AlexLMX/iStock via Getty Images

Much of financial analysis consists of looking at the outcomes:

- Revenues

- Earnings

- Growth rate

- Margins

All of that stuff is great to look at, but today I want to examine real estate from a different angle: the underlying forces that govern these factors over the long run. Specifically, I want to look at the business models of the various property types with regard to whether it makes sense for a REIT to be in the space or if the property is just better off being owned by the end-user.

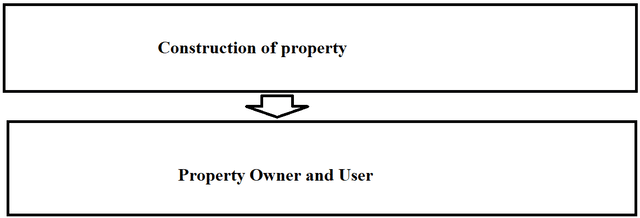

Essentially, we will be looking at whether this model is better:

2MC

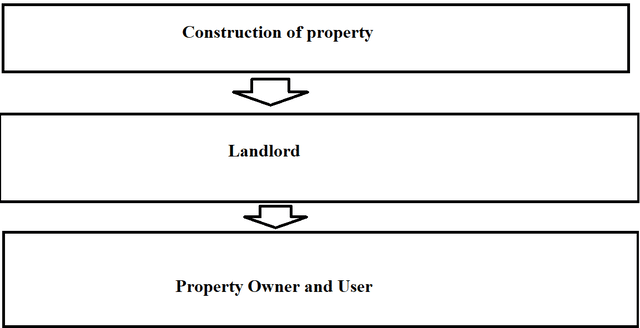

Or this model?

2MC

Is the landlord a useless middleman that just adds cost to the supply chain or is there a sound reason to have this extra layer?

As with most things the answer is that it depends.

There are substantial advantages and disadvantages to adding the landlord layer into industry verticals and the net advantage or disadvantage varies greatly between sectors.

The greater the net advantage to having a landlord as part of the vertical the better that REIT subsector will tend to perform over the long run.

Here are some potential advantages to having the Landlord layer:

- Shared infrastructure

- Duration barrier to entry

- Capital barrier to entry

- Temporal barrier to entry

Below we walk through our thought process on what makes certain REIT subsectors stronger than others.

Shared infrastructure

Perhaps the best example of this is roads. A road is valuable to thousands of people but not valuable enough to any individual person that they would be willing to individually bear the cost of paving and maintaining it.

This makes roads a natural shared infrastructure asset. The cost burden of the road is shared among entire communities (via taxes) and then the communities collectively benefit from that road. Certain sectors of real estate function in a similar fashion.

- Shopping centers: Each tenant benefits from the foot traffic generated by other tenants.

- Towers: a single third party owned tower can have multiple carriers using the infrastructure thereby splitting the infrastructure costs between them.

- Data centers with cross connections provide added benefits to multiple tenants.

- Fiber infrastructure can be leased to multiple users without creating latency.

In each case, the ability to share the infrastructure between multiple users creates value for the third party owner of the real estate.

Duration barrier to entry

Hotels are the pinnacle of duration barrier to entry with hotel stays ranging from 1 day to a few months for extended stay hotels. With this length of stay it is simply not feasible for the tenant to own their own building in which to stay. Thus, the property is more efficiently owned by a third party rather than the user.

As such the third party owned hotel must exist and there must be some sort of margin to that third party owner so as to induce its existence.

Apartments arguably fall into this category as well. One could debate how long one has to live in one spot for homeownership to be viable, but in my opinion anything less than 2 years it is better to rent an apartment than to own due to selling costs and other frictions.

Capital barrier to entry

A tenant may not have the capital for their required infrastructure. This happens most frequently in the following sectors:

- Apartments: Individuals without the money for a down payment on a home may rent an apartment even if they are staying in one area for a long time.

- Manufactured housing: Rents of less than $1000 per month work for a large portion of the population that cannot afford to buy

- Healthcare: Healthcare operators can expand their practices faster by not tying up capital in the real estate

- Triple net: Sale leasebacks free up capital for growth

Temporal barriers to entry

In addition to being costly, building infrastructure can take potentially many years with zoning and then the actual construction. In renting pre-existing real estate, the tenant can skip this delay.

Rather than existing in certain sectors this driver is more often consequent to growth frenzies. For example in 2020 and 2021 logistics companies wanted to rapidly expand their delivery networks so they rented up millions of square feet of industrial space. Most of the players involved could afford to build their own warehouses, but it was a race to get the most space the fastest, so they could not afford construction delays.

All of the above are reasons that it makes sense to have a landlord layer, but it’s not purely beneficial. There are also costs involved to having the extra layer. Specifically:

- Leasing costs

- Corporate G&A

Leasing costs

Having a 3rd party owner requires the building be leased to the user. The efficiency with which this leasing is done is a big determinant of the success of the REIT sector. One of the key aspects to look at here is a push versus pull model.

- Pushing involves leasing agents trying to sell the space to anyone who might be interested.

- Pulling is where tenants seek out the landlord.

It has changed over time as to which sectors are push versus pull, so I can only comment on how it exists as of today.

Push sectors:

- Office – low occupancy forces landlords to be aggressive about getting their space leased which means leasing commissions and tenant inducements cost as much as 8%-20% of revenue.

- Hotel – online travel agencies have forced themselves into the industry to such an extent that it is incredibly difficult to achieve strong occupancy without going through these vehicles which are essentially leasing agents. The net cost is close to 20% of revenue.

- Poorly located malls – once occupancy gets below a certain level mall landlords are being forced to offer potential tenants amazing deals. Even if it doesn’t show up in leasing costs, it shows up in net effective rents.

- Triple net re-leasing upon lease expiry – After the initial 15 to 20 year term of triple net properties ends they will often have to pay a fair amount to get it re-leased, particularly if the original tenant leaves.

Pull sectors:

- High occupancy is the primary driver of tenants seeking out the landlord.

- Farmland: One of few industries that has consistently been essentially 100% occupancy.

- Apartments and industrial: Presently pull sectors but that hasn’t always been the case. In 2009 both apartments and industrial were push sectors. It just so happens that right now occupancy is very high which means landlords have multiple bidders to choose from.

- Triple net initial lease: The sale-leaseback initial lease of triple net is highly efficient. The tenant is wanting a capital infusion which makes them highly incented to sign the lease.

- Government leased properties: The U.S. government has a remarkably high renewal rate and the REIT can usually negotiate directly with them such that leasing commissions are minimal.

Corporate G&A

Beyond leasing costs, having the landlord layer means there is another entity in the vertical and this entity has its own cost structure. This difficulty is unavoidable but there are 2 key ways to mitigate the damage:

- Companies that run lean

- Efficient scale such that G&A is a reduced percentage of revenue

Putting it together

There are many reasons to have a landlord layer within an industry vertical. The viability of this layer depends on the factors discussed above. In general the REIT sectors that have the cleanest business models are

- Towers

- Farmland

- Apartments/manufactured housing

- Industrial

- Shopping centers

- Cross connect data centers (not hyperscale)

In each case the strength is assuming standard or better occupancy. Oversupply can make any sector dangerous while undersupply can at least temporarily cause otherwise weak sectors to perform well.

Be the first to comment