anyaberkut/iStock via Getty Images

Aviva (OTCPK:AIVAF) has recently released its most recent quarterly figures, which supported its capital return plans for next year.

As I’ve analyzed in a previous article, Aviva is now a much different company compared to a few years ago, as the company has sold many of its operations and is now focused on three core geographies (U.K, Ireland, and Canada), thus its investment case is currently geared to profitability and income.

As the company has recently released its Q3 2022 trading update, I think now is a good time to revisit its investment case to see if Aviva remains an interesting income play or not.

Recent Earnings

Aviva announced its Q3 2022 trading update on November 9, 2022, which were mixed as the results were good, but the capital ratio was below expectations. Regarding its operations, the company has remained on a positive path, delivering an improvement in profitability during a tough macroeconomic period.

In its life insurance segment, during the first nine months of 2022, sales amounted to £24.9 billion (-1% YoY), with annuities being particularly weak as Aviva remains focused on pricing and this strategy led to £2.9 billion lower sales compared to the same period of last year. Other segments reported growth, with health (+5%) and protection (+3% YoY) being the strongest ones.

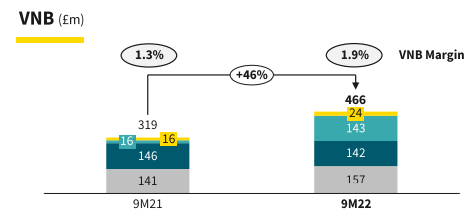

While volumes were slightly down on a yearly basis, Aviva was able to improve its business margins in a considerable way, leading to an increase in value of new business (VNB) to £466 million. This represents an increase of 46% YoY, which is justified by an embedded product offering and better reinsurance terms, which led to a VNB margin of 1.9% compared to 1.3% in the same period of last year. This clearly shows that Aviva’s pricing strategy is now more focused on profitability rather than growth, which seems to be a good approach in the current operating environment.

Value of new business (Aviva)

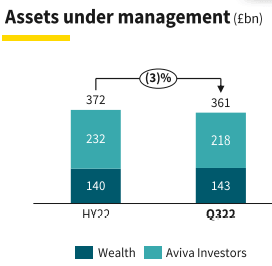

In its wealth segment, as the capital markets have been relatively weak in recent months, it has reported lower net inflows than during the first nine months of 2021, even though the decline was only 4% YoY. Indeed, its wealth net flows amounted to £7 billion in 9M 2022, representing some 6% of assets under management (AuM) at the end of 2021, which can be considered a very good result given that most asset classes have negative returns during 2022. However, where the company has felt more impact of weak capital markets was in its asset management segment, with Aviva Investors reporting a decline of 54% YoY on net inflows, to only £400 million in 9M 2022, but have remained positive which can also be considered positive given the challenging market environment.

Despite these net inflows both on its wealth and asset management segments, due to negative market returns, especially in fixed income assets due to rising bond yields, Aviva’s total AuM was €361 billion at the end of last quarter (-3% YoY).

AuMs (Aviva)

In general insurance, gross written premiums increased by 10% YoY to £7.2 billion in 9M 2022, while the combined ratio deteriorated slightly as insurance claims normalized after the reduction during the pandemic, namely in the auto segment. Its combined ratio was 94.3% in 9M 2022 (vs. 92.4% in 9M 2021), with higher combined ratios across all of its geographies.

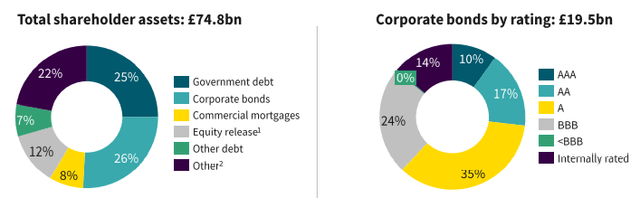

Regarding its asset portfolio, Aviva’s investment policy has remained unchanged in the past few months, despite higher asset volatility, with most of its investments being made in sovereign and corporate bonds. It has low exposure to equities, emerging markets sovereigns, and European peripheral countries, having therefore an asset allocation with a relatively low-risk profile.

Investment portfolio (Aviva)

On the cost side, despite inflationary pressures, Aviva was able to reduce controllable costs by 2% YoY to about £2 billion, reflecting its efforts to reduce operating expenses and improve efficiency. The company is on track to achieve its cost savings target of £750 million be the end of 2024, compared to its baseline costs in 2018.

Moving to capitalization, its Solvency II ratio was 215% at the end of September (pro-forma for further debt reduction after the end of the quarter), which is well above its 180% target, but declined from 234% at the end of June. This lower solvency ratio is explained by the company’s debt reduction measures, acquisition of Succession Wealth in August, and dividend accrual. Moreover, significant volatility in the U.K. sovereign bond market also had some impact in its capital position, and the impact of this volatility was not as expected by its implied sensitivities.

Nevertheless, even during a period of higher volatility than expected, Aviva’s liquidity position remained quite good, showing that the company has a strong business model. Its centre liquidity was £1.9 billion at the end of Q3, still a level that is higher than its medium-term goal.

Its cash remittances, which reflect cash generated by operating units that flow to the holding level, are expected to be above last year’s level (£1.66 billion), which is more than enough to finance its dividend distribution, debt reduction plans, and also perform share buybacks next year.

Indeed, following its £1 billion of debt reduction in recent months, Aviva has now practically completed its deleveraging plans, and now has a comfortable 29% debt leverage ratio, thus it does not need to retain much earnings going forward. Aviva confirmed its plans to start a share buyback program next year when it announces its 2022 full year earnings, expected to be released next March.

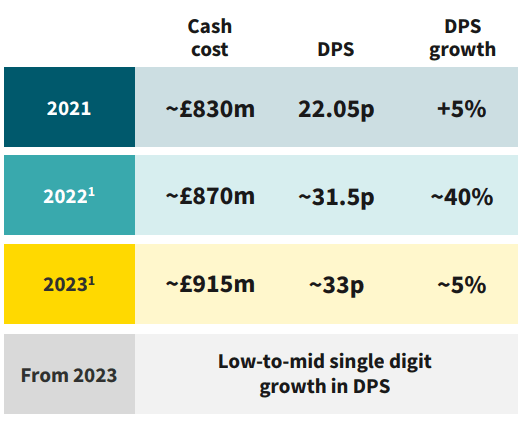

Moreover, its guidance related to its 2022 and 2023 dividend payments remained unchanged, as recent market volatility and impact on capital has not changed significantly its excess capital position and cash buffer at the holding level, enabling it to increase dividend distributions to shareholders over the next two years.

Guidance (Aviva)

As can be seen in the previous graph, Aviva’s annual dividend represents a cash outflow of about £870 million, which is well below its cash remittances of at least £1.6 billion. This means that Aviva’s dividend is well covered by organic cash generation and is therefore sustainable over the long term.

Its total dividend related to 2022 earnings is expected to be £0.315, of which the company already paid an interim dividend of £0.105 in September, and its final payment is expected to be made in May 2023. At its current share price, Aviva offers a forward dividend above 7%, which is quite attractive to income investors.

Moreover, this high-dividend yield is also likely to increase in the coming years, given that Aviva’s dividend guidance is to grow its annual dividend in the next few years, increasing even further its income appeal.

Conclusion

Aviva has delivered positive financial figures in the last quarter despite a challenging operating environment, showing that it has strong business fundamentals. This is strong support for the company’s ambitions regarding its dividend and share buybacks in 2023, which will provide an attractive shareholder remuneration policy. Its shares are still trading below book value, which seems to be undemanding and makes Aviva a great income and value play right now.

Be the first to comment