NicolasMcComber/E+ via Getty Images

Investment thesis

With relatively lackluster performance over the last 3 years, the WisdomTree Japan SmallCap Dividend ETF (NYSEARCA:DFJ) is a singular Japanese equities strategy. Delivering a patchy track record and managing unwieldy 711 positions make us believe the strategy is lacking in high conviction ideas and requires better position sizing. We rate the ETF as a sell.

Quick primer

WisdomTree Japan SmallCap Dividend ETF tracks the WisdomTree Japan SmallCap Dividend Index (WTJSC). There are 711 holdings in the fund, it has an expense ratio of 0.58%, and currently has a 12-month projected 3.44% dividend yield.

Cumulative performance

Cumulative performance (Refinitiv)

Relative performance

Our objectives

In this piece we want to assess the following:

- look at the technical analysis to see the short and long-term performance of the fund.

- portfolio construction despite the limited disclosure available.

We will take each one in turn.

Appearing low-risk and low return

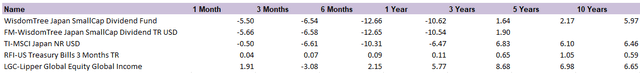

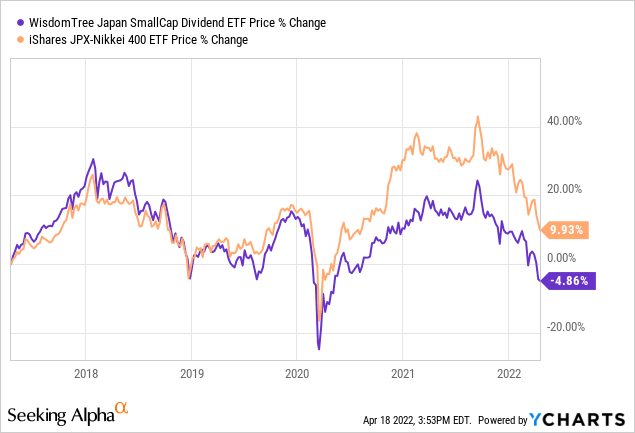

DFJ has an adjusted beta of 0.88 versus the Topix Index, suggesting comfortably lower volatility than the Japanese market overall. However, from a relative performance standpoint, we see that it began to underperform the broader market from the middle of CY2019 and has continued to do by nearly 15% (see relative performance chart versus iShares JPX-Nikkei 400 ETF). The cumulative performance shows a pretty mediocre 2.17% annual equivalent return over the last 5 years (see cumulative performance table).

On a positive note, despite its small-cap focus, DFJ has significantly outperformed the Japanese small-cap growth indices TSE Mothers by 17.5% over the last 3 years (and an impressive 32% over the last 5 years). Despite this, investors would have fared better in both the short and long term with the general MSCI Japan Index, highlighting that there does not appear to be much of an edge with this small-cap product. The expense ratio of 0.58% is at a standard and acceptable level for a management fee.

A brief look at beta, performance, and expense ratio shows that investors are not paying over the odds for this niche product. Expectations over returns may also be limited, with access to local economy stocks (that would usually fly under the radar of standard funds) being the key motivation for investment. We look at portfolio construction to see what DFJ offers from this perspective.

Looking unfocused despite targeting a specialist asset class

The fund has its largest holdings by sector in industrials at 25%, a standard level for many Japan ETFs. Consumer cyclicals come second at 16%, followed by materials at 15% and financials at 13% – again all very standard allocations and nothing too unusual.

What does stand out at DFJ is the very large number of holdings at 711. In an active strategy, you would be highly challenged to keep pace with so many positions – despite being an ETF, the strategy’s model must have some hard and broad parameters to select and position so many companies.

The top 10 positions held made up 6.67% of the portfolio, meaning that there is a very long tail of minor holdings in small caps making up the majority of the fund. Perhaps some of these are very illiquid which would explain the position-sizing methodology.

The largest holding at 0.83% is Nishimatsu Construction (1820), a general contractor with a market capitalization of JPY212 billion/USD1.7 billion. This is a good stock pick, up 33% over the last year and outperforming the Topix Index by 43%. Valuations look cheap on a PER FY3/2023 9.5x and an estimated dividend yield of 5.8% but a cash-burning business may have issues down the line.

We see other top holdings that have decent dividend yields but perhaps have questionable outlooks as a sustainable businesses. Konica Minolta (4902) (OTCPK:KNCAF) has an estimated dividend yield of 6.2% but its core business remains office copiers (we are negative on peer Canon (CAJ)). Toyo Seikan (5901) is an ex-growth manufacturer of drinking cans and containers that faces an uphill struggle to generate free cash flow, although it offers a 5.8% yield. Seven Bank (8410) operates the ATM network used in Seven-Eleven convenience stores (run by Seven & i Holdings (OTCPK:SVNDY)), under pressure from digital transformation. As a leading domestic electricals retailer, K’s Holdings (8282) has limited scope for growth with consumer spending under pressure. Regional bank Mebuki Financial Group (7167) (OTCPK:MEBUF) offers very little that a Japanese megabank like Sumitomo Mitsui Financial Group (SMFG) cannot.

Our key takeaway here is that the fund does not offer much value in tracking the WisdomTree Japan SmallCap Dividend Index. Position sizing skills appear marginalized, and the primary value stock picks lack high conviction demonstrated by the vast number of positions being held. Overall, we do not see the benefit of gaining access to Japanese small caps as an asset class in this product and format.

Conclusion

Japanese equities as an asset class have some appeal from both value and growth perspectives and remain a deep market with many sectors and market cap range. However, as an 8% allocation to the MSCI World Index, it is not a ‘must-have’ element in many global funds. We would think of Japan as being a real stock-picker’s market (as opposed to buying a NASDAQ or FTSE tracker), and funds that illustrate this include the Baillie Gifford Shin-Nippon and the JPM Japan Fund. These active strategies would charge higher fees, but we believe would provide better stewardship for investing in Japanese equities. DFJ’s prospective 12-month dividend yield of 3.44% is too low to be attractive – we rate this ETF as a sell.

Be the first to comment