Diego Thomazini

The iShares U.S. Financials ETF (NYSEARCA:IYF) contains a broad array of US financial stocks, both insurance and banking companies. Insurance is less of an interesting discussion at this point; of course, they benefit from higher rates because of their short duration fixed income investment portfolios. Banking also has been benefiting from higher net interest incomes and margins, but there is a bear case against banking that we will discuss, and mostly debunk. Overall, while there are pressures in the capital markets divisions of full-service banks, things generally look pretty good for the US financial sector.

IYF Breakdown

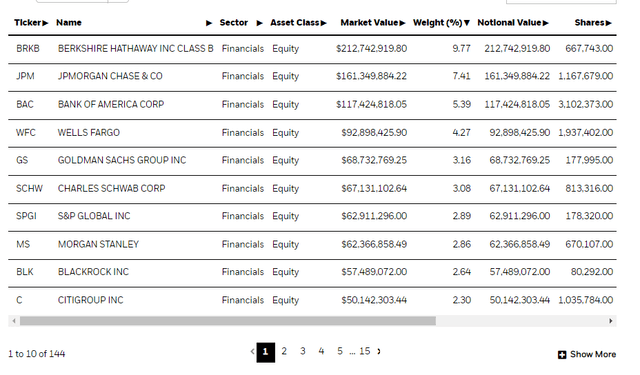

Let’s have a quick breakdown of the IYF.

While there are 139 holdings, and it is diversified from totally idiosyncratic management and execution risks, there’s quite a lot of skew on the portfolio because there are a lot of small, regional financial players in the US that command small value weightings.

Some of the big ones are Berkshire Hathaway (BRK.A) (BRK.B), JPMorgan (JPM), and more full service banks like Bank of America (BAC). There are also some ratings companies and brokerages. Let’s discuss the likely fortunes of each category.

Brokerages

This is an easy one: they like volatility. Markets are providing that in spades right now as they hone in on reasonable rate and inflation expectations. While CPI peaking puts some perspective on the possibility of slowing down inflation, we’ve only seen one down quarter. There’s still a lot of uncertainty, and markets will be overshooting and undershooting across asset classes as they try to triangulate on the right forecast. Brokerages are going to benefit from the volatility in terms of trading volume but also opportunistic spreads that they can get as they deal.

Ratings Companies

Ratings companies barely feature, which is a good thing. They are not doing well. We covered Moody’s (MCO) recently and discussed how the capital markets side of the business is suffering as the markets have shut down meaningfully on primary issues in debt. There will be some resumption as issues in the leveraged markets pass, but it’s not a healthy business right now.

Full-Service Banks

Full service banks are exposed to capital markets pretty meaningfully. Most have about 30% exposure to investment banking type revenues. The rest typically are corporate/retail banking and asset management. The latter generally stays pretty resilient in down markets. Retail and corporate banking is where things get a bit more dicey.

There is a bear case out on banks that make money off lending. The argument basically comes down to the duration gap and the fact that mark-to-market accounting requirements don’t kick in unless banks think they need to, therefore giving them agency to preserve headline income. The idea is that if mark-to-market accounting was used on longer-duration assets, discounts would be pretty severe because of the duration. 20% decline could be attributed to those assets, and this would actually require banks to recapitalise in order to preserve reserve ratios, diluting current shareholders. It wouldn’t be that fun, and it would definitely create panic among investors.

It’s not a dumb case. The yield curve is flat but shifted up. Longer-term rates are not that low anymore, all at around 3.5% for the next 30 years. These could go up depending on inflation data, but the longer-term rates are more important due to discounting effects and are determined by factors related mostly to cost-push structural factors. While the dislocation in energy markets can account for this longer-term rate, and indeed is a permanent and structural impact on costs, we think there’s no real reason to be alarmed. Eventually, productivity gains will offset the current gap downwards in productivity for the Western Bloc. Also, the duration gap is probably not too bad. While mortgages make it longer, they also have variable components. About 50% of assets are longer than five years in duration for major Euro banks. The rest are rather short, and since mortgages dominate the longer-duration profile, we think things will be fine. The declines in longer-term assets shouldn’t stick.

Bottom Line

As said, the insurance exposures are fine. There are other resilient components. Even retail banking should be good on the asset value side. Indeed, the net interest income is rising, so why be concerned? It’s a sign that the duration gap isn’t too much of a problem and capital calls being needed seems like a stretch on the bear side.

The IYF expense ratios aren’t that low at 0.39%. We don’t love that, but it’s the same as the iShares U.S. Insurance ETF (IAK). The IYF PE is low at 10x, which implies more than enough earnings yield considering the resilience of much of the portfolio. Comprehensively, there is probably about 10% exposure to IB and other capital markets revenues, which are the only volatile ones. Others will be solid, so a 10% earnings yield is good. The 1.7% yield in dividends is bad, but earnings are ultimately what matters to shareholders. We still think there’s attractive duration built-in going on with retail banks, which should allow resistance to interest rate declines. Overall, IYF looks decent.

Be the first to comment