JHVEPhoto/iStock Editorial via Getty Images

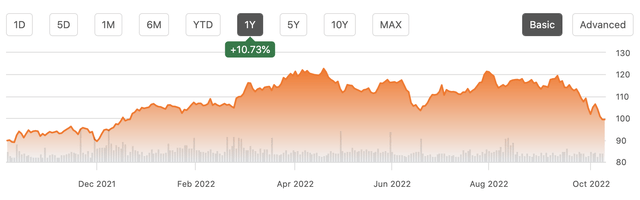

Finding stocks that offer protection during a period of rising interest rates and a period of economic uncertainty is a difficult task with many businesses either cyclical or trading at valuations that leave little margin for error with the 10-year treasury near 4%. Atmos Energy (NYSE:ATO) may be an exception, given its regulated business model and a valuation that is now reasonable. It can be an effective safe haven during a period of significant volatility.

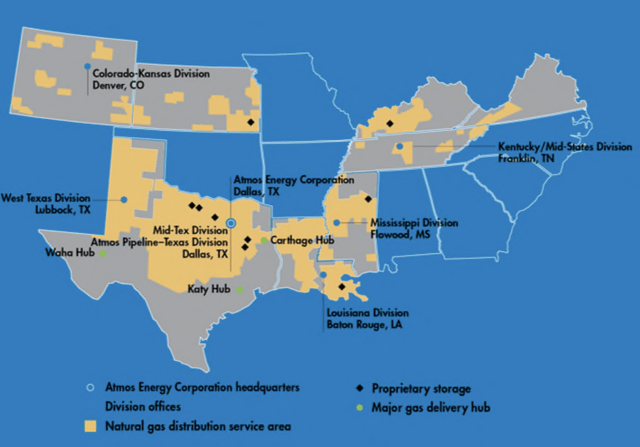

For those unaware, as you can see below, Atmos operates in the South-Central United States with 63% of its operations in the state of Texas. Atmos transports natural gas. About 68% of its business is distributing natural gas utility services. 66% of that business services residential consumers, the remaining commercial and industrial customers. The distribution unit has three million customers. The other 32% of its business is a pipeline and storage business that services produces in the Texas gas shale formations.

As with most utility businesses, Atmos’s operations are regulated. 98% of its operations are in locations that encourage natural gas usage, creating a favorable environment for the company to operate in. In its distribution business, ATO is allowed to earn a return on equity of up to 9.8%. Its pipeline and storage business has a permitted return on equity of up to 11.5%. Importantly, the revenue is tariff based rather commodity based, meaning that ATO receives a fixed amount for transporting the gas irrespective of its price.

The fact that Atmos does not take commodity risk-it merely is paid for the service of transporting and distributing natural gas-and that it receives regulated returns on equity and rate increases in friendly states has been a template for very steady performance. The company has grown its earnings per share for 19 consecutive years, and it has 38 years of dividend growth, including an 8.8% increase to $0.68 in this fiscal year. While this track record provides validation of its business model, as investors we are focused on the present and the future, not the past. Will Atmos be able to continue this track record of steady growth? It appears so.

In the company’s fiscal third quarter, it earned $0.92, up 18% from a year ago. Revenues rose by $211 million to $816 million. Much of this was due to $162 million increase in natural gas costs, the balance being due to regulatory approved increases. As noted above, ATO does not take commodity risk in its business. It is paid for distributing gas and receives a fee for that service, passing on cost increases or decreases to customers. Movements in natural gas can create or detract from top-line growth, but it washes out on the bottom line.

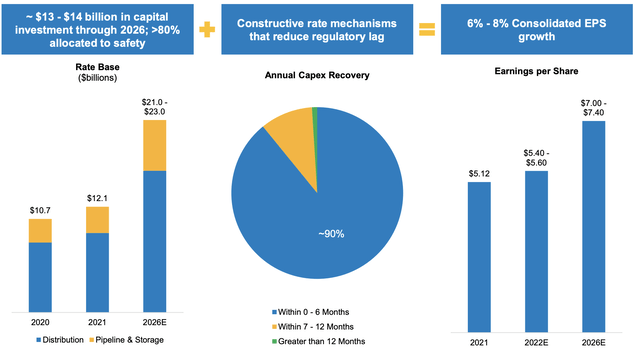

For the full year, the company should earn $5.50-$5.60 and spend about $2.45 billion in cap-ex. The company has registered $175 million of regulatory wins that boost operating income with another $145 million pending as of September 9th. In all of 2021, there were $186 million in increases. So, the steady, favorable regulatory environment remains intact. I would highlight the importance of its cap-ex spending. These capital expenditures increase the “rate base,” or the assets off of which the company is able to earn revenue. Getting regulatory approval for capital projects is critical to generate earnings and dividend growth.

Indeed as you can see below, the company’s goal is to generate 6-8% EPS growth between now and fiscal 2026. Underpinning this plan is a cap-ex budget of $13-14 billion, providing significant rate base growth. Importantly, Atmos begins earning on that capital spending within 6 months 90% of the time.

Having approval to do projects and begin earning on them quickly is critical as we think about how inflation impacts the business as it is a bit of a double-edged sword. To a certain extent, inflation is actually a positive for the business. In the distribution business for example, ATO earns 9.8%. So if a project requires $100 of equity, ATO will earn $9.80. If the regulator approves $110 for the project because building materials are more expensive, it would now earn $10.78. Importantly, there are not large lags between projects and earnings that increase the risk of cost overruns vs the approved rate increase. In a world of higher inflation, the $13-14 billion in viable projects ATO sees could turn into $15-16 billion, creating incremental rate growth opportunity.

Now, inflation is not a panacea, as I said it is a double-edged sword. Beyond getting more revenue from cap-ex projects, ATO can also get rate increases from annual cost increases, but those cost increases may not always keep pace with inflation. This year the company is getting credit for 3-3.5% operating and maintenance inflation, so if a 6+% inflation environment were to persist for a long period and is not reflected in future increases that could pose some margin risk. If ROEs deviate too much from the 9.8% and 11.5% target levels, there could eventually be faster O&M increases in the future to catch Atmos up.

Ultimately to achieve its goal of $7.20 EPS by 2026, Atmos will need to deliver on these cap-ex plans. Fortunately, most of its capital program is aimed at safety measures. For instance, it aims to replace half of its network’s steel piping by 2025, a program that has been ongoing and receiving regulatory approval since 2012. It is adding wireless metering and taking actions to reduce methane emissions by 15-20% a key priority to help the energy sector reach carbon targets. The nature of its capital program, improving and modernizing operations, should increase confidence it receives approval.

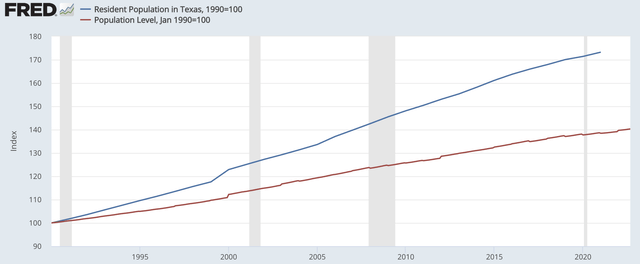

Additionally aside from the favorable regulatory environment, I view Atmos’s presence in Texas as a clear positive. As you can see from the below chart, Texas’s population growth has consistently surpassed the country as a whole. Growing populations mean more potential customers, more cap-ex opportunities, more cash flow and more dividend capacity.

Now, to finance its cap-ex, Atmos relies on a mix of debt financing, operating cash flow, and an at the market equity program. Because of the company’s persistent equity issuance, its shares outstanding have increased by 6.1% over the past year. As an investor, I never love to see share counts increase as that dilutes my ownership in the business. That said, Atmos does do so in a reliable way. Atmos engages in forward agreements to give it certainty on the price it will receive for the stock. Based on the relative attractiveness of debt vs equity, it can shift the mix somewhat. By pre-agreeing to a price, the risk of the stock plummeting, Atmos still having to issue equity, and turning what would have been accretive cap-ex to a dilutive program is greatly reduced. So far this year, it has issued $675 million of equity at about $94, alongside $800 million in debt.

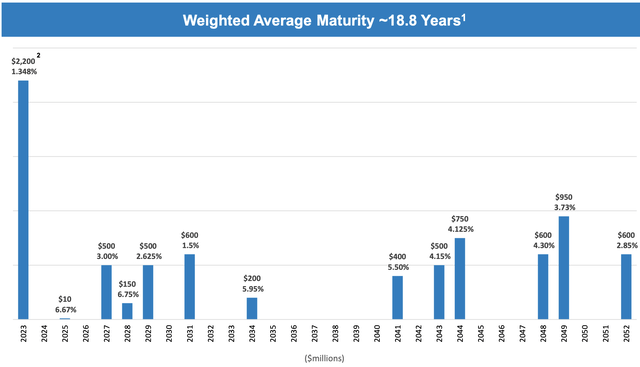

Atmos has entered into forward agreements that give it $701 million in available equity it can sell at $108.71 in Q4 2023. Given the stock is now below $100, this is an attractive strike price that management has secured. Importantly, Atmos has locked in low interest rates on much of its debt with an average maturity of nearly 20 years, significantly reducing its sensitivity to higher interest rates.

Over time, Atmos targets a 50-60% equity to capitalization ratio. Today it stands at 62%, excluding a winter storm securitization from Winter Storm Uri. The 2021 storm caused significant damage and costs for Atmos; Texas is allowing all of these costs to be recovered via a surcharge to customers, which finance a separate tranche of debt-this cost recovery again speaks to the favorable regulatory environment. With its equity weight above the high-end of target, I am hopeful that ATO tilts financing cap-ex the next two years towards debt to reduce equity dilution.

Having done an 8.8% dividend increase last November to $0.68, I would expect another high-single digit increase this November. Ultimately, ATO has very little economic sensitivity. Because it receives a regulated rate of return, Atmos will never deliver explosive profit growth, but it also won’t see business fall much during a recession. Atmos is well positioned to steadily grow income as it expands its rate base through a credible multiyear cap-ex program. Given its ability to pass on higher construction costs and with annual cost escalators, ATO also is relatively resilient to inflation pressure.

Over the next 12 months, Atmos should earn close to $5.80-6 giving shares a forward multiple of about 17x, and assuming a $0.05 dividend increase in November, it has a prospective dividend yield of about 2.93%. Atmos shares are not going to double or triple, but they can be a steady performer during a period of tremendous uncertainty and compound steadily over time to help you generate growing dividend income. I believe shares can trade back to the $110-120 area or a 20x multiple given its very predictable cash flow. Atmos could be an effective way to generate steady, economically-insensitive income in your portfolio.

Be the first to comment