Justin Sullivan

Investment Thesis

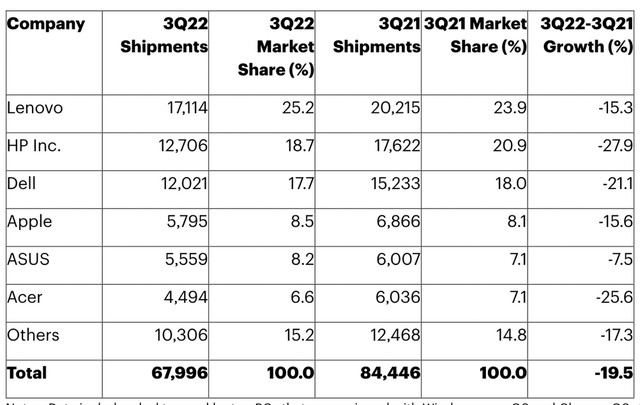

Most recently, I stumbled across an article from Gartner saying total PC shipments dropped by 19.5% YoY during the third quarter of 2022. Of course, this should not come as a surprise since the current high inflation and threat of a recession are already having a serious impact on consumer spending. The difficult comparable sales are also hard to beat, since last year was still positively impacted by covid lockdowns.

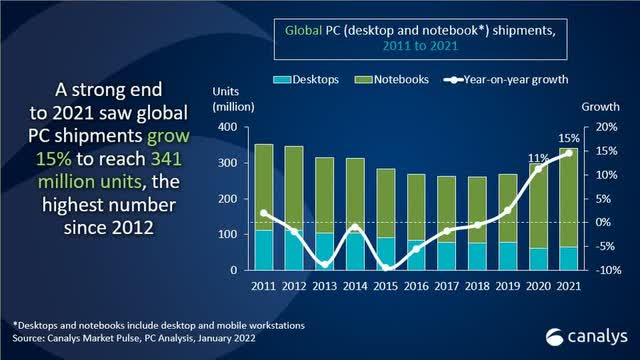

Where global pc shipments were flattish in the period 2016-2019, we saw a serious increase boosted by lockdowns in 2020 and 2021. With people sitting at home and being forced to work from home, more and more people were in need of a (new) PC to be able to do their work. And besides the work-from-home boost, the general staying-home trend boosted things like gaming as well. These tailwinds were great for PC manufacturers such as Lenovo (OTCPK:LNVGF, OTCPK:LNVGY), HP Inc. (HPQ), and Dell Technologies Inc. (NYSE:DELL). All saw a strong sales increase, and because of higher demand and higher prices, margins also saw a strong improvement.

Now we are living in completely different times. No more covid and no more lockdowns. People are slowly returning to the office, and global demand for PCs is dropping since most people bought new ones during the last 2 years and, therefore, these PCs are not at the end of their lifecycle yet. Also, with people returning to work, a PC at home has become unnecessary for many. Moreover, new threats to the economy appeared in the form of extreme inflation, increasing interest rates, and a recession around the corner.

These are all not having a positive effect on the economy, shown by the huge drop in the markets so far this year. The result of all the above-named factors has resulted in a huge drop in PC shipments worldwide, and this is having a very negative effect on all PC manufacturers. The Gartner report shows that total shipments for the third quarter came in at 68 million units, a 19.5% decrease. This was the steepest decline since the mid-1990s. This is what the director analyst at Gartner, Mikako Kitagawa, had to say:

While supply chain disruptions have finally eased, high inventory has now become a major issue given weak PC demand in both the consumer and business markets. Back to school sales ended with disappointing results despite massive promotions and price drops, due to a lack of need as many consumers had purchased new PCs in the last two years. On the business side, geopolitical and economic uncertainties led to more selective IT spending, and PCs were not at the top of the priority list.

This all sounds very bad for PC manufacturers, and it sure is. But these kinds of drops and bad news often result in very attractive entry prices in these companies. It is best to buy on a cyclical low in order to reap the best results. I have been following Dell Technologies for a while now and I believe now might be a good time to see whether Dell is a buy within the current economic cycle and at current valuations.

Dell Technologies

Dell Technologies is an American technology company with a focus on PC hardware and related products and services. Where Dell is mostly known for its PCs and monitors, the company’s products also include computer software, computer security, network security, and information security. Hardware includes personal computers, servers, smartphones, and televisions. The company is headquartered in Round Rock, Texas, and was formed as a result of the merger between Dell and EMC in 2016. Dell currently operates with 2 different divisions:

- Client solutions: this includes products such as desktop PCs, notebooks, printers, monitors, tablets, and projectors under the Dell name.

- Infrastructure Solutions: this includes servers, storage, and networking.

Dell is a huge technology firm, as shown by its yearly financial numbers. Dell realized $101.2 billion in revenue during FY22, which has been growing at a 6% CAGR since 2019. Free cash flow in FY22 was $7.1 billion.

Dell is a huge player in the global PC market and has a strong market share. As of 3Q22, Dell had a global PC market share of 17.7% and was, therefore, the third largest manufacturer of PCs behind peers Lenovo and HP Inc.

Overview of PC market share (Canalys)

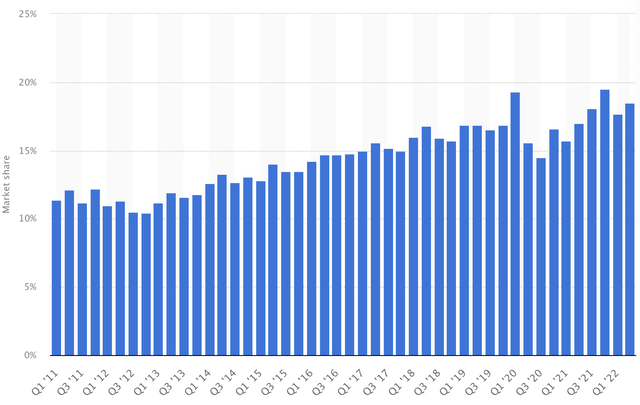

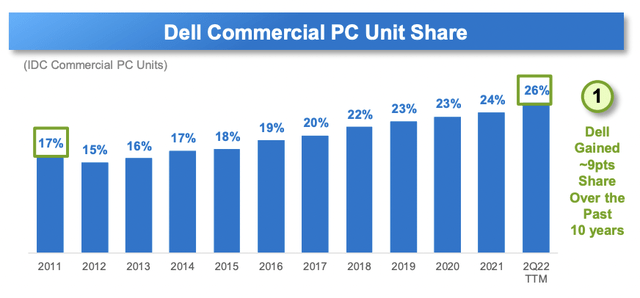

Market share for Dell did drop YoY to 17.7% from 18% in the year-ago quarter. Dell saw a drop of 21.1% in total shipments YoY, which was right in between its two main competitors, with HP Inc losing a little less than 28% and Lenovo losing just 15.3%. But where Dell might have dropped some market share over the last year, they have been increasing their market share over the last decade; jumping from just over 11% in 2011 to 17.7% in the latest quarter. This shows that Dell knows what it is doing and has been very consistent at it. I believe the current offering of Dell and technological dominance, as shown by their latest PC offering, does give Dell the opportunity to keep growing its market share and, therefore, grow at a faster pace than the global PC sector. Dell is a dominant force in most PC and personal computing segments, as shown by multiple reviewing sites like TechRadar for PC and for ultrabooks by IGN.

Dell PC market share (Statista)

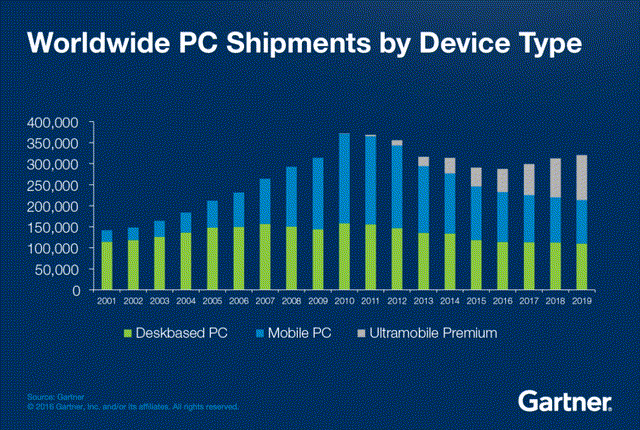

It is still important to note that despite winning market share over the last decade, the industry stays cyclical, and winning market share is not going to offset this. Yet, despite being cyclical, the market size is growing over a longer time period. According to Statista, the total PC market size is projected to reach $207.6 billion in 2022, with laptops accounting for over $120 billion. Market size is expected to grow at an annual growth rate of 1.36% (CAGR 2022-26), resulting in a total market size of $219.1 billion. Please note that so far, we have only been talking about PC hardware revenue and shipments and not all additional services.

The slow cyclical growth of the PC sector is also shown in the image below.

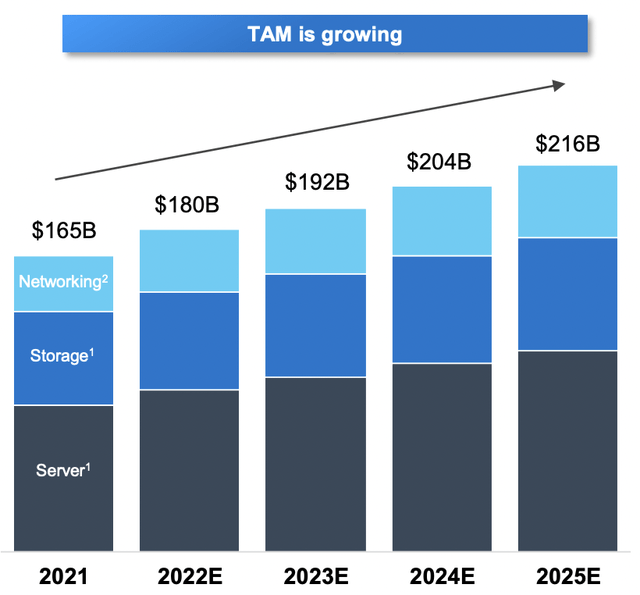

While I continue to believe that the PC hardware segment will remain strong for Dell and I expect them to keep gaining market share and grow total revenue over a longer period, the real growth opportunity lies within their infrastructure and security solutions. This is a sector that is growing much faster while being non-cyclical by nature.

Dell offers a wide variety of cybersecurity solutions such as zero trust security and endpoint security. Dell also offers infrastructure solutions for businesses; this is what they say about it:

Every organization needs to be a digital organization powered by data, running in a multi-cloud environment, and able to harness artificial intelligence, machine learning, IoT, edge computing and more. Look to us for IT infrastructure and workload solutions – that can be delivered on-demand, as a service – to help your organization transform and thrive.

Dell infrastructure solutions include AI, analytics, HPC, and cloud partnerships with Microsoft (MSFT), Oracle (ORCL), SAP (SAP), and VMware (VMW). In addition to this, Dell also offers workforce solutions. Dell is leveraging its huge system exposure within businesses to offer additional services. These services include AI workstations, Hybrid clients, endpoint security, and remote workforce.

All in all, this is a very broad segment for Dell, with huge growth potential and a way to offset the cyclical weakness of the hardware segment. The growing digitalization will be a driving force for Dell in this segment. Areas such as cloud, hybrid cloud, working from home, and cybersecurity will be growing topics in which enterprises will be forced to spend more. With the huge exposure Dell has in this sector already, it is in a great position to leverage its IT hardware to offer more digital services.

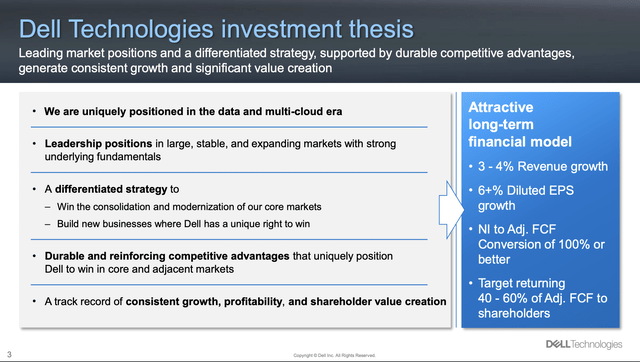

Dell itself is seeing these opportunities as well, and they acknowledge that they are in a strong position within future growth markets. Dell aims for 3-4% revenue growth over the long term, which I think is a little bit of a safe estimate as I think growth will come in between 4-8% over the long term. EPS is expected to grow a bit faster, as the service segment will be the faster-growing segment while carrying higher margins. Dell is seeing a $720 billion TAM (total addressable market) for the business. Dell is planning on maintaining its strong market share over multiple business segments and expanding into more service revenue sources. Here are a few segments where Dell holds the number one position:

- External enterprise storage (32.5% share)

- PC workstations (37.7% share)

- Commercial PC (26.5% share)

- PC monitors (22.4% share)

- High-end PC gaming (30.6%)

The long-term outlook looks rosy, but how are the short-term financials doing?

Financial results

On August 25th, Dell reported their 2Q23 results, and they did not disappoint. Dell reported record second-quarter revenue of $26.4 billion, which was up 9% YoY. Operating income was $2 billion, up by 7.4%. EPS saw 14% growth and thereby outpacing revenue growth.

The client solutions group (CSG) saw revenue come in at $15.5 billion, up 9% while operating income for this segment was $1 billion and shipments were ahead of expectations.

The infrastructure segment (ISG) saw revenue of $9.5 billion and an operating income of $1 billion. Both segments saw nice growth of 9% and 12%, respectively. This is what management had to say:

We continued to execute well in an increasingly challenging environment with record second quarter revenue of $26.4 billion, up 9%. We also advanced our long-term strategy – growing the core while innovating for our customers and enabling their opportunities in the data era.

Dell returned $850 million of capital back to its shareholders in the form of dividends and share buybacks. Free cash flow for the quarter was $700 million, meaning shareholder distributions were not fully covered by free cash flow for the period.

Looking at these numbers, we are not seeing any slowdown at all, with even the client solutions group increasing its revenue despite a drop in delivery numbers. Dell even reclaimed the number-one spot in commercial PCs. Dell did acknowledge that they saw demand decline over the quarter, but strong delivery numbers managed to offset this weakness.

The infrastructure solutions group also saw strong revenue growth. Dell did see less demand for its services as customers are taking a more cautious view of their needs. Dell did see its APEX product grow strong by growing orders by 78% YoY and adding almost 200 new customers. Annual recurring revenue (ARR) for this product is now over $1 billion. The total ARR for Dell increased by 8% to $5.2 billion. So, the underlying business is getting stronger, but near-term economic uncertainty is being a drag on growth for this segment. This segment is seeing strong long-term potential with a growing TAM.

During the first half of their FY23 book year, Dell has seen revenue growth of 12% with revenue coming in at $52.5 billion. Operating income was $4 billion in the same period and grew by 12%. EPS grew by a faster 24% during the first half of FY23.

This shows us that the first half of the year was still strong with solid growth across the board. Yet, there was a slowdown in demand visible at the end of Q2. I expect the impact of less consumer spending, high inflation, and a looming recession to have a more severe impact on the business. I do not expect much growth for the 2nd half of the year.

Management shares this expectation and gave a negative outlook for Q3 and the FY23 numbers. For Q3, Dell expects revenue in the range of $23.8-$25.0 billion, which is down 8% at the midpoint. They are expecting CSG to decline in the high teens, driven down by a drop in PC shipments. ISG is expected to keep growing in the low teens, but not being able to offset the drop in PC shipments. EPS is expected to come in flat YoY despite the drop in revenue, thanks to cost savings.

For the full year, Dell expects revenue growth to be flat to 2% growth despite the strong growth we witnessed during the first half of the year. This shows that management expects the business and economy to become very negative. FX headwind is expected to be 400 bps for the year. EPS is expected to increase 9% YoY for the full year, despite all weaknesses. The main threat here is a higher than anticipated FX headwind.

Balance sheet and valuation

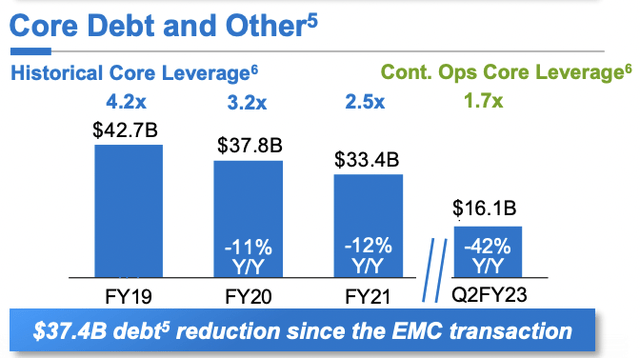

At the end of the most recent quarter, Dell had $7.1 billion in cash and investments on the balance sheet and debt of $16.1 billion. In general, I do not like to see a negative net cash position for any business. I do like to see management actively paying down debt levels as Dell has been doing over the last few years. Dell ended 2019 with a massive $42.7 billion but paid down this debt to the $16.1 billion currently on the balance sheet. Dell paid down the largest part of its debt with the excessive cash it earned during the covid boom in PC shipments. I believe this was the best decision management could make for this capital allocation, and for this reason, I will cut them some slack for the remaining debt on the balance sheet. I do believe Dell has their priorities in order.

Dell wants to use its income and free cash flow to reinvest in organic growth opportunities, targeted M&A that accelerates the strategy, and pay down additional debt as they target a 1.5x core leverage. I see absolutely no issues for Dell to achieve this goal. Dell gets an A+ rating from Seeking Alpha for profitability.

Dell also pays a very solid dividend yield of 3.37%, while only having a 14.3% payout ratio. This means the yield is 100% higher than the sector average, while the payout ratio is 50% below the sector average. This is a very strong payout, but the dividend history is the aspect that’s missing for Dell. Management does expect to have the opportunity to grow the dividend at least consistently with their long-term value-creation framework EPS CAGR of 6%+. So, management expects to grow the dividend by at least 6% per year. This is not the best dividend growth, but if it would manage to keep this promise, it is a very nice dividend stock to own, starting with a yield of 3.37%.

As for valuation, Dell is valued at a forward P/E of just 5.4, while being down by over 31% YTD. Dell has taken a massive drop so far this year while revenue increased. Yes, of course, revenue for the full year is expected to come in pretty much flat on a YoY comparison, and it’s safe to say that FY24 revenue will probably come in even lower YoY. If we look at the revenue estimates by analysts, we can see that they expect revenue for this year to come in at about +1% YoY, in line with management expectations. For FY24, analysts expect negative growth of 2%. If the recession will not go as deep as some may fear, I think this is a fair estimate. I think income for Dell will come in between 0% to -5% YoY depending on the severity of a potential recession. Analysts expect EPS growth to remain positive thanks to a better product mix and Dell increasing margins.

What I conclude from this is that Dell is very cheap by current comparisons, but I do expect estimates to come down slightly. That won’t change the fact that Dell is very cheap, and a recession seems to be already priced in. Dell receives an A- from Seeking Alpha Quant, as the company is undervalued compared to the sector average on about every metric. On a forward P/E basis Dell is 68% undervalued compared to the sector average and receives an A+ for its P/E valuation. For a final comparison; HP currently trades at a P/E of 6.88 and Lenovo at a P/E of 5.76. All seem attractively valued, but the business mix of Dell is most attractive to me.

Risks

So, then what are the risks for Dell? Well, I believe the main risk will remain to be the economy. We can all make nice estimations, but in the end, we don’t know where the economy will be in six months’ time. The biggest threat to a company like Dell is if we enter a deep recession which results in high unemployment levels and consumer spending dropping far. Large IT investments such as laptops will be the last thing people will be buying. Also, businesses will start being even more careful with their IT spending. Dell already saw a slowdown in demand as businesses started to become more careful. That comment does not particularly comfort me. In the case of a severe recession, there is still more downside in the stock, although I remain of the opinion that the current stock price has already a lot of downsides priced into it. It remains a tricky investment in a recessionary environment.

In the long term, I do not see many issues for Dell. It is, of course, a risk for a hardware company to lose market share to rivals. But the only real threat I can see in the PC business is Apple with its Mac computers. Although Apple only has a market share of just over 8%, they have been growing this share rather quickly. Apple is a very dominant force with a strong user base.

Conclusion

I started writing this article completely from zero, with no idea whether I would end up with a buy, hold, or sell rating. I believe Dell is a wonderful business and a strong long-term investment. Dell offers investors sustainable long-term growth driven by global growth trends and ongoing digitalization. Dell has a very strong market position within the cyclical PC hardware business, but I am more interested in its software, storage, and services business, as this is where I see the most growth potential for Dell. And I believe Dell can leverage its hardware dominance to offer more and better services to small and large businesses. Also, the increase in margins and strong EPS growth offer nice returns to investors in combination with the solid dividend yield. I don’t see Dell as a huge growth opportunity and I am not even sure if it will outperform the S&P 500 over the next couple of years, but I do think this stock gives a lot of safety and growth certainty combined with a nice dividend yield and growth prospects.

I believe the current valuation is low enough to rate the stock a risky buy right now. I would prefer a lower price with a better margin of safety, but current prices offer a nice opportunity to start a small position.

I rate Dell a buy on a fair price and solid long-term growth perspective.

Be the first to comment