Anne Czichos/iStock Editorial via Getty Images

Since our initiation of coverage, we were pretty bullish on Deutsche Post AG (OTCPK:DPSTF, OTCPK:DPSGY). After the Q1 results, we published an analysis called: A New Normal To Price In, in which we emphasized how we positively view: 1) DHL Global Forwarding & Freight division performance, 2) Deutsche Post & Parcel segment (with a contrarian view versus the market expectation), 3) and its compelling valuation with a dividend yield higher than 4.5%.

Looking at the stock price evolution, the company declined more than 16%. However, we are happy to quote the latest CEO comment, Frank Appel explicitly said that: “the first three quarters of the year were the most successful in our company’s history thanks to the international DHL business“. This goes very well in line with Mare Evidence Lab’s internal thesis: they call it resilience; we call it a new standard. We now believe that these positive results won’t go unnoticed in the investor community and we expect Wall Street analysts will price in this new normal and upgrade upwards their earnings forecast.

Q3 results

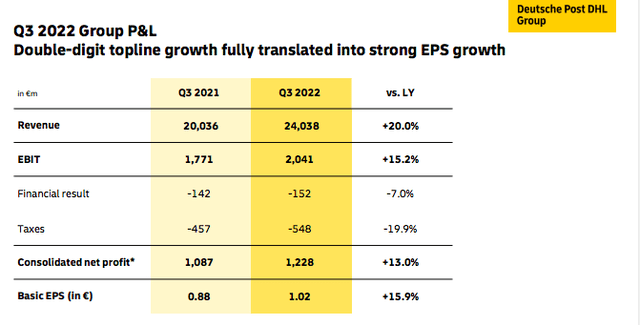

Last week, Deutsche Post presented its Q3 figures. Despite a weakening economic environment, the logistics group increased its revenue by 20% on a yearly basis and reached €24 billion compared to the €20 billion achieved in the same quarter one year ago. In detail, higher turnover was driven by favorable FX (for almost €1 billion) and by the latest acquisition of Hillebrand Group which generated almost €600 million in the third quarter alone. The company operating profit recorded €2 billion and was up by 15.2% over the prior-year quarter end. The company’s worldwide networks, its flexible structures, and the intensive cooperation between the company divisions were the reason behind its success. Looking at Mare Evidence Lab’s thesis, we highlight that:

- DHL Global Forwarding & Freight reported an EBIT number higher than 57% compared to last year and reached €584 million. This was mainly due to the continued high freight rates. Although air freight volume slightly fell, the Sea freight segment increased by 11.9%. A growth that is also explained by Hillebrand’s takeover. Overall, the EBIT margin improved to 7.4% from 6.5%;

- Despite the fact that fewer people utilize postal service, top-line sales and earnings at Post & Parcel division were at the previous year’s level. The company’s operating profit achieved €290 million compared to €300 million recorded last year. Despite lower volumes, higher sales and a strict cost discipline partially offset the results.

Deutsche Post financials in a snap

Conclusion and Valuation

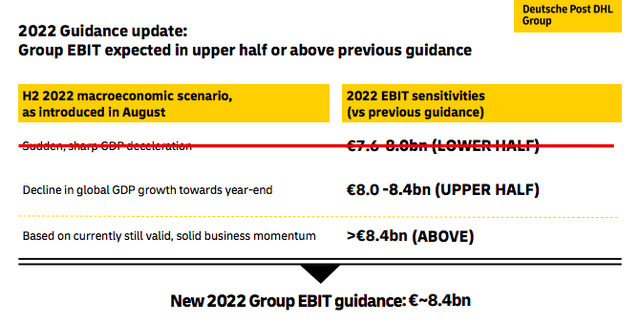

The company reported a good set of numbers. In our past analysis, we said that management has always been very cautious; however, in response to the positive business and earnings development of the DHL divisions, the Group raised its earnings forecast for the current financial year to a record level of around €8.4 billion (previously EBIT forecast was set at €8.0 billion). We mentioned our two buy case recap based on DHL’s core business activities. Going to the valuation, Deutsche Post is still trading at a discount compared to its historical average. Before going to the numbers, it is important to remind the following key takeaways:

- The world’s leading logistics group completed its first share buyback tranche of €800 million; however, there is a new share repurchase of €500 million with an end date in Q1 2023;

- The company has a safe balance sheet with net debt/EBITDA at 1.3x, despite that interest expenses had increased by €10 million in the quarter; even with higher interest rates, we believe that this trend will reverse;

- After higher working capital requirements experienced in the first half of the year, the company is benefitting from a reverse trend;

- Net income was up compared to last year’s number as well as its EPS which increased to €1.01 from €0.87.

With record results and higher guidance, Deutsche Post AG is still trading at an 8x P/E compared to its historical past average of 15x. Therefore, we confirm our previous valuation with a target price of €62 per share.

Deutsche Post new guidance

Source: Deutsche Post Q3 results presentation

Be the first to comment