scanrail

In our previous article we covered Desert Mountain Energy (OTCQX:DMEHF) and its hydrogen ambitions in detail. In part two, our focus is helium and wrapping up the entire analysis.

Desert Mountain Energy Helium Production

Desert Mountain Energy is not immune to supply chain disruptions. In fact, they have been plagued with them (much like most industries). The helium production plant keeps slipping. While Desert is making progress, one might expect additional delays or for Mr. Murphy to chuckle and make life more difficult. However, all hopes and dreams rest on the helium plant coming online. Once this occurs and hopefully is successful DME can parlay the profits into various project expansions and new venues. Let us explore helium a bit more and a long term outlook.

Helium Plant Start Up

We can refer to two interviews to get an idea of the intent of DME concerning purity rates of the helium that will be produced; how they intend to start off; and if they have customers in place. Per Don Mosher of DME:

|

And then we have this very insightful gem concerning start up times per CEO Robert Rohlfing at the 6:28 min mark via the Ellis Martin report from Oct 26, 2021:

|

Mr. Rohlfing goes on to say (around the 8 min mark) that long term they foresee having to build 3 production facilities to deal with an increase in production and the noble gases. Mr. Rohlfing then follows up with an example of royalty payments at the 10:25 min mark (for Arizona state-owned land that has been leased).

Helium Production Plant Status

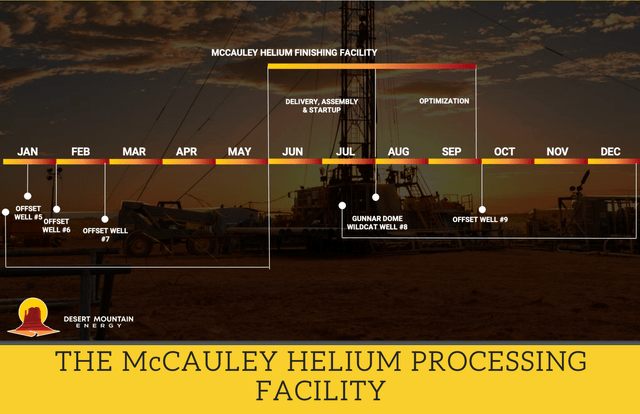

Helium Facility (Desert Mountain Energy 9/22 slide deck)

We can see from the graphic that the production plant was to build it out in the summer. Granted, the build out has experienced delays but in 2022 everything is delayed. We can see forward progress though via:

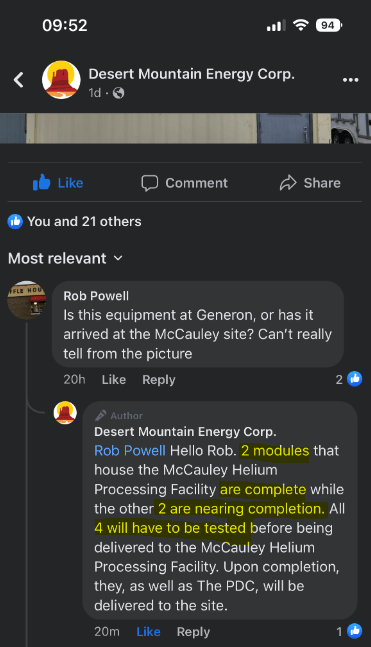

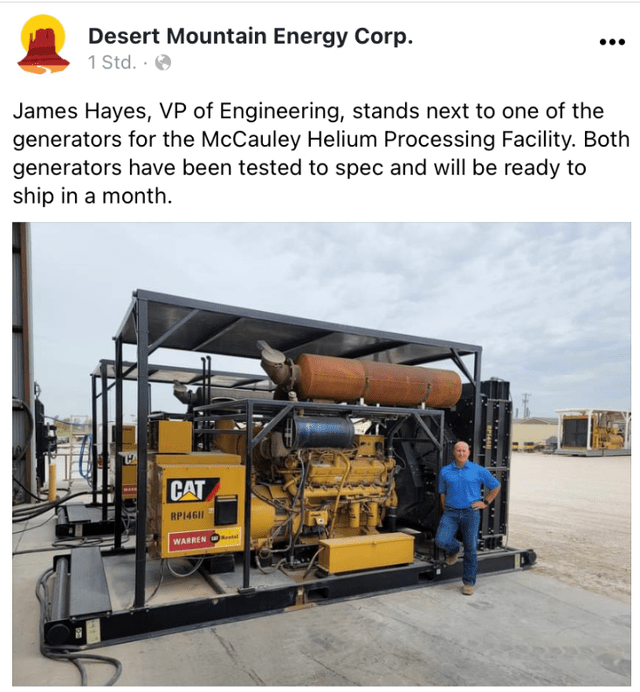

Having read the caption in the picture above, we can assume these units have or will ship soon.

Update On the Plant Status via Facebook – 10/19/22

Per Facebook we can see progress on the components that make up the helium facility. The time of when the plant comes online is a bit of a mystery, but it seems close. Once it is up and running, most likely we have a few months of optimization.

Personal estimation: Nov-Jan launch, then 3 months of optimization. That is my SWAG. Maybe it will be sooner. Maybe it will be later. Point is, revenue is not too far away for the patient investor in my opinion.

Status Update 10/19/22 (Facebook)

Energy Savings Might Have Attracted Beam Earth to Desert Mountain Energy

Getting right to the point, in a recent PR, Desert Mountain Energy announced they have a design that results in a 55% energy cost savings for helium and hydrogen production.

|

A 55% reduction in energy use is not a trivial amount and that might be one reason why Beam Earth will be pairing up with DME.

|

And per CEO Robert Rohlfing

|

Looking at the below quote from DME:

|

I think the above quote concerning 0.7 to 1.1% helium is a reference to helium assets that Beam Earth might own elsewhere. That is my speculation. If DME can apply 55% energy reduction to Beam Earth assets in order to make it more cost effective and profitable, well, it’s a win for everyone.

Beam brings the hydrogen know-how; Desert brings the energy saving designs and the hydrogen-rich property. The pair up makes sense for the Arizona assets and more so as it expands into “other jurisdictions”.

Desert Mountain Energy Future Expansions Via “Other Jurisdictions”

What other jurisdictions might DME be pondering by partnering up with Beam Earth? In an interview CEO Robert Rohlfing make a rather interesting statement:

|

This is a rather cryptic statement. On the surface it seems basic enough, as in they are simply going to expand to other states. This has been mentioned in other interviews (and I think they will), but what if they are looking to pair up with Beam Earth overseas? I think it is a possibility.

Beam has talked about Africa and Brazil (per interviews) as possible locations for assets, whether Desert becomes a part of that is speculation. It is interesting to note that as of 10/3/2022 DME has signed a JOA (Joint Operating Agreement) with Beam Earth. Per the PR we see:

|

Desert Mountain Might Go International

Thus, we see DME and Beam focusing on hydrogen zones in the McCauley field while also eying ~other~ regions and what are these regions? In the PR from DME on 10/12/2022 we gain additional insight.

|

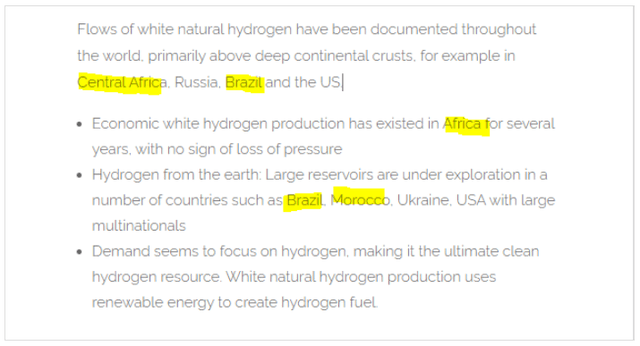

Hence, we have gone from cryptic “jurisdictions” to a possible international presence. Brazil or Africa are the two most obvious areas given Beam Earth interviews which we covered in our last article.

Beam Earth and Brazil

Mr. Pierre Levin discusses Brazil (at the 6 min mark) and how white hydrogen could help them concerning fertilizers:

|

Additionally, we can see some chatter on the Beam Earth website. While not direct evidence it does give us an idea into places they are thinking about.

Beam Earth Looking At Hydrogen Locations (Beam Earth)

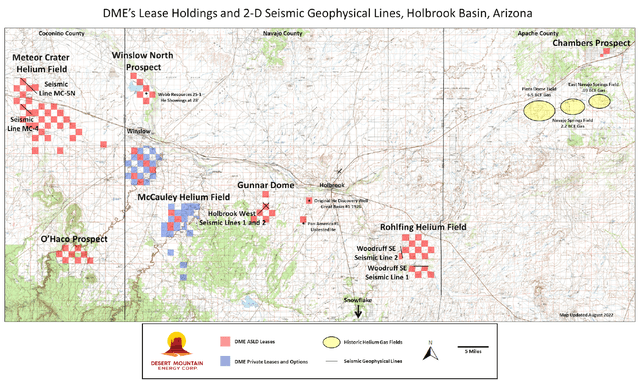

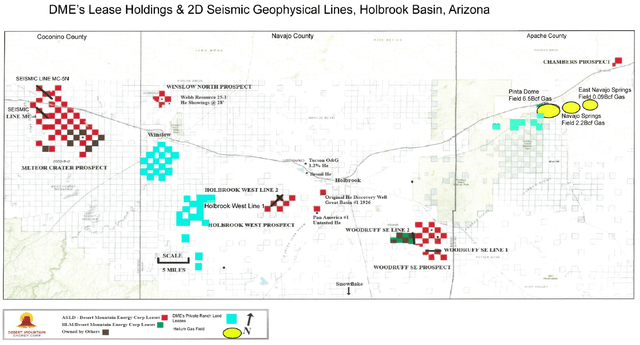

Desert Mountain Land Watch

Looking at an old map from 2021, we can see some changes compared to the 8/18/2022 map. It appears that private leases in north-west have been dropped while gaining the south-west O’Haco Prospect. The Winslow North Prospect has also grown considerably.

DME Land Holdings as of 2021.

Compared to 2022 below.

DME Land Holdings 8/18/22 (DME)

Concerning the 8/16/2022 PR, we see DME has acquired 40 acres in Navajo Country, Arizona. Looking at the above map, we note this is the center county on the map. Since the McCauley Helium Field has a company owned block where the production plant will be, we could assume that the new 40 acre block is Gunnar Dome.

Idle Musings of Future State Side Expansion

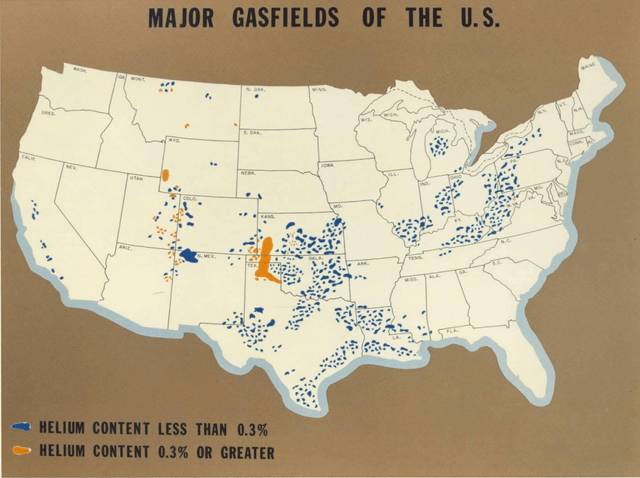

Diverting for a moment, let us pull up a USA map of major gas fields. Note: helium is often associated with gas fields. This might give us an idea where DME could be looking state side for future helium fields.

We can see low helium content of less than 0.3% in blue. Note: My research has noted that over 0.3% is the grade at which you can mine helium profitably. All blue zones are not optimal. Orange is 0.3 percent and greater. Looking at Arizona, DME property is slightly to the west of the southern orange zone. These orange areas might also give us a broad idea where DME might one day expand geographically in neighboring states namely Colorado, Wyoming, or Utah border.

Desert Mountain Energy – Risk

Know that DME is an OTC stock. DME does not produce revenue in large amounts at the moment (maybe they will report that the recently acquired DME trucking fleet brings in minor revenue this quarter, but I digress).

DME has a respectable cash position, but the bulk of it will be spent getting the production facility online. While I had had concerns about the cash in the treasury, that concern has been reduced due to a recent private placement raise of capital.

2nd Risk Point – A challenge to some of DME’s leases might exist. I covered this in my last article on DME. No new updates are available at the moment concerning the challenge. I can see no legal filings whatsoever. It is possible this issue has evaporated away.

3rd Risk Point – Delays, delays, and more damn delays. Speaking frankly the helium plant should have been online some time back but supply chain woes have impacted DME. While the plant should be online soon, we live in a world of delays and it is about to get very interesting with various rivers in the nation at low water levels. This is impacting barge shipping.

Realize that DME is a penny stock and it comes with high risk. No guarantees exist that anything is going to work. With high risk comes high reward (or high loss). Black Swan events can and will happen at the worst of times to the best of stocks.

Current politics are not conductive to a healthy stock market. Better days will come but this might take some time.

Keep powder dry and understand what you are investing in. If you are new to penny stocks or have no clue what you are doing, it might be best to invest in blue chips instead of practicing educated gambling or consult a licensed financial advisor.

The Natives Are Restless

Some chatter in various forums is focused around the production plant experiencing delays. Realize that the average mining project takes 10 years from concept to pulling out pay dirt. Delays do add to costs. I expect further delays since that is just the nature of 2022. Many companies I track are having supply chain issues.

One thing that often amazes me is just how impatient people can be. Maybe they are very young and inexperienced or maybe they are in a race for time due to seniority. The latter I can understand, but for the younger folk they need to realize that impatience can be a very large hindrance in the investing journey. Mining projects take time and in 2022 we are still suffering from supply chain woes. Talk to any mining company and they will tell you they are impacted or constrained from getting basic materials, all the way to specialized equipment. A prime example would be Electra Battery Materials (ELBM) who just announced their cobalt refinery will be delayed due to supply chain issues.

This is but one example of problems impacting the entire mining industry be it helium, lithium, or cobalt. The takeaway is that a few months of delay for DME is not a monstrous issue. It is just the world we live in. For the patient investor this is a minor issue, but one to watch. The company does have a burn rate after all. The takeaway is plan for the best but prepare mentally for delays. I’m not guaranteeing they will occur but I’d like readers to be mentally prepared.

Military Implications and Desert Mountain Energy

I could go into a very long geo-political write up on China, but the short story is China is a rising power that controls a large percentage of critical elements. In the past, they have used the ability to hinder nations that displease them (such as Japan) by banning rare earth exports to them.

Rather than be held economic hostage to such a possibility, it would be wise for the U.S. government to promote companies that seek out and discover such said critical elements. It must also be noted that our military does rely on some of these elements and not having easy access or domestic sources could place the U.S. at a disadvantage. This is where Desert Mountain might come into play given some of the elements they have hinted at such as H3. One such example is the U.S. relying on Chinese rare earth elements (aka REE) for military applications such as the F-35. Given China controls the overwhelming percent of REE it comes as no surprise the defense contractors are sourcing material from China for use in military applications. It is a pretty dumb move on the part of the U.S. and hopefully politicians wake up and further encourage domestic REE and associated critical elements be sourced from domestic U.S. sources. As an example of the folly of relying on foreign sources for critical weapon systems may I present the F-35 with some China REE in it.

Desert Mountain in not the business of hunting down these rare metals, however, they do aim to provide helium and hydrogen, which do have a variety of applications including space (via purging of rockets).

Besides NASA and SpaceX, we do have the rarely talked about Space Force which oversee military space launches. They require helium to purge rockets as well.

Desert Mountain Energy Customers – 300 Mile Radius

In a recent interview (from Aug 23, 2022), James Hayes, VP of Engineering at DME, said that he was going to haul helium up to 300 miles to potential customers. In the interview, Mr. Hayes offered up additional color on the topic of helium and who might buy it:

|

Pulling up a map of Arizona and pulling a 300-mile radius from the very center of the McCauley helium field (noted by the red dot), we could guess at several potential customers ranging from military, to border control, and included are semi-conductor fabs.

When it comes to semi-conductor manufacturing, Intel (INTC) and TSMC (TSM) are expanding in Arizona. These facilities will demand helium. Further details can be found at:

An Intel partnership will invest $30 billion in Arizona chip factories while TSMC moves forward with a $12 billion dollar plant.

A Five-Year Viewpoint of Desert Mountain

Looking forward five years can be a challenge and it is full of assumptions but lets us ponder that in five years we have three helium fields in operation in Arizona with the ability to remove and sell CO2, Neon, and Argon along with various forms of helium (both common and rare) followed by hydrogen.

Helium prices are at historic highs. Neon is also challenged as much production comes out of the Ukraine. Meanwhile hydrogen production will benefit from the Biden administration’s hydrogen credits (which we covered previously). Overseas operations in Brazil and other regions are in play. We might even have operations in various domestic states. Of course, this viewpoint assumes the company is successful in the present or is not bought out in the future. We could be looking at a future Air Liquide (OTCPK:AIQUY) (OTCPK:AIQUF) in the making given time.

How We Are Playing The Market

Having been educated in the markets for 31 years I will say this is one of the more challenging markets. I could list many reasons why things are going to be nasty. From rising interest rates, a housing market that is too high and about to turn, to politicians that just charge it to the national debt. OPEC cutting 2 million barrels of production (expect oil prices to blast off after the mid-terms, mayhap in January and with that inflation). The point is things might get a lot worse before they get better.

However, given the United States natural resources and physical boundaries, the nation sits in a favorable posture that few other nations can mimic. Much like we saw in 1999, 2001, or 2008 the United States will recover and those practicing dollar cost averaging, in these dark times, might emerge in an enviable position, having acquired good assets at beat up prices.

Additional Resources:

Beam Earth in H-Nat Summit 2022

Helium Exploration & Exploitation Holbrook Basin, Arizona – YouTube

“Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!”

Be the first to comment