designer491

Preferred stock can be a useful and important part of a diversified fixed-income portfolio, even with the decline in all segments of fixed income in 2022, however, recent events related to preferred stock delistings have put to the forefront a risk that needs to be taken into stronger consideration by investors. While the matter of delistings is certainly not new, these recent events have heightened our concerns on this risk, and we also call on the SEC to take up the issue to protect investors.

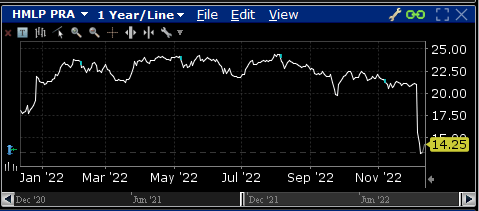

Earlier this month Höegh LNG Partners LP (HMLP) announced that it will delist its 8.75% Series A Cumulative Preferred Stock units (HMLP.PA), effective January 2, 2023, to save legal, audit, and other reporting costs associated with the preferred stock listing. While the company intends to continue to pay the distribution, the withdrawal and effective loss of liquidity for unitholders is a major negative event that led to a sharp 33% plunge in the price from the low $21 range to $14.25 as of this writing, as seen in the chart below.

HMLP-A Price Chart 2022 (Interactive Brokers)

While some may find value in what is now a 15% current yield, the lack of liquidity creates massive uncertainty for unitholders going forward, and it’s unclear what investors should do next. HMLP management has affirmed that it does not care about its preferred investors who handed over $176 million in cash to the company in good faith, expecting that the public listing of the preferred stock would remain stable and tradable as expected when initially issued. The proper action would have been to redeem the issue as the parent company Höegh LNG Holdings Ltd. did when it acquired HMLP and paid common shareholders in cash.

The action of delisting preferred issues and disrespecting preferred stock investors is not just a phenomenon of smaller and obscure issuers. The same thing is happening to the preferred issues of PS Business Parks (PSB) Series X, Y, and Z (PSB.PX) (PSB.PY) (PSB.PZ) totaling $755 million of combined face value. PSB has been reliably issuing, paying and redeeming preferred issues since 1999 when its Series A preferred was issued. Series X was issued in 2017 as a solid investment grade issue (rated Baa2) yielding 5.25% – presumably a perfect fit for a long-term, conservative income-focused investor. PSB-PY was also issued in 2017, and PSB-Z in 2019.

In July 2022 PSB was acquired by Blackstone (BX), through its Blackstone Real Estate affiliate, for $7.6 billion. The higher leverage on PSB as part of the acquisition led to a decline in the PSB preferred issues but they remained listed. However, BX decided to take advantage of the situation by announcing an offer to purchase PSB X, Y, and Z at large discounts to $25 par ($15.29, $15.33, and $14.34 per share for these issues, respectively) – in advance of a planned delisting. We have no problem with the purchase offer, but why the need to delist? The message to preferred shareholders is as follows: Sell to us at deep discounts thereby handing us about $300 million in value (i.e., the difference in the offered purchase price and combined face value of the preferred) or face a delisting and further loss of value due to illiquidity. Could BX have maintained the public listing and allowed preferred shareholders the right to decide to tender shares or hold, collect the dividend and sell whenever they wanted in the future? Certainly – and the cost of maintaining the public listing is negligible compared to the $7.6 billion valuation of PSB and $91 billion market cap of BX. But the goal is not to save on reporting costs, but to pressure preferred shareholders to sell.

These actions are legal by BX, but demonstrate egregious disrespect for the preferred shareholder, again, many who thought they were buying a low-risk issue. Especially given that BX specifically stated the following when the acquisition of PSB was announced: “PSB’s three outstanding series of preferred stock, and associated depositary shares, will remain outstanding in accordance with their terms following the closing. We currently intend to continue to have the depositary shares representing our preferred stock listed on the NYSE with public reporting, so long as there is at least $75 million aggregate liquidation value of preferred stock outstanding.” Only four months after the acquisition closed, BX reneged on this statement (but note a carefully worded “intention” by BX, not a commitment) – $300 million of value was more important than maintaining respect for its preferred stock investors. Nothing illegal here, just a bold-faced “screw you” from a $100 billion asset management company. Management of PSB could have also taken preemptive action to protect its preferred stockholders – after 20 years of loyalty – as part of its final agreement with Blackstone.

The matter of preferred stock delisting made its third headline in the last few weeks when on November 16, 2022 the courts approved a $13 million settlement related to the delisting of the preferred stock of AmTrust Financial Services, Inc. dating back to 2019. A class action suit against the company, its CEO, and two directors alleged that they stated several times that an acquisition of the common stock would not disturb the listing of the preferred stock but soon after the acquisition closed they announced just that – a delisting.

The delisting of preferred issues is not a new occurrence, however, it seems to be happening more often, and the Blackstone announcement in our view is a particularly egregious example given the size of the combined issuance and the company taking this action. We believe the SEC needs to take a closer look at this matter, after all its stated mission is “to protect investors, maintain fair, orderly and efficient markets, and facilitate capital formation.” Smaller investors, who hold lots of the preferred stock out there, are not being protected in these instances. The obvious protection is a change of control clause, which requires full redemption of preferred stock.

The final message is that investors need to be more wary of delisting risk. In our view, large companies are less likely to allow this to happen and large-cap issues (e.g., preferred stock of money center banks) appear much safer from delisting risk. While small-cap preferred stock has always been a very small allocation in our portfolios, these recent events will likely greatly reduce or eliminate small-cap preferred issues (those without a change of control clause) from consideration going forward. We have recently divested out of modest preferred positions in Seapeak LLC (SEAL.PA) (SEAL.PB) and Dynagas LNG Partners (DLNG) (DLNG.PA) (DLNG.PB) for these reasons, despite solid results and strength in the LNG industry. As usual, diversity is the key to proper fixed-income investing, as even with these bad outcomes, a diversified portfolio should be able to withstand negative events that can occur from time to time.

Please see the Downtown Investment Advisory profile page for important disclaimer language, which is an integral part of this article.

Be the first to comment