RiverNorthPhotography/iStock Unreleased via Getty Images

I have written a variety of articles on shoe manufacturers and retailers over the past 12 months, including a bearish take on Nike (NKE) here, alongside bullish suggestions for Weyco Group (WEYS) here and Genesco (GCO) here.

Two more shoe retailers have caught my attention in the autumn. Designer Brands (NYSE:DBI) and Caleres (NYSE:CAL) have similar business models and operating returns, with stock price zigzags and valuations nearly identical in 2022. The buy thesis is based in low price to earnings ratios, crossed with nice share “outperformance” momentum.

The companies appear ready to move substantially higher, especially if the U.S. equity market holds up and the economy does not slide into deep recession (I cannot guarantee either will take place). The good news is shoe sales survive relatively well in recessions and online sales are less of a threat long term, as customers prefer trying on 5 or 10 pairs to find the perfect fit before purchase.

Designer Brands runs 550 Designer Shoe Warehouse stores (92% of sales from U.S. and Canada retail outlets including Shoe Warehouse, with 8% ordered through online direct channels, for Q2 2022FY), while Caleres (formerly Brown Shoe) operates 1,000 Famous Footwear retail locations (60% of Q2 2022FY sales) and 13 e-commerce websites (40% of sales). While both market popular brand-name shoes manufactured by other suppliers, each company is heavily involved in the design, production and distribution of their own footwear, sometimes under license agreement.

Designer Brands Website, November 13th, 2022

Designer Brands Website, November 13th, 2022

Valuation Comparisons

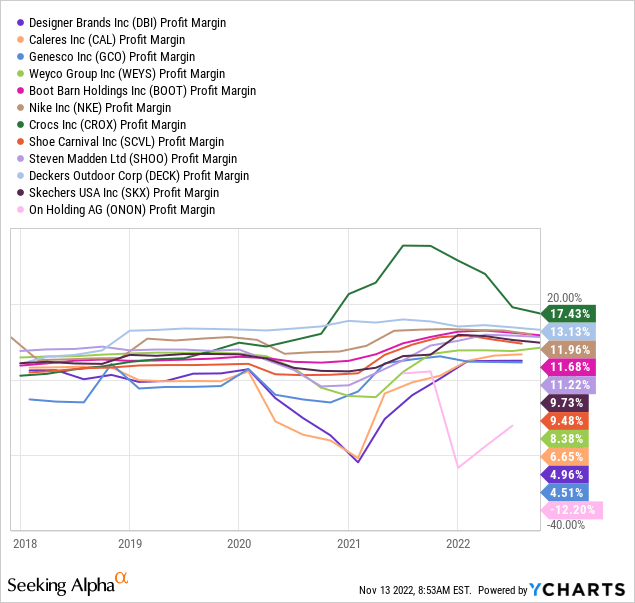

What’s fascinating to me is each runs a slightly different business model, but with almost identical returns and profit margins. For example, final income over the last 12 months ran at a 5% margin on sales for Designer Brands and 6.6% for Caleres. These results are lower than many peers that manufacture product, then wholesale to mass merchandisers, on top of running a branded retail footprint like Nike, Skechers (SKX), or Crocs (CROX). I have drawn a 5-year graph of margins below including a number of other peers and competitors from Genesco and Weyco to Boot Barn (BOOT), Shoe Carnival (SCVL), Steven Madden (SHOO), Deckers Outdoor (DECK), and new to the scene On Holding AG (ONON).

YCharts – U.S. Shoe Retailers, Net Profit Margin, 5 Years

The lower than industry margin average means Wall Street values them as higher-risk choices, usually with reduced multiples on fundamental operations. However, today’s inexpensive pricing for both seems excessive to me and other investors, somewhat proven out by upward sloping price patterns during 2022. Despite a weakening economy and equity selling in peer names like Nike and Crocs, Caleres and Designer Brands are producing total return gains this year.

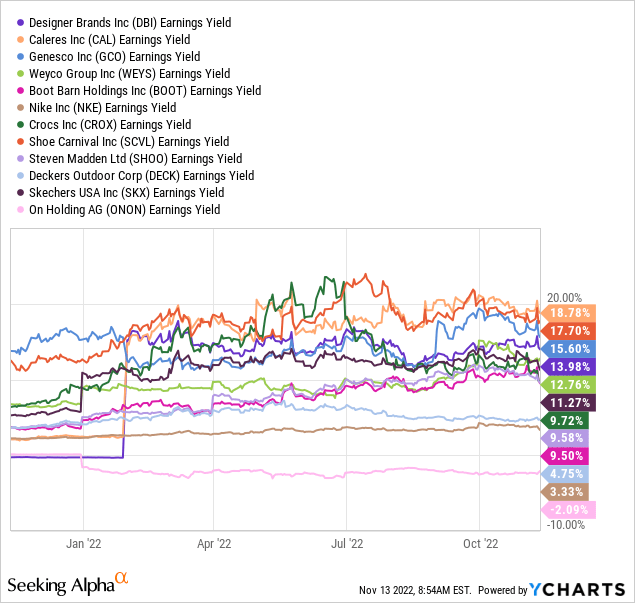

Again, if earnings and sales just remain steady, both Designer Brands and Caleres look like bargains today. The basic earnings yield story is pictured below on a 1-year graph. Theoretical 18%+ yields on your investment capital from Caleres and 14% from Designer Brands are near the top of the industry list.

YCharts – U.S. Shoe Retailers, Trailing Annual Earnings Yield, Since November 2021

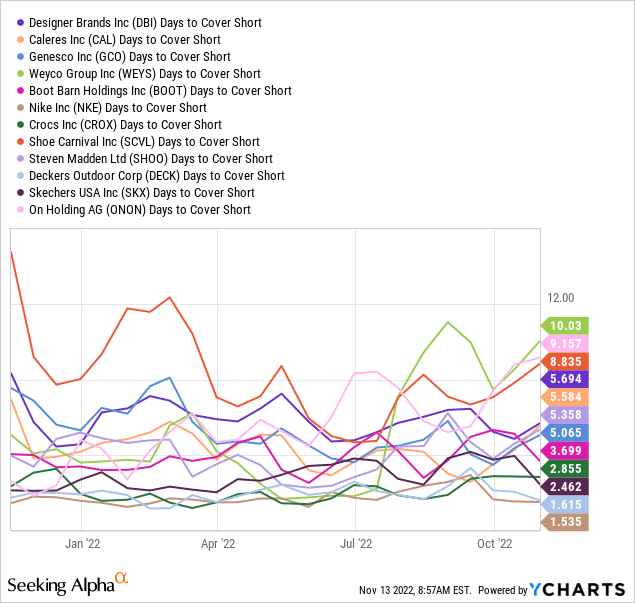

Short sellers remain skeptical that earnings will hold up in a potential recession next year. Short ratios for the two are higher than the industry, but also may provide more buying fuel (short covering) if the economy can grow or only experience a mild downturn in 2023. The ratio of average volume days to cover the entire (exchange tracked) short position is drawn below.

YCharts – U.S. Shoe Retailers, Average Volume Days to Cover Short Interest, Since November 2021

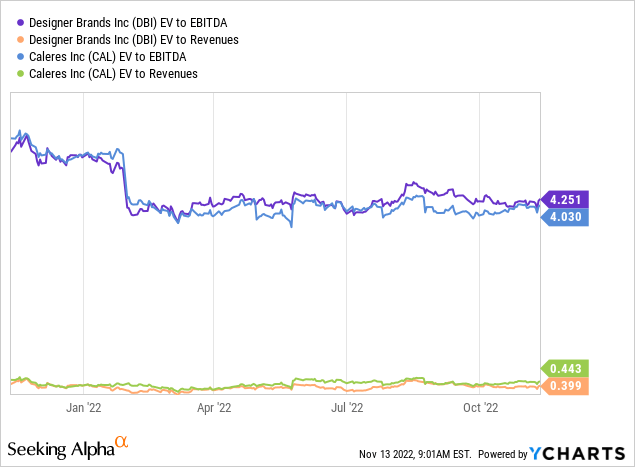

So, which choice is better for investors? Honestly, I don’t have a good answer. If you review enterprise valuations on EBITDA or Revenues, the two are pretty much identical twins.

YCharts – Designer Brands and Caleres, EV to Trailing EBITDA and Revenues, Since November 2021

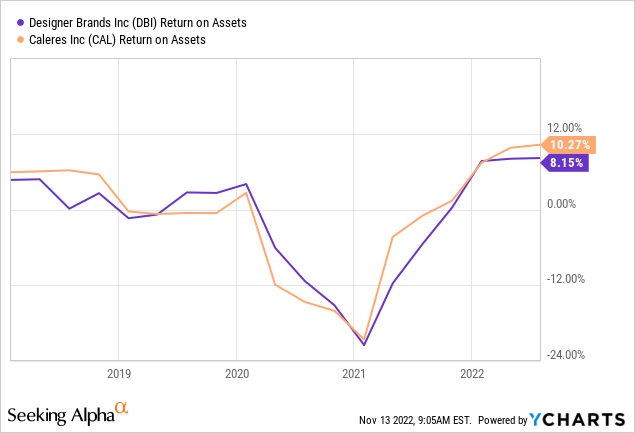

The raw income return on assets has mimicked the other in lockstep over the past four years, drawn below.

YCharts – Designer Brands and Caleres, Return on Assets, 4 Years

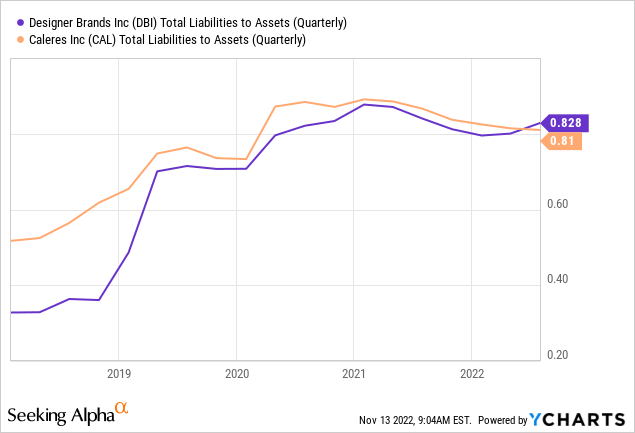

Plus, the measures of total liabilities to assets are basically equal. Balance sheet risk is about the same as a result.

YCharts – Designer Brands and Caleres, Total Liabilities to Assets, 4 Years

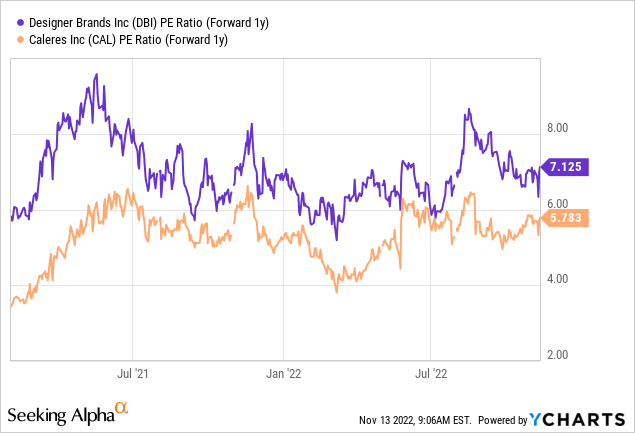

For me, the tie breaker is found in price to forward earnings estimates. Caleres appears to be marginally cheaper at 6x vs. Designer Brand’s 7x ratio. So, Caleres is the name I have added to my portfolio first.

YCharts – Designer Brands and Caleres, Forward 1-Year Estimated Earnings Yield, Since February 2021

Improving Technical Momentum

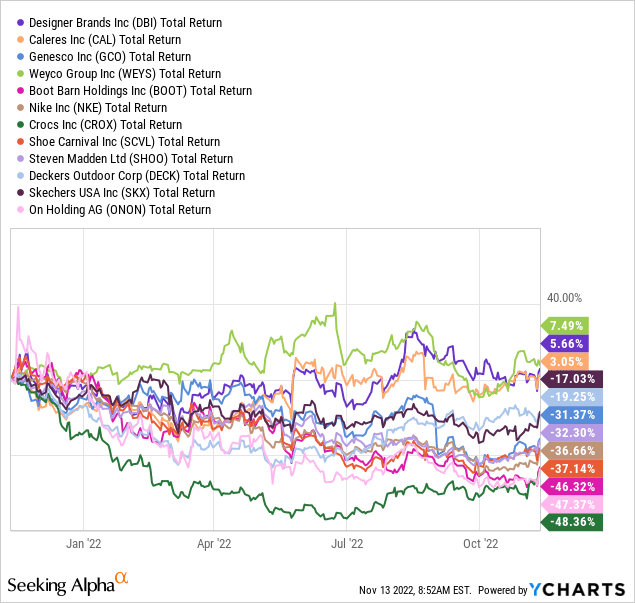

Believe it or not, both shoe retailers have been able to outline total return gains for shareholders over the last 52 weeks. They are leaders in this regard for the industry. My research suggests low earnings valuations should support another year of industry outperformance in 2023.

YCharts – U.S. Shoe Retailers, 1-Year Total Returns

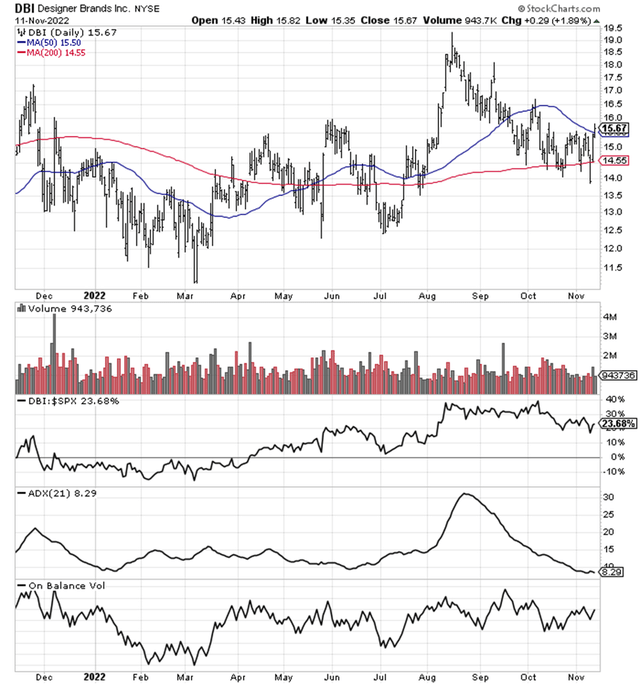

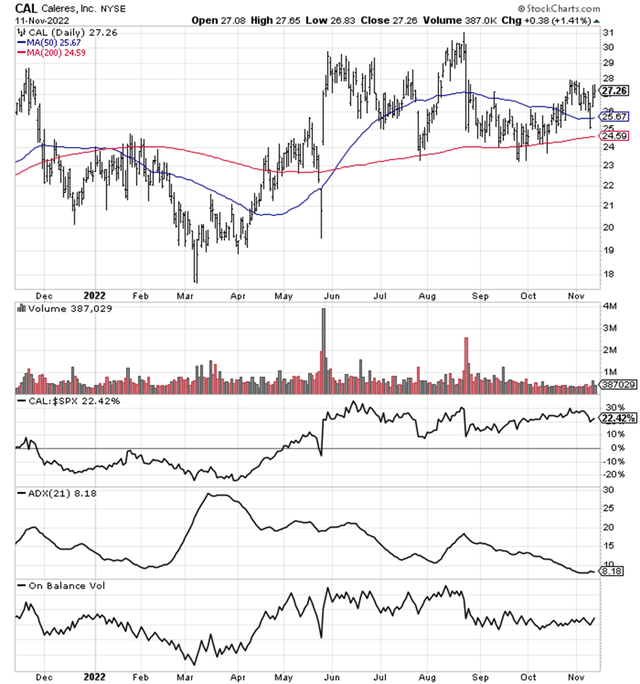

Individual chart patterns are stronger than 90% of the equities I sort weekly. Both stocks are trading above their 50-day and 200-day moving averages, which is a constructive price pattern I prefer.

Both have outperformed the S&P 500 for total returns over 12 months by better than +20%. The 21-day Average Directional Index readings are low, indicating a balance of sellers and buyers over the last month. Effectively, any new buy interest may not be able to find supply without bidding price higher appreciably. In addition, On Balance Volume trends are positive. When you put all the technical momentum ideas together, Designer Brands and Caleres appear to offer a truly bullish outlook vs. the industry.

StockCharts.com – Designer Brands, Daily Price/Volume Changes, 1 Year StockCharts.com – Caleres, Daily Price/Volume Changes, 1 Year

Final Thoughts

I already own Caleres and am considering buying a stake in Designer Brands. The setups and math for each are almost identical. Total return upside potential could be as high as +50% over the next 12 months, if a severe recession is avoided.

Worst-case scenarios of further large Wall Street losses generally (greater than -20% from today for the S&P 500) and a deep recession in 2023 could push prices for each down -30% to -40%. Any new issue sourcing the regular supply of shoes from Asia, particularly China, also bear watching. The appearance of tariffs (overseas or in America) plus additional COVID-19 supply disruptions could keep either company in check for price gains.

The most probable scenario is the two stocks will have to fight another round of selling in the U.S. stock market and a slowing economy next year. With both enterprises paying 1% dividend yields currently, a +15% to +20% total return over 12 months is my baseline projection. Nothing spectacular for sure, but also a gain potentially beating the market/industry by a decent margin, when all is said and done.

I rate both Designer Brands and Caleres as Buys, with a slight edge given to Caleres if you decide to purchase only one of the names.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment