HeliRy

Investment Thesis

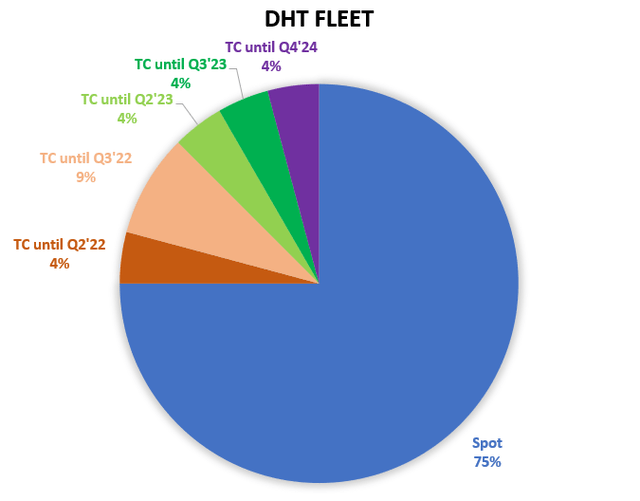

DHT Holdings (NYSE:DHT) is a tanker company focused on VLCCs exclusively, with 24 tankers from which 18 were as of the latest information exposed to the spot market. I have written a few articles about the company in the past and I have also been long the stock, but I have recently liquidated my holdings due to more attractive risk-rewards elsewhere in the energy sector.

Figure 1 – Source: DHT Holdings

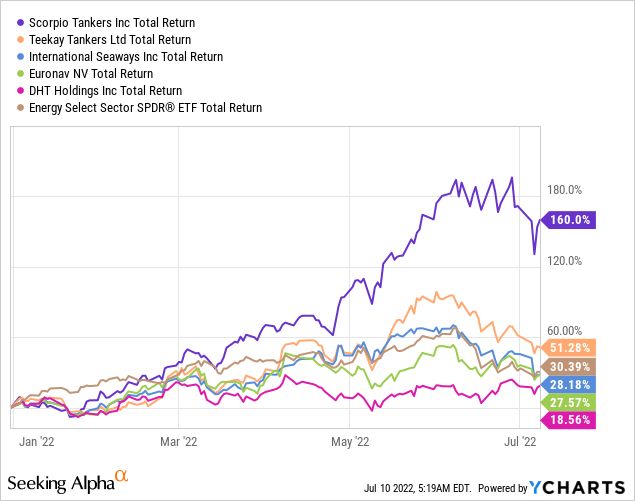

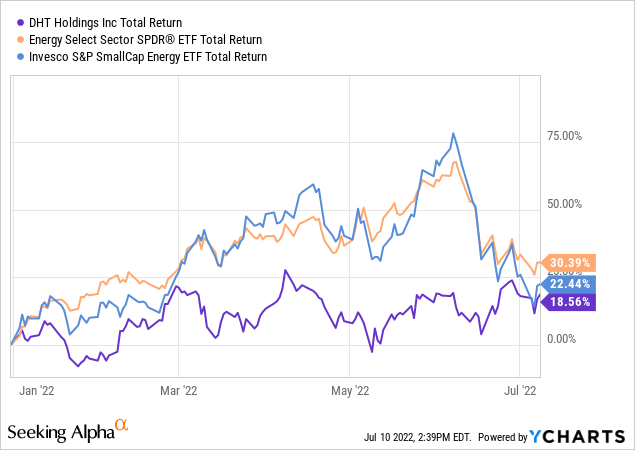

Many shipping companies with a focus on oil and product tankers have so far had a very good year, while most stocks without a connection to energy have seen declines in 2022. Shipping companies with exposure to product or mid-size oil tankers have outperformed DHT so far in the recovery, primarily due to more attractive tanker rates.

That might mean DHT has the potential to at least partly catch up once VLCC rates improve. However, a recovery is potentially dependent on China not continuing with zero covid policies, the U.S. not restricting oil exports, and/or sanctions being lifted on Iran & Venezuela.

Oil & Tanker Market

Since the invasion of Ukraine, we have seen tanker rates recover from the lows about 6 months ago across tanker types. However, if we just focus on the oil tankers, the recovery in tanker rates has not been equal across all sizes.

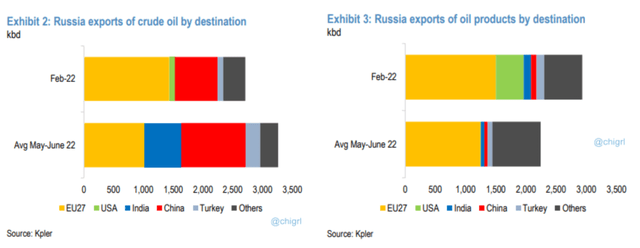

As Europe has decreased its imports of Russia oil, we have seen some rearranging of transport routes. India’s reliance on VLCCs has decreased as the country has bought more oil from Russia, primarily transported on mid-size tankers. We have seen less oil being exported outside of Europe from the North Sea, which also means less demand for VLCCs.

Figure 3 – Source: @chigirl on Twitter

China’s zero Covid policies have also impacted VLCCs disproportionally, since the infrastructure to handle the larger tankers is better in Asia. Now, China might be moving away from zero Covid policies going forward, but it is still a potential risk factor in my view.

Another potential risk factor which might not be probable, but the impact would likely not be good for VLCCs, is if the U.S. enacted some kind of export restrictions on oil or products. While this would have dire effects on the U.S. allies, making it quite unlikely, I would not rule it out completely as a desperate move with an upcoming U.S. election.

Despite the weak tanker rates over the last couple of years, we have seen relatively little recycling of older VLCCs. That has been and might continue to be a headwind for the segment.

If the restrictions are scrapped on Iran and Venezuela, we would on the other hand see a very positive impact on VLCCs. If or when such a move would happen is still very unclear, at least to me.

Another factor which will eventually be a positive for VLCCs and tankers in general is the drawdown of oil inventories. It is not sustainable and will need to reverse relatively soon. Once we see that trend reverse, the demand for tankers will naturally increase as well.

Balance Sheet & Capital Allocation

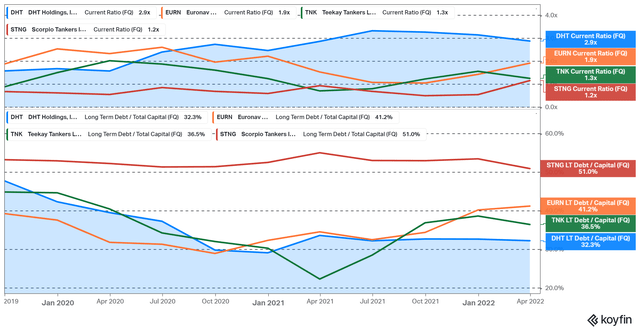

DHT has lately been operating with less leverage and more liquidity than most peers in the industry. That means the breakeven tanker rate is among the lowest in the industry and it also provides the company with a lot of flexibility on the capital allocation side.

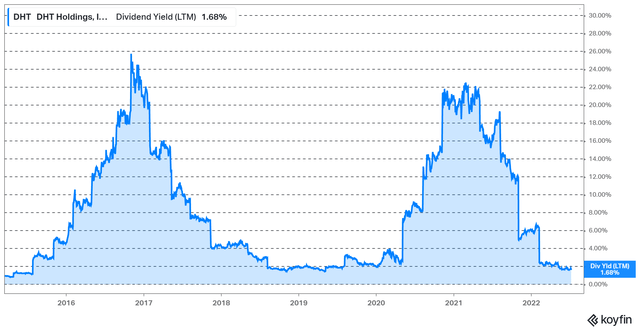

Figure 4 – Source: Koyfin

DHT has opportunistically bought back 2.8M shares during Q2-22, equivalent to 1.7% of the outstanding shares at an average price of $5.6256. The company does also pay out a very substantial part of earnings in dividends, which means the dividend yield can rise very drastically during periods of very good tanker rates.

Figure 5 – Source: Koyfin

However, the lower financial leverage also means the company can underperform to the upside in turning points as have seen lately.

Conclusion

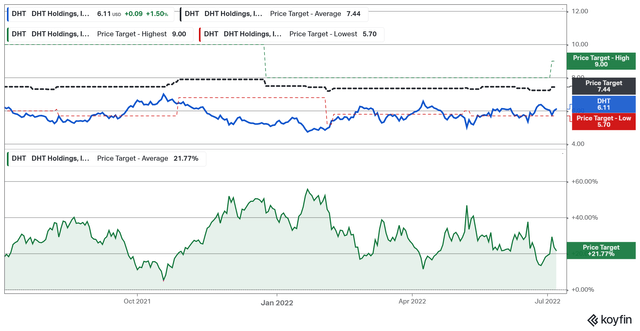

I do think the average broker target price of $7.44 is a relatively good approximation for a conservative NAV for DHT. Now, if we see VLCC rates stay elevated for a while, I have no doubt that will increase some.

Figure 6 – Source: Koyfin

It is, however, important to note that VLCC rates are still very far from peak levels at the moment and the stock has not underperformed oil producers by much in 2022. So, I do think the risk-reward based on what DHT can generate in earnings at this market is less attractive than many other energy companies presently. There are, for example, off the beaten path oil producers, which have gotten severely punished in the very recent correction, while they are still making record earnings at the current oil price.

I would not rule out a recovery in VLCC rates this fall, which would likely mean a good stock price performance for DHT. There are, however, several potential risk factors together with the potential for demand destruction as the global economy is weakening. I would need a more depressed share price and a more favorable risk-reward to buy the stock.

Be the first to comment