Jerod Harris/Getty Images Entertainment

Dell Technologies (NYSE:DELL) is a leading computer hardware company which dominates the corporate market. They have generated high revenue growth, exploding profits and have innovative products which in one case has beat the Apple (AAPL) equivalent in terms of performance.

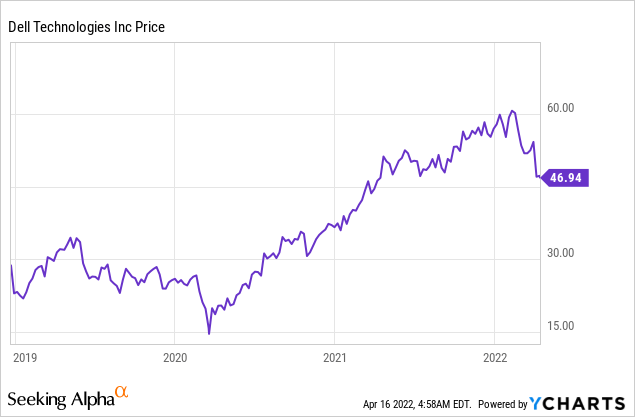

The company’s share price rose a meteoric 127% in 2020, but has now pulled back by 22%. Let’s dive into the business model, financials and valuation.

Dell Share Price (Y chart)

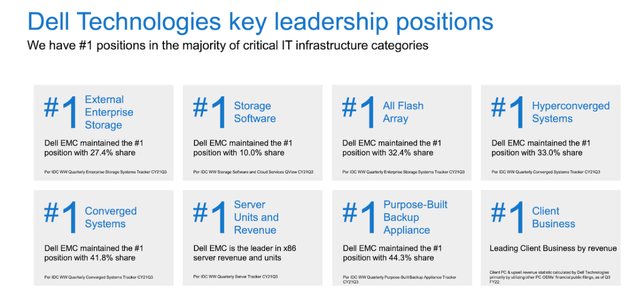

Solid Business Model

Dell Technologies is a leading computer hardware and infrastructure solutions provider. Now although Apple steals all the limelight in terms of quality home PC’s, Dell truly offers an enticing value proposition for home users and especially corporations. Corporations love to talk about Apple products, but go into any large consulting firm and you will find mostly Dell or other Windows-based computers. For example, when I was a consultant at Arup everyone had a Dell. This article also states Ernst & Young (E&Y) uses Dell, Deloitte (Dell or HP (HPQ)) and McKinsey use mostly Windows-based PCs such as the Lenovo ThinkPad.

This is for a few reasons, cost, Windows operating system, support and more recently great performance & design.

Dell Leadership (Investor report)

Dell recently introduced the new XPS 13 Plus which looks very similar to a MacBook Pro, but according to a review by Windows Central, Dell has “higher performance” and has won multiple awards at CES. The company also introduced the world’s thinnest gaming laptop (Alienware x14). Dell’s old black box style laptops are a thing of the past. These new laptops are truly innovative.

Dell XPS 13 Plus (Dell Website)

I also noticed Dell is extremely in tune with market trends and have recently introduced a new 4K webcam, which perfectly addresses the work from home trend and has excellent marketing messages to communicate this. The only negative reviews are from users who discovered the product wasn’t compatible with macOS. This should have been communicated clearly, but also shows Apple customers are preferring to buy a Dell product.

The Infrastructure Solutions Group introduced Dell PowerProtect Cyber Recovery for AWS (Amazon Web Services). This gives organisations data protection from hackers which is another growing corporate priority. The company also spun off VMWare, the leading virtual systems solution.

Solid Financials

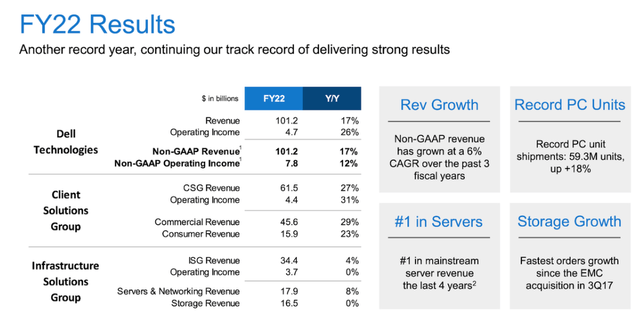

Dell has generated fantastic financial results with full year revenue of $101.2 billion, up 17% YoY. The company also achieved record full-year diluted earnings per share of $6.26, up 114%.

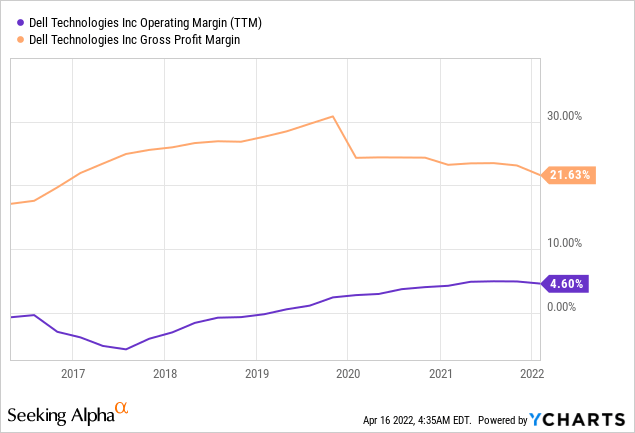

Dell Margins (Created by author Y chart)

The company still has a fairly low operating margin of just 4%, which makes sense given their competitive market pricing & high quality products.

Dell’s Client Solutions Group has generated tremendous growth of 27% on the revenue and 31% on operating income YoY. This group could be Dell’s growth engine moving forward.

Dell Financials (FY2021 Report)

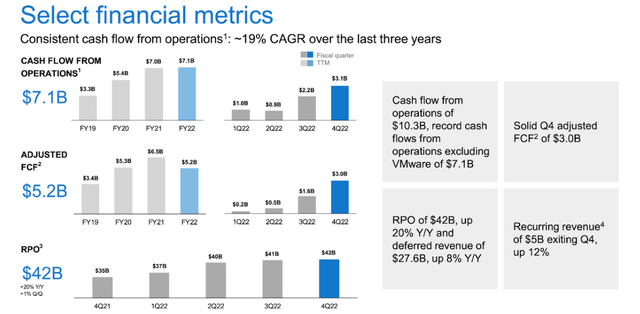

Dell generates strong free cash flow which have been increasing sequentially over the past quarters.

Dell Cash Flow (FY21 Results)

Dell also announced a quarterly cash dividend policy, with an initial quarterly dividend of $0.33 per share and 2023 dividends of approximately $1 billion to be paid out.

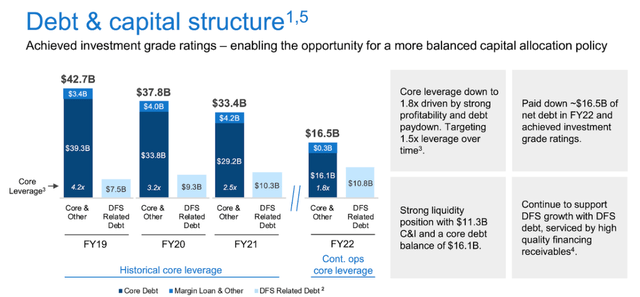

The company currently has $9.4 billion in cash, current debt of $5.8 billion and high long term debt of $21 billion. This high debt could be an issue as interest rates rise.

Dell Debt (Investor report FY21)

Is Dell Stock Undervalued?

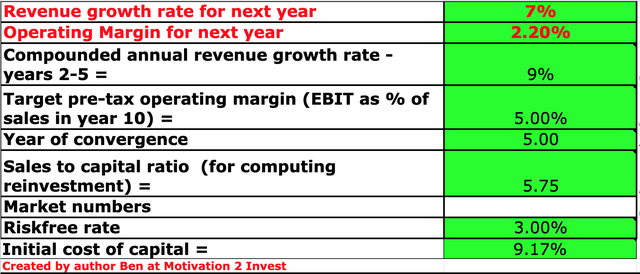

In order to value Dell technologies, I have plugged the latest financials into my discounted cash flow model. I have conservatively predicted revenue to grow by just 7% which is at the low end of the company’s 11% midpoint guidance. For the next 2 to 5 years after I have forecasted 9% revenue growth.

Dell Stock Valuation (Created by author Ben at Motivation 2 invest)

I am cautiously optimistic that the company can grow margins of the next 5 years, as I noticed their new XPS 13 product is priced much higher than prior models. The sales to capital ratio is generated from prior years results.

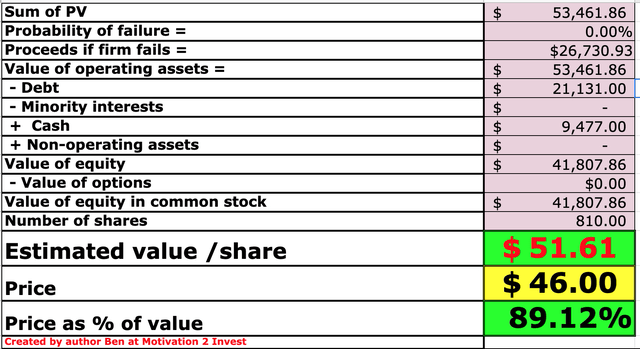

Dell Stock (Created by author Ben at Motivation 2 Invest)

Given these estimates I get a fair value of $51 per share, the stock is currently trading at $46 per share and is thus ~11% undervalued.

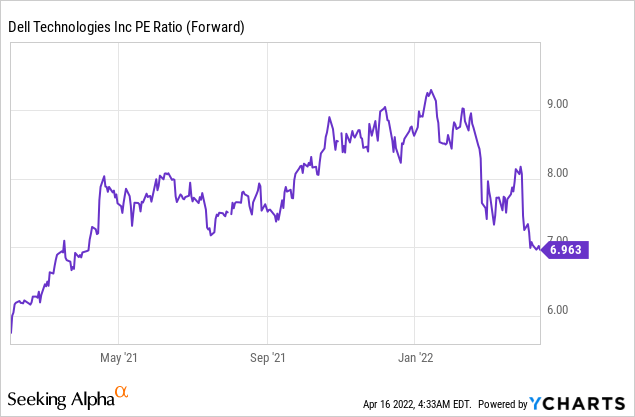

In terms of relative valuation, their PE ratio is just 6 which is much lower than the Computer Programs and Systems average PE ratio of 16.

Dell PE Ratio (Created by author)

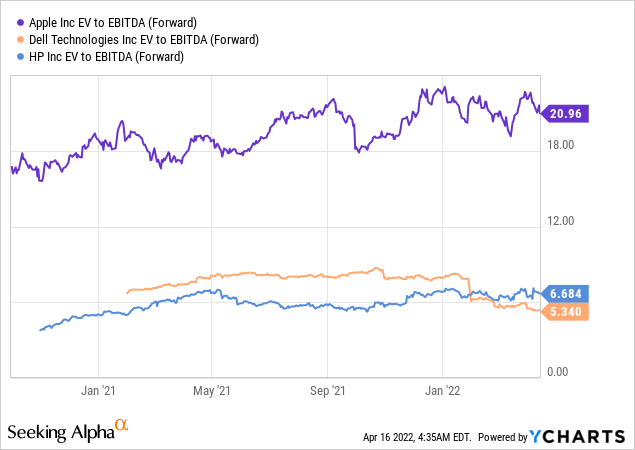

If I compare to other company technology company’s such as Apple and HP inc, Dell is trading at the cheapest PE and EV to EBITDA forward multiple.

Dell Valuation peers (Created by author)

Risks

High Debt

Dell has high debt even for a mature company, they have current debt of $5.8 billion and high long term debt of $21 billion. This high debt could be an issue as interest rates rise.

Low Margins

Dells low ~2% margin could be an issue as we move into a high inflation environment. Price inflation for items such as semiconductors could squeeze these margins. Dell doesn’t have brand “Pricing Power” unlike Apple which can charge much higher prices just for the brand even on equivalent performance specifications.

Competition

The computer market is notoriously competitive with foreign manufacturers continuously driving down costs and producing the lowest cost computers with high performance. Dells competitors include HP, Lenovo (OTCPK:LNVGY), Samsung (OTC:SSNLF), Compaq, Acer, Apple and even Google (GOOG) (GOOGL) with it’s Chromebooks.

Dell is competing head to head with Lenovo in the corporate market and recent tech reviews show their ThinkPad X1 matches Dell’s XPS 13 Plus in terms of performance and can only be separated by design. Personally, I think the XPS 13 has a more modern and Mac style design which will be more enticing for customers. According to a management study, Dell has an advantage over other firms in the industry by having superior supply chain management. The company must continually stay in tune with their customer needs, in order to produce the best products at the most competitive prices.

Final Thoughts

Dell Technologies is a fantastic company, they are innovating on all fronts and have even started to improve their design to more of an “Apple-like” style. From analysing their product reviews, it is clear they are in tune with the customer and have the financial growth to back it up. The stock looks to be undervalued both intrinsically and relatively. The company’s low margins and high debt could be the only issue moving forward as we go into a high inflation, rising interest rate environment.

Be the first to comment