Godji10

By Marshall Gordon and Nicholas Wu, PhD

Mid-Cap Biotechs Seeing Clinical Breakthroughs

One area of health care that has failed to ride the tailwinds of COVID vaccine development is biotechnology. This innovative subsector has faced headwinds from increasing competition, patent expirations and prescription drug pricing scrutiny, and has underperformed the S&P 500 Index over most of the last five years.

Despite poor sentiment toward biotech, we see reasons for optimism. Recent clinical successes and M&A could bring interest back to the industry, especially among mid capitalization names with derisked or approved products. The drug development process has evolved into two stages. In the first, small and mid-cap biotech companies add significant value through early-stage discovery, research & development (R&D), and in the second, large cap biotech and pharmaceutical companies leverage scale to successfully launch and commercialize approved treatments. These complementary competencies are a key driver of drug development partnerships such as the Pfizer-BioNTech joint venture to scale and commercialize BioNTech’s Comirnaty COVID-19 vaccine, as well as outright acquisitions by larger biopharma companies.

Several recent high-profile announcements of successful clinical trials have helped biotech stocks achieve and hold substantial price gains. First, Alnylam Pharmaceuticals (ALNY) demonstrated a benefit on exercise tolerance and quality of life in their APOLLO-B trial of Onpattro for TTR cardiomyopathy. This opens up a major new market segment to Alnylam and solidifies what has historically been the riskiest portion of the stock’s valuation.

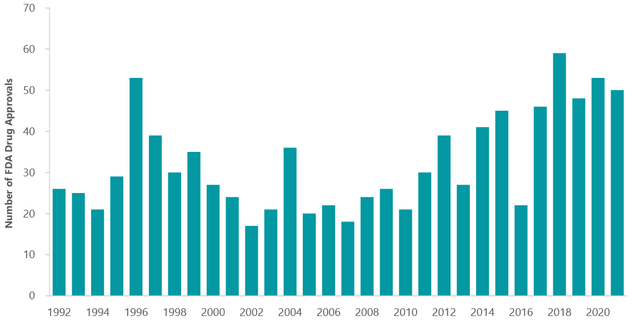

Exhibit 1: Inflection Point in Product Innovation

FDA Approvals By Year (fda.gov)

Secondly, Karuna Therapeutics (KRTX) and Chinese partner Zai Lab (ZLAB) announced that KAR-XT successfully demonstrated strong efficacy on both positive and negative symptoms of schizophrenia with a tolerable profile. KAR-XT is the first drug since the 1950s to offer a new mechanism of action to treat schizophrenia, and it should be a multi-billion-dollar drug at peak.

In October, Merck (MRK) announced positive Phase III data for sotatercept, a proprietary fusion of proteins designed to help treat pulmonary arterial hypertension. Sotatercept was the cornerstone of Merck’s $11 billion acquisition of clinical stage biotech Acceleron last year.

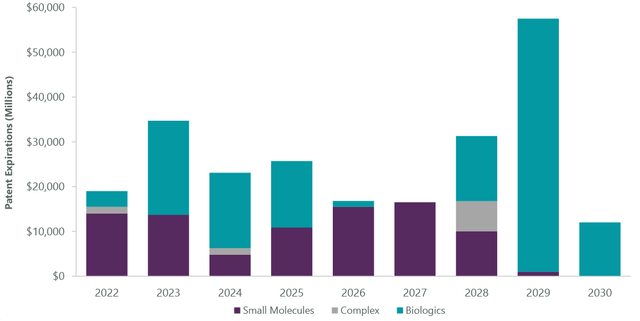

For large-cap therapeutics, the near-term outlook is generally stable, but a substantial wave of patent expirations is looming in the second half of the decade (Exhibit 2), creating increasing urgency for a new innovation cycle. Bringing a new drug to market can cost companies upwards of $2 billion, which includes taking on the risk of a failed clinical trial. In today’s environment, many biopharma companies are willing to pay a premium to acquire a smaller drug developer with a later stage, derisked treatment. Some acquirers are waiting as much as a year into commercial sales to determine if real demand exists for these recently approved for products, as was the case with Pfizer’s (PFE) takeover of migraine treatment developer Biohaven Pharmaceutical.

Exhibit 2: Patent Cliff Approaching

ClearBridge Investments, Company Reports

We saw two multi-billion-dollar acquisition announcements by larger cap companies in the third quarter alone. Amgen (AMGN) will acquire ChemoCentryx for $3.7 billion to access its approved autoimmune drug Tavenos, while Pfizer will acquire Global Blood Therapeutics for $5.4 billion to get its approved drug to treat sickle cell disease, Oxbryta, and follow-on compounds in the same disease area.

Restructuring, corporate activity and COVID-19 revenues have significantly improved the funding positions of many large caps, providing ample dry powder for M&A. Pfizer, for example, has compiled approximately $50 billion in cash from COVID-19 vaccine sales, while European pharmaceutical makers Novartis (NVS), GSK (GSK), and Sanofi (SNY) have increased their war chests by liquidating non-core businesses.

Having an established biopharma franchise behind a new treatment can improve efficiency and its potential addressable market. While a single product sales effort can be uneconomical, leveraging an established sales infrastructure which offers multiple products can provide a greater marketing budget as well as access to hard-to-reach markets like primary care physicians and non-U.S. populations. Such has been the case for Allergan, which has benefited from the larger sales reach of acquirer AbbVie (ABBV) and could see the market for its treatment for bipolar disorder, Vraylar, expand by 3x to 4x.

The industry received more positive news in recent weeks from Biogen (BIIB) and Eisai Pharmaceutical’s announcement that their confirmatory pivotal trial of lecanemab as a disease modifying treatment for Alzheimer’s disease cleanly met its primary and all secondary endpoints. While recent headwinds won’t abate overnight, we believe biotechnology companies should not be overlooked within a larger allocation to health care.

Marshall Gordon and Nicholas Wu, PhD are senior health care analysts at ClearBridge Investments.

Be the first to comment