JacobH

We have covered Cameco Corporation (CCJ), Sprott Physical Uranium Trust (OTCPK:SRUUF), and Uranium Royalty Corp (UROY) from the uranium universe in the past. We have been bullish on only one of the three during the course of our coverage, choosing to remain neutral on the other two. Today, we look at a fourth uranium play, Denison Mines Corp (NYSE:DNN).

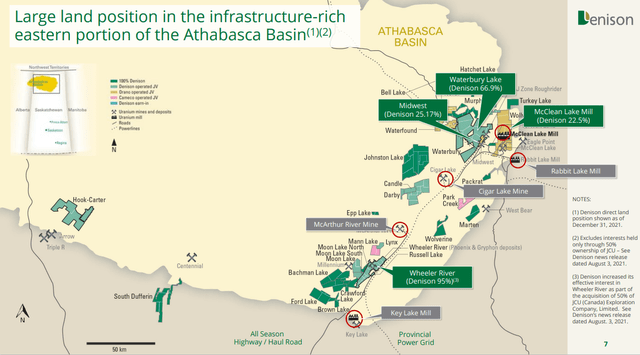

Based in Canada, DNN is a uranium exploration and development company primarily operating in Saskatchewan.

It also participates in decommissioning or post-closure mine care and maintenance for mines and related environmental services. Accordingly, the results reflect two reportable segments: mining and closed mine services.

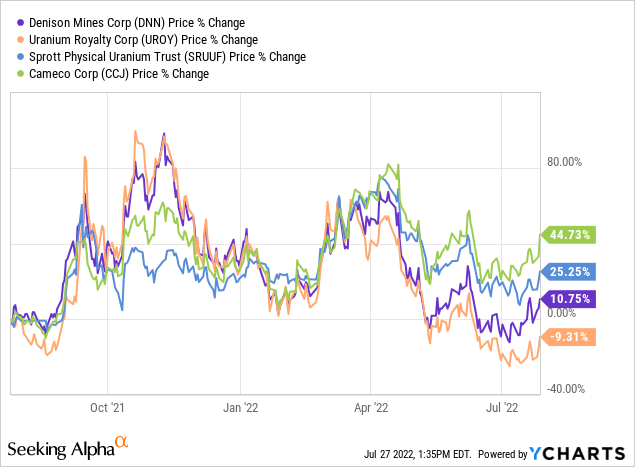

While its one year performance is decent:

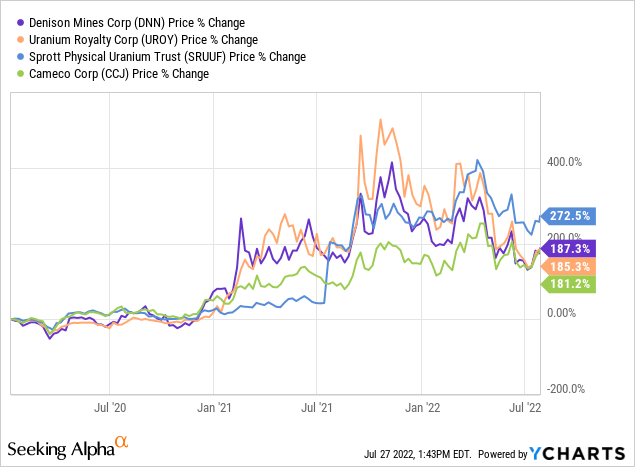

Its five year performance would have made its investors a small fortune.

We review the most recent numbers and see if we fall in the bullish camp or not.

The Assets

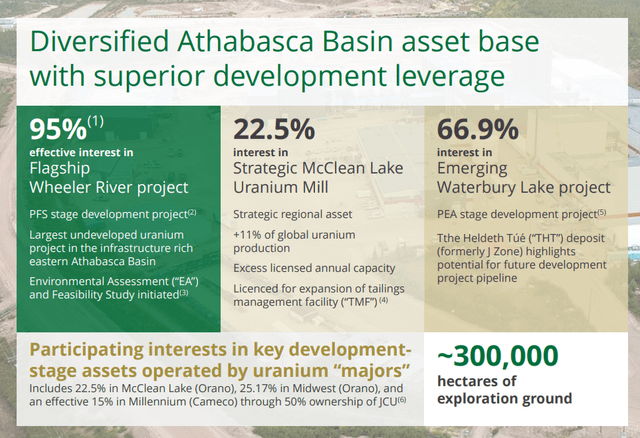

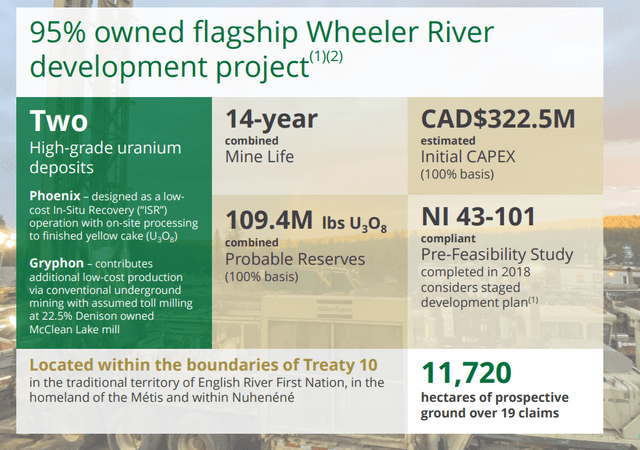

The first thing that should strike you about Denison mines is the quality of the asset base. Denison has 95% effective interest in the flagship Wheeler River project which is currently in the feasibility assessment stage. Alongside that, it also has a 22.5% interest in the strategic McClean Lake Uranium Mill. It also has a 66.9% interest in the Waterbury lake project and boasts of exploration potential beyond these. Some of these assets give Denison the room to become a substantial producer in the medium term.

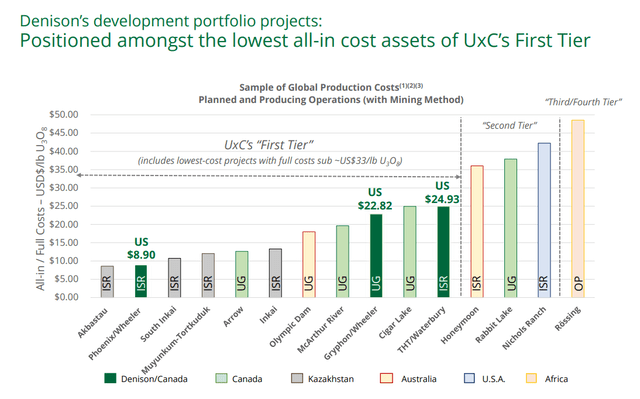

This is important as a large number of speculative uranium plays remain just that, speculative. One of the reasons we see this panning out over the medium term as well is that the all-in cost for producing uranium at these mines is one of the lowest in the world.

Now we must take some of these numbers with a pinch of salt. The assets have not yet been completely developed and put into production. Rising inflation and rising costs of other forms of energy definitely have an impact on mining costs in the medium term. So whatever we see above, likely comes in higher when the mines are actually put into production. That said, the buffer, or the margin of safety, is rather high in these cases. Specially with the uranium spot price near $55 a pound, even if costs tend to double from this low base over the long run, you can assume that Denison will still be raking in large amounts of cash.

Can They Develop This?

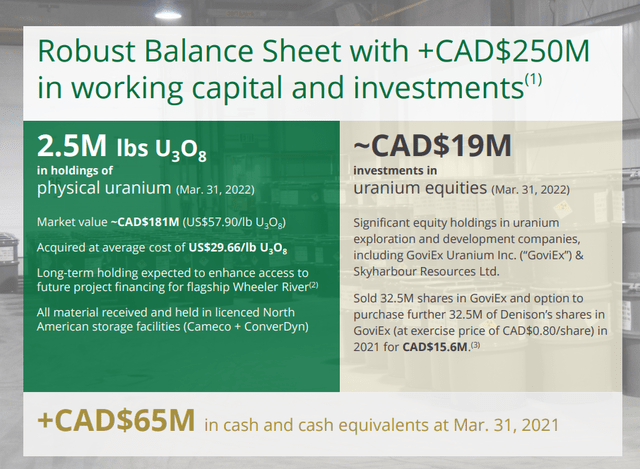

Now that we have the assets that we like the next thing that we need to check is whether Dennison has the potential to develop them by itself. This is important to examine as a lot of speculative plays have to raise so much capital by the time they reach production, that there is little room for the early investors to actually benefit from getting in on the resource play. In the case of Denison, a cursory glance at the balance sheet shows that it has a large amount of working capital and cash which should allow it to develop this over the medium term.

It is fascinating here to see Denison “double-down” over the uranium thesis by holding 2.5 million pounds of Uranium, instead of actual cash. We get that Uranium is undervalued, and certainly taking off a few million pounds in a supply constrained market will help all producers. That said, if the thesis does not work out, Denison could be forced to liquidate these same pounds of uranium near a cyclical bottom.

Valuation

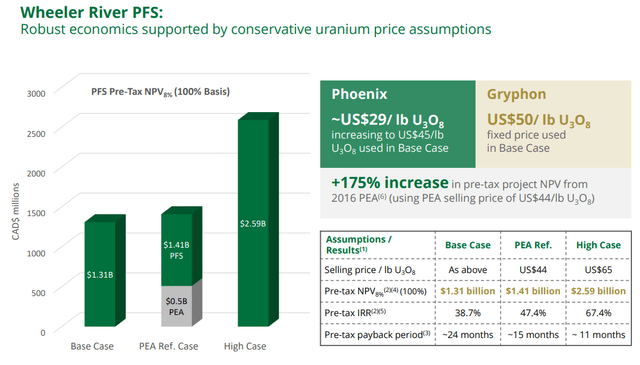

There is a long timeline and a lot of capex between the feasibility study and the actual production. Wheeler River will consume over $300 million CAD.

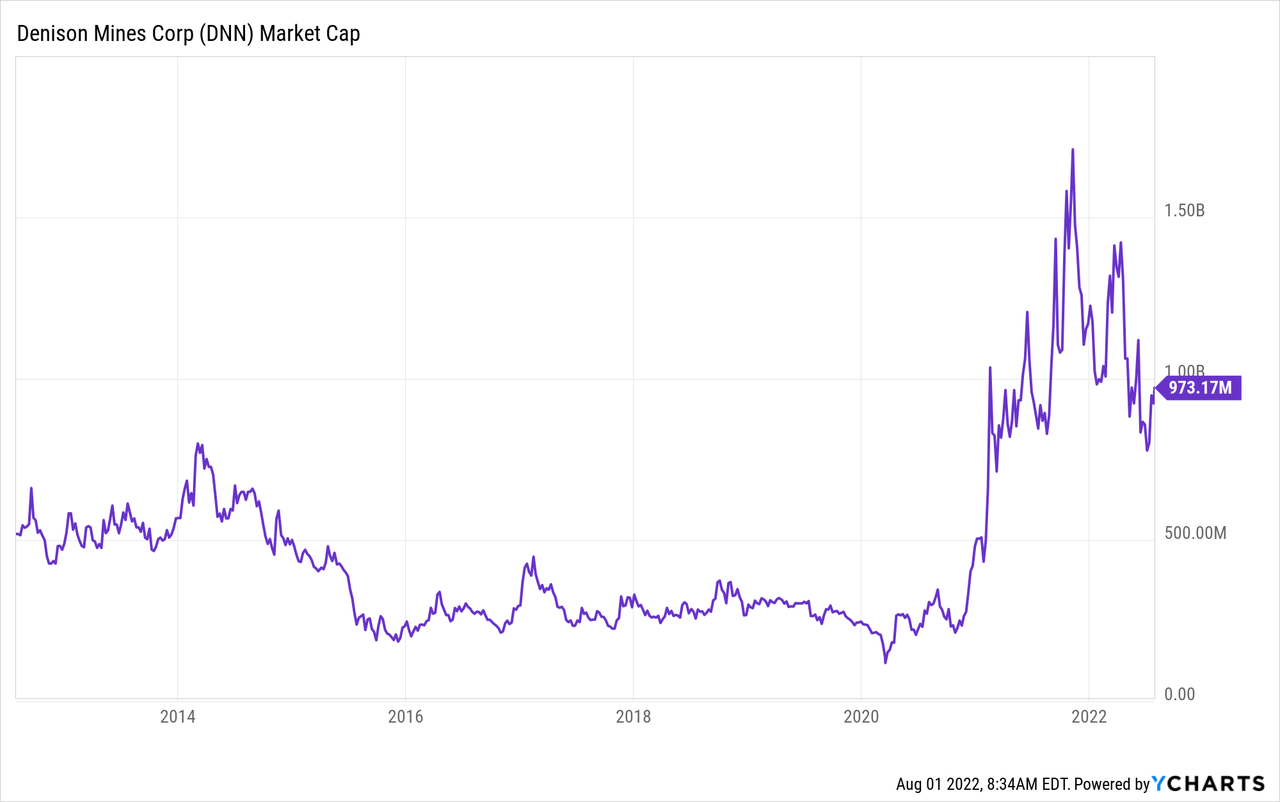

Denison also already sports a billion dollar market capitalization.

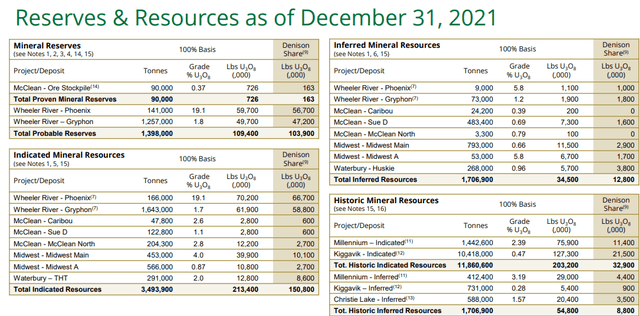

So any potential that we see, has to be weighed against what is priced in. Denison’s potential still seems good in relation to that market capitalization. With over 100 million pounds of Uranium reserves and 150 million pounds of resources, the math looks compelling, if Denison can execute successfully.

There is promise in the stock, even if prices stay at or about the current range and Denison can develop the mines in a timely manner. Wheeler alone has a $2.59 billion NPV at $65/pound prices.

Of course, higher uranium prices will boost the upside potential.

Verdict

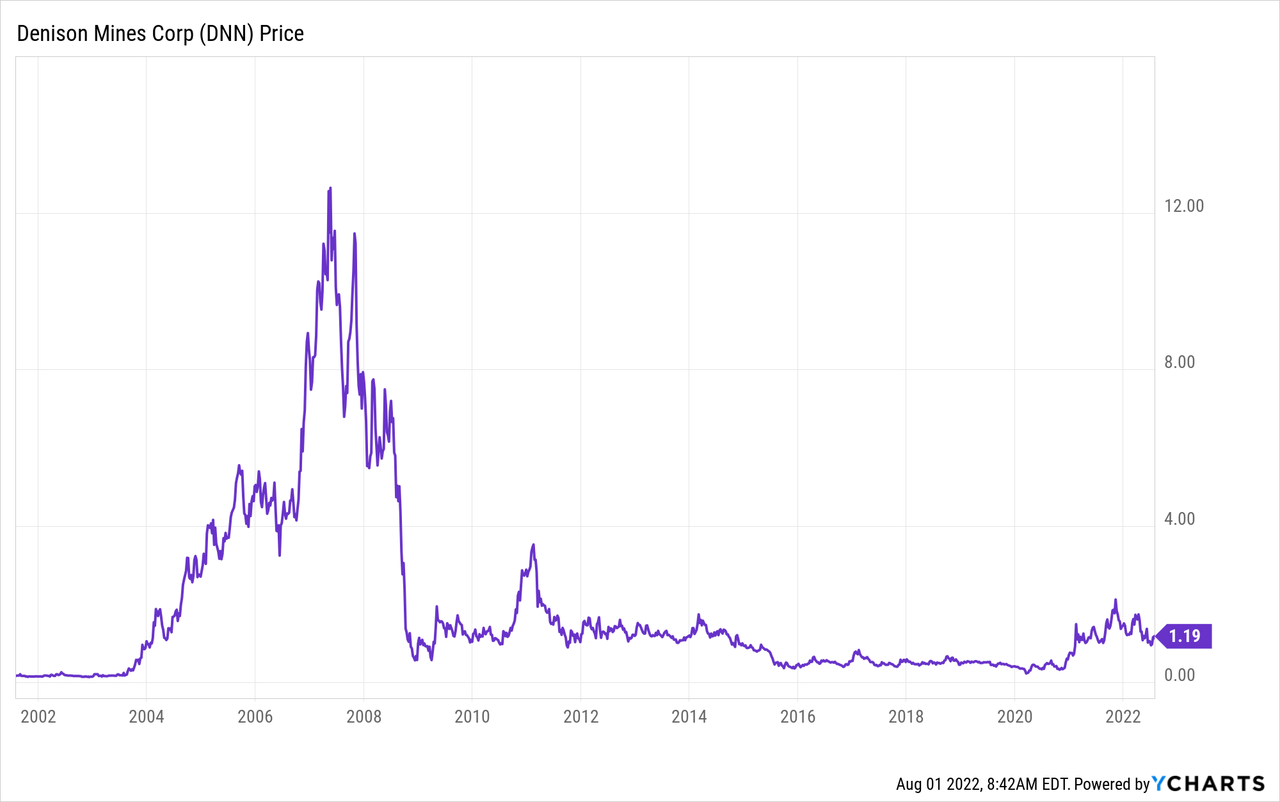

One thing that works against Denison is that has been around for a really long time.

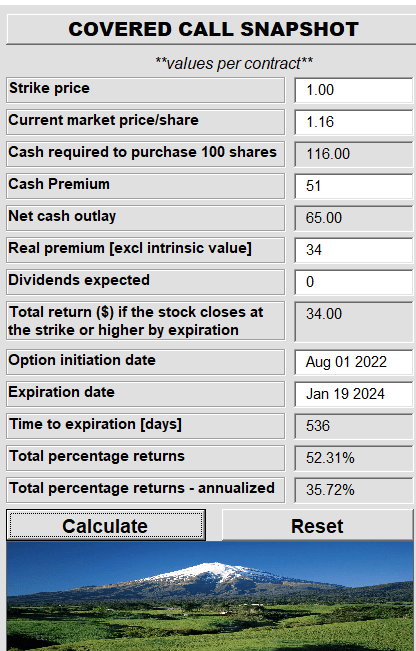

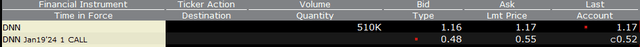

Current revenues are still just at $4.4 million a quarter. That does increase the skepticism of the longer run success potential. On the flip side, one might argue that Uranium has been in a bear market for a good deal of this time frame and the lack of profitability of even major producers like CCJ, speaks to how difficult it is to advance projects or raise capital. Based on what we have looked at, we think this deserves a buy rating. Certainly the valuation here is far better than what we have seen for CCJ or UROY. One additional advantage here is the pricing of options. We like the $1.00 strike covered calls for January 2024 for this stock.

At present prices, it offers an interesting total return even if Denison drops to $1.00 from here.

Author’s App

That is a rather interesting setup.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment