guvendemir/E+ via Getty Images

Investment Thesis

With the reopening cadence and record travel bookings, Delta Air Lines, Inc (NYSE:DAL) could be riding on massive tailwinds for recovery by FQ2’22. Nonetheless, it is also apparent that the market is less optimistic, given the rising oil prices, complex staffing issues in the flight industry, slower return of corporate travel, and the potential recession reducing consumer demand moving forward. As a result, the DAL stock had plunged by 25.6% in recent weeks since early June 2022, triggered by the Feds announcing its hikes in interest rates.

As the result of the mixed signals, the DAL stock has been on sideways price action in the past three weeks ranging at $29s. Therefore, we recommend conservative investors to take a back seat and wait for the management’s guidance in its upcoming earnings call for more clarity. In the meantime, investors with a higher tolerance for short-term turbulence may choose to nibble here, given the relatively attractive risk/ reward ratio.

Delta Air Lines Has A Good Chance For Recovery In FY2022

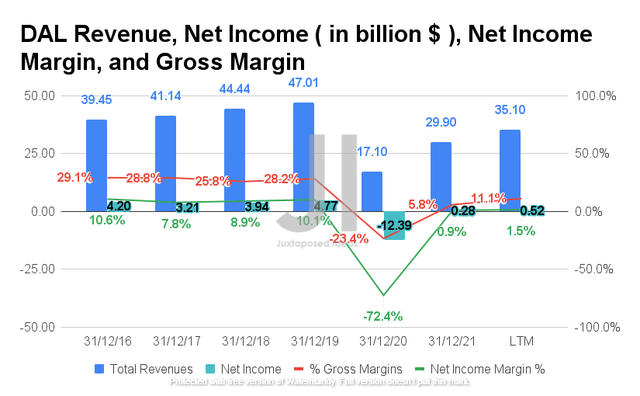

DAL Revenue, Net Income, Net Income Margin, and Gross Margin

DAL Revenue, Net Income, Net Income Margin, and Gross Margin (S&P Capital IQ)

Despite the devastating effects of the COVID-19 pandemic on the air travel industry, DAL has had a promising head start towards recovery, with revenues of $35.1B and gross margins of 11.1% in the LTM. Though it is not yet comparable to its FY2019 levels, we are encouraged by the massive improvement of 205.2% and 34.5 percentage points from FY2020 levels. However, DAL also not reported positive net incomes in the past two quarters, given the effects of the Omicron variant on travel restrictions then. Nonetheless, we expect massive improvements by FQ2’22, given the reopening cadence, triggering the notable rebound in domestic/ international air travel.

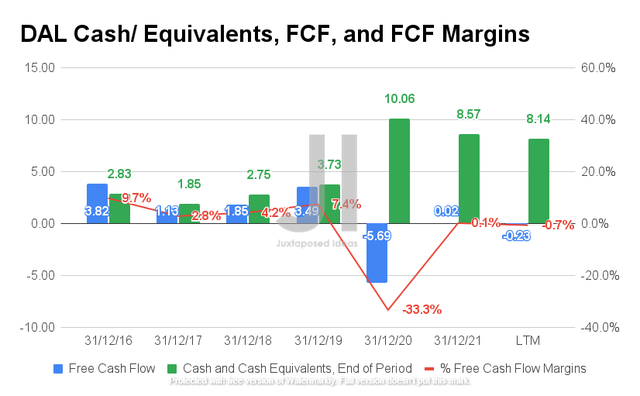

DAL Cash/ Equivalents, FCF, and FCF Margins

DAL Cash/ Equivalents, FCF, and FCF Margins (S&P Capital IQ)

Given that DAL is still struggling to return to profitability, it is expected that the company will report Free Cash Flow (FCF) of -$0.23B and FCF margins of -0.7% in the LTM, representing a massive decline of -93% and 8.1 percentage points from FY2019 levels. Nonetheless, we expect the company to turn things around from FQ2’22 onwards, given the robust consumer demand at nearly pre-pandemic levels during the summer holidays, despite the temporary headwinds in staffing issues affecting its flight scheduling.

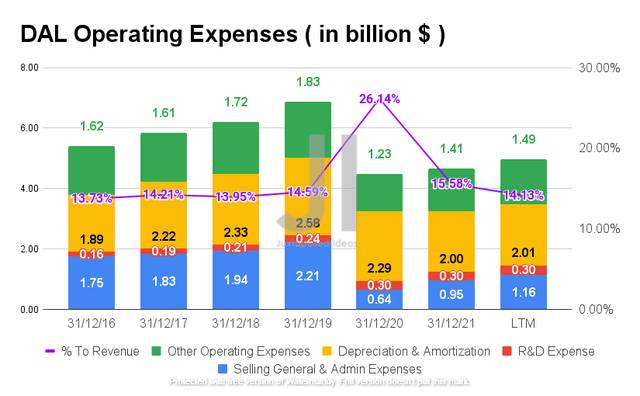

DAL Operating Expense

DAL Operating Expense (S&P Capital IQ)

As observed from the chart above, DAL has been relatively prudent in its capital management, given the massive moderation in its operating expenses in the past two years. By the LTM, the company reported a total of $4.96B in operating costs accounting for 14.13% of its declining revenues, representing a massive moderation of expenses by 27.6% from FY2019 levels. Assuming that the management is able to improve its operational efficiencies, we are relatively confident of its future execution and return to profitability moving forward. In addition, DAL has been relatively insulated from the record-high oil prices thus far through its own oil refinery near Philadelphia, thereby improving its chances for recovery in this high commodity pricing environment.

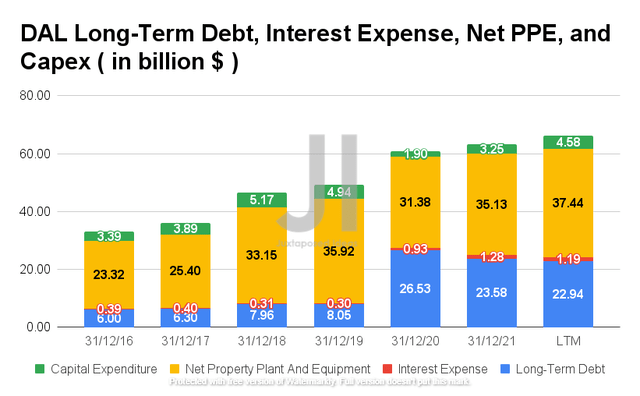

DAL Long-Term Debt, Interest Expense, Net PPE, and Capex

DAL Long-Term Debt, Interest Expense, Net PPE, and Capex (S&P Capital IQ)

DAL had also taken massive loans in FY2020 to tide through the plunge in its revenue then, during the heights of the pandemic. Its interest expenses had also increased to $1.19B in the LTM, representing an increase of 396.6% from FY2019 levels. However, we must also highlight the management’s capability to deleverage fast from $26.53B in FY2020 to $22.94B by the LTM, representing a notable decrease of 13.5% in long-term debts, though still a massive increase of 284.9% from FY2019 levels. We are also optimistic about its deleveraging moving forward, given the management’s guidance for another $2B in debt reduction in FQ2’22. Dan Janki, DAL’s CFO, said:

Reducing debt is our top financial priority as we target investment-grade metrics and $15 billion of adjusted net debt by the end of 2024. (Seeking Alpha )

Nonetheless, DAL took on more net PPE assets at $37.44B and capital expenditure of $4.58B by the LTM, thereby further eroding its cash and equivalents to $8.14B in the LTM given the global reopening cadence and the pent-up travel demand, with the additional guidance of gross Capex of $1.2B in FQ2’22. Assuming that DAL (and the travel industry ) is able to weather the potential recession, as it did through the recession in 2008 with YoY revenue growth of 18.5%, we might see these investments pay off in the short and intermediate term. We shall see.

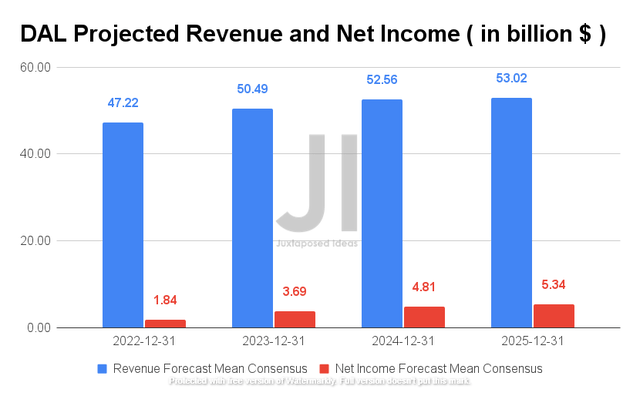

DAL Projected Revenue and Net Income

DAL Projected Revenue and Net Income (S&P Capital IQ)

DAL is expected to report revenue growth at a normalized CAGR of 3.54% by FY2025, while also reporting excellent revenues of $5.34B at the same time. Its net income profitability is also expected to recover to pre-pandemic times by FY2025 with net income margins of 10%, compared to 10.1% in FY2019. For FY2022, consensus estimates that DAL will report revenues of $47.22B with a net income of $1.84, representing an increase of 9.7% though a decline of 61.3% from FY2019 levels, respectively.

Analysts will also be closely watching DAL’s FQ2’22 performance, with consensus revenue estimates of $13.58B and EPS of $1.66, representing an increase of 8.3% and a moderate decline of -27.1% from FQ2’19 levels, respectively. We are relatively optimistic though, since the company has been smashing consensus estimates for the past four consecutive quarters.

So, Is DAL Stock A Buy, Sell, or Hold?

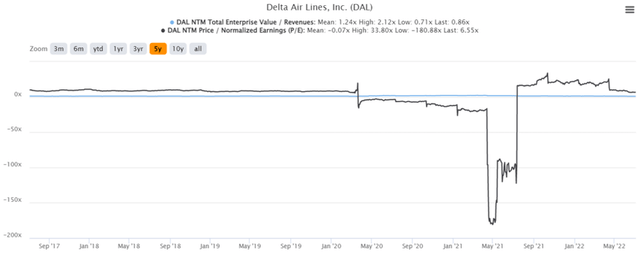

DAL 5Y EV/Revenue and P/E Valuations

DAL 5Y EV/Revenue and P/E Valuations (S&P Capital IQ)

DAL is currently trading at an EV/NTM Revenue of 0.86x and NTM P/E of 6.55x, lower than its 5Y EV/Revenue mean of 1.24x though elevated from its 5Y P/E mean of -0.07x. The stock is also trading at $29.53, down 36.1% from its 52 weeks high of $46.27, nearing its 52 weeks low of $28.10. It is apparent that the reduced flight schedules for the summer season have partly attributed to its poorer stock performance thus far, given the industry-wide staffing issues.

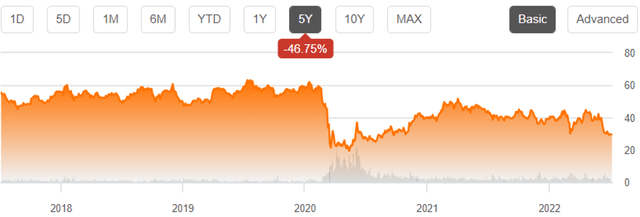

DAL 5Y Stock Price

DAL 5Y Stock Price (Seeking Alpha)

Despite consensus estimates strong buy rating with a price target of $51.0, we prefer to wait it out post FQ2’22 earnings call on 13 July 2022. We reckon that the bearish market sentiments and the potential recession reducing consumer spending may push the stock further downwards in the short term, assuming a softer FQ3’22 guidance. That would provide a more attractive entry point for bottom-fishing investors.

Even so, investors with a higher tolerance for volatility looking for long-term growth may nibble now to take advantage of the 72.71% upside potential. Though speculative, we also may also see a moderate stock recovery upon a stellar FQ2’22 performance, given the pent-up travel demand in the past few months.

Therefore, we rate DAL stock as a Hold for now.

Be the first to comment