cemagraphics

The energy sector has outperformed the broad market by an impressive margin this year. While the S&P 500 has declined 15% this year, the Energy Select Sector SPDR ETF (XLE) has rallied 59%. Diamond Offshore Drilling, Inc. (NYSE:DO) has rallied “only” 30%, and it is trading at only 7.4 times its expected earnings in 2024. As a result, some investors are likely to conclude that the stock is attractive, especially given the multi-year high oil prices that are prevailing right now. However, Diamond Offshore Drilling stock is highly risky from a long-term point of view.

Business overview

Diamond Offshore provides contract drilling services to the energy industry worldwide. The company has a fleet of 12 offshore drilling rigs, including four drillships and eight semisubmersible rigs, and serves government-owned oil producers as well as independent oil producers.

The offshore drilling sub-sector has been by far one of the worst-performing sub-sectors of the stock market since 2014. During 2012-2014, the price of oil hovered around $100, and hence there was strong demand for the rigs of these companies. Thanks to the sky-high day rates they were charging on oil producers, off-shore drillers were enjoying excessive profits in those years.

However, as in most cyclical businesses, offshore drillers invested hefty amounts in new rigs near the peak of the cycle of their business, and thus they greatly increased the global supply of offshore platforms. Even worse, due to the boom of shale oil, the price of oil collapsed, from $100 in mid-2014 to $30 in early 2016. Even when the price of oil recovered to $50-$60 in 2017-2019, the global offshore rig market was still highly oversupplied. The situation became even worse when the pandemic struck. Overall, most of the major offshore drillers, including Seadrill, Valaris, Diamond Offshore, and Noble have gone bankrupt in recent years.

On the bright side, the energy market has recovered strongly from the pandemic. Global oil consumption has recovered to pre-pandemic levels while the ongoing war in Ukraine has led Europe and the U.S. to impose sanctions on Russia. As Russia normally produces approximately 10% of global oil output, the sanctions have tightened the global oil market, and thus they have led the price of oil to rally to multi-year highs this year.

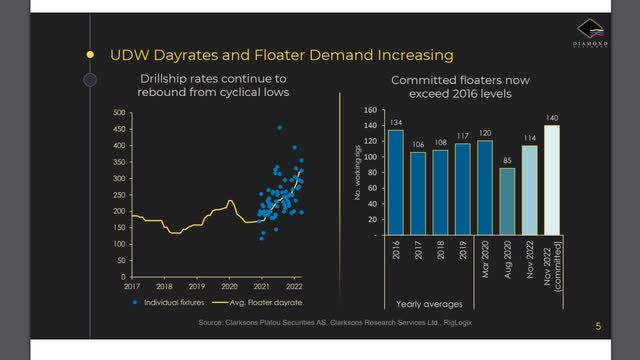

High oil prices have triggered a partial recovery in the demand for offshore platforms. The total number of active floaters worldwide has recently exceeded the level reported in 2016.

Day Rates and Floater Demand (Investor Presentation)

The rebound in the global demand for floaters has led to a recovery in the day rates charged to oil producers by offshore drillers.

As the sanctions of western countries on Russia are not likely to be withdrawn anytime soon, the short-term prospects of Diamond Offshore are positive. Analysts seem to agree on this view, as they expect Diamond Offshore Drilling to switch from a loss per share of -$0.83 this year to a modest profit per share of $0.36 in 2023 and a profit per share of $1.32 in 2024. Nevertheless, it is worth noting that an essentially flat rig count over a 6-year period does not bode well for the long-term prospects of offshore drillers.

The risks

As long as the price of oil remains around its current level, the demand for offshore platforms will remain strong, and thus Diamond Offshore is likely to narrow its losses and gradually become profitable. However, it is critical to keep in mind the dramatic cyclicality of the energy market.

The multi-year high prices of oil and gas that have prevailed this year have caused a global energy crisis. As the energy cost has increased dramatically, numerous consumers are struggling to afford their cost of living. This has led most countries to invest in renewable energy projects at a record pace in an effort to reduce their dependence on oil and gas. As a result, there is a record number of clean energy projects under development right now. It will take about 2-4 years for most of these projects to come online. As soon as they come online, they are likely to take their toll on global oil consumption, and thus they will probably cause a downturn in the oil industry.

It is also important to note the extremely high sensitivity of offshore drillers to the cycles of the price of oil. To be sure, Diamond Offshore has incurred material losses for eight consecutive years, with the exception of 2017, when the company posted a minor profit per share of $0.13. This helps explain why Diamond Offshore went bankrupt in 2020. While the company has restructured, it remains highly vulnerable to the boom-and-bust cycles of the global energy market.

The fundamentals of the oil industry are currently positive for Diamond Offshore, primarily thanks to the sanctions imposed by western countries on Russia, as these sanctions have greatly tightened the market. However, as experience has shown, the price of oil has never remained around its current price for more than a few years. Whenever the next downturn shows up, the business of Diamond Offshore is likely to come under pressure.

Debt

As the bankruptcy of Diamond Offshore is recent, the company has tried to maintain a decent balance sheet. Its net debt (as per Warren Buffett, net debt = total liabilities – cash – receivables) currently stands at $591 million. This amount is only 63% of the market capitalization of the stock, and hence it seems manageable under normal business conditions.

Moreover, Diamond Offshore has drastically reduced its interest expense compared to the pre-bankruptcy levels. Its interest expense has decreased from $111 million in 2017 to $38 million in the last 12 months. However, Diamond Offshore is still unable to cover its interest expense, as it has incurred operating losses of $43 million in the last 12 months. As long as the company continues to recover from the pandemic, it is likely to become capable of covering its interest expense at some point in the future. On the other hand, whenever it faces the next downturn of the energy market, it will probably come under great pressure. This is the primary reason behind the seemingly cheap valuation of Diamond Offshore Drilling, Inc. stock, which is trading at only 7.4 times its expected earnings in 2024.

Final thoughts

The above risks do not mean that Diamond Offshore is a poorly managed company. Diamond Offshore Drilling management is probably doing its best to improve the factors that are under its control. However, the whole sub-sector of offshore drillers is a highly risky segment of the stock market due to its dramatic sensitivity to the downturns of the price of oil.

The aforementioned bankruptcies of most major offshore drillers are testaments to the high risk of these stocks. Even Transocean (RIG), the largest player in this business, has plunged 91% over the last decade, whereas the S&P 500 has nearly tripled during this period. Overall, offshore drillers currently enjoy strong business tailwinds, mostly thanks to the unprecedented sanctions imposed by western countries on Russia, but they remain highly vulnerable to the downturns of the oil industry.

Be the first to comment