cagkansayin

Co-produced with Treading Softly

I’ve long encouraged investors to find income from the basics and necessities of life. It’s important to find sources of income from defensive and durable locations.

We have written previously on generating income from lower risk and self-funding sources. Places like gas stations, large infrastructure projects, and utilities to name a few.

So today we want to visit another extremely defensive idea for income investors.

The grocery store.

Consumer Staples With High Yield

When you go to the grocery store, you’re looking for various food items, seasonings, and cooking oil. All of these components have to be manufactured and produced by someone. So why can’t you get paid by them since you’re paying them?

Look at my latest haul! (B&G Foods)

When you buy Crisco cooking oil, or Weber seasonings, or Green Giant veggies you’re buying various brands that fall under one umbrella.

That company is B&G Foods, Inc. (NYSE:BGS).

BGS is an extremely old company in some regards and a younger one in others. Various BGS products can trace their histories back to 1822. BGS, in its current form, originated in 1996 but did not trade publicly until 2007.

During its 26-year history, BGS has grown via organic sales and rapid acquisitions of new brands. They have completed 24 acquisitions since 1996. This provides them a revenue stream from over 50 brand names you can readily find on grocery store shelves – like Crisco.

Common Equity Doesn’t Interest Us

BGS’s common shares yield an attractive 8.3% at this time, but we’re not interested in them now.

2020 put a ton of pressure on BGS as many expected their dividend to be cut and sales to plummet. However, late in 2020 and through 2021, BGS saw that consumer fears over the economy, COVID, and the growing interest in cooking at home helped buoy their revenue, and the share price recovered.

All along, management stayed confident in their dividend and paid it routinely. There was never a cut or pause in its regular payment.

So why are we sidestepping the common for now? We see two very present risks that reduce our confidence in the near term on their dividend.

Risk #1: Inflation And Rising Costs

Inflation has had a major impact on various sectors, but few have seen prices rise as sharply as consumer staples. BGS is experiencing higher input costs and labor costs while trying to balance raising their prices without losing their share of consumer spending.

Management is aware of this headwind and has been raising prices on their products. These actions have a lag time as expenses rise immediately, while higher prices take time to implement. Their quarterly earnings will drag until price increases start to flow into the top and bottom lines:

Some key perspectives on the quarterly results. Pricing, the price increases effective in the last couple months, Crisco plus 25%, Green Giant plus 8% have been implemented and are yielding benefits, but are just taking effect in the market with the required customer lead times

We see this as a risk as long as inflation remains elevated. Management has to walk the line between raising prices to offset costs but not raising them too rapidly so that consumers move to other options that sit on the shelf next to their offerings.

Risk #2: Increased Leverage Ratios, Decreased Dividend Coverage

BGS has recently announced they are raising their permitted leverage ratio for a short time. This change in their credit agreement allows them to go up to 8x through Sept 2023 and then reduce back down to 7x.

B&G Foods’ maximum consolidated leverage ratio will increase from 7.0X to 1.0X to 7.5X to 1.0X for the quarter ending on July 2, and then to 8.0X to 1.0X for the quarter ending October 1 through the quarter ending September 30, 2023.

The maximum consolidated leverage ratio will decrease to 7.5X to 1.0X for the quarter ending December 30, 2023 before returning to 7.0X to 1.0X for the quarters ending March 30, 2024 and thereafter.

This is a sensible move due to the risks we discussed above. Management received permission to raise their goalposts temporarily as they adjust to the higher costs and get higher prices to consumers. Management did forecast they expect their leverage ratio to peak in Q3 of 2022 and reduce as higher per unit revenues start to flow into their accounts.

The issue here is the common dividend isn’t covered. BGS has paid out a handsome $0.95 while only earning $0.35 per share in the first half of 2022.

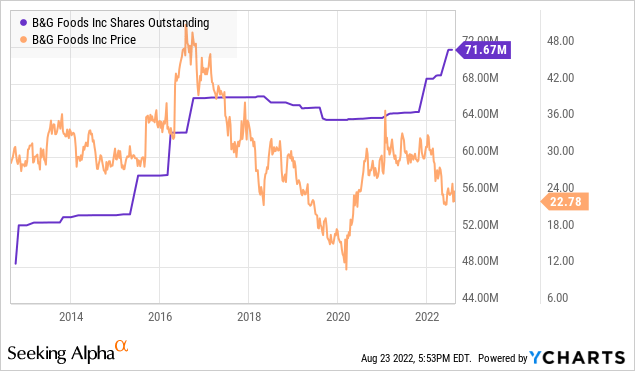

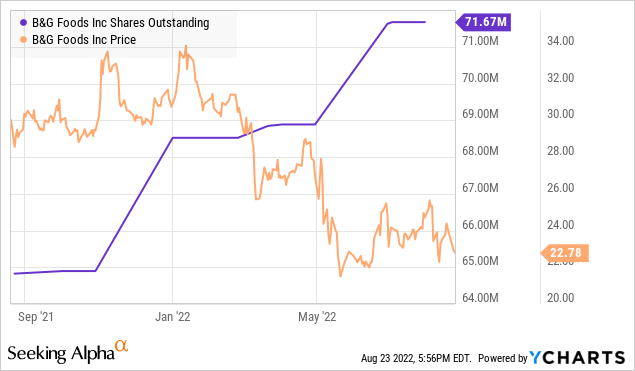

This would be concerning on its own. Add in that BGS is frequently issuing new shares into the market as their yield attracts new investors.

We can see from the chart above that BGS is issuing large swaths of shares into the market even while their share price declines. The burden of their common dividend continues to climb while management tries to balance their leverage ratio. When a company uses this strategy to deleverage, the common shareholders pay the price.

The fastest way to manage debt is to pause or reduce its dividend. Right now, the dividend is attracting new investors and allowing BGS to raise capital through selling shares.

So it appears management will keep the dividend, for now, to attract new capital while waiting for revenue from price increases to arrive. What happens if their cap on the leverage ratio declines faster than they are ready for? Goodbye common dividend.

For these reasons, we are sidestepping the common shares entirely, there is a high degree of execution risk, and while we think management can thread the needle effectively, we want safe and defensive income. The common has a high yield, but it is hard to see it as “safe.”

When we look higher up the capital stack, we do see something that we like.

It Pays to Be A Bondholder

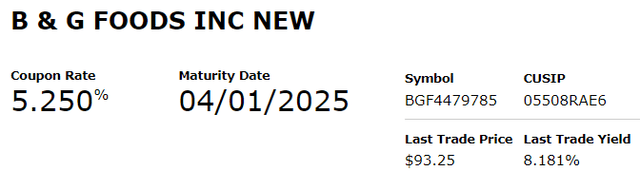

While BGS common is risky, BGS does offer an attractive bond buying opportunity. We particularly like their bond maturing in 2025, CUSIP 05508RAE6.

This bond has a yield to maturity of 8%.

BGS also offers a 2027 bond with a similar yield to maturity. We like the closer maturity date, as it must be paid in full before the 2027s can be tackled. We want to be first in line to get paid and redeemed.

So why the bonds over the common? As many astute investors know, bonds must be paid before any common dividends go out the door. Dividends are optional. Interest payments on bonds are not. Furthermore, the bond’s yield is only 20 basis points lower than the common shares without the massive headwinds the common dividend faces.

The risks to the common outlined above are beneficial for bondholders in several ways. The bond’s interest is currently covered 1.46x by operating revenue in the first half of 2022. EBITDA covers interest 2.24x in the first half. This is lower than ideal and likely part of the reason the bonds trade below par. However, this coverage will improve as higher product pricing flows into BGS.

While BGS’s management has been historically on the side of maintaining the dividend even in hard times, a debt ratio ceiling is something no management team should play a game of chicken with. At $133 million/year, the dividends alone are higher than their annual interest payments. Providing a safety cushion that BGS could access in an emergency to pay down debt and deleverage.

This situation is similar to when High Dividend Opportunities sidestepped the uncovered high yield dividend of Antero Midstream (AM) in the past and opted for their highly attractive bonds. We profited nicely from them and were able to roll those profits into AM common shares after the risks abated, and the common dividend was cut, as we expected.

While we do not necessarily expect a common dividend cut from BGS, we see it as a risky bet for 8.3% when we have other higher-yielding and covered options. Thus, the safer and lower-risk bonds are attractive, but we would avoid the common shares.

Conclusion

I might be in the minority, but I like grocery shopping to pick out my goods. I enjoy seeing the options and occasionally completely changing my meal plan based on the sales and ideas that I see available.

When I hit the gas station for fuel and go to the grocery store, I get paid for both stops. I own the gas pump. I own brands on the shelves that we all love and enjoy.

You can as well. By taking time to evaluate BGS common and bonds, we can see that while the common is a high-risk option, the bonds are actually set to see stronger coverage and lowered risk as BGS takes steps to raise prices and adjust to new costs.

We can enjoy a defensive investment in a sector that consumers need to buy – food.

I am constantly looking for lower-risk and high-yielding investments and opportunities in my retirement planning. I am constantly researching the companies behind products I use on a regular basis, and if their common shares are not attractive, I climb higher to see if the higher fruit is better than the low-hanging ones.

This is a valuable process that has led to many of my investments in the past. That’s the beauty of income investing, getting paid by everything around me. When I go out or stay in, I am generating income. You can as well. BGS’s bond offerings are one way to do so.

Be the first to comment