gesrey

Amid the value investing triumph of 2021 that lasted into 2022 supported by persistent inflation and the withdrawal of the ultra-loose monetary policy, small-caps have shown comparative resilience, even though an argument could be made that their inherently weaker profitability and thus higher sensitivity to financing costs becoming more burdensome should stimulate investors to rotate towards more resilient, self-sufficient names that could be found aplenty among large-caps. Yet they have still defied this skepticism, chugging along despite the market falling steeply.

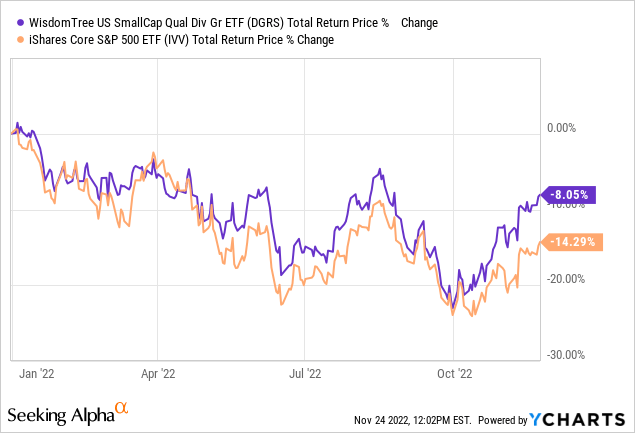

Certainly, the echelon has not been immune to the broad market sell-off completely. However, the WisdomTree U.S. SmallCap Quality Dividend Growth Fund (NASDAQ:DGRS), a fund we will be discussing today, has declined by only 8% while the iShares Core S&P 500 ETF (IVV) has fallen by 14.3%.

Incepted in July 2013, DGRS addresses the small-cap quality issue I touched upon above by leveraging a smart-beta Return on Equity- and earnings growth-mindful strategy encapsulated in a dividend-paying equity portfolio. This is a combination I like, yet the reality is less exciting than it might seem upon cursory inspection.

The fact is, even though its 2022 decline is less steep compared to IVV and other mega-cap growth-heavy plays, DGRS delivered sluggish performance over other periods (since inception included). More specifically, during the August 2013 – October 2022 period, DGRS outperformed the WisdomTree SmallCap Dividend ETF (DES), delivering a higher CAGR and also better risk-adjusted returns (the Sharpe and Sortino ratios), yet it failed to keep pace with the iShares Core S&P Small-Cap ETF (IJR), let alone IVV.

| Portfolio | IVV | DGRS | DES | IJR |

| Initial Balance | $10,000 | $10,000 | $10,000 | $10,000 |

| Final Balance | $27,319 | $19,933 | $18,275 | $23,090 |

| CAGR | 11.48% | 7.74% | 6.74% | 9.47% |

| Stdev | 14.94% | 19.41% | 19.30% | 19.52% |

| Best Year | 31.25% | 30.79% | 31.39% | 26.61% |

| Worst Year | -17.75% | -12.41% | -12.83% | -13.65% |

| Max. Drawdown | -23.93% | -33.09% | -38.08% | -36.12% |

| Sharpe Ratio | 0.75 | 0.44 | 0.4 | 0.52 |

| Sortino Ratio | 1.16 | 0.66 | 0.57 | 0.78 |

| Market Correlation | 1 | 0.87 | 0.87 | 0.9 |

Created by the author using data from Portfolio Visualizer

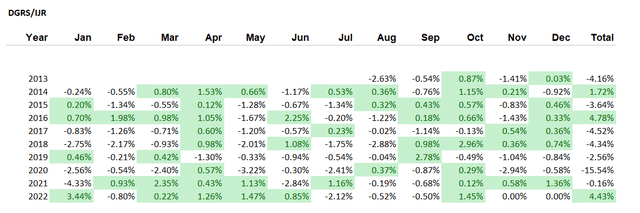

Comparing the monthly and annual returns of DGRS and IJR, we see that the former lagged systematically, except for 2014, 2016, and 2022 to date.

Created by the author using data from Portfolio Visualizer

Apart from mixed performance, DGRS has other vulnerabilities, and surprisingly, on the quality side mostly, which makes us conclude the fund is a pass at this point. Now let us discuss all these in greater depth.

What is DGRS’ investment strategy?

DGRS tracks the WisdomTree U.S. SmallCap Quality Dividend Growth Index, which is essentially a fraction of the WisdomTree U.S. SmallCap Dividend Index, with quality and growth screens applied.

For the quality part of the equation, the index provider uses the three-year historical average for ROE and ROA. For the growth part, the long-term earnings growth expectations are assessed.

The benchmark leverages a smart-beta methodology, with constituents’ weights depending on their cash dividends. In theory, this should contribute to the DGRS portfolio’s value characteristics, slightly tilting it towards cheaper names. The selection and weighting process is described in much greater depth in the methodology document.

In the current version, the portfolio includes 286 equities, with just 17% allocated to the main ten, thus offering comparatively attractive diversification, which is reflected in its B- Risk grade. Regarding sectors, the fund favors industrials (25.2%), financials (21%), and consumer discretionary (13%), whilst it is less enthusiastic about communication services (1.9%) and energy (1.7%). Here, it should be noted that meager exposure to the latter sector is more likely the consequence of lackluster trends in ROA and ROE in the oil & gas industries resulting from the crude price collapse during the early weeks of the pandemic in 2020 which sent their revenues and earnings plunging.

The weighted-average market cap stands at about $2.46 billion, as per my calculations, which implies DGRS has a larger exposure to mid-caps rather than to stocks traditionally deemed small-caps (sub-$2 billion in market value) as players with below $2 billion account for just 35%. Please do note that this issue is not unique to DGRS, and large exposure to mid-size names could be observed in the cases of other seemingly small-cap funds. For example, IJR has a WA market cap of around $2.38 billion, though with the median at $1.4 billion.

Assessing growth, quality, and value

Turning to the growth and quality factors, the first thing worth touching upon is the forward EPS outlook. Here, there is a disappointment as around 21% of the holdings are forecast to face earnings compression in the near future. The silver lining is that close to 45% are anticipated to deliver at least 10% growth, which is arguably fine, though of course not exceptional. It should also be noted that the portfolio has just a handful of outstanding top-line growth plays, with those potentially capable of delivering over 20% forward growth accounting for around 7%.

Please take notice that the index DGRS tracks favors “the top 50% of companies with the best-combined rank of growth and quality factors” from the selection universe, and it is not supposed to reflect the performance of only the top growth & profitability plays.

The next factor of interest is quality, and there is also something to criticize here.

First, we see just about 48% of the holdings having a Quant Profitability grade of no less than B-. This is a bleak result as I prefer to see no less than 80% when it comes to dividend-focused ETFs. For better context, the ALPS | O’Shares U.S. Small-Cap Quality Dividend ETF (OUSM) which I reviewed a couple of weeks ago allocated close to 85% of its net assets to top-quality mid- and small-caps as of writing the said article. The flip side of that portfolio was a large share of stocks priced at a premium to their sectors and historical averages.

It should also be noted that DES which tracks a dividend equity basket without earnings growth and ROE, ROA screens applied, had only a ~35% allocation to B- rated stocks and better as of my July 2022 note. However, the surprise is that IJR sports a ~52% share of holdings with a B- rating and better; the two likely reasons for that are the market-cap weighting of the index it tracks and the financial viability criterion (net income must be delivered, which I discussed in the article last December) its methodology has.

Also, we obviously cannot ignore the value factor. First, the fund has a weighted-average earnings yield of around 8% (an LTM Price/Earnings of ~12.5x), as per my estimates. In my view, the main factor impacting this seemingly cheap level is the size discount. Second, close to 37% of the holdings have a B- Quant Valuation grade or better. This is an acceptable result, yet ~33% of the portfolio has a D+ rating or worse, which poses risks in case inflation persists and investors continue rotating out of expensive stocks.

Final thoughts

DGRS features a strategy cramming the dividend, small-size, quality, and growth factors. This is a combination I appreciate, yet the analysis above revealed that the strategy is not completely invulnerable.

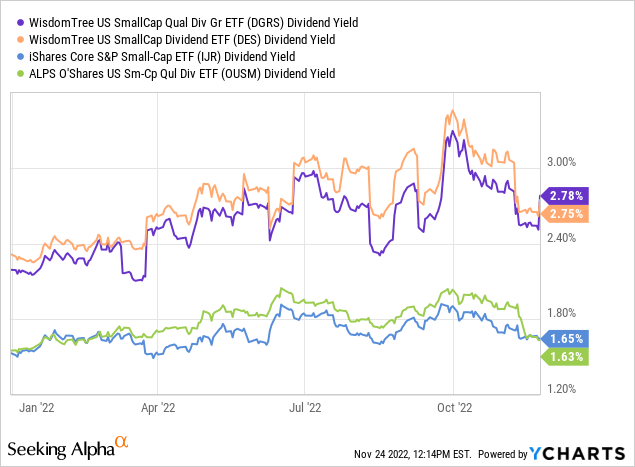

DGRS has a few advantages, with comparative resilience against the headwinds in 2022 being among them. Meanwhile, it has monthly distributions, which is a clear benefit. Speaking of the yield, it is arguably competitive, while the expense ratio is modest at 38 bps. Its distribution growth story is the one I rate highly, especially the 3- and 5-year CAGRs.

Nevertheless, its quality profile is far from ideal, for my taste. Valuation is also not spotless. All in all, with the positives nearly on par with the negatives, I opt for a Hold rating.

Be the first to comment