Alexyz3d

In a move that was already expected, L3Harris Technologies (NYSE:LHX) has confirmed that it will be acquiring Aerojet Rocketdyne (NYSE:AJRD). In a report published on Seeking Alpha on Sunday, I outlined the potential acquisition and, with the confirmation of the acquisition, I’m revisiting the subject to see what the acquisition means for L3Harris Technologies.

Acquisition Of Aerojet Rocketdyne: No Surprise

That Aerojet Rocketdyne would be acquired does not come as a surprise. Two years ago, Lockheed Martin attempted to acquire the manufacturer of rocket motors, but the deal was ultimately terminated as it was unlikely that Lockheed Martin would gain approval for the transaction. This was driven by the fact that Lockheed Martin is one out of three main customers of Aerojet Rocketdyne and one out of two main defense corporations in the defense field. Had Lockheed Martin (LMT) acquired Aerojet Rocketdyne, Raytheon Technologies (RTN) would depend on a supplier which was owned by the competition, which is hardly a desired scenario for an essential company in rocket and missile production such as Aerojet Rocketdyne.

Following the termination agreement, a proxy battle unfolded between the then-Chairman of Aerojet Rocketdyne and its CEO. I won’t go into detail on that proxy battle, but it seemed that the chairman opposed the combination with Lockheed Martin and hoped for other ways to create value. He envisioned a plan that should boost shares of Aerojet Rocketdyne to $65 which is >15% higher than what Lockheed Martin offered for the company.

In August, I marked shares of Aerojet Rocketdyne a buy on their prospective performance as a standalone business:

…there’s some prospect on favorable adjustments in the second half of the year. That combined with the exposure to hypersonics, Patriot and Space programs where the world is trying to arm against Russian aggression and remove Russian dependency positions Aerojet Rocketdyne in an almost superior space.

Not much later it became clear that Aerojet Rocketdyne was soliciting proposals from takeover candidates which further boosted the attractiveness of the company and, in a December report, I maintained my buy rating recognizing the essential status of Aerojet Rocketdyne in rocket and missile propulsion, the concurrent uptick in space and defense demand, strength in hypersonic weapon system development and the potential of an acquisition.

Today’s announcement that L3Harris Technologies is one that has been in the making for months after the takeover by Lockheed Martin was terminated.

$58 Per Share

When a company is being acquired, the question that investors should ask is whether the acquisition price is good. Aerojet Rocketdyne will be acquired for $4.7 billion or $58 per share. We don’t have a lot of references as to what constitutes a good price for Aerojet Rocketdyne because there’s no major acquisition momentum in aerospace and defense, and Aerojet Rocketdyne is one of its kind. The latter could serve as an indication that a high premium is justified.

Generally, when a company is acquired, I’m looking for the acquisition to be at a 33% premium. Aerojet Rocketdyne is being acquired at a premium of roughly 6%, but what’s reflected in the current price is the anticipated acquisition. Compared to my report from earlier this year, the premium is slightly over 40%. So, in that sense, the $58 per share offer is good.

Last year, in all sectors, the median EBITDA multiple in buyouts was 20.7 up significantly from the 14.2x in the year prior. The consensus estimate for Aerojet Rocketdyne this year is $2.21 billion and $2.32 billion next year. Using the EBITDA margin of 14%, we get to an adjusted EBITDA of $309 million to $325 million. This implies a buyout multiple of 14.5-15.2. A report from Jane’s shows that the 13-quarter transaction multiple was 12.2 and 13.1 for the previous quarter, specifically for the aerospace industry. So, this implies a premium of 10% to 25% to value the essential status of Aerojet Rocketdyne for national security. I believe that overall, this is a good price. It’s lower than the $65 per share that the former executive Chairman promised during the proxy battle, but that forecast was almost certainly driven to receive shareholder votes.

The Value of Aerojet Rocketdyne To L3Harris Technologies

So, the price is right and then the next question becomes why should a company be interested in acquisition in the first place. Especially in the case of Aerojet Rocketdyne this is an interesting question to ask as it also provides an answer to why an acquisition by L3Harris Technologies has a higher chance of being approved than the combination of Aerojet Rocketdyne with Lockheed Martin.

So, I highlighted the concerns regarding a takeover by Lockheed Martin. For L3Harris Technologies, those concerns exist to a far lesser extent. A takeover by Lockheed Martin was a vertical integration that could potentially weaken competitive strength in the defense complex while for L3Harris Technologies this is a diversification move. You could even say this is horizontal integration.

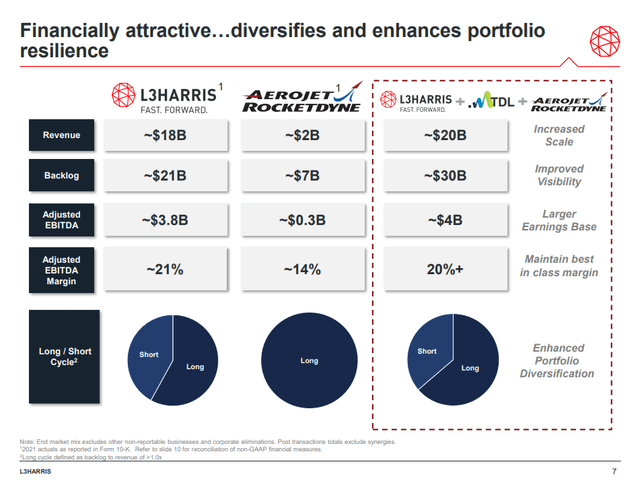

That is also what we see in the headline of one of the slides in the slide deck from L3Harris. With Aerojet Rocketdyne and the recent TDL acquisition, revenues will grow 10% and backlog will even grow by a third with a long-term focus of the backlog while EBITDA will grow by 5%. Admittedly, on cost synergies, we haven’t seen L3Harris putting a number and as it stands now, the acquisition will be negative on the EBITDA margins, but overall Aerojet Rocketdyne should be able to see growth as its Standard Missile production capacity will expand, missile defense demand is up and demand from space is up as well. So, we do expect that what Aerojet Rocketdyne cannot deliver in terms of margins, they will be able to partially compensate for that with topline growth. So, the limited insight in any cost synergies is not a major concern and I believe that, with a higher production capacity going forward, Aerojet Rocketdyne also is positioned to grow its margins. So, in the acquisition, I do see a significant diversification that will see modest sales acceleration in sales growth, a more long cycle oriented backlog and EBITDA growth going forward.

L3Harris To Slow Stock Repurchases

At the time of the writing, LHX stock is down over 3%, and it’s very common to see the stock of the acquiring party tanking after an acquisition announcement because the acquisition is usually financed with debt, which leads to higher interest expenses. L3Harris expects the transaction to be completed in 2023 and as expected will also finance the deal primarily with debt. The reason why shares are down currently is because the company also announced that to sustain its investment grade rating and a targeted leverage of <3.0, it will slow down stock repurchases. So, that obviously is the short-term negative for L3Harris shareholders but should pay off over the longer term.

Conclusion: Aerojet Rocketdyne Is A Gem For L3Harris

I believe that Aerojet Rocketdyne is a gem for L3Harris. The acquisition price is great, because for that price L3Harris is getting itself an essential link in the national security chain with a solid backlog firmly supported by increased demand in missile defense and space exploration. This also is clear when just looking at the backlog as a fraction of the sales. For L3Harris this is slightly over 1.15 while it is 3.5 for Aerojet Rocketdyne. Overall, L3Harris is buying Aerojet Rocketdyne for all the reasons I presented in my reports over the past months explaining why investors should buy Aerojet Rocketdyne.

What remains to follow going forward is how Aerojet Rocketdyne grows in the hypersonics and space field and whether L3Harris will quantify expected cost synergies.

Be the first to comment