imaginima

Delek Logistics Partners, LP (NYSE:DKL) is a drop-down master limited partnership that primarily handles crude oil and refined products in support of the refining operations of Delek US Holdings (DK). Although Delek Logistics Partners is closely affiliated with a single customer, it still has many of the characteristics that we have come to appreciate with midstream companies, such as very stable cash flows and a very high distribution yield. Indeed, as of the time of writing, Delek Logistics Partners yields 6.47%, which is easily in line with the highest partnerships in the sector. Delek Logistics Partners is not content to simply maintain its distribution at the current level and provide its investors with a stable income, however. The company has numerous growth opportunities on the table that should allow it to increase the amount that it pays out to its investors. This is something that should prove very attractive in today’s inflationary environment. As there appears to be a lot to like here, let us investigate to see if Delek Logistics Partners could be right for your portfolio.

About Delek Logistics Partners

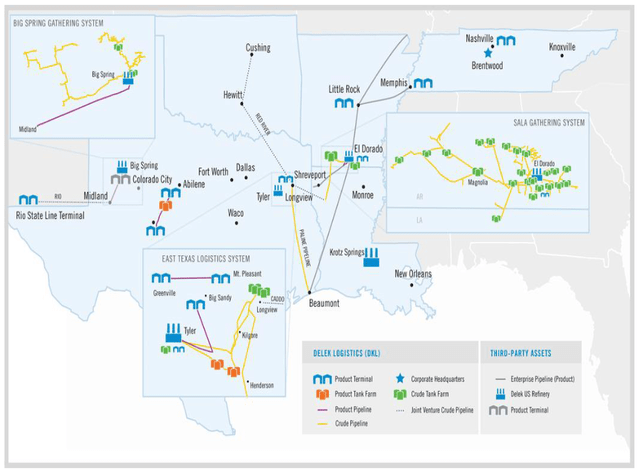

As stated in the introduction, Delek Logistics Partners is a midstream company that primarily transports crude oil and refined products in support of the refining operations of its parent company Delek US Holdings. The company primarily operates in Texas, Oklahoma, Arkansas, Louisiana, and Tennessee:

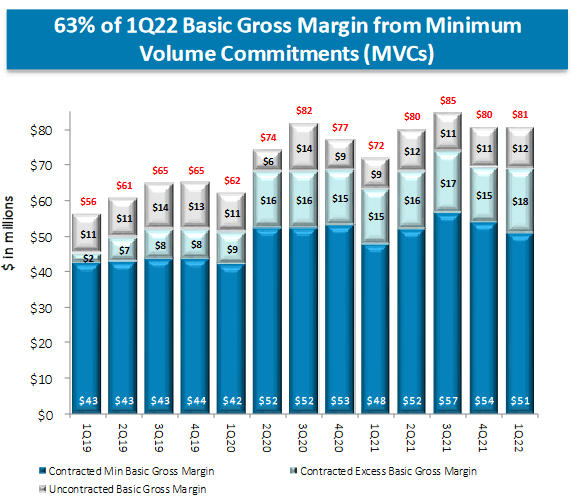

The fact that the company operates primarily in these states should not be particularly surprising since the region has been the focal point of the American energy industry for the past century. The company’s assets are admittedly not nearly as extensive as some of its peers possess, however. In total, Delek Logistics Partners owns approximately 855 miles of crude oil and refined product transportation pipelines, a 600-mile crude oil gathering system in Arkansas, a 200-mile gathering system in the Permian Basin, and ten million barrels of liquids storage capacity. The company also recently acquired a crude oil and natural gas gathering and processing system in the Northern Delaware Basin, which we will discuss later in this article. The fact that the company’s infrastructure is not as extensive as some of its peers possess should not be a deterrence to investment however as Delek Logistics Partners has many of the same characteristics that have long attracted us to the midstream sector. One of the most important characteristics is that the company enjoys remarkably stable cash flows regardless of the conditions in the broader economy. This is because of the business model that the company uses. In short, Delek Logistics Partners enters into long-term contracts (five to fifteen years in length) to provide transportation and storage services for its customers. The length of these contracts should ensure that they outlast most short-term economic problems since most economic shocks only last for a year or two at most. Under these contracts, the customer pays Delek Logistics Partners based on the volume of resources handled, not their value. This provides the company with a substantial amount of insulation against changes in resource prices. In addition to this, these contracts include minimum volume commitments, which specify a certain volume of resources that the customer must send through the partnership’s infrastructure or pay for anyway. Approximately 63% of Delek Logistics Partners’ basic gross margin (analogous to gross profit) comes from these contracts:

Delek Logistics Partners

We can see above that the partnership’s gross margin has been reasonably stable since the start of 2019. At the very least, it was much more stable than energy prices over the period and the company was clearly not affected very much by the sharp price declines that occurred back in 2020. This is very nice to see since the gross margin is the money that the company has available to cover its non-product-related expenses and ultimately make its way down to the investors. This overall stability then is quite nice to see because it shows us that Delek Logistics Partners is not affected much by changes in energy prices and provides a great deal of support to the distribution.

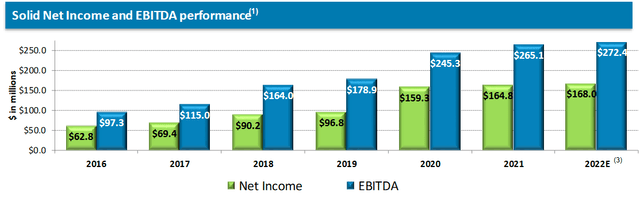

As investors, we are not satisfied by simple stability. We want to see growth. Fortunately, Delek Logistics Partners has a long history of providing exactly this for its investors. As we can see here, the company has increased both its EBITDA and net income in every year since 2016:

The fact that Delek Logistics Partners was able to deliver growth in 2020 despite the coronavirus-driven collapse of energy prices further confirms my statements that the company is insulated from fluctuations in energy prices and other economic shocks. This is exactly the kind of thing that we look for in an income investment. The way that the company delivers growth should be fairly obvious when we consider that midstream infrastructure only has a finite capacity of resources that it can handle. As the company’s revenues and by extension cash flows are dependent on the volume of resources that it transports, Delek Logistics Partners needs to construct or acquire new infrastructure. The company has a very solid growth pipeline to continue its historical growth trajectory via this method.

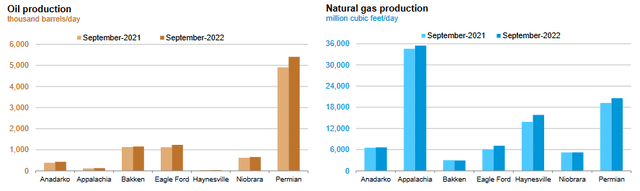

The company took a major move in this direction back in June 2022, when it acquired the 3Bear gathering and processing system in the Northern Delaware Basin. This $625 million transaction greatly expanded the company’s operations in that region and had a positive impact on the company’s second-quarter 2022 earnings results. The system currently consists of approximately 485 miles of both crude oil and natural gas gathering pipelines, which Delek Logistics Partners expects to expand as producer activity in the Permian Basin continues to increase. Despite a few major producers in the area foregoing growth and holding production steady, production in the basin has indeed been increasing. As we can see here, the production of both crude oil and natural gas in the Permian Basin (which includes the Delaware Basin) have increased compared to last year’s levels due largely to the sharp increase that we have seen in energy prices:

U.S. Energy Information Administration

As long as energy prices remain elevated, it seems likely that producers in the basin will increase their activity further. Thus, there may be some reasons to believe that Delek Logistics Partners will be able to expand this system in the near future and derive further growth than the acquisition itself has already delivered. However, this potential expansion of the gathering system is not the only benefit that Delek Logistics Partners will derive from this acquisition. In addition to the gathering system, the acquisition also provides the company with a natural gas processing plant that is capable of handling 88 million cubic feet of natural gas per day. While this plant will generate some incremental cash flow for Delek Logistics Partners, it also expands upon the company’s extremely limited presence in the natural gas midstream space. As we will see in just a moment, the fundamentals for natural gas are significantly better than those for crude oil so the fact that Delek Logistics Partners is expanding its presence in this area could prove beneficial. As already mentioned, Delek Logistics Partners completed the acquisition in June so it received about a month of cash flow from these operations in the period. However, it will receive cash flow for all three months of the third quarter. Thus, Delek Logistics Partners should display an incremental boost to its financial performance during the third quarter of 2022.

Fundamentals Of Crude Oil And Natural Gas

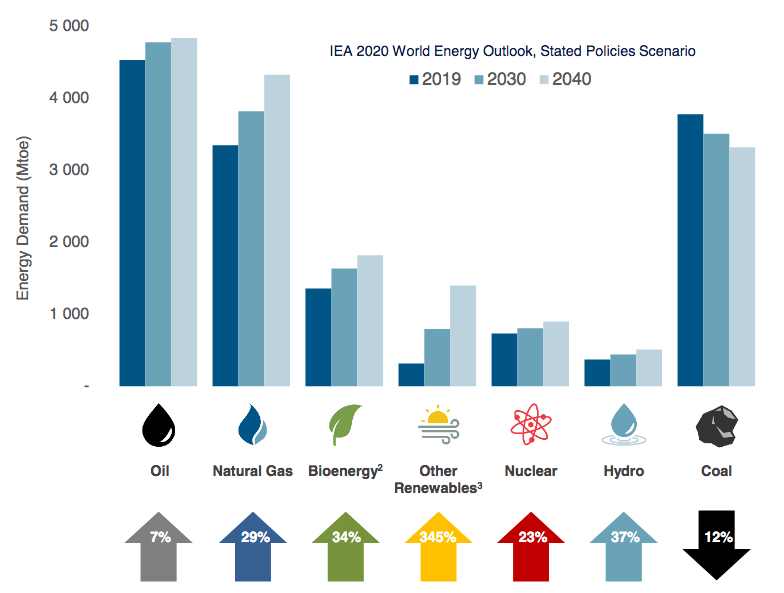

As just stated, the fundamentals for natural gas are better than those for crude oil. This is one reason why the 3Bear acquisition is so beneficial for Delek Logistics Partners since it provides the company with greater exposure to this commodity as opposed to its traditional focus on crude oil and refined products. With that said though, the fundamentals for both types of hydrocarbons are quite positive. This is something that may come as a surprise to many readers since there is currently a great deal of effort being devoted to weaning the world off of fossil fuels. However, according to the International Energy Agency, the global demand for crude oil will increase by 7% and the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

The demand for natural gas will be driven by global concerns about climate change. As everyone reading this is no doubt well aware, these concerns have led governments all over the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. A common method that is being used to accomplish this is to encourage utilities to retire old coal-fired power plants and replace them with renewables. However, renewables have one major problem. Namely, these sources of power are not reliable enough to support the needs of modern society on their own. After all, solar power does not work when the sun is not shining and wind turbines do not work if the air is still. The most common solution to this problem is to supplement renewable energy plants with natural gas turbines. This is because natural gas has the reliability to keep the grid operational when renewables cannot and burns cleaner than other fossil fuels, so it serves the purpose of reducing carbon emissions.

The case for crude oil demand growth may be somewhat harder to understand since we are seeing numerous developed nations actively attempting to reduce the use of crude oil within their borders. However, it is a very different story if we look at the various emerging nations around the world. These countries are expected to see tremendous economic growth over the projection period. This growth will have the effect of lifting the citizens of those countries out of poverty and putting them firmly into the middle class. These newly middle-class people will begin to desire a lifestyle that is closer to what their counterparts in the Western nations enjoy than what they have now. This will require increased energy consumption, including energy derived from crude oil. As the populations of these nations are substantially larger than the populations of the world’s developed nations, the growing consumption here will more than offset the stagnant-to-declining demand in the developed nations.

Earlier in the article, I stated that upstream producers are likely to grow production as long as prices remain high. Fortunately, this is likely to be the case due to the basic laws of economics. This is because production is unlikely to grow as quickly as demand. One reason for this is that the energy industry has been chronically underinvesting in production capacity since the bear market of 2015. That is one reason why the offshore drilling industry never recovered the strength that it once had. This could prove to be a real problem going forward. As Moody’s recently pointed out, the industry must increase upstream spending by 54%, or $542 billion, in order to avoid a supply shock. It is highly unlikely that the industry will actually do this. After all, it is under tremendous pressure from environmental activists and politicians to improve the sustainability of its operations. The sector as a whole has underperformed the broader market over the past decade so investors have also begun to demand improvements in the form of higher returns. We, therefore, have a situation in which demand is likely to grow much more quickly than the supply of hydrocarbons. This is exactly the kind of thing that results in rising prices due to the laws of economics.

Distribution Analysis

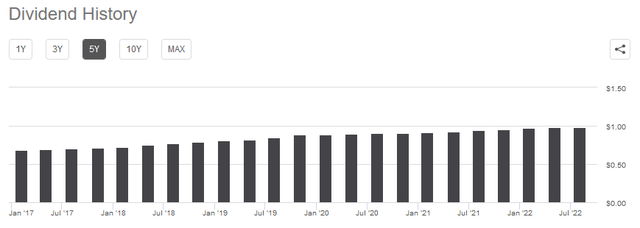

One of the biggest reasons why we invest in midstream companies like Delek Logistics Partners is because of the incredibly high yields that they typically possess. As mentioned earlier, Delek Logistics Partners yields 6.47% at the current unit price, which is substantially higher than the 1.46% yield of the S&P 500 index (SPY). Furthermore, Delek Logistics Partners has a long history of raising its distribution on an annual basis:

This is something that truly sets the company apart from its peers as very few of them have delivered such steady distribution growth. Indeed, many midstream partnerships are currently paying out much less than they did in 2018 and 2019. It is also very nice to see a track record like this during inflationary times, which we are seeing in a very big way today. This is because inflation is steadily decreasing the number of goods and services that we can purchase with the distribution so it can feel as if we are getting poorer and poorer over time. The fact that Delek Logistics Partners pays us more money each year helps to offset this effect and keep our purchasing power relatively steady. As is always the case though, it is critical to ensure that the company can actually afford the distribution that it pays out. After all, we do not want it to suddenly be forced to reverse course and cut the distribution since that would reduce our incomes and almost certainly cause the unit price to decline.

The usual way that we judge a midstream partnership’s ability to pay its distribution is by looking at a metric known as the distributable cash flow. This is a non-GAAP figure that theoretically tells us the amount of money that the company generated through its ordinary operations that is available for distribution to the limited partners. In the second quarter of 2022, Delek Logistics Partners reported a distributable cash flow of $55.562 million, which represents a slight increase over the $53.829 million that it reported in the second quarter of 2021. This was sufficient to cover its distribution 1.30 times over. Admittedly, this is a much lower coverage ratio than that of many of the other midstream companies that we discuss here at Energy Profits in Dividends. However, it is still well above the 1.20x that analysts generally consider to be reasonable and sustainable. It is also sufficient to meet the more conservative 1.30x figure that I typically like to see to be confident in a company’s distribution. Overall, this distribution is probably reasonably safe and is unlikely to be cut but it is not quite as safe as what some peer companies possess.

Conclusion

In conclusion, Delek Logistics Partners is a little-known and little-followed midstream company that may be worth your attention. The company boasts a long track record of profitable growth, which it has used to reward its investors with a long line of distribution increases, and a pipeline for continued growth going forward. The fact that the company has begun to move into the natural gas space could also prove to be a promising development over the next several years. Overall, this company looks like a good way for an investor to earn an attractive 6.47% yield today.

Be the first to comment