DmyTo/iStock via Getty Images

If it hadn’t been for the fear of humiliating myself before such a grand assembly, I would willingly have fallen at the feet of this generous gambler, to thank him for his unheard of munificence. But little by little, after I left him, incurable mistrust returned to my breast. I no longer dared to believe in such prodigious good fortune, and, as I went to bed, saying my prayers out of the remnants of imbecilic habit, I said, half-asleep: “My God! Lord, my God! Please make the devil keep his word! “Charles Baudelaire, French poet, “Le Joueur généreux,” pub. February 7, 1864

Watching with interest the FTX saga unfolding as a very large Ponzi scheme, which will no doubt have great ramifications, when it came to choosing our title analogy we reminded ourselves of the concept of “Deceptology” which explores the extraordinary brain functions that allow us to be fooled by “magicians” (central bankers) or “con artists” (some crypto gurus as of late). “Deceptology” is an emerging field in neuroscience that seeks to understand in neurological terms why our brains are fooled by “magic tricks”. For those who have been following us for many years, “Deceptology” has been a veiled recurring theme in our musings. In September 2014 after all we used the following derived quote in our conversation “Simpathy for the Devil”:

“The greatest trick European central bankers ever pulled was to convince the world that default risk didn’t exist” – Macronomics, 2014

This is why on many occasions we indicated that central bankers “Jedi tricks” did not work on us.

The seminal work from Baudelaire also inspired the scenarists of the great 1995 movie The Usual Suspects:

“The greatest trick the devil ever pulled was to convince the world he didn’t exist” – Roger “Verbal” Kint- The Usual Suspects

In a 1995 interview with Rolling Stone, Mick Jagger said:

“I think that was taken from an old idea of Baudelaire’s, I think, but I could be wrong. Sometimes when I look at my Baudelaire books, I can’t see it in there. But it was an idea I got from French writing. And I just took a couple of lines and expanded on it. I wrote it as sort of like a Bob Dylan song.”

Mick Jagger wasn’t wrong. As one knows, the “Devil is in the details” and if he had taken a closer look to his Baudelaire books he would have noticed that his inspiration indeed came from there (maybe he was deceived?) but we ramble again.

Returning to our subject of “Deceptology“, we also need to remind ourselves of Hyman Minsky theory in the sense that Minsky defines three approaches to financing firms may choose, according to their tolerance of risk. They are hedge finance, speculative finance, and Ponzi finance. Ponzi finance leads to the most fragility.

- for hedge finance, income flows are expected to meet financial obligations in every period, including both the principal and the interest on loans.

- for speculative finance, a firm must roll over debt because income flows are expected to only cover interest costs. None of the principal is paid off.

- for Ponzi finance, expected income flows will not even cover interest cost, so the firm must borrow more or sell off assets simply to service its debt. The hope is that either the market value of assets or income will rise enough to pay off interest and principal.

“Financial fragility levels move together with the business cycle. After a recession, firms have lost much financing and choose only hedge, the safest. As the economy grows and expected profits rise, firms tend to believe that they can allow themselves to take on speculative financing. In this case, they know that profits will not cover all the interest all the time. Firms, however, believe that profits will rise and the loans will eventually be repaid without much trouble. More loans lead to more investment, and the economy grows further. Then lenders also start believing that they will get back all the money they lend. Therefore, they are ready to lend to firms without full guarantees of success. Lenders know that such firms will have problems repaying. Still, they believe these firms will refinance from elsewhere as their expected profits rise. This is Ponzi financing. » – source Wikipedia

As such “Deceptology” works indeed quite well at the end of the “business cycle”. If one looks at the list of “Ponzi” schemes uncovered throughout the years, one can notice in the linked list that, there were plenty that unfolded around the Great Financial Crisis (GFC). In the case of FTX, it seems to us that many crypto exchanges are indeed facing a “Minsky” moment.

On a side note, one of our favorite books of all time is “The Great Gatsby” by Francis Scott Fitzgerald because it is an epitome of “Deceptology” and the fading “American dream” as described on deceptology.com:

“What defines the American Dream is not how much money an individual has or how powerful he or she is. The common misconception is that money and fame can buy or illicit happiness, but as Fitzgerald demonstrates, it is not possible. When dreams are centered on vices such as greed and narcissism, the world as a whole suffers.” – deceptology.com

What we think is very important in the “Deceptology” principle is the core difference between “explicit” and “implicit” guarantees as we wrote back in 2014:

« Investors have indeed Sympathy for the Devil we think, as they continue to pile up with much abandon and more and more getting “carried away” in their insatiable hunt for yield. In that sense Baudelaire’s 1869 poem rings eerily familiar with the current investment situation in the sense that investors have been giving our “Generous Gambler” the benefit of the doubt (OMT – and now full blown QE) and shown their sympathy and their blind beliefs in “implicit” guarantees, rather than “explicit” (such as the German Constitution as we argued in various conversations) » – Macronomics 2014

We quoted Dr Jochen Felsenheimer in our conversation “The Unbearable Lightness of Credit” in August 2012, let us do it again for the purpose of the demonstration:

“The advantage of explicit guarantees is that the market can value them and that the guarantee can be taken up – even in a crisis! For this reason, we can quote the “last man standing” at this point, the president of the German Federal Constitutional Court, Andreas Vosskuhle: “The constitution also applies during the crisis”. That is a hard guarantee, both for politicians and for investors!”

We will not discuss the issue of implicit guarantees and explicit guarantees from a credit valuation point of view as we have already approached this subject about “capital structure” and the “quality of the collateral”. The great “Deception” politicians have been pulling has been selling “entitlements” based on “implicit” guarantees rather than “explicit” ones. Let us explain, the developed world is “awashed” in unfunded liabilities, therefore “it may be funded” has for so many people clinging to their “pension benefits” has become “it is funded”. The “woozle effect” in that case is that many think that what is in reality clearly “unfunded” is “funded”. And of course, it isn’t (a woozle, occurs when frequent citation of previous publications that lack evidence misleads individuals, groups and the public into thinking or believing there is evidence, and nonfacts become urban myths and factoids).

In continuation to our previous conversations where we warned about the potential for “risk reversal”, we were not that surprised about the outcome following the US CPI print being lower than expected (7.7%) and the rally that ensued. It is a classical pattern of strong rallies that can happen during a “bear market”. In this conversation, we would continue to look for what appears to us to be “attractive” from a “principle of scarcity” perspective as well as our thoughts on the stage of the current credit cycle following the latest publication of the Fed’s quarterly Senior Loan Officer Opinion Survey (SLOOs).

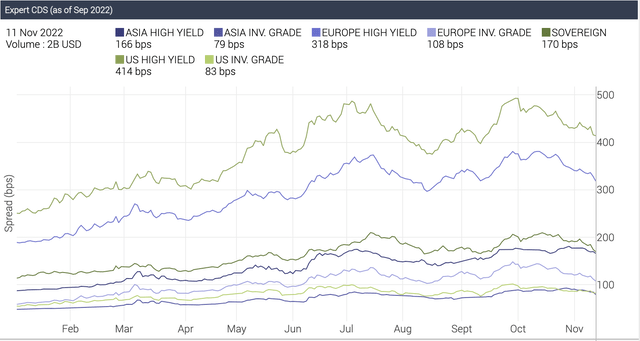

While overall global CDS 5 years YTD indices have continued to rally on better than expected US CPI (7.7%) we continue to believe it is way too early to expect the Fed to change its hiking narrative:

We have seen a tightening in CDS indices since our last conversation (from 434 bps to 414 for US High Yield vs 338 bps to 318 bps in European names). We still expect an acceleration in the widening in European credit vs US in upcoming quarters as Economic data deteriorates further. October gains were significant most interestingly in the synthetic space has indicated by the tightening of European High Yield proxy CDS index Itraxx Crossover down from 600 bps to 484 bps:

“No fear in iTraxx XO and Equity markets. This means only one thing. Issuers will go on a binge and sell as much debt as they can this week. We are already seeing this with Hungary, National Bank of Greece and numerous other Corporates. » – Heard on the Trading Floor

Itraxx Crossover (Heard on the Trading Floor – Twitter)

Why the rally in credit markets?

As we posited in our previous conversation the bear market rally in credit markets was depending entirely on bond volatility receding as per below YTD MOVE index:

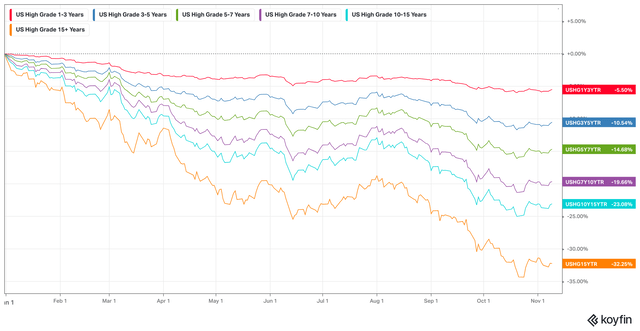

Bond volatility falling is much more supportive of credit markets. Most of them were already badly mauled by “convexity” throughout the year particularly in “US Investment Grade” relative to US High Yield.

US IG by tenor (Macronomics – KOYFIN)

Already many financial pundits are pointing towards the potential attractiveness in some credit market segments. At this stage, we think we have to wait and see a continuation in the fall in bond volatility. Risk Parity and leveraged players do not like bond volatility. No wonder that the 60/40 portfolio this year lost 15% on par with a 1937 performance.

As such credit markets being leading indicators, we do think the rally in equities markets could continue while no doubt we see deterioration on the horizon, particularly in Europe due to energy woes and poor macroeconomic data.

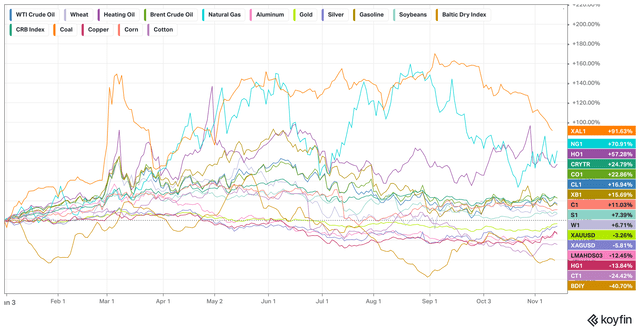

As we posited in our previous conversation, with a potential re-opening of China on the cards, we continue to view very positively commodities play:

“We find that traded commodities have historically performed best during high and rising inflation. In aggregate, they have a perfect track record of generating positive real returns during our eight US regimes, averaging an annualized +14% real return.” (Man Group) (h/t @wifeyalpha)

This ties up as well nicely to our previous conversation relating to the “scarcity principle”:

Commodities YTD (Macronomics KOYFIN)

As we stated in our previous conversation, a China re-opening would be very bullish and we have already seen a significant rally in basic metals such as copper and nickel. We expect more obviously given the global demand dynamics and supply constraints even with “global trade” concerns and economic deceleration. We think Asia and some Latin American countries will fare much better than Europe in that context.

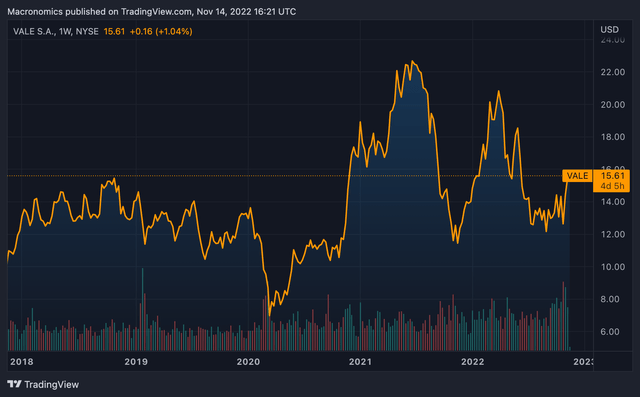

As such we are for instance very positive on Brazilian commodity play VALE (disclosure we are long):

VALE SA (Macronomics – TradingView)

We see it as a good long-term play from a “scarcity principle” point of view on top of a 9% dividend yield. Iron ore could continue to surge provided China eases COVID curbs. You can as well look at BHP and Rio Tinto.

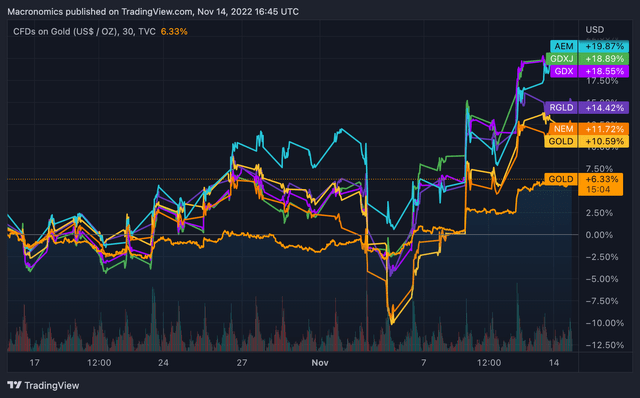

When it comes to the “barbaric relic” aka gold, given that Mack The Knife’s rampage (US dollar + Real Yields) has been becoming less murderous following the “risk reversal” on a weaker than expected US CPI, we have become much more positive on gold in general and gold miners in particular:

Gold and Gold Miners 1 month (Macronomics – TradingView)

Over one month, we have seen a “break out” on a few names which have been battered during most of the year thanks to “Gibson Paradox” playing out. As such no wonder Junior Gold Miners have been more sensitive to the recent bounce in gold prices. Lower yields and lower US dollar have been helping in the ongoing reversal.

In our last conversation we advised you to use risk reversal option strategies to hedge your bets and profit in the event of an unexpected rally which we had following the US CPI print “miss”. Though it doesn’t mean that markets are going to be less volatile going forward. Monitoring bond volatility is essential we think as well as next US CPI print.

- Where are we in the Credit Cycle?

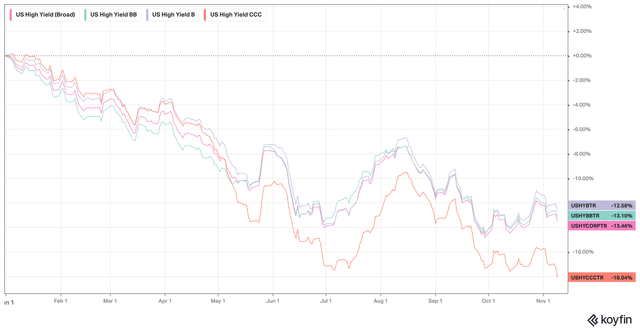

As financial conditions continue to tighten, there is a growing dispersion between not only issuers but also within the rating spectrum as it can be seen YTD relating to US High Yield where CCCs rated are underperforming more and more BBs and single Bs as the Fed tighten the “credit noose”

US High Yield YTD (Macronomics – KOYFIN)

How do we know financial conditions are tightening?

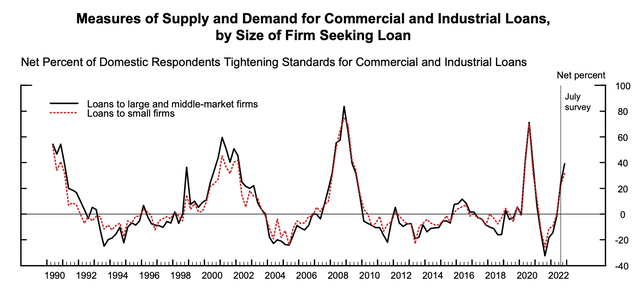

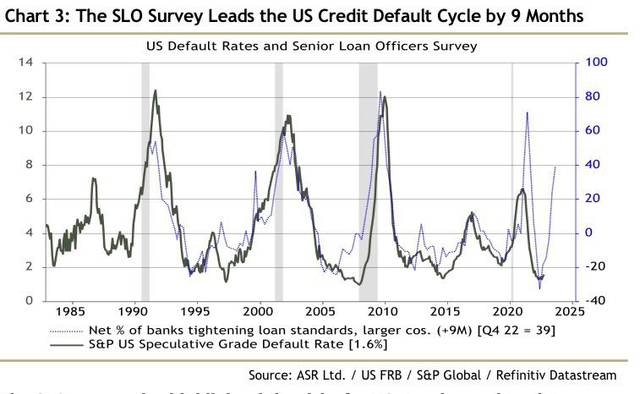

For cues on financial conditions we monitor closely the Fed’s quarterly Senior Loan Officer Opinion Survey (SLOOs). The most predictive variable for default rates remains credit availability and if credit availability in US dollar terms vanishes, it could portend surging defaults down the line. As such the latest Fed SLOOs clearly indicates a tightening overall in financial conditions:

“The October 2022 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the third quarter of 2022.

Regarding loans to businesses, survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the third quarter. Meanwhile, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

SLOOs October 2022 (US Federal Reserve)

For loans to households, lending standards tightened or remained basically unchanged across all categories of residential real estate (RRE) loans and demand weakened for all such loans. In addition, banks reported tighter standards and stronger demand for home equity lines of credit (HELOCs). Standards tightened for credit card loans and other consumer loans while standards for auto loans remained unchanged. Meanwhile, demand strengthened for credit card loans, was unchanged for other consumer loans, and weakened for auto loans.” – source Federal Reserve

The quarterly Senior Loan Officer Opinion Surveys (SLOOs) published by the Fed are very important to track. The SLOOs report does a much better job of estimating defaults when they are being driven by a systemic factor, such as a turn in business cycle or an all-encompassing macro event. Tightening in credit standards in conjunction with rate hikes eventually weight on US High Yield and credit availability for weaker rated issuers such as CCCs issuers:

On the economic front we also recently read that about 49% of restaurants were unable to pay their rent in October, up from 36% in September, per Bloomberg last week. On top of that 37% of small businesses, which between them employ almost half of all Americans working in the private sector, were unable to pay their rent in full in October. That’s according to a survey from Boston-based Alignable, a network of seven million small business members. It’s up seven percentage points from last month and is now at the highest pace this year, the survey showed as indicated by Unusual Whales.

We also read with interest David Rosenberg’s comment on our Twitter feed:

“During recessions, University of Michigan consumer sentiment averages 71. During expansions, the average is 88. It’s sub-55 this month, 16 points below the average of all recessions over the past seven decades. What is that again about walking like a duck? The University of Michigan’s index assessing “unfavorable news surrounding tighter credit conditions” was also noteworthy – it’s now up to the highest level since Dec 1980, back when the Fed’s tightening cycle was in the process of peaking – but too late to save the economy from a sharp recession” – David Rosenberg

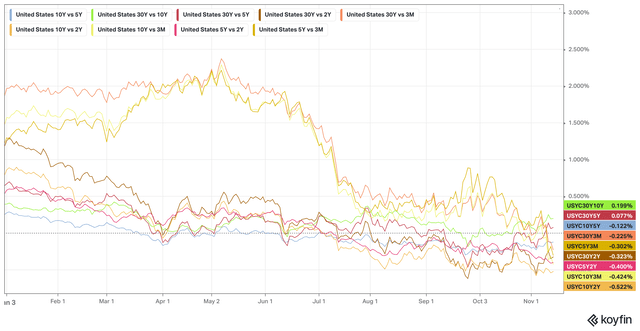

While the Biden administration might not see a recession down the line, the yield curve begs to differ:

US Yield Curve (Macronomics – KOYFIN)

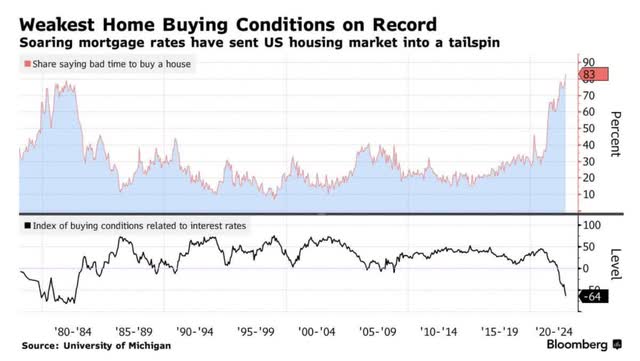

The US yield curve suggests not only recession ahead, but housing has been made less affordable as well (worst on record):

UMich Housing Affordability (Bloomberg – Twitter)

As well the SLOOs clearly indicate that corporates will gradually refinance to higher rates and it might become difficult for some CCCs issuers, not to mention that the fiscal deficit has been expanded due to surging interest payments. Maybe it is a case of “Deceptology” when it comes to the Biden administration assessment of “recession risk”? We wonder…

“The greatest deception men suffer is from their own opinions.” – Leonardo da Vinci

Be the first to comment