ozdigital/iStock via Getty Images

Investment summary

We are long DexCom, Inc. (NASDAQ:DXCM) shares and believe the company has the mid-term growth levers in place to secure an additional 18-20% upside from its current market price. I believe that DXCM’s track record of high FCF prints and ongoing return on invested capital is currently under-reflected in its share price and that shares should be trading up near the $103 mark. Here I’ve noted several upside factors in the DXCM investment debate. Net-net, I rate DXCM a buy on a $103 price target.

Mid-term growth driver – Omnipod 5

DXCM has partnered with another long in our med-tech equity bucket Insulet Corporation (PODD) [See my analysis: Insulet, Bullish Factors For Portfolio Inclusion; HB Insights July FY22 – Buy, price target $284] in PODD’s Omnipod 5 tubeless automated insulin delivery (“AID”) system.

The Omnipod 5 AID system is the only tubeless AID system in the U.S., and DXCM’s G6 CGM system is needed to control it. In other words it cannot operate without DXCM’s proprietary involvement, creating a unique value proposition for investors. This is a clear differentiator for the company and it reduces the execution risk in its commercialization strategy, by allowing PODD to do some of the heavy lifting, whilst adding another stream of value to the company’s top-line.

Findings from Sherr and colleagues (2020) illustrated good effect in patients aged 6 and over using the system and safety data held up well. Whereas Sherr et al. (2022) demonstrated the system produced no episodes of severe hypoglycemia or diabetic ketoacidosis, but improved all glycemic measures in its population of 80 children aged 2-6 years.

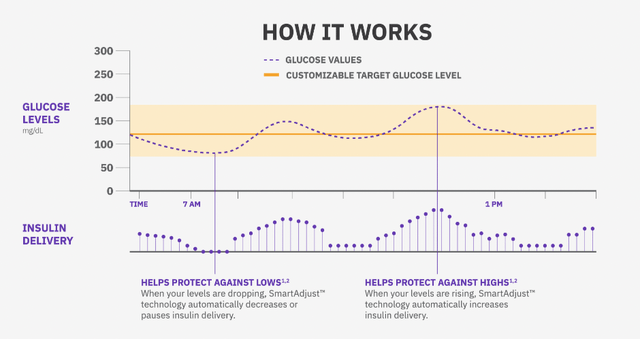

Exhibit 1. Demonstration of BGL/Insulin coupling in the Omnipod 5 system with DXCM’s G6 CGM.

The system integrates with the G6 app and automatically adjusts insulin to smooth out spikes and troughs in blood glucose levels (“BGLs”). Every 5 minutes, the system corroborates with itself to automatically increase, decrease or pause the delivery of insulin to maintain a target BGL zone. It does this 24/7.

The economics of the device are quite interesting for DXCM as well, in that providers can prescribe the Omnipod 5 to patients with insurance coverage, and this can be accessed via the pharmacy channel – in fact it’s the only U.S. insulin pump that is available through pharmacy.

Most recently the system has made progress in the pre-adolescent and infant segments. It received FDA approval for the system in children aged 2-5 years with type 1 diabetes in August, and then on 20 September received CE Mark approval for the same population group. It’s understood to be available in select countries midway through next year.

DXCM Operating trends back in cycle

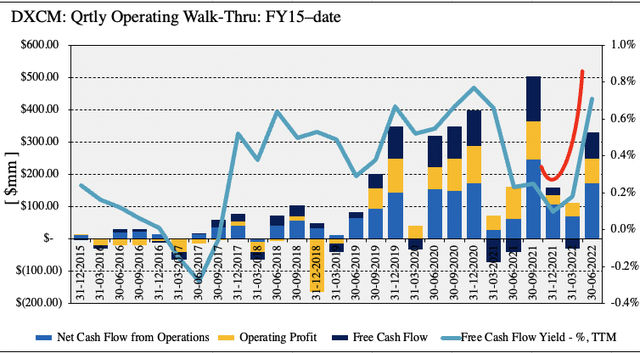

As seen in Exhibit 2, quarterly operating income and free cash flow (“FCF”) have dwindled in recent years. As a result, DXCM was printing numbers seen in FY18 at these levels, up until Q1 FY22. However, we’ve now seen a return towards previous earnings cycles, and consequently realized FCF yields are back at pre-pandemic highs. This is coupled with strong FCF conversion of $81.3mm last quarter that has benefitted from previous cycles of investment into the company.

I’m satisfied to see the upswing in FCF conversion and FCF yield back to pre-pandemic ranges, and this forms an important part of the investment debate. Our estimations also predict the company to generate $2.89 Billion in revenue this year, calling for 14.3% growth at the top YoY [discussed later], and project it to bring this down to $148mm in FCF below the bottom line [+179% YoY]. Therefore DXCM is entering the forward-looking climate gathering fundamental momentum and strengthening its bottom-line fundamentals in doing so.

Exhibit 2. FCF and FCF yields normalizing to the upside and returning back to pre-pandemic ranges.

- We project $148mm in FY22 FCF, calling for 179% growth.

- I estimate the uptick in cash flow yields from Q2 FY22 will pull through to this level.

Note: All figures in $mm of [%]. Free cash flow calculated as [NOPAT – investments]. FCF yield calculated as function of enterprise value on trailing twelve month basis. All calculations are from GAAP earnings with no reconciliations. (Data: HB Insights, DXCM SEC Filings)

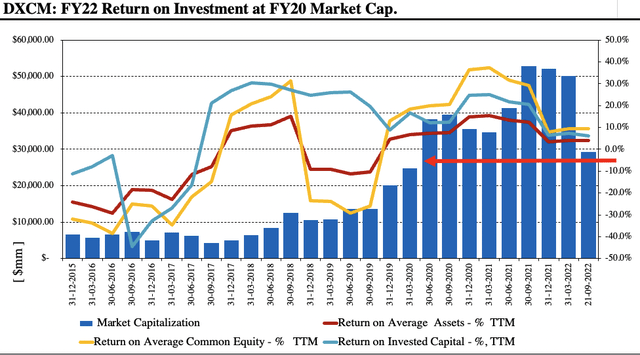

Adding to the fundamental strength seen above is the company’s return on investment trends. As seen in the chart below, in buying DXCM we are now buying into FY22 profitability levels albeit at a FY/19’20’ market capitalization. This is pre-pandemic times and investors have discounted the growth in FCF over this time. It has printed a cumulative $595mm in FCF since Q2 FY18, whereas its averaged a return on investment (“ROIC”) in the double digits since then as well. In Q2 FY21-Q2 FY22 it realized an average 12.5% TTM ROIC each quarter, and this tells me the DXCM compounds capital faster than the WACC hurdle of ~6.75% with its ongoing investments.

Similar trends are observed in current investments/assets, realizing a 7.4% TTM return on assets (“ROA”) last period. Again, these numbers are robust for the company and we are buying into these growth trends at unfairly discounted multiples by my estimation.

Exhibit 3.

Note: All figures are in $mm or [%]. Return on invested capital and return on assets calculated as [NOPAT/invested capital and NOPAT/total assets] respectively. All calculations made from GAAP earnings with no reconciliations. (Data: HB Insights, DXCM SEC Filings)

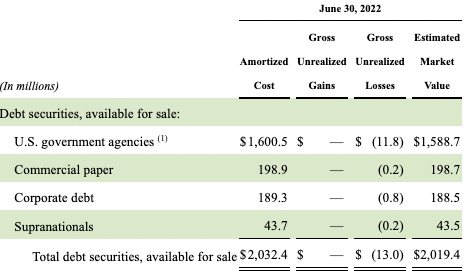

One point I’d point out in the investment debate is the question of what we’re exactly buying in DXCM. With the obvious strengths around its intangibles, it only identifies $28mm in net intangibles on the balance sheet, and another c.$943mm in PP&E. However, of the company’s $5.2 Billion in total assets, ~73% or $3.8 Billion of this amount falls under current assets, and of this, c.$2 Billion is booked as short-term marketable securities. The breakdown of DXCM’s holdings are seen in Exhibit 4.

Exhibit 4. Breakdown of ST Marketable securities for DXCM.

- These make up 38% of the total asset base.

Data: DXCM 10-Q Q2 FY22, “Fair Value Measurements”, pp.18-20; see: pp.19

Valuation and conclusion

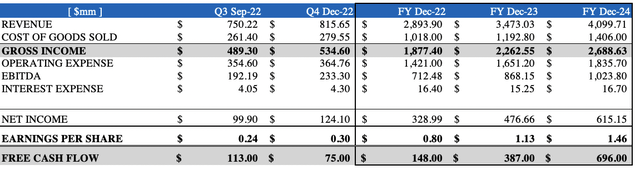

Our internal team forecasts a period of substantial growth from top-bottom line over the coming 3-year period for DXCM. We see FCF CAGR of 67% into FY24, with the company realizing $696mm [$1.77/share] in FCF by this time, with equally as strong earnings growth into this period. I’m happy with these numbers but it tells me one of 2 things: either there’s plenty of upside that’s yet to be baked into the stock price, or, investors have correctly discounted the stock based on multiples its currently trading at.

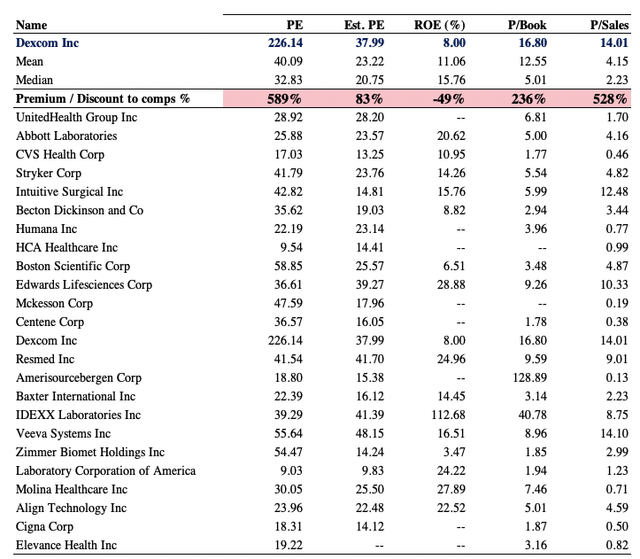

Exhibit 5. DXCM Forward estimates, FY22 remainder; then FY22-FY24

Shares are also trading at a premium to comps used in this analysis, particularly at 16.8x book value. Valuations are certainly unattractive in terms of relative value, however, it depends on the premium one would pay in order to access the trailing and forward-looking strengths in ROIC and FCF that’s been discussed here today. As long-term holders of DXCM, we’re happy to continue sizing up the position with each pullback to range, as has been the case in 2022. However, I’d just not this is based on our original entry points before the pandemic. So for new-entrants into the stock, I’m not as confident the same mathematics will prevail.

Current valuations certainly add a downside tilt to the risk/reward calculus at this point. However, the market has priced DXCM at ~38x forward P/E, well above the peer group, suggesting investors are expecting an above-sector result from the company at the bottom line. Further, assigning DXCM’s 3-year average P/E of 129x to the FY22 EPS estimates of $0.80 sets a price target of $103.

Exhibit 6. Multiples and comps analysis

Data: HB Insights, Refinitiv Datastream

Net-net, there’s plenty to like about in this name, and plenty that isn’t discussed in this report as well. Chief to the investment debate shown here is the company’s resilient FCF conversion and generous return on investment exhibited on an ongoing basis. These are attractive features in the investment debate and warrant a buy on themselves. Balancing this however are current multiples at which DXCM is trading at that are unsupportive of immediate entry. Regardless, DXCM I believe there’s several mid-term growth drivers yet to be priced into the stock, in particular momentum from the Omnipod collaboration. I rate DXCM a buy on a $103 price target.

Be the first to comment