PeopleImages/iStock via Getty Images

Investment Summary

The market selloff in FY22 has provided compelling opportunities within the health care and medical technology (“medtech”) universe. The low beta, high-quality, defensive sector has historically performed well in periods of central bank tightening. Moreover, healthcare and medtech strategies have offered uncorrelated upside capture for investor portfolios during previous periods of economic slowdown. With the asymmetry in risk assets widening, healthcare looks more attractive as a risk-off, defensive play.

Indeed investors should be focused on stepping up in quality and in liquidity, adding a layer of resiliency to portfolios. As such, turning toward large cap, defensible names within the sector, leads us to examine DENTSPLY SIRONA Inc. (NASDAQ:XRAY) in the same vein. We’ve found a lack of upside to be priced into the stock looking ahead, and note there are better alternatives within the space. Valuations are a concern and we see the stock heading to $20 before any re-rating. XRAY has clipped a 43% loss in the past 12 months, and is drifting away to the downside from medtech peers. With lack of flesh to put on the skeleton, we rate shares neutral with a price target of $20.

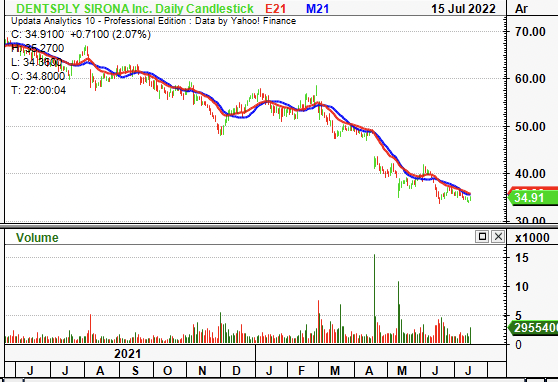

Exhibit 1. XRAY 12-month price action

Data: Updata

Market Factors

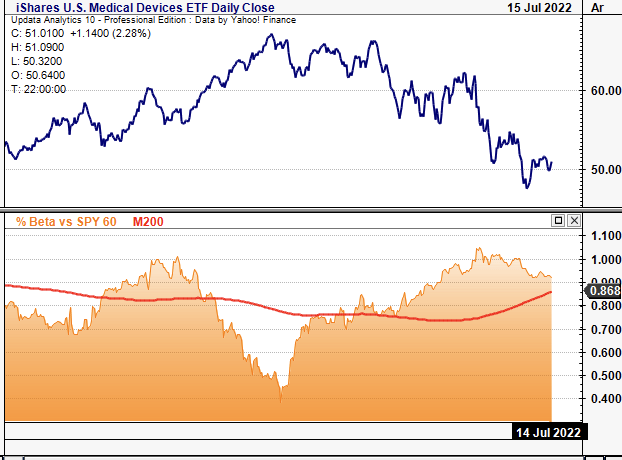

Investors have shifted focus away from top-line growth onto bottom-line fundamentals. The high beta/growth trade has unwound in FY22 and growth has now de-rated substantially off 2021 highs. Consequently, low-beta, high quality strategies have outperformed in FY22. Exposure to these factors has lent investors strategic and tactical alpha this year, and we project this trend to continue. Medtech looks particularly attractive, with a 0.87 2-year normalized beta to US stocks, and industry tailwinds regarding surgical volumes.

Exhibit 2. Medtech offers low-beta, high quality exposure – equity factors investors’ are paying a premium for in FY22

Data: Updata

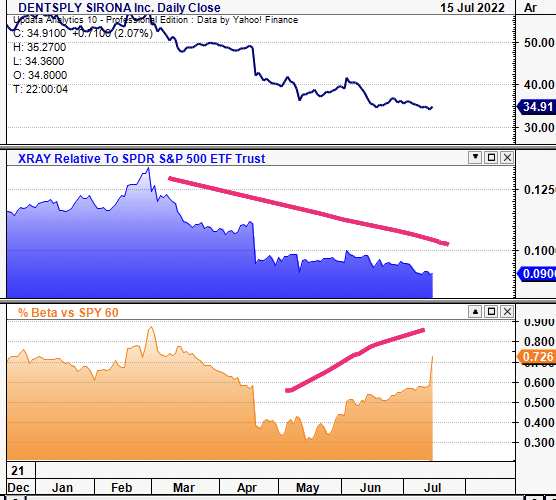

In this vein, XRAY’s losses YTD are explained in Exhibit 3. The stock has lost relative strength compared to the benchmark whilst its covariance structure has simultaneously shifted upwards. Whilst it is still considered a low-beta play at 0.76, it’s the up-tick in equity beta that appears to have weighed in on the XRAY share price in FY22. As correlations have moved towards 1 XRAY has looked increasingly less attractive compared to the US benchmark. The downtrend looks set to continue as seen below.

Exhibit 3. XRAY weakening against US benchmark, whilst covariance structure shifts upward

Data: Updata

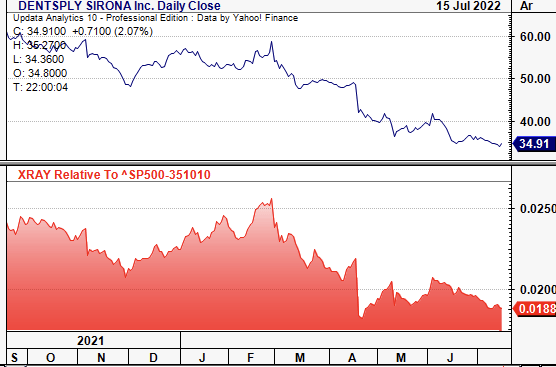

XRAY’s weakness against the health care equipment and medical devices index has gained substantially since March. It now trades at a 12-month low relative to the sector. Ideally, if XRAY were catching a bid we’d see it strengthening vs. the sector, yet, it continues to re-rate to the downside. Hence, we look for XRAY to display idiosyncratic risk premia to beef up the investment case.

Exhibit 4. XRAY is weakening against the medtech sector as well.

Alas market mechanics suggest XRAY continues to weaken and the risks discussed here must be factored in

Data: Updata

Fundamental Factors

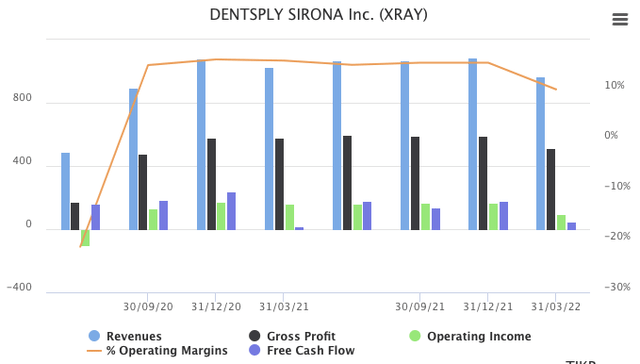

On examination of its financials, we find fundamental momentum is weak and is continuing to soften for XRAY. It printed quarterly operating income of $98 million in Q1 FY22 on an operating margin of 10.2%. This is below the 2-year quarterly average for the company and sees it slip behind pre-pandemic levels. Moreover, quarterly FCF conversion has normalized at ~18% over the past 2 years to date, however, has been seasonal, seen below. Net-net, XRAY’s mature growth phase presents us with desirable characteristics throughout the P&L. Its top-line is hedged due to the distribution of revenue throughout its portfolio and customer base.

We project XRAY to print $510 million in FCF for FY22, presenting a forward FCF yield at ~6.7% of its current market cap (~5% of enterprise value). ROA also narrowed to ~4% in Q1 FY22, well above its 7-year quarterly average of -2%. Whilst ROIC came in at 5% which was above average. XRAY’s WACC is 7.7% meaning it needs to compound return on capital at that level to realize operating leverage.

Moreover, FCF yield normalizes to -2.7% for XRAY in this same period, hence unrealized tangible value is above historical averages for XRAY looking ahead. However, it comes into next macro-regime with weak fundamental momentum at the bottom line.

Exhibit 5. XRAY Operating performance, FY20–date

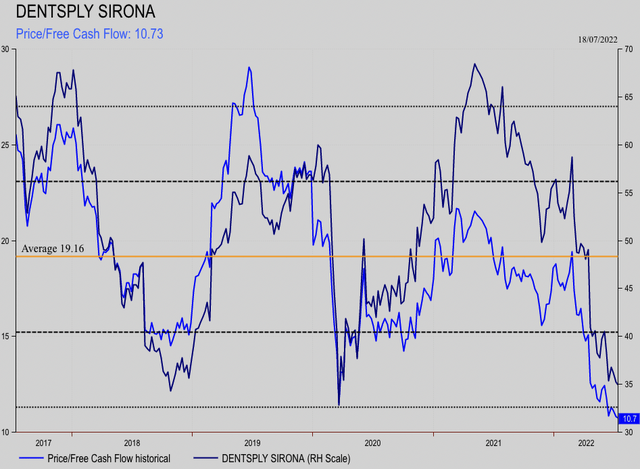

As seen in Exhibit 6., FCF multiples have tracked the stock price with high correlation and fairly narrow dispersion, in seasonal fashion since FY17 for XRAY. P/FCF looks to front-run the XRAY share price and has led the stock lower this YTD. With the trend in FCF edging lower, this also points to further downside on the chart.

Exhibit 6. Seasonal FCF; FCF multiples have de-rated to 5-year lows, and lead the XRAY share price lower

Continues to demonstrate that investors are rewarding bottom-line fundamentals

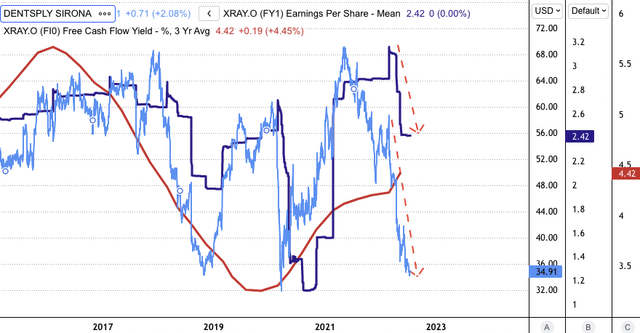

This is a key risk that must be considered and helps explain the divergence of XRAY from the medtech universe. XRAY’s bottom-line fundamentals continue weakening too. As seen in Exhibit 7, XRAY looks to continue printing lower earnings, with consensus estimates pointing to EPS of ~$2.42 in FY23, well behind FY21 actuals of $2.55. Whilst 3-year rolling FCF yields (red line) have lifted in FY22, we estimate this to line back up with XRAY’s earnings cycle as it has done consistently since FY16. These are leading indicators that point to further mid-term downside, in our estimation. With profitability weakening, this softens the investment case markedly.

Exhibit 7. Earnings estimates pushing lower as well

Valuation

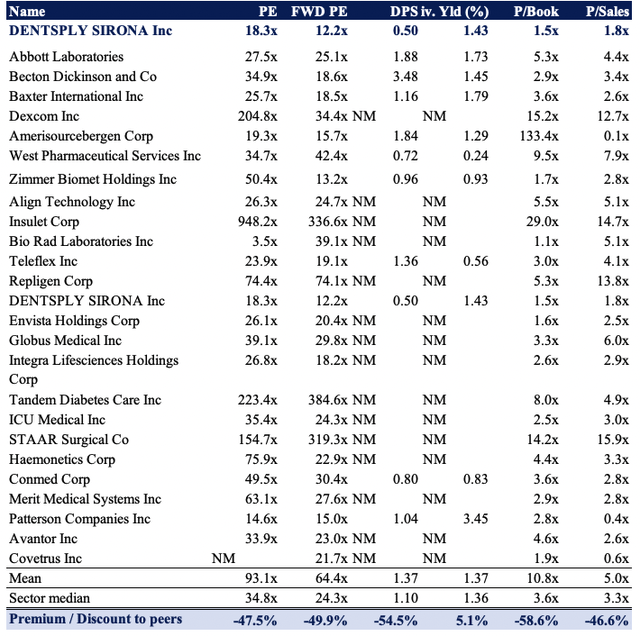

Shares are trading at ~12x forward P/E and currently add ~1.4% yield on top of forward capital gains. Shares are also priced at ~1.5x book and are priced at ~2x sales. XRAY trades at a ~42% discount to key multiples examined in this report. The question is, is the discount correct, or is there compelling value to be realized in the XRAY share price?

Exhibit 8. Multiples & Comps

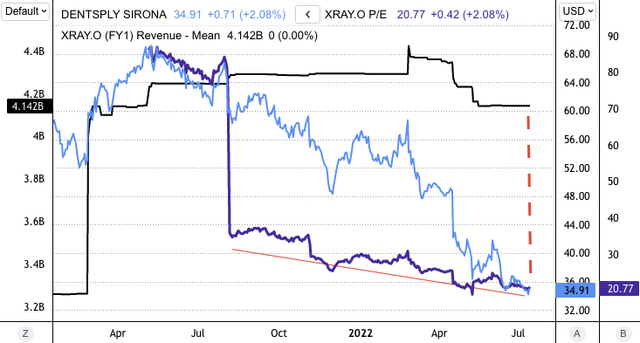

XRAY is in fact converging to the downside, and has de-rated at the multiples level, as seen below. Exhibit 9 illustrates our macro-thesis nicely, in that investors have been agnostic to top-line performance in FY22. Whilst XRAY’s sales have remained buoyant, its share price has converged towards the weaker earnings profile (red dash). Looking ahead, this tells us the market will continue to compress XRAY until it can push earnings back to July FY21 levels, adding a bearish tilt to the risk/reward calculus.

Exhibit 9. De-rating in earnings based multiples points to further downside looking ahead

Note the divergence in top-line growth and the XRAY share price to illustrate out findings

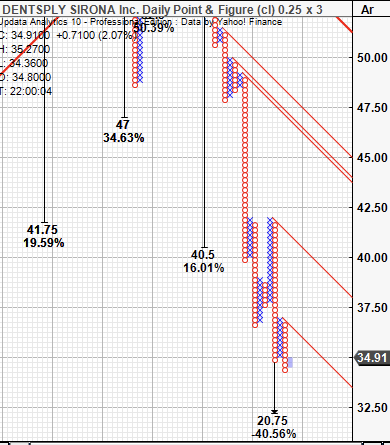

Point and figure charts suggests price action has turned bearish with multiple downthrusts off FY21 highs. We see downside targets at $20.75 and a series of previous downside targets have been taken out, adding weight to this price objective. As seen via the numerous down-trend lines, the stock continues to set lower-highs and now must break above ~$40 for a reversal.

Exhibit 10. Multiple downside targets have been validated adding substantial weight to $20.75 downside target.

Data: Updata

Assigning 12.2x our FY22 P/E estimates of $1.58 sees us price the stock at $19.20. Doing the same to FY23 estimates of $1.85 and discounting this at 12.5% sets a price target of $20.06.

Combining these inputs on an equal weighted basis has us price XRAY at $20 neat. Alas, without the margin of safety to absorb another ~20% decline in US earnings, XRAY fails to justify its inclusion in a long-only, equity focused portfolio.

In short

Firstly there are upside risks to our investment thesis on XRAY. The market could completely shift and reward defensives period, ignoring fundamentals alone and focusing on the healthcare sector. Next, there’s a chance XRAY could surprise to the upside in EPS and FCF, providing some steam into the stock’s engine.

However, we’re ideally chasing names that offer a 20%+ margin of safety (valuation, earnings yield, dividends, and/or FCF yield and FCF/share) to position against a 20% decline in US earnings. Stocks with these characteristics add the layer of resilience needed to overthrow the forward looking macro climate. Alas, we’ve priced XRAY at $20, and feel there’s better names within the space. Without taking a directional view on individual stocks, rate neutral.

Be the first to comment