JasonDoiy

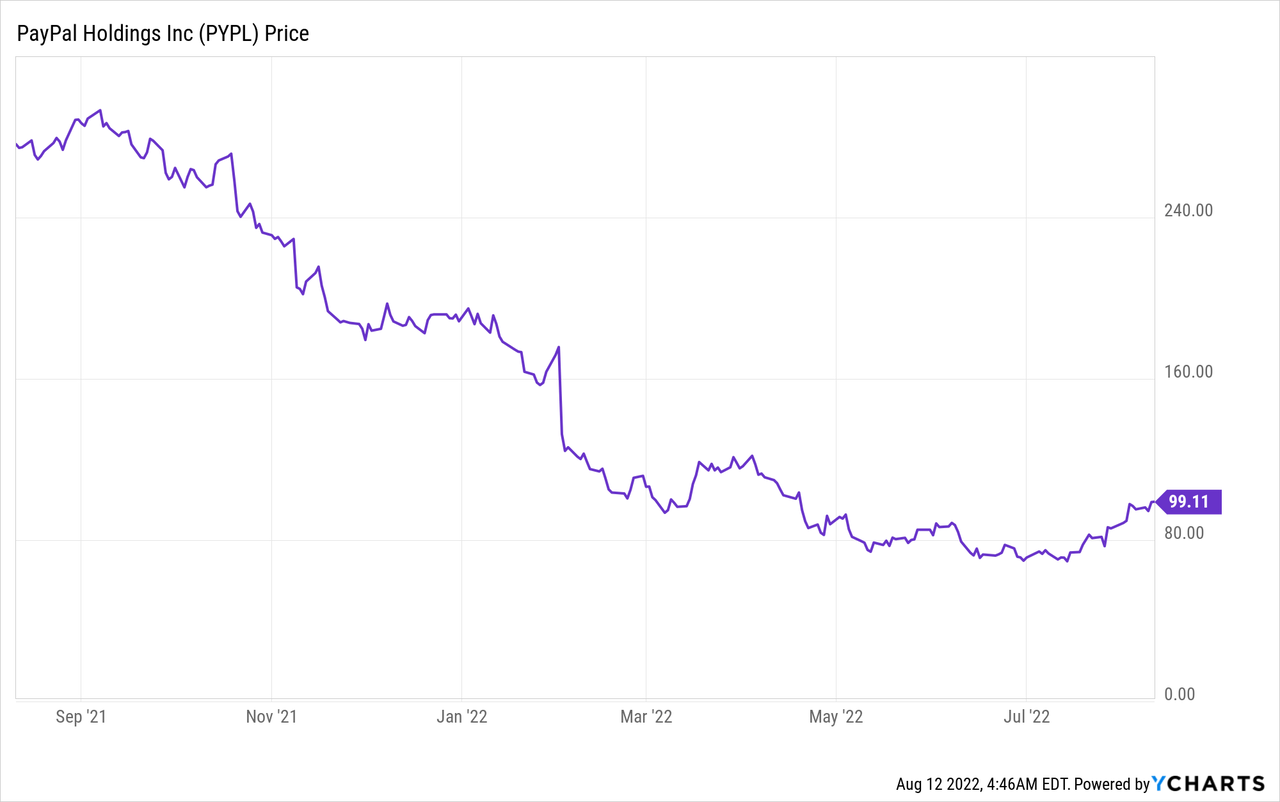

PayPal (NASDAQ:PYPL) is a fintech juggernaut which is poised to increase it’s profitability after management has made it a strategic priority. PayPal’s share price increased by over 200% in 2020, as a stimulus check fueled consumer caused a boom in total payment volume. But since September 2021 the stock price was butchered by ~75%, due to slowing growth and the high inflation environment. However, a recovery looks to be in sight as the company has announced strong financials and bought buyback shares in the second quarter. In addition, management has agreed to work with activist investor Elliot Management, which should help to boost shareholder returns long term. In this post I’m going to deep dive into the Business Model, Financials and Valuation, let’s dive in.

Evolving Business Model

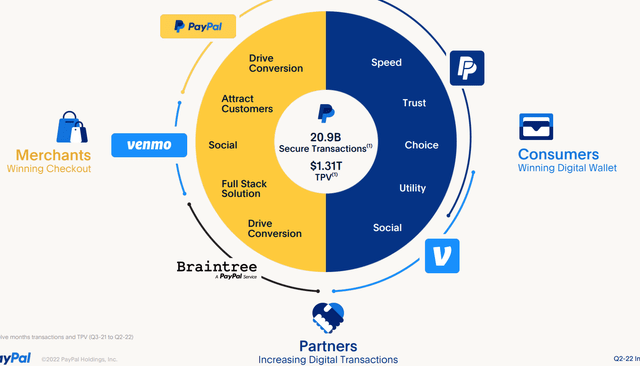

Founded in 1998 by the “PayPal Mafia” which includes an all star team of Silicon Valley legends such as; Peter Thiel (early Facebook Investor), Max Levchin (Affirm Founder) and even Elon Musk (X.Com merged with PayPal). In the early days of the internet, a key barrier to mass adoption of Ecommerce was “Safe” online payments. For those that can remember, at the time there was alot of fear about using your credit card directly online. PayPal solved this problem and since then has evolved to serve over 430 million consumers and merchants globally. At the time of writing the company processes over $1.31 trillion in total payment volume.

PayPal Business Model (Investor Presentation)

PayPal has grown it’s business through a variety of acquisitions over the past decade. These include Venmo the Social Payments app, acquired in 2012, Braintree the payments gateway acquired in 2013 and Zettle the merchant Point of Sale (POS) provider acquired in 2018. As far as acquisitions go these three have helped to grow PayPals business substantially and were boosted by the pandemic.

For example, PayPal has a strong relationship with Grubhub the online food delivery network, which has boomed during the pandemic. 95% of all GrubHub transactions are processed by PayPal’s Braintree platform. While Paypal’s “Hyperwallet” enables Grubhub drivers to receive “Instant Cash-out” of their payments.

PayPal has also rolled out new credit offerings for Small Medium Sized Businesses (SMBs) in the second quarter of 2022. These include an expansion of Working Capital in France and Holland. In addition to a PayPal Business Cashback card in partnership with Mastercard for U.S. residents. This gives them a substantial 3% cashback when checking out with PayPal.

The company also launched crypto transfers between PayPal and other exchanges. In addition, to introducing a no fee send/receive process to friends/family in the US, as they hope to expand the popularity of the service.

Buy Now Pay Later (BNPL) services has seen a major boost in popularity with Affirm, Klarna and many more. PayPal has expanded it’s offering with a Pay Monthly service for those in the US. Although, I believe they have been very slow of the mark when compared with the aforementioned more nimble competitors.

Ebay Breaks up with PayPal

PayPal is “breaking up with eBay” as the ecommerce provider plans to switch to a native payment integration via competitor Adyen. However, eBay has agreed to keep PayPal as a payment option for customers until July 2023. The loss of eBay is a major blow to PayPal and it’s not just about the lost payment volume. In my eyes the loss of eBay is a black mark on PayPal and how seamless or expensive it is as a payment service. Having used PayPal many times in the past, I feel this system is good as it “works” but the interface does feel more clunky than others in my opinion.

Growing Financials

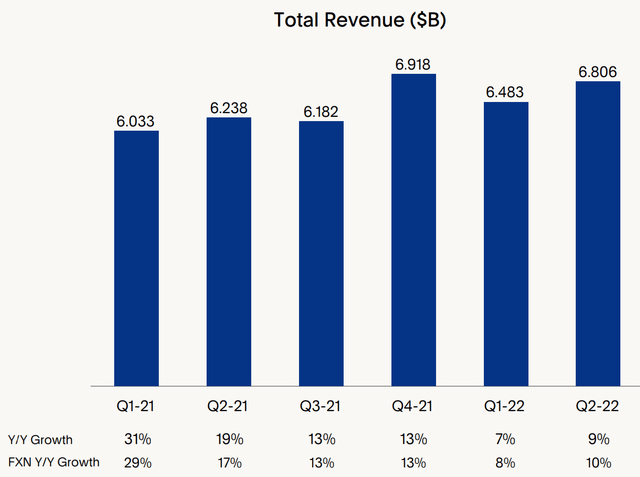

Paypal generated strong financials for the second quarter of 2022. Total revenue was $6.8 billion, up 9% and 10% FX-neutral year over year. This also beat analyst expectations by $21.58 million. If we exclude eBay, revenue increased by 14% over a 3 year CAGR.

Transaction revenue grew by a solid 8% year over year, which was primarily driven by the Braintree product. Other Value Added Services (OVAS) revenue increased by 21% year over year. The total “take rate” (which is the percentage of money PayPal takes per transaction) was flat year over year. Venmo and the P2P mix benefited this but it was offset by lower eBay volume/yield and lower FX fees. PayPal has smartly implemented derivative hedging for the volatile exchange rates, which they expect will result in $372 million of hedging gains in international transaction revenue over the next 12 months.

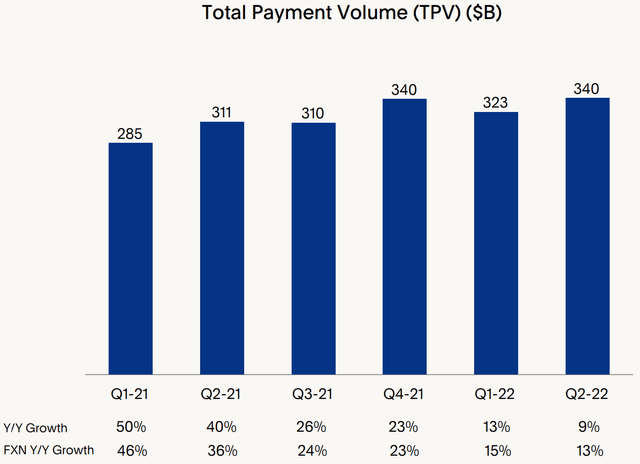

Total Payment volume (TPV) popped by 9% year over year to $340 billion. If we excluding eBay, TPV actually increased by 11% which was a positive sign. eBay volumes declined by a substantial 39%, as the company has removed PayPal as the main payment method, but will still offer it as an alternative up until July 2023.

Venmo volume increased by 6% year over year to $61B, which is not extremely large but keep in mind this is on top of 58% growth in Q2,21.

Total Payment Volume (PayPal Q2 report)

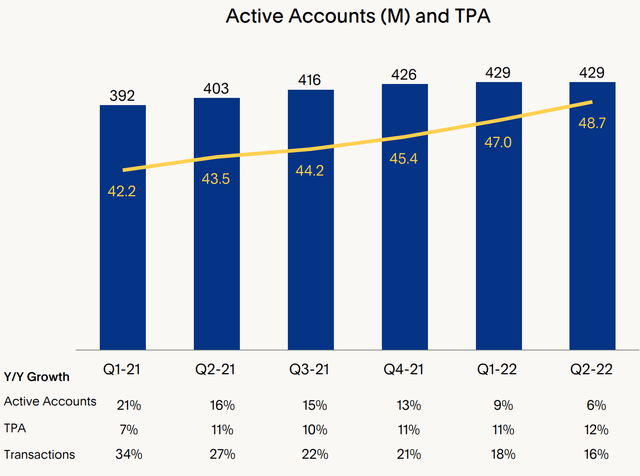

Total Active accounts popped by 6% year over year to 429 million. This account growth was driven primarily from Venmo.

Active Accounts (PayPal Q2 Report)

Total expenses ballooned by 20.1% year over year to $5.5 billion. This was driven by a sharp uptick up in Volume based expenses which popped by 29.7% year over year. This was a result of increased funding costs, driven by unbranded processing growth. Non Transaction related expenses were only up 6.4% year over year as the company focused on cost control across all segments.

Overall Operating Margin (GAAP) slid by ~684 bps to 11.2%. This resulted in GAAP EPS of minus $0.29, which was worse than $1.00 in Q2 2021. The GAAP EPS included a one of negative impact of ~$0.37 related to a “discrete” tax charge from acquired intellectual property. In addition, to a net loss of -$0.45, driven by a decline in PayPal’s marketable securities. This is a common trend I have seen across many earnings reports, as the rising interest rate environment has compressed the valuation of many companies.

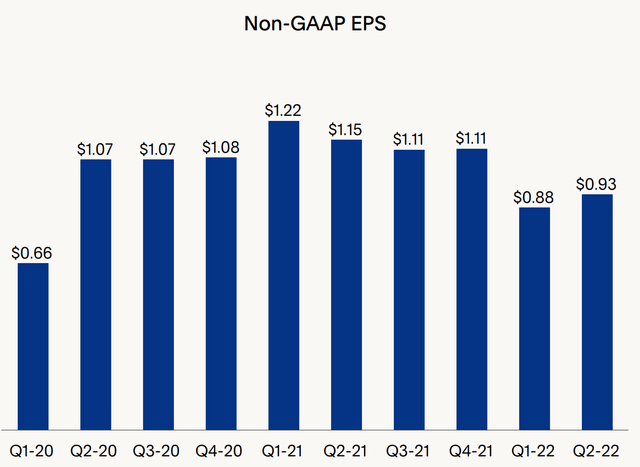

If we adjust for these prior expenses EPS on a non-GAAP basis was $0.93, which beat analysts low expectations by $0.06. However, it should be noted this was still down from the $1.15 in Q2’21.

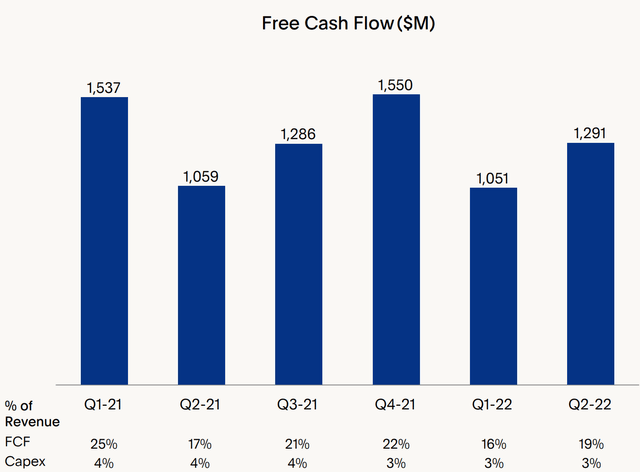

The company’s operating cash flow popped by 12% year over year to $1.5 billion. In addition, it’s Free Cash Flow (FCF) popped by 22% to $1.3 billion which was driven by higher cash earnings and positive changes in working capital.

PayPal has a strong balance sheet with $15.6 billion in cash, cash equivalents and short term investments. In addition to total debt of $10.6 billion.

Management showed confidence in the second quarter and bought back a staggering 8 million shares of stock, which returned $750 million to shareholders. It’s Board of Directors have also authorized $15 billion in share repurchases, which brings it’s total outstanding repurchase capacity to a substantial $18 billion.

Strong Guidance

For the full year of 2022, Management is guiding for $27.85 billion in revenue, with net revenues jumping by 10% year over year. Earnings Per Share is also forecasted to strong at $3.87-$3.97 (Non GAAP), as CEO Dan Schulman showed confidence.

“We expect operating margin expansion beginning in the fourth quarter of this year and continuing in 2023,” PayPal CEO Dan Schulman Q2 earnings call.

Advanced Valuation

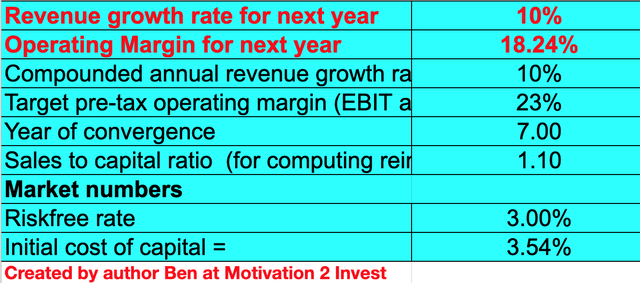

In order to value PayPal I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method. I have forecasted a conservative 10% revenue growth per year over the next 5 years. Driven by managements guidance and the growing Fintech market.

PayPal Stock Valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted margins to expand to 23% over the next 7 years, driven by managements planned focus on margin expansion and greater economies of scale. To increase the accuracy of the valuation, I have capitalized the company’s R&D expenses.

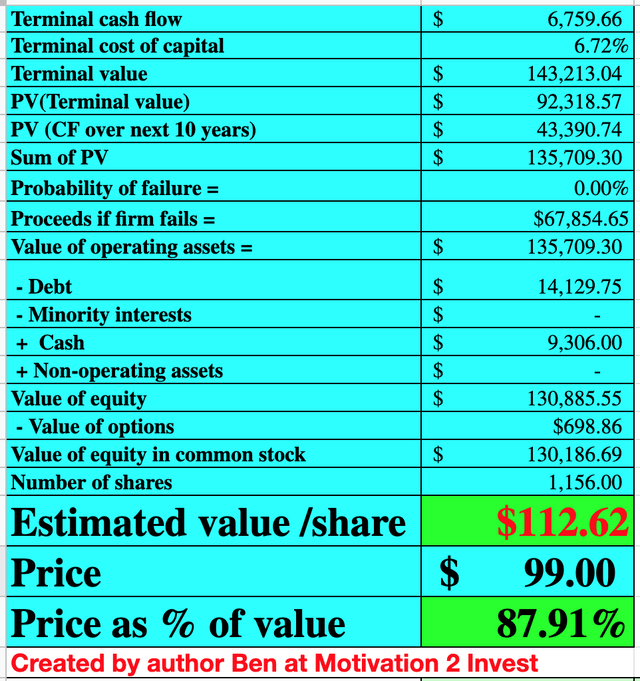

PayPal stock Valuation 2 (created by author Ben at Motivation 2 invest)

Given these factors, I get a fair value of $112/share the stock is trading at ~$99 at the time of writing and thus is approximately 12% undervalued.

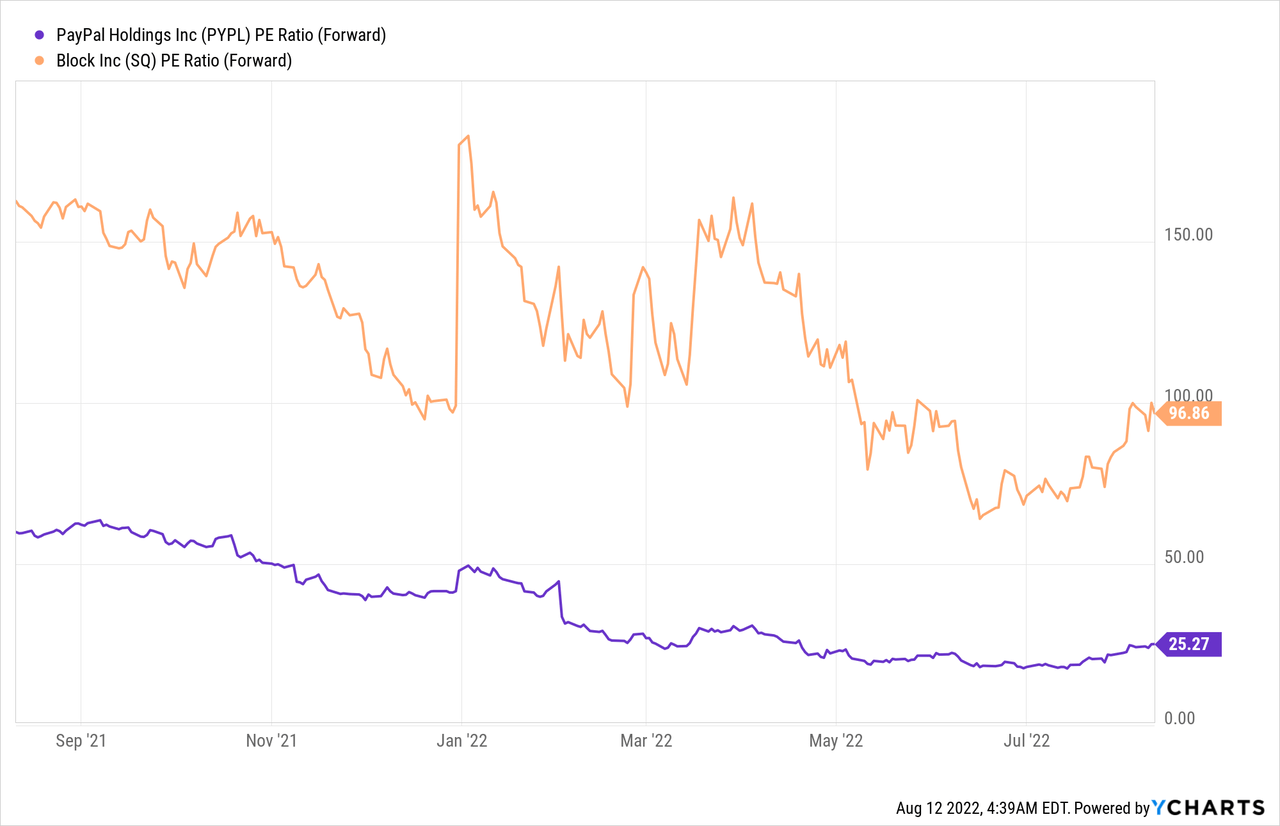

As an extra data point, PayPal trades at a Price to Earnings (PE) (FWD) ratio = 25, which is 37% cheaper than it’s 5 year average. It is also one of the more profitable fintech companies in the market, as I have compared to Block (SQ) on the chart below. PayPal also trades at a Price to Sales Ratio = 4.1 , which is ~49% cheaper than it’s 5 year average.

Risks

Recession

The high inflation and rising interest rate environment is squeezing both the consumer and merchants with higher input costs. Therefore if people have less excess funds to spend and are cutting back, this will directly impact PayPal’s revenue as they make money from taking a percentage of Total Payment volume.

Has PayPal Lost it’s Innovation Edge?

As I mentioned at the start with regards to the PayPal and eBay split. I do feel PayPal is not as innovative as other companies in the payment space such as Square (now Block) (SQ), I feel complacency may have got the better of them with regards to the roll out of new features and innovations, such as Buy Now Pay Later and Crypto.

Final Thoughts

PayPal is a fintech juggernaut which has continued to dominate over the past few decades. The company has grown by acquisition and snapped up prized gems such as Venmo, which has helped the brand to stay in touch with the younger generations. After the stock prices substantial crash, it is still undervalued and given the growth in the industry it looks like a great long term play due to their trusted brand.

Be the first to comment