JHVEPhoto

Dear readers/followers,

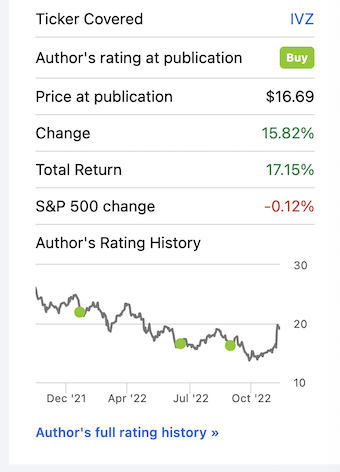

I’ve been looking at Invesco (NYSE:IVZ) at a few times in the past – and now it’s time for an update. The recent sort of market bounce we’ve seen has really pushed this business upward in a way that has significantly outperformed the broader market. Take a look at these trends.

IVZ Article (Seeking Alpha)

Let’s look at what’s changed, and why things are moving as they are.

Invesco – Updating on the company

To say that 2022 in terms of investing has been a rollercoaster would be an absolute understatement. It’s been non-stop political and economical ups and downs that’s left investors wondering whether they will end the year in the black, or deeply in the red. It’s unlikely that we’ll see volatility abate in the short term – in fact, I believe that upcoming macro dictates that we’ll see a bit of a drawdown again.

This makes it all the more important that investments you make are made in quality businesses at good prices – and that is what I am all about.

Invesco hasn’t been a good performer this year so far. Even if we’re up from my last set of articles, the YTD and my position return are in the red at over 20% at this time. However, I believe trough valuations with over 4% yield, that’s something that’s over for the time being.

AUM was up compared to Market RoR in October, and despite multiple cuts to underperform and similar ratings from various institutions, the company has held up pretty well in the storm. Profitability is excellent, and valuation, while no longer at trough multiples, is looking interesting.

Don’t forget some of the immediate issues/challenges with the business here. Invesco was one of the investment managers hit hardest by COVID-19, and the stock took a massive hit due to Invesco Mortgage Capital, its REIT handling business, announcing that they were unable to meet margin calls due to dramatic overvaluations, which resulted in a delay of dividend payments. However, the company and Invesco itself have since more or less recovered from this and things are looking very different today.

8,000+ employees worldwide make the company what it is – one of the more diversified investment managers in the market. At 70% retail and 30% institutional, the client domicile counts almost 30% of AUM across the US, and its profile is more international than most investment management firms here.

As far as Invesco goes, the pandemic could not have come at a worse time in the company’s history. Invesco was busy integrating massive M&As at the time, which caused the bottom to fall out.

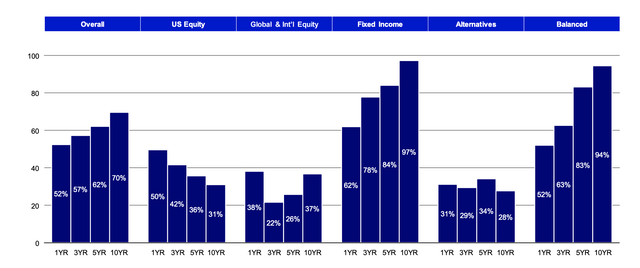

Still, the company’s fundamentals are as steady as the rock of Gibraltar despite all of this. Not only did the actively managed assets land in the top half of the peer group, or beat the benchmark…

IVZ IR (IVZ IR)

…the company also saw relatively stable AUM despite the market environment, and only slightly declining flows. The fact that flows are declining should be no surprise to anyone in this market. It’s Risk-off – and everywhere you turn, you’re getting that message mostly repeated, that you should be taking “risk off the table.”

Institutional and global flows reflect this new reality as well. While sales aren’t as bad as 2Q22, they’re still almost $10B below, on a gross basis, where they were in 4Q21.

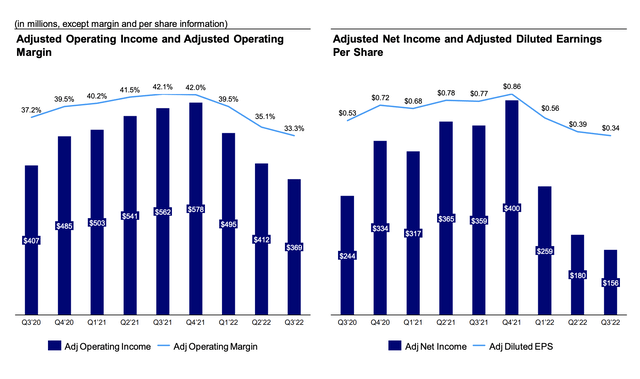

Revenues were down 16.7% YoY – but the company also managed a 4% OpEx reduction, which is a positive. How things look in terms of profitability and margins is not good. It cannot be expected to measure up to previous trends, of course, but we’re now at levels that we have not seen since the Pandemic and before.

IVZ IR (IVZ IR)

Buybacks are gone. The company hasn’t bought back significant amounts since 1Q22, which they given the valuation, could have done not that long ago. Company leverage remains conservative, but including preferred stock, it’s up to levels not seen since before 2021, at around 2.67x. Not worrying either to me or the market – because IVZ retains IG-rating, but still. worth noting. The payout ratio as a percentage of net income is up from 20% in late 2021, to 55% as things currently stand.

This illustrates well just how an asset manager like IVZ keeps taking hits and getting punched in this sort of environment. You cannot expect the company to perform “well” here, only to maintain what it has as well as possible.

There are a few positives to the company in terms of trends.

- Net inflows in active income and greater china are up – almost $6B YoY – and global institutions managed 12 consecutive quarters of organic growth here.

- Balance Sheet is solid, over $1B in cash and equivalents, and debt less preferreds is down.

…but that’s more or less it. The remaining current trends point downward – but trends are really the only things that are currently pointing downward. Current forecasts and expectations are a very different thing – because they believe FY22 to essentially be trough for the company, and for things to not go much lower than that.

What I’ve written as the primary risk to the company in one of my earlier articles has in fact materialized.

The primary risk factor to a company such as this is AUM flows – specifically outflows. Market downturns tend to include people selling shares or portions of their holdings, including ETFs. The company’s income and how it’s doing is directly tied to inflows and outflows and share prices as well as performance – not that different from how most businesses operate, but still a bit different from say, a consumer staples or financial that also serves as a deposit bank or includes more legacy banking services.

(Source: IVZ Article)

But this does not mean IVZ is necessarily an unattractive business. If we look at the totality of IVZ’s historical trends and performance and how they’ve typically done in recessions, the picture is actually fairly positive, all things considered.

While the company’s EPS in the financial crisis dropped by around 20-40% on a year-over-year basis, it also grew by 77% followed by 22% from 2010 to 2011. In short, this company goes down, but it goes back up. Additionally, it hasn’t dropped below $1.9/share in EPS in the last 10 years, with a recently-bumped dividend that consumes around $0.79 on a per-share basis per year.

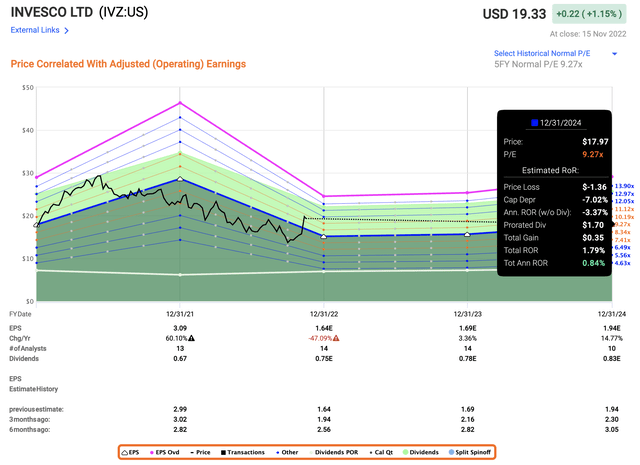

The market expects a similar performance out of the business this time around, with a recovery from trough in the following manner, in terms f valuation.

Invesco’s Valuation

Coming to an adjusted EPS of $1.64, which is close to half for 2022E for what we saw in -21, we reverse in 2023 with a 3% EPS growth, followed by double digits in 2024 to almost $2/share.

The company has technically been lower than the levels we’re seeing at this time – but those lows were back in the pandemic. At any time aside from that the last 10 years, the recent trough was the lowest we’ve seen for the business. Invesco remains BBB+ rated, and this means close to 4% from a BBB+ rated business only trading at barely double-digits in terms of normalized EPS.

The main issue is the drop in valuation and the continued market volatility. I’ve held myself off from buying more of these, instead focusing on other appealing businesses with a better near-term upside that provides cushioning in the case of pressure.

The company’s current 3-5 year growth rates do not allow for much fundamental upside, despite going double digits in 1-2 years according to current forecasts. The dividend is also well-covered, by any standard here, and no one is forecasting a cut here.

The recent surge in share price presents a bit of a problem. If the FX hadn’t been so unfavorable, I might have loaded up when the company was below 9x P/E. As it stands though, there’s a very limited appeal to anything the company has to offer here, beyond for the very long term and including a beyond-recession reversal.

The problem with that is, plenty of companies have that reversal potential – and at higher targets than IVZ does.

While history allows for IVZ trading as high as 13-16x P/E, I wouldn’t personally consider those multiples all that valid or interesting to invest in – especially not in this environment.

In fact, I would say that my current thesis on the company is that IVZ has gone “too far” too quickly. A 15%+ RoR in as short a time as this, given the fundamentals, looks very unfavorable when looking forward to potential rates of return.

IVZ IR (IVZ IR)

While the potential for outperformance on part of the company is most certainly there, I consider this to be somewhat doubtful in light of the current environment, as do most analysts following the business.

At under $14-$16, Invesco is a “BUY”. But at over $19, i have difficulties seeing the upside that’s making people excited. S&P Global analysts average price targets starting at $11 up to $22, with averages at $15.5, making IVZ short-term 20% overvalued according to them here.

only 3 analysts out of 13 have a “BUY” rating on the company here – and i join the chorus of being careful here. The likelihood of you beating inflation with this investment is no longer high as I see it. The company could keep trading at 7-8x P/E, and you’d still walk away with more or less double digits under these forecasts – but it can’t to the same at double-digit P/Es.

IVZ remains a contrarian pick. This company hasn’t shown signs of fundamental deterioration in its earnings capability if we look outside of this environment – only issues that come with changes like the ones we’re currently seeing and that we’re continuing to see.

I’m slightly lowering my PT to $19/share for the medium/long term, and changing my thesis to “HOLD” at this time. While I am careful about changing long-term PTs to reflect short-term realities, I can’t completely ignore the potential of a decline here that reflects the company’s compressed earnings capabilities in the next 1-2 years.

For that reason, I am now a “HOLD”.

Thesis

My thesis for IVZ is simple.

- This company is a good, but not class-leading investment/asset manager that’s trading at a significant discount to most of its peers.

- It yields a nice 3.8%+ and further dividend cuts seem unlikely at this point, given the recent bump. Credit is solid despite the mortgage problems, and the upside even on a flat forward basis is market-equivalent.

- Based on this, I’m changing to “HOLD” with a PT of $19/share. I’m at a profit in parts of my position, but I’m being more careful here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment