JacobH

In late September, I wrote a piece about Denison Mines Corp. (NYSE:DNN) in which I gave the company a Buy rating. This was largely based on its sizable physical uranium holdings as well as the impressive amount of U3O8 reserves at its Wheeler River project. However, in the Risk section of the article, I noted that Wheeler River still contained a significant degree of risk. That’s because Denison plans to use an in-situ recovery (“ISR”) process instead of conventional mining methods at Wheeler, a process that is unproven in Canada.

In recent days, however, Denison announced that it was able to successfully recover uranium-bearing solution from the Feasibility Field Test (“FFT”) that’s currently underway the property. In this article, I’ll discuss what that means for the project as well as the impact it may have on the company and its stock price.

Wheeler River Project

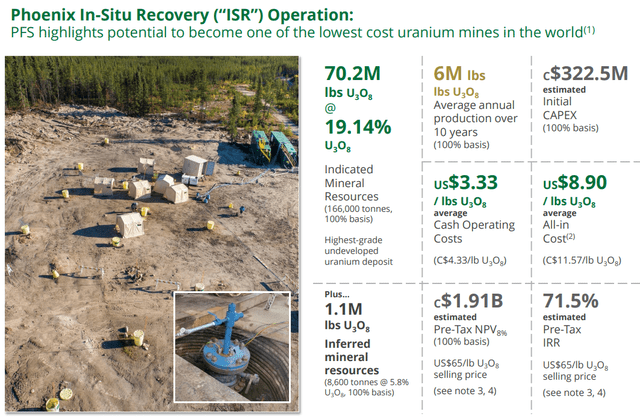

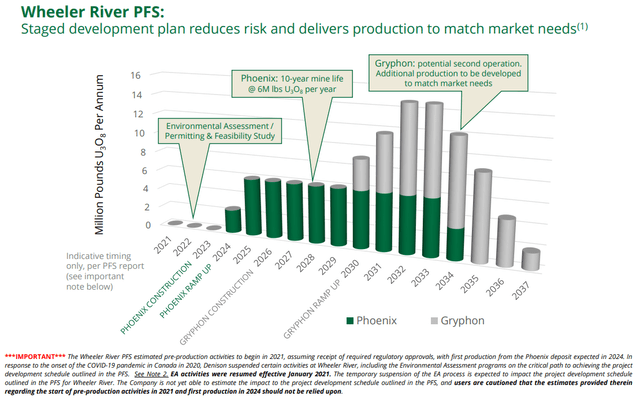

Wheeler River is made up of the Phoenix and Gryphon uranium deposits that were discovered in 2008 and 2014, respectively. Denison, which owns 95% of the project, plans to develop the property in two phases. The first phase will be the Phoenix deposit which will be developed as the ISR operation while the Gryphon will later be developed as a conventional underground mine. Taken together, the project is estimated to produce 109.4 million pounds of U3O8 over a 14-year mine life.

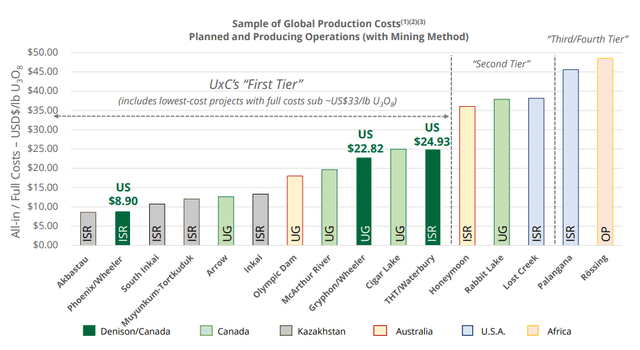

On its own, the Phoenix is anticipated to produce 6m/lbs of U3O8 per year for 10 years and has a resource size of 70.2m lbs (Indicated) of U3O8 grading at 19.14%. A 2018 Pre-Feasibility Study (“PFS”) listed its capex as $250m, a pre-tax IRR at 71.5%, and an NPV of $1.4b. The NPV of C$1.91b on the slide below is in Canadian dollars, I converted it using a USDCAD exchange rate of 1.37. It should be noted that the NPV and IRR assume a $65/lb price for U3O8, which is higher than both current spot and term prices. It also assumes that Denison is able to utilize ISR methods to achieve the very low all-in production cost of $8.90/lb U3O8.

ISR Field Test Results

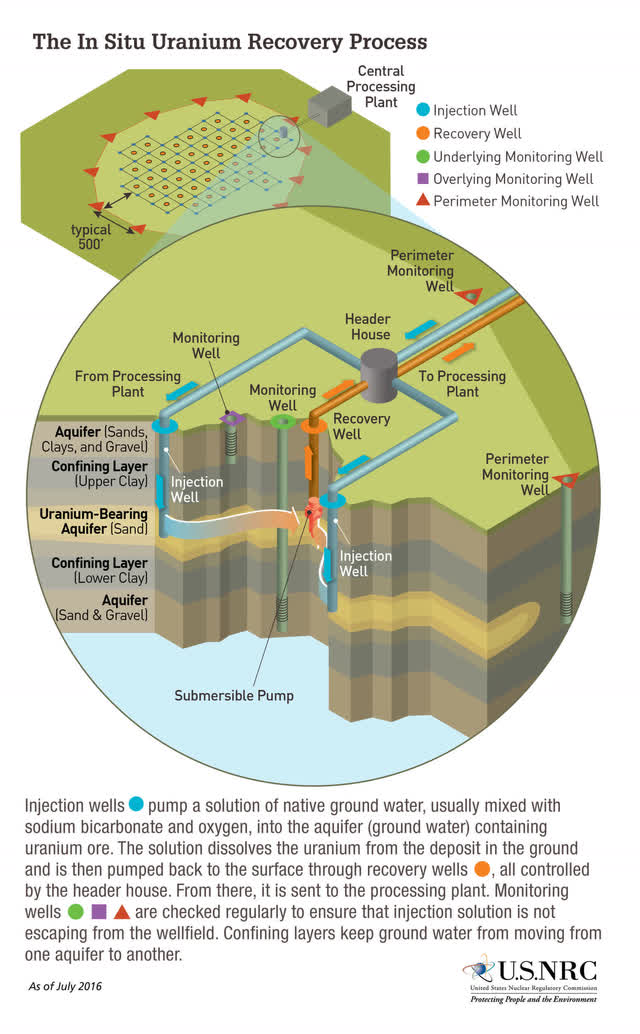

In situ recovery, also known as in situ leaching, is a commonly used process in uranium mining. In fact, the World Nuclear Association lists it as the most commonly used method of uranium extraction in the world. Fifty-seven percent of world uranium is mined using ISR, and most of the uranium mined in Kazakhstan, Uzbekistan, and the US is done using the method.

The uncertainty surrounding Denison’s use of ISR doesn’t come from the method itself but rather from where Denison has proposed to use it. ISR has yet to be used for uranium recovery in Canada and has never been attempted in the Athabasca Basin, a uranium-rich area located in the northern part of the province of Saskatchewan. And although the basin is host to some of the world’s top-producing uranium mines, they all use conventional mining methods. It’s not known whether the Athabaskan soil will be receptive to the method.

A detailed explanation of ISR is beyond the scope of this article. But essentially, employing the process means that the ore is recovered by pumping a solution underground that dissolves the mineral. The pregnant solution, meaning both the solution with the dissolved mineral, is then pumped back to the surface whereby the mineral is recovered from the solution.

ISR has environmental advantages over conventional mining. The amount of land utilized in carrying out the process is much less than conventional mining methods, and no tailings or waste rocks are generated. However, its deployment does require suitable geology as the orebody needs to be permeable by the solution that’s being used. That question is what overhangs the Phoenix project.

ISR is also cheaper to use than conventional mining methods. Its anticipated use is what’s underpinning the extremely low-cost projections at the Phoenix property. The aforementioned PFS listed Phoenix’s All-in costs at a very low $8.90/lb U3O8. And granted, while inflation has since pushed up costs for almost everything, the project would still have one of the lowest all-in production costs in the world even if its costs were to come in at $10-$11/lb. Lower even than Cameco Corporation’s (CCJ) Arrow deposit and significantly lower than its Cigar Lake mine.

However, the inability to use ISR at the Phoenix property would force Denison to use conventional mining methods. This would probably result in substantially higher production costs and long delays, pushing the date of the first production far into the future. Covid had the effect of pushing back the first production, which was due to occur in 2024, to a probable date in 2025. But if ISR were to not work, production would probably be delayed until the latter part of the decade.

That’s what made the announcement of Denison’s successfully recovered uranium-bearing solution from the ISR Feasibility Field Test (“FFT”) so significant. Kevin Himbeault, Denison’s VP of Plant Operations & Regulatory Affairs, said that, “The recovery of uranium-bearing solution at targeted rates and grades is history in the making. Initial analysis indicates the hydrogeological system has responded as expected with pH trends, flow characteristics and uranium recovery meeting expectations.”

This was the first phase of a three-phase process, but its completion cleared a major hurdle. The next step is the neutralization phase which focuses on returning the area to an environmentally acceptable condition and should be completed by year-end. The final step is the management of the recovered solution, and it is expected to begin next Spring.

Risk

The primary risks to this thesis come from two sources, with the first being the price of uranium. No one can predict with certainty where prices are going, and if a sharp fall in uranium prices were to occur, DNN’s stock could plummet.

The other source of risk comes from the use of in situ recovery. News on this first phase was very positive, but it is a chemical process and something could still go wrong in the other two phases of the FFT, preventing its successful deployment.

Takeaway

The fact that Denison is still a pre-production uranium miner means that its stock is still highly speculative. However, I viewed this week’s announcement as removing some of the risk overhanging the Wheeler project. I initiated a position in the stock and intend to add to it on any pullbacks. As the question mark overhanging the ISR process fades and as the probability that Denison begins production in 2025 or 2026 grows, its stock price should start to more greatly reflect increases in the term price of uranium.

Be the first to comment