onurdongel

Delek Logistics Partners, LP (NYSE:DKL) “owns and operates logistics and marketing assets for crude oil, and intermediate and refined products in the United States.” The midstream partnership competes in three segments: Pipelines and Transportation, Wholesale Marketing and Terminalling, and Investment in Pipeline Joint Ventures.

The company flies under the radar of most investors, but it is among the few companies in the midstream market that pays out a consistent distribution at a significant yield.

After reaching a 52-week high of $64.46 on September 2, 2022, the share price has pulled back to approximately $50.00 per share, resulting in a yield of just under 8 percent. In this article we’ll look at the various elements of its business model, some of its recent numbers from its earnings report, and how it is positioned for long-term growth.

TradingView

The business model of DKL

There are several things included in DKL’s business model that are very attractive in my opinion. The first has to do with the length of contracts the company works out with its customers; they are from five to fifteen years in duration, which protects if from price fluctuations under various economic conditions.

The benefit of this is it provides consistent cash flow no matter how strong or weak the general economy is at any one time.

Another positive part of the contracts is that its customers pay the company not on price, but on the volume of resources the company is handling on their behalf. So not only does the company mitigate the rise in the broader economy, it also reduces risk associated with prices of the product it is transporting or storing for them.

Last, there is a minimum amount of volume its customers must commit to during the period of the contract, and whether they move it through DKL or not, they must pay for the volume. This provides support for the underlying performance of the company, resulting in stability in its results.

I like the business model of DKL, and as the company invests in more infrastructure it should continue to deliver solid results to investors.

While it’s unlikely the company will return to the growth trajectory it has enjoyed over the last couple of years, when it jumped from about $38.00 per share as of August 16, 2021, to its 52-week high of $64.46 per share on August 29, 2022, which would place it in the growth and income category, I believe it still has a lot of room left to grow as it adds to its infrastructure.

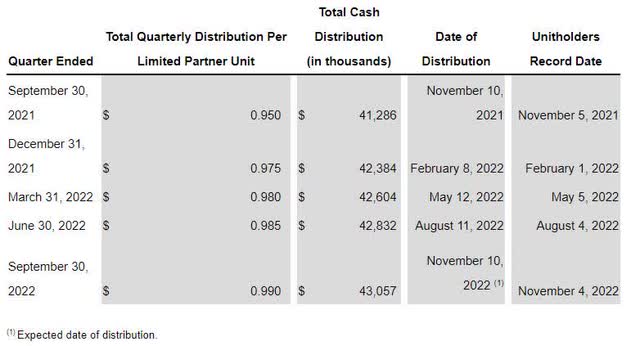

Over time it’ll provide more growth, but I see it primarily as an income vehicle going forward. In that regard, the company is a compelling holding, as it has increased its distribution for 39 quarters in a row and is likely to continue to do so in the quarters and years ahead.

Here are some of the company’s recent distributions.

Company 10-Q

Some of the numbers

Since increasing its infrastructure over time is the key to its ability to continue to maintain a consistently high yield, we’ll look at the financials.

At the end of the third quarter DKL had $193 million in available capacity under its $1 billion credit facility, while holding debt of $1.45 billion. As of October, it extended its facility by $1.2 billion “including senior secured revolving commitment of $900 million with a maturity date on October 27 and a new secured term loan of $300 million with a maturity date in October 24.”

This will provide more than enough capital to invest in building more infrastructure or acquiring it.

After adjusting for its acquisition of 3 Bear, the company has distributable cash flow of about $70 million, up from the distributable cash flow of $56 million in the third quarter of 2021.

Of the three segments it operates in, Pipelines and Transportation accounted for a margin contribution of $54 million, up from the $47.4 million in the third quarter of 2021. The improvement was attributed to “annual tariff escalations” on its pipelines and “strong refinery utilization rates at the Delek U.S. refineries.”

Its Wholesale Marketing and Terminalling segment contributed margin of $18.3 million in the reporting period, down from the $19.6 million in the third quarter of 2021. Lower margins from higher operating costs were the reason for the lower contribution.

Last, its Pipeline Joint Ventures segment generated a contribution margin of $8.6 million compared to $47.3 million in the third quarter of 2021. An increase in volume at Red River and Caddo joint ventures were the contributing factors there.

Conclusion

Delek Logistics Partners has been a consistent performer for a number of years that keeps on raising its distribution from quarter-to-quarter, pointing to the fact the company has the ability to identify where and what to build, or where and what to buy to build out its infrastructure in a way that provides increasing distribution yields.

There’s nothing I can see that would suggest the company is going to experience any type of disruption to its business model, which means it is highly likely to continue to increase its distribution in the quarters and years ahead, based upon its past expertise in successfully increasing its infrastructure organically or via acquisitions.

With a solid yield of approximately 8 percent at this time, and the ability to add to its current annual rate of $3.96, this midstream company is definitely worth taking a close look at.

Be the first to comment