JGalione/iStock via Getty Images

One of the most important aspects of investing is looking at where the market and humanity are headed. DexCom, Inc. (NASDAQ:DXCM) is a company looking towards the future where diabetes management is done completely digitally. As it stands today, DXCM is predominantly helping type 1 patients monitor glucose levels where strong payer coverage has brought on a strong uptake of patients over the past several years.

The company is profitable, growing quickly and moving in type 2 diabetes with increased coverage coming with its new G7 monitor later in 2022. The company has a massive runway of potential customers in the U.S. and other developed markets with no sign to the end of the diabetes problems worldwide. The planet has a staggering 535 million-plus diabetes patients and growing. The expenses all of these patients are costing is nearing 1 Trillion U.S. per year, an incredible number that makes DexCom technology essential to lowering cost in the United States. The company has strong margins as well giving huge potential earnings growth in the years ahead. The only downsides are a premium valuation and potential competition from Abbott Lab’s (ABT) Freestyle Libre or others.

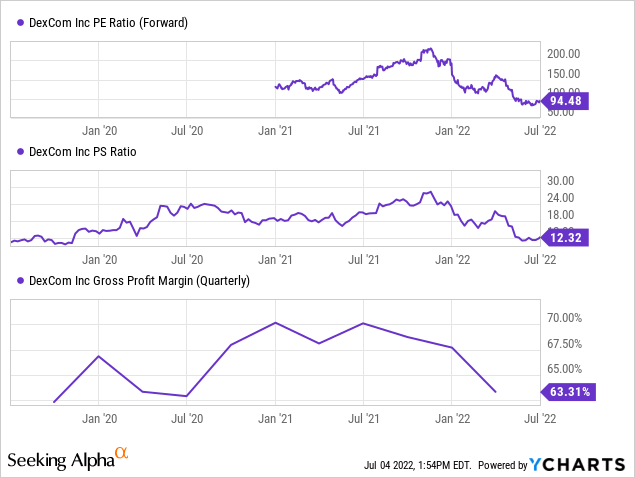

DXCM Valuation and Profitable Growth

The DXCM story needs to be looked at through the lens of much higher revenue in coming years, especially as G7 rolls out and makes continuous monitoring even easier. Current year guidance by management is for 20% revenue growth – a solid but unspectacular number as G6 growth slows. DexCom is focused on gaining essential approvals for G7, which should reaccelerate growth. G7 is already in limited use in the United Kingdom, with other international markets rolling out throughout the year.

The U.S. is pending full approval, with a substantial increase to the U.S. sales force to be ready whenever approval happens. Meanwhile, valuations have improved with the stock trading back at pre-Covid 19 multiples at 12.3x trailing sales. Forward earnings are under 100x which is acceptable for a company with a decade of profitable growth left over 25% per year. Margins in Q1 fell to 63.3% of revenue, but these are mostly temporary issues, including plant damage in Australia costing 1% and G7 ramp expenses causing issues.

The company guided to 65% for the year, and 2023 will see further increases as the new G7 sensor ramps. Revenue in Q1 2022 grew 25% to $628.8 million over Q1 2021, but the most important metric of sensor volume grew in the low 40% range. Pricing is going to come down slowly over time, which is going to be offset by lower cost as DexCom is able to ramp up manufacturing. Moving sales to international is a headwind to revenue as well, as many emerging markets are not able to pay the premium pricing that the United States or Western Europe can. On top of that, $6m was lost due to foreign exchange headwinds, which have only increased since the first quarter. Look for a larger $10 plus impact on revenues for the coming Q2 report.

Omicron was a headwind until lately, with some international reacceleration coming in new patients over summer 2022. Operating income for Q1 was $50.3 million, or 8% of revenue as costs for the G7 launch continue to weigh on profitability. Look for an inflection in profitability in 2023 when the G7 is fully ramped and G6 usership declines below 30%. DXCM has $2.7 billion in cash to fund sales force expansion and additional manufacturing facilities required to increase structural margins to close to 70%.

DexCom ONE and G7

Two significant products are rolling out to new markets in 2022, with its most advanced monitor yet in G7 rolling out globally this year. DexCom ONE is filling a niche at a lower price point, giving patients with lesser income and coverage an effective tool against diabetes. It isn’t meant to be used to an insulin pump, but rather as a standalone device to track glucose levels in an all-in-one device. They have brought this product based on G6 out in Bulgaria, Estonia, Latvia and Lithuania to strong demand.

20% of the sales so far have been to type 2 diabetes patients with insulin intensive therapy – the large untapped market that DexCom hopes to penetrate globally over time. Spain and the United Kingdom are rolling out now, with additional countries planned for the course of the year. This product should do well with type 2 patients and those that want those insights into their blood sugar without the high price point of coming G7. It is meant for the less intensive population that isn’t captured by G6 or G7 and will be a strong contributor to future growth.

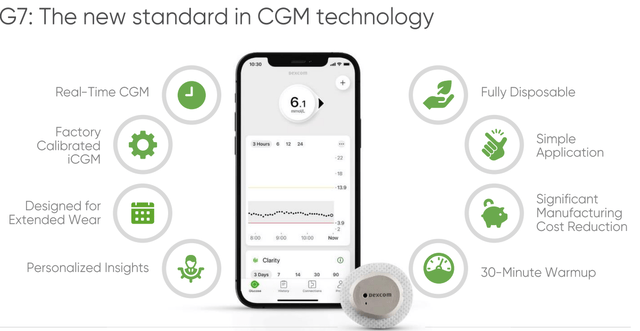

G7 – Future of CGM (DXCM presentation)

G7 is the upgrade to the flagship G6 sensor which has several significant upgrades. The G7 is easier to use, easier to recycle, cheaper to manufacture at scale and provides longer battery life for patients. Being 60% smaller is a big upgrade for comfort, with it less likely to snag on clothing. These upgrades will be more profitable for DXCM, and a good quality of life upgrade for users. This should mean significant uptake throughout 2023, improving margins back towards 70% level by the end of next year.

The U.S. approval is pending, with the FDA coming back with minor questions for management prior to approval. Management is extremely confident of approval this year, with their teams ready to ramp as soon as it’s approved. The G7 system will be fully integrated with the major insulin pumps with an easier-to-use application. Making things extremely easy for patients is essential to fast uptake from older systems or from not using CGM at all.

Long term, the company is aiming for 80% penetration of both Type 1 and insulin-intensive Type 2 diabetics. Right now, Type 2 is a greenfield opportunity with a giant runway. Data continues to show continuous glucose monitoring improves health outcomes, so DXCM management is working hard on reimbursement for Type 2 patients. CEO Kevin Sayer notes:

“If you are going to be intensively using insulin, there is no reason to not treat yourself with CGM. It is just a much better tool. So, I believe that penetration get every bit as high as the Type 1 population without any question.”

In the end, CGM technology is going to improve health outcomes for patients, which reduces healthcare burden and actually saves money for insurance companies in the longer term. This makes G7 for Type 2 diabetes that use insulin a win-win, that should lead to increased coverage in the United States as DexCom becomes more influential.

Bottom Line

While many people are wanting to continue to avoid growth stocks due to the current bear market and possible recession, now is a great time to buy for long-term holders. The market is reducing inflation expectations lately as commodities sink, which should be supportive for growth stocks. Confirmation of recession later this summer would actually be good for growth stocks as DXCM can grow nicely through a recession.

I would use this period to accumulate DexCom with an eye on the potential large earnings expansion over the coming years as the company expands globally and rolls out both G7 and ONE. The stock is trading at a valuation comparable to prior to Covid-19 which is reasonable given its blue-chip status with a solid technology lead on the competition. Buying DXCM below $85 is a great purchase for those that see the big potential for medical devices with our aging world population.

Be the first to comment