the FFO and AFFO before making the preferred dividend payments were almost $120M and in excess of $112M respectively.

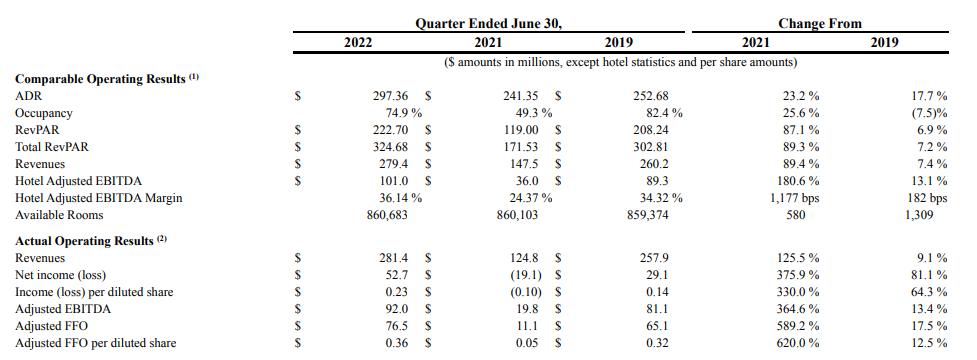

The press release announcing the quarterly results also contains a very interesting table which clearly shows the Q2 results in 2022 were actually better than in 2019, the pre-COVID year. Whereas the REIT generated $65.1M in AFFO in Q2 2019, the $76.5M result in the current year is substantially better and the AFFO per share increased by about 10%.

DiamondRock Hospitality Investor Relations

The preferred shares are now more attractive than a few months ago

As explained in my previous article: The series A preferred shares are cumulative issue, offering an annual preferred dividend of $2.0625 per preferred share paid in four quarterly installments. The securities can be called from Aug. 31, 2025 on.

As I already explained earlier in this article, the preferred dividend coverage ratio is excellent as DiamondRock only needs to use a fraction of its FFO and AFFO to cover the preferred dividends.

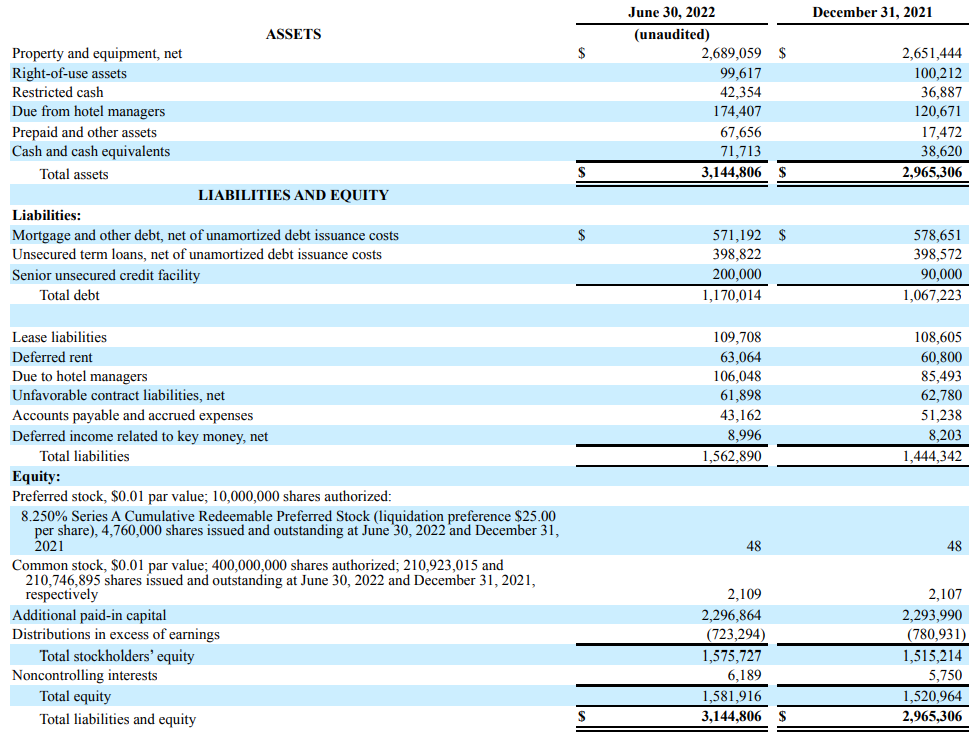

And as DiamondRock only recently restarted paying dividends on the common shares, the vast majority of the cash flow generated in the first half of the year was added to the balance sheet. As you can see below, DiamondRock saw the total amount of stockholders’ equity increase from less than $1.52B to almost $1.58B, an increase of almost exactly $60M while the share count remained unchanged. The increased equity portion on the balance sheet helped DiamondRock to close an acquisition in April.

DiamondRock Hospitality Investor Relations

On April 1st, it acquired the Kimpton Fort Lauderdale Beach for just over $35M while it also plans to spend about $100M on capital improvements on the existing assets this year.

This means that based on the book value of the assets, the equity value consists of approximately $1.56B in common equity and $119M in preferred equity. I like the ratio of preferred equity versus common equity as it is clear there’s quite a big cushion to protect the preferred equity holders during tough times.

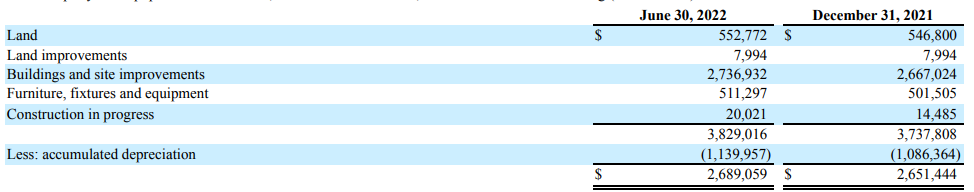

Additionally, the equity value is based on the $2.7B book value of the assets. This already includes in excess of $1.1B in cumulative depreciation expenses. The acquisition value of the land and buildings was approximately $3.3B so even if the equipment and furniture has zero value, it’s tough to imagine the value of the land and buildings has gone down since their respective acquisitions.

DiamondRock Hospitality Investor Relations

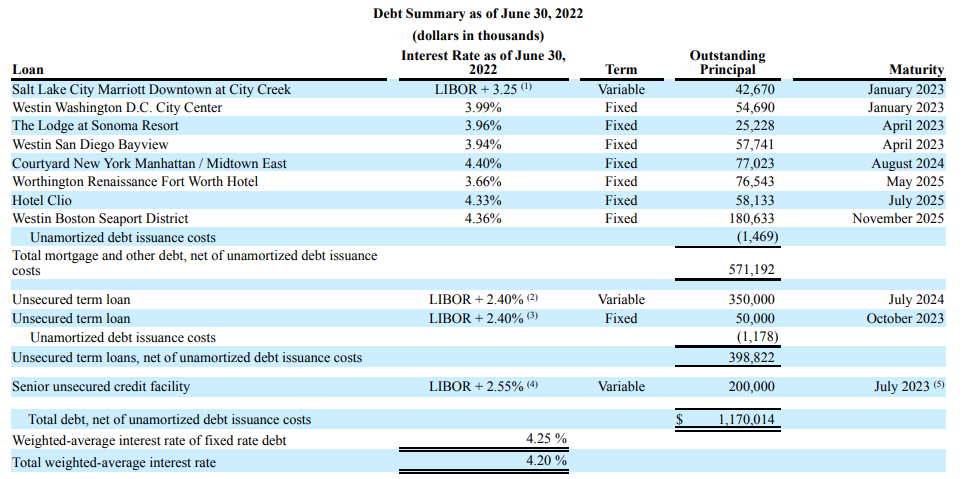

There’s one caveat though, an item that’s definitely more relevant for the common stockholders than the preferred shareholders. About half of the debt consists of mortgages on specific properties. Most of those mortgages have a fixed interest rate but as you can see below, four of these mortgages are up for renewal within the next seven months. While I don’t anticipate any issues to refinance the mortgages, we should expect a higher cost of debt. This will result in higher interest expenses and a lower FFO and AFFO unless DiamondRock is able to hike its revenue and margins elsewhere.

DiamondRock Hospitality Investor Relations

Investment thesis

I am very interested in the DiamondRock Hospitality preferred shares as I think the risk/reward ratio is excellent. While I understand I forego potential capital gains, I am more than happy to consider these 8.4% yielding securities for my income portfolio. The current yield is approximately 8.4% but the yield to call is approximately 8.87% as the preferred shares are trading about 1.5% below par and can be called in just over 35 months.

I currently have no position in DiamondRock’s common equity nor in the preferred shares, but I may pull the trigger sooner rather than later. I understand that additional rate hikes by the Federal Reserve will continue to add pressure on the fixed income prices, but I always make sure to have cash on hand to add to my positions.

Be the first to comment