Nicholas Smith

Investment Thesis

Although Deere (NYSE:DE) prices have dropped significantly from their highs, the stock still has downside risk. Deere is a strong player in the agricultural and construction equipment market, but the macroeconomic agenda looks like a strong headwind for the company. The markets are very sensitive to the state of the economy, so even the company’s leadership and high pricing power have limited potential. We recommend refraining from investing in Deere at current prices and waiting for a more attractive entry point.

Deere’s sales market is under threat

John Deere is the world largest manufacturer of agricultural equipment and major player in the construction and forestry equipment sector. Although the US remains the largest market, Deere operates in virtually every country.

The key audience of Deere’s the farm equipment segment is agricultural households, so the company’s future profit is largely dependent on farmers’ well-being. When deciding whether to buy or upgrade the equipment, farmers are typically guided by their current income, crop yields expectations and prices in the following periods.

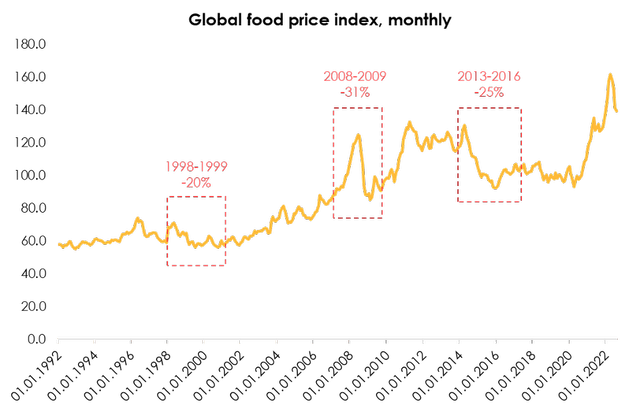

Skyrocketing food prices have benefited the agricultural industry in 2022. Despite strong increase in the fertilizers price and other production costs, food price increases fueled by resource shortages significantly exceeded the PPI.

Nevertheless, food prices have fallen precipitously for the 6th month in a row, and the recession has not yet begun. Historically, cycles of food price declines during periods of deteriorating economic activity have been protracted and abrupt, according to IMF.

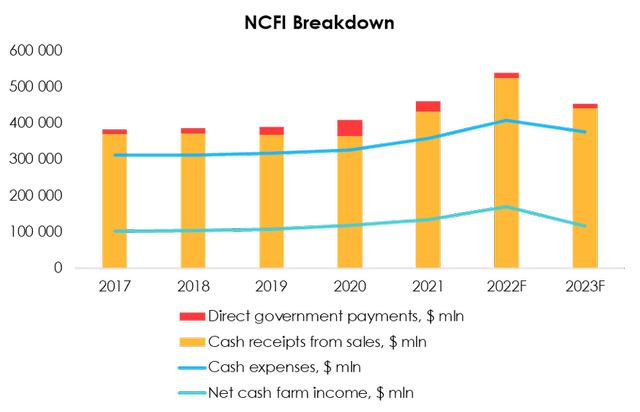

We use NCFI (Net Cash Farm Income) as the defining measure to forecast Deere’s financial performance in the agricultural equipment segment. While NCFI remains high given 1H 2022 situation, we expect a strong profit decline in the US market next year. Overall producer inflation remains highly elevated relative to historical levels (rising wages and intermediate production), and food prices are prone to a big drop.

Meanwhile, the government subsidies have declined strongly relative to 2020-2021, which is an additional headwind for farmers. The cycle of rising interest rates is greatly increasing the cost of financing, so leasing or buying vehicles on credit is also increasingly expensive. With tightening credit and shrinking profit margin, debt service is becoming increasingly burdensome for households.

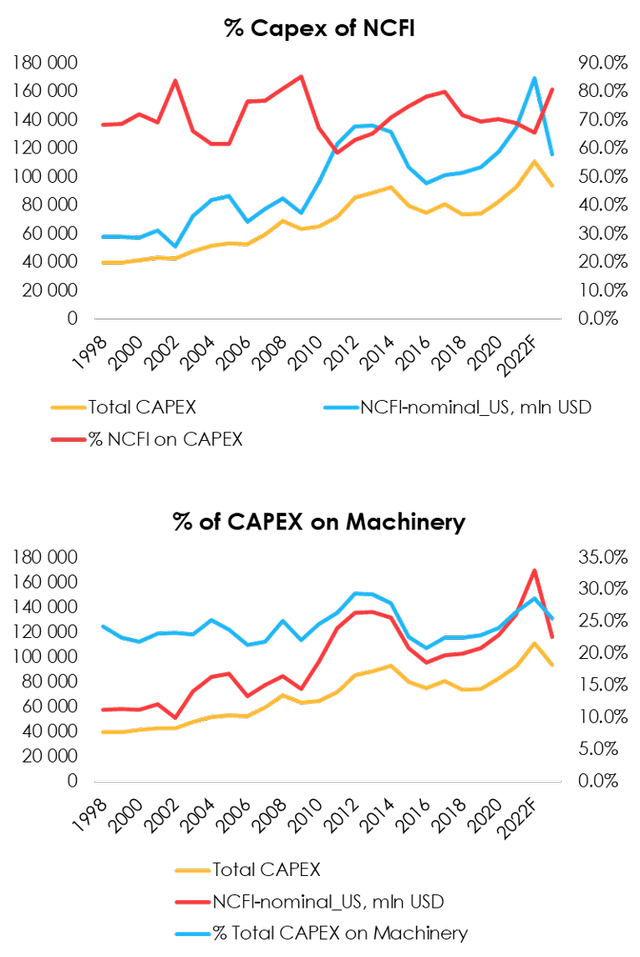

Although total capital investment of farmers (as % of the NCFI) tended to decline in high-yield years, the CAPEX share of machinery increased. We attribute this to the relative cost of investment, as purchases of equipment, tools, etc. are constant and require permanent maintenance, while purchase of expensive tractors and combines requires careful planning and certain optimism.

A glance on Q3 earnings – still fine, but the perspectives are turbid

Deere 2022 reports still look good. The company’s revenue is growing at double-digit rates and profit margin remains high, but there are some alarming signs.

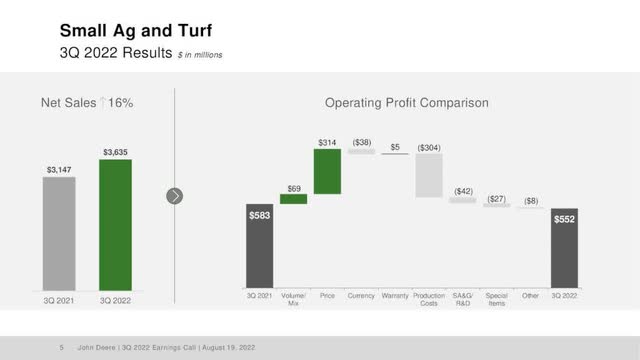

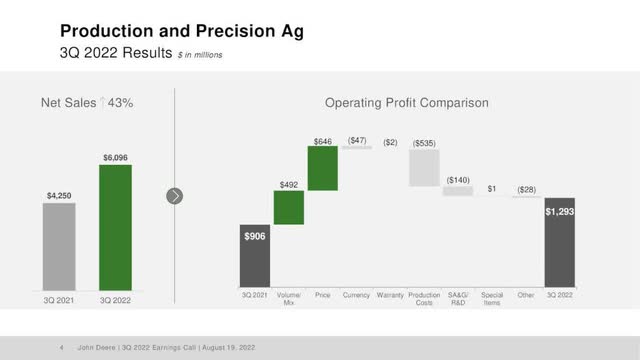

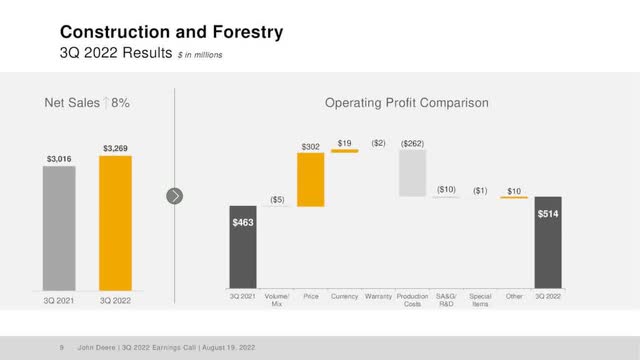

Company data Company data Company data

In almost all segments, product price appreciation remains the main driver of net sales. Volume and product mix make minor contribution to overall revenue growth. By working with small businesses, Deere remains flexible in pricing, but demand for equipment is more dependent on global factors rather than Deere’s marketability.

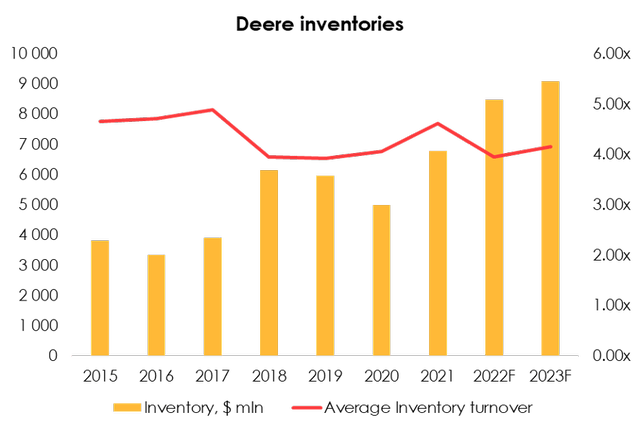

In terms of free cash flow, Deere, like many other companies, has significantly boosted inventories over the past year, due to both strong product cost increases and large sales cycle caused by lower demand. In the first 3 quarters of 2022, Deere generated only $418 mln in operating cash flow as working capital investments totaled $5 830 mln. Given the historical seasonality we expect Deere to sell a substantial part of inventory in Q4, but strong working capital growth is a worrisome factor. We estimate operating cash flow in fiscal 2022 to be $5 075 mln (management guidance is $5 – 5.5 mln), but even so, year-end inventories will remain severely overvalued compared to the historical levels.

Although Deere’s Income Statement looks good, we are somewhat uncertain about the company’s near-term financial results. The economy has not yet fallen into recession, so we think the main challenges lie ahead. It shall be either a drop in product demand or declining profitability, as Deere will have to sell its high-priced 2022 products at a discount.

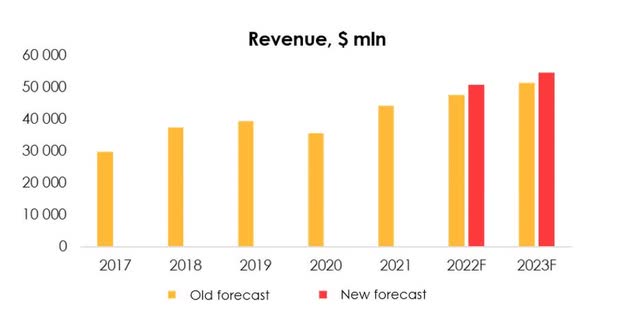

We expect the company’s revenue to total $50 659 mln in fiscal 2022 and $54 564 mln in 2023, but this will largely be driven by higher product prices (including Construction & Forestry segment, where Deere’s financial results are more secure due to work with the big players on contracts).

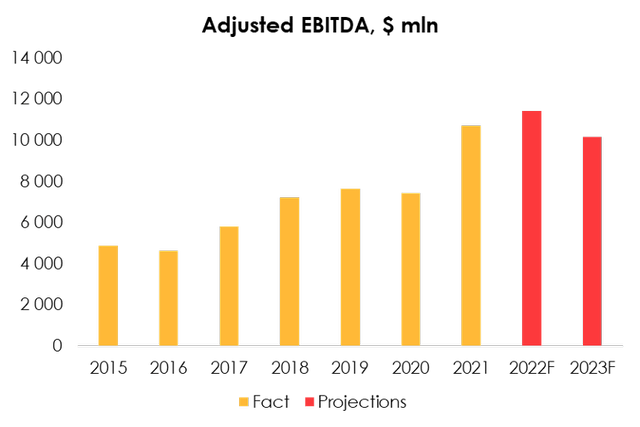

In the meantime, however, we expect a slight decline in the company’s EBITDA in 2022, due to ongoing increase in production prices and wages, as well as a gradual decrease in the company’s marginal pricing power.

DE stock valuation

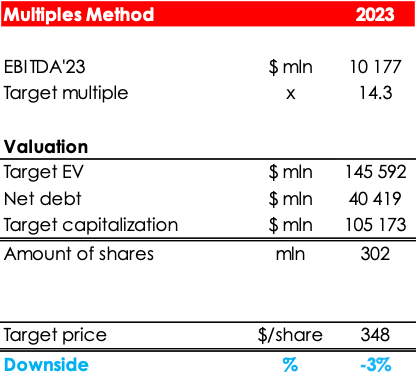

The fair value of Deere stock is $328 per share. The valuation includes 2023 EBITDA and FCF forecasts to determine the net debt, dividend payments and share buybacks. Given the current economy difficulties, we expect Deere to be conservative in terms of shareholder incentives, so the company will not boost the dividend payment much next year. The valuation is based on discounted financial results at the rate of 13%.

Invest Heroes

Based on the new assumptions, we give Deere a HOLD rating. Downside – 3%.

Conclusion

Macroeconomic challenges affect the corporate sector in different ways. Many companies are moving steadily through the current economic slowdown cycle, Deere is one of them – all recent reports look good at first glance. However, we believe the hardest part is yet to come. While Industrials sector remains a good choice to buy in times of recession, key sales markets of Deere are strongly influenced by the overall state of the economy and commodity prices.

We believe that buying Deere stock at current prices is not reasonable. There is uncertainty about the company’s future financial results, and the downside risks remain.

To manage the position, we recommend keeping an eye on Deere’s financial statements, macroeconomic indicators (FAO, USDA) and industry surveys.

Be the first to comment