Ceri Breeze/iStock Editorial via Getty Images

Summary

Veolia Environnement (OTCPK:VEOEY) is a French-based diversified environmental services business whose stock has been hit hard in 2022. VEOEY is off 36% year to date (in US dollar terms through October 31st), as investors weigh the impact of the company’s deal to acquire Suez FP (now closed with some divestitures to come).

Veolia levered up to purchase Suez, and its stock also has been under pressure from a weakening Euro and heightened recession risk in France and Europe.

Veolia Stock Chart (Bloomberg)

Big picture, the company looks like a solid Compounder.

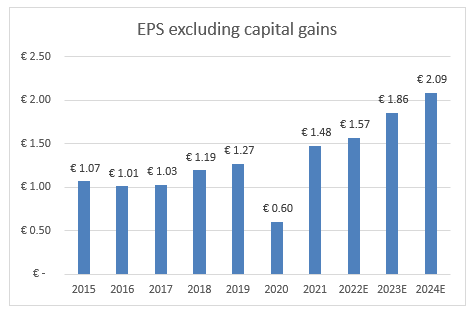

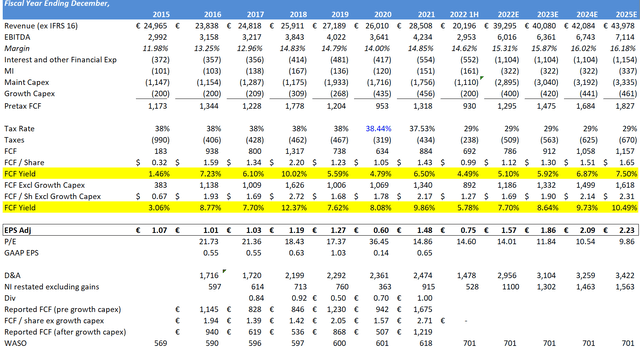

EPS Growth (Author Spreadsheet and Estimates / Co Financials)

- EPS has grown 5.6% to 8.8% annually (depending on which year you start with, 2015 or 2017).

- The dividend yields 4.4% today (3.4% net of withholding for ADR holders).

- The company operates in water, waste and in energy services businesses, all benefiting from environmental secular growth trends.

- The Suez deal also looks attractive if a tad rich on a valuation basis. There are tons of synergies, and the new CEO has her hands full integrating it (e.g. she is new and an unknown, but not likely to rock the boat going forward with another deal).

- The balance sheet is more levered than normal but remains investment grade. The company will likely reduce debt to normal levels within a year.

- The company expects 40% EPS accretion by 2024, which implies just over €2.00 in EPS in 2024. At $22, the stock is at record cheap forward multiple.

- Veolia should be able to grow EBITDA organically by 4-6%, with Suez synergies adding 1-2% to that each year through 2024/2025.

In the very long term, shareholders have not done well owning Veolia. From its 2000 listing until 2010, VIE FP (French ticker) fell from €40 to €10 per share. The starting valuation was bubbly (it was 2000), with the stock trading at a high 20’s multiple on a P/E basis (and 10x EBITDA).

However, today our entry point looks attractive at 6.4x EBITDA and under 12x 2023 earnings (and about 10x 2024 estimates).

Over the past decade, the stock has done extremely well. Veolia is up 15.3% annually in Euro terms and 12.8% in US dollar terms.

From $22, we peg the downside as $15-18 per share with upside to $40+ including dividends in a 3-4 years.

We assume in our bullish scenario that VEOEY trades to just a 16x market multiple on 2025 earnings per share of $2.50 (similar in Euros). That is upside of 95%.

We own a starter position and intend to add more below $20.

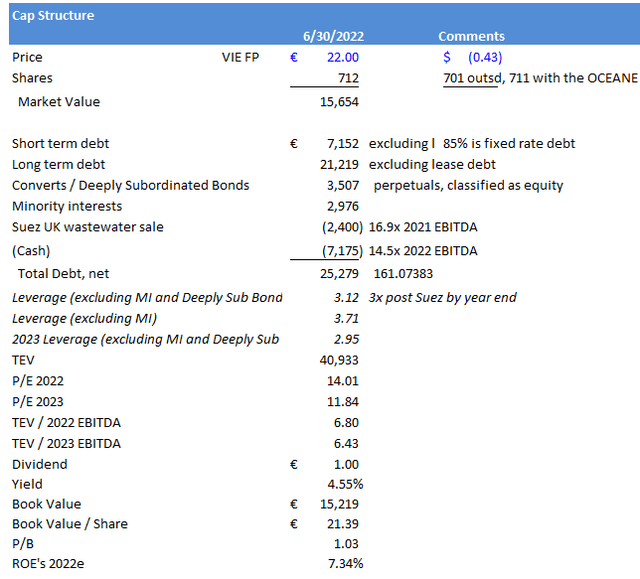

Capitalization

Capitalization Table (Author Spreadsheet / Company financials)

Note: with the Euro now approximately at parity with the dollar, both VEOEY and VIE FP in France trade at similar levels (1 ADR = 1 share).

Veolia is a bit overlevered today but maintains an investment grade credit rating (BBB). Leverage excluding their Deeply Subordinated perpetual bonds is 3.1x after factoring in the Suez UK wastewater sale proceeds.

Including the subordinated bonds, Veolia is 3.7x levered. Guidance is 3x by year end excluding the Suez UK sale/sub bonds. On 2023 estimates, backing out the 160 million of EBITDA from Suez and factoring in growth, we estimate that total leverage will drop to 3.4x. Excluding the perpetual sub bonds, leverage drops to 2.9x next year.

In our leverage math above we didn’t factor in € 800mm of working capital cash flow that the company anticipates flowing back to the company in the back half of 2022. That would reduce leverage by another 0.15 turns.

The dividend yields a healthy 4.4% today and looks well covered (€1.50 in current EPS and a €1.00 dividend).

History

Veolia group was created via the spinoff of the environmental assets of Vivendi. In 1999 Vivendi consolidated several of its subsidiaries including Vivendi Water, Waste (ONYX), Energy Services (Dalkia) and Transport (CONNEX) into Vivendi Environnement. An IPO in Europe was completed in July 2000 on the Paris Stock Exchange, with a listing on the NYSE in the Fall. By 2006, Vivendi had sold 100% of its shares in Vivendi Environnement. The company changed its name to Veolia Environnement, adopting the Veolia brand across all its segments.

The company has been an active acquirer of businesses over time, with the Suez deal closing in early 2022 the biggest to date at €19 billion.

Business

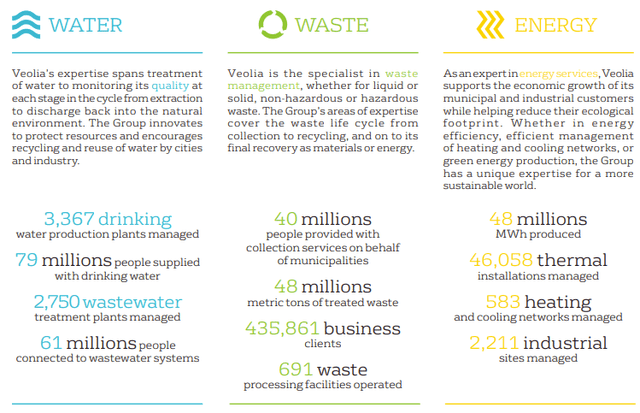

Veolia group focuses on what they call “ecological transformation.” In 2022, with ~220,000 employees globally, Veolia designs and provides solutions for water, waste, and energy management. Through these three business segments, Veolia helps to “develop access to resources, preserve available resources, and replenish them.”

Last year, Veolia supplied 79 million people with drinking water and 61 million people with wastewater service, produced nearly 48 million megawatt hours of energy and treated 48 million metric tons of waste.

Business overview (Annual Report)

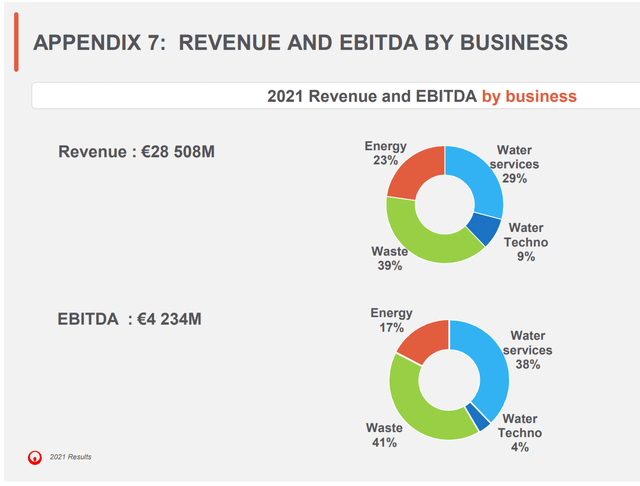

48% of the company’s €28.5 billion in revenue in 2021 was tied to Industrial customers. 52% are municipal customers. As for end markets, Veolia has little exposure to the economic cycle, with only 15% of revenue tied to industrial production.

Goldman research suggests that Environmental Services is a fragmented, $1.4 trillion industry, and that Veolia can grow EBITDA by 7% annually through 2025. There is no doubt that waste treatment, recycling and water services are long term secular growers.

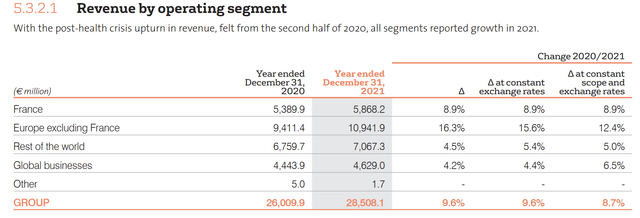

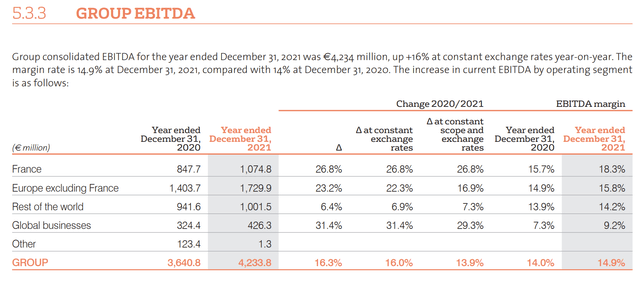

Regionally, France totaled 25% of the company’s EBITDA in 2021. Rest of Europe was 41% with the balance outside of Europe (34%).

Revenue by Segment (Annual Report) Annual EBITDA (Annual Report)

In late January 2022, Veolia completed the acquisition of Suez Group (SEV FP) for €19.85 per share. The revenue breakdown proforma for the Suez deal is 37% waste, 42% water treatment, and 21% energy (Suez was larger in water treatment).

Below are 2021 figures.

Revenue/EBITDA by Segment (Veolia Slides)

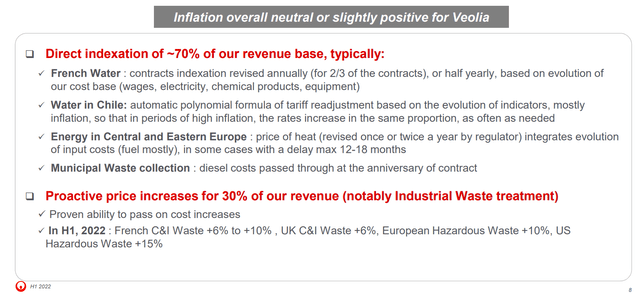

Inflation is a neutral to slight positive for Veolia. 70% of revenue is directly tied to inflation indices. With the other 30%, the company has been able to pass along price increases.

Inflation Impact (Veolia Slides)

The Water segment is broken down into 1) Water Operations, which can be driven by wet or dry conditions. As an example, less water was consumed in 2021 owing to a wet summer. 2) Technology and Construction revenue will grow as municipalities build new buildings/infrastructure (schools for example). This segment is quite stable and recession resistant. In 2021 revenue was up 2.1% (ex-currency). Volumes were up 0.5% proforma and combined EBITDA was flat in the first half of 2022 vs 2021.

This segment is more utility-like, with less cyclicality but also less growth than the other segments that Veolia operate.

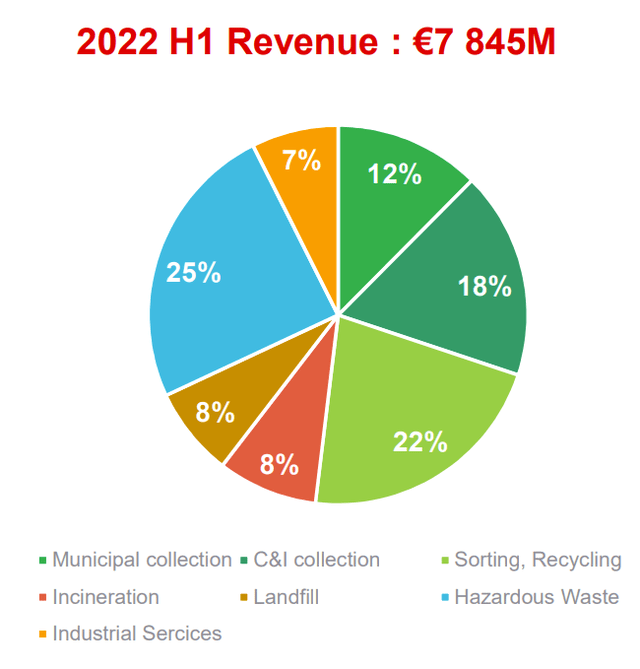

The Waste segment includes a mix of collection, sorting/recycling and incineration/landfill revenue.

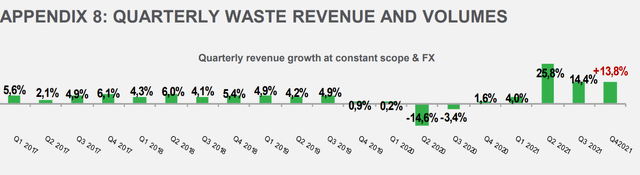

Waste Revenue H1 (Veolia Slides)

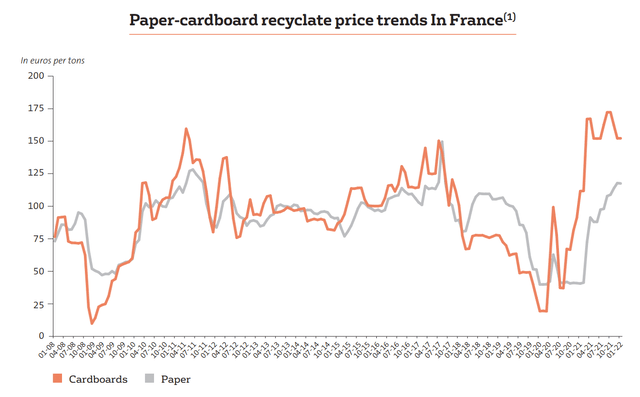

Waste was the fastest growing business in 2021, with revenue up 14% (ex-currency and constant scope). Hazardous waste treatment is a fast-growing business bolstered by the Suez deal. Prices of recycled goods (mostly cardboard and paper) rose in 2021, driving growth in this segment too. Volumes returned to pre-Covid levels in 2021. The long-term chart of recyclate prices looks a tad volatile, but we bet in this market will remain strong.

Recyclate prices (Veolia Slides)

This is the most interesting and valuable business at Veolia. Organic revenue growth has averaged roughly 5% (ex-pandemic noise) annually. US waste management peers trade at 12x 2023 EBITDA (see comps below) given the growth in the industry, not to mention the ESG element as well as the long dated, recurring stable cash flow characteristics.

Waste Segment (Veolia Slides)

The Energy segment is a service-oriented business that provides local loop management (connecting grids), energy services for buildings and industrial companies.

They operate and maintain heating and cooling networks, and help companies manage the supply of various forms of energy as efficiently as possible. The energy segment also audits companies and buildings, often designing and then installing more efficient energy equipment.

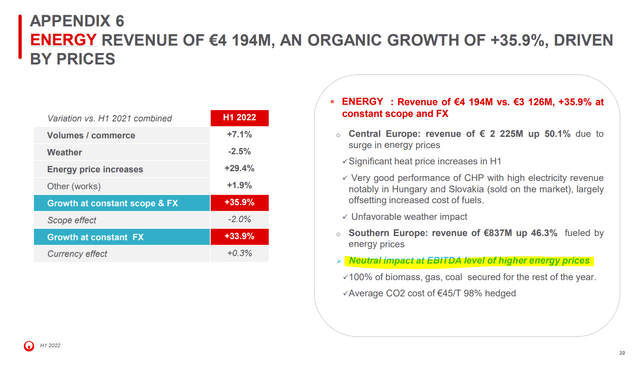

The energy segment grew revenue 12% last year (ex-currency and constant scope, that is proforma for the Suez deal and net of divestitures). Weather can impact demand in this segment. Mostly higher electricity and energy prices are passed through to end users. The company describes Energy as providing mostly heating for municipal customers (for residential consumers). This segment is highly regulated enabling higher input cost pass-throughs. 95% of energy purchases have been secured for 2022 and 70% for 2023.

With energy prices spiking in 2022, Energy showed 36% revenue growth in H1. The impact on EBITDA however was zero. Again, this is all pass-through revenue.

Energy Revenue (Investor Slides)

The company does have contracts that can be cancelled in all segments. Over time renewal rates are high, but contracts can get renegotiated too. The City of Lyon water deal is being recut to a lower EBITDA figure (starting in 2023). Their SEDIF contract expires at the end of 2022 but did get extended by a year. Stellantis has a large contract that was recently renegotiated with Veolia.

As for margins, the company has actively been reducing costs via cost discipline and efficiency gains. Their annual efficiency gain goal is €350 million, of which €178 million was achieved in the first half of 2022.

In 2015, Veolia reported 12% EBITDA margins. Those were 14.6% in the first half of 2022.

M&A History

Veolia has been a buyer of smaller companies in its three lines of business since it IPO’d. Suez SA (SEV FP) was the largest transaction to date, costing Veolia €8.9 billion in equity. The deal started when Veolia purchased Engie’s 29.9% equity stake in Suez in October 2020 (at €15.50 per share). They purchased the bulk of the remaining shares by January 2022 (at €20.50 per share), with Suez de-listed in February (and roughly 5% still outstanding).

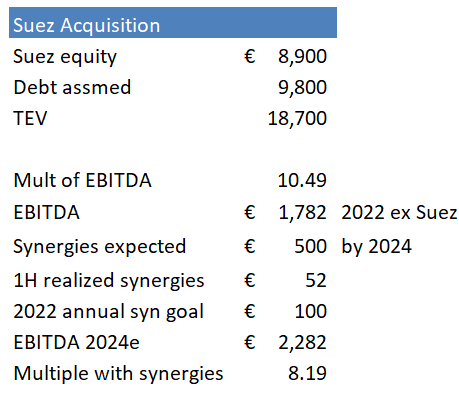

They paid cash and added €9.8 billion in debt to the balance sheet. With revenue of roughly €10 billion and EBITDA of €1.8 billion, Veolia paid about 10.5x EBITDA.

Valuation Suez (Author spreadsheet/company financials)

The assets overall appear quite complementary. Suez has a bigger hazardous waste business, and far more water businesses in the mix (which are less volatile and arguably worth more; but that comes with less growth).

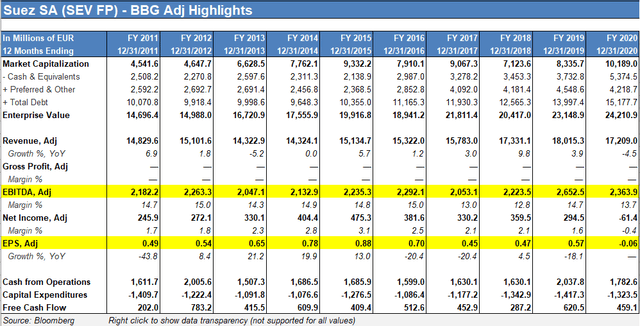

Here are slides detailing Suez’ business segments. Below is annual summary financial data.

Suez Financials (Bloomberg/Financials)

Overall, the deal cuts Veolia’s exposure to the more cyclical energy segment from 21% to 16%. It gains exposure to the more stable/regulated water ops.

To close the merger, Veolia has divested itself of 7 businesses this year. Most recently they sold the UK wastewater business out of Suez for €2.4 billion. Reportedly they are selling it at 14.5x EBITDA.

Taking into consideration all antitrust disposal for the European Commission and the asset disposal that are under process, which total for more than €1.5 billion and the strong H2 free cash flow that will include the working capital reversal and the EBITDA generation, the leverage at year end will be around three times. And after the Suez UK disposal, the leverage ratio will be well below three times EBITDA and will give us balance sheet headroom to fuel our development.”

On a side note, Veolia essentially gave away its Russian business and took an €80 million impairment. Russia/Ukraine represented less than 0.5% of revenue in 2021.

Guidance and Model

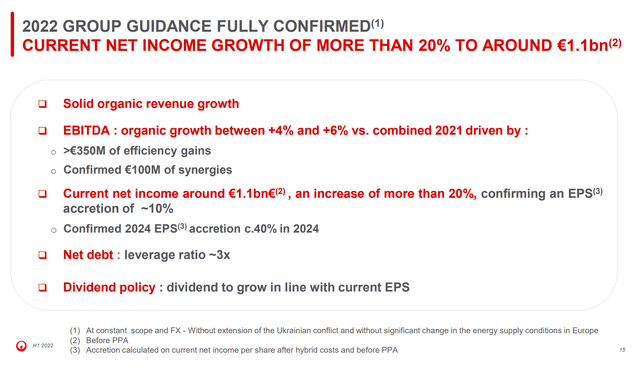

Below the company affirmed its guidance to grow EBITDA 4-6% organically in 2022.

Guidance (Veolia Investor slides)

Longer term, Veolia has guided to 40% EPS accretion in 2024. Off a 2021 base of €1.48 in EPS, a 40% increase implies €2.07 in EPS in 2024. With EPS growing 8.8% over the past 5 years (5.6% over the past 7 years to take the “worst” case), it appears reasonable that with Suez synergies they can grow a little faster (12% annually for a couple years).

Below is our summary model.

Summary Financials (Author spreadsheet/company financials)

Street estimates are a bit higher in 2024, with EPS estimates at €2.22. In 2025 analysts are forecasting $2.50 in EPS.

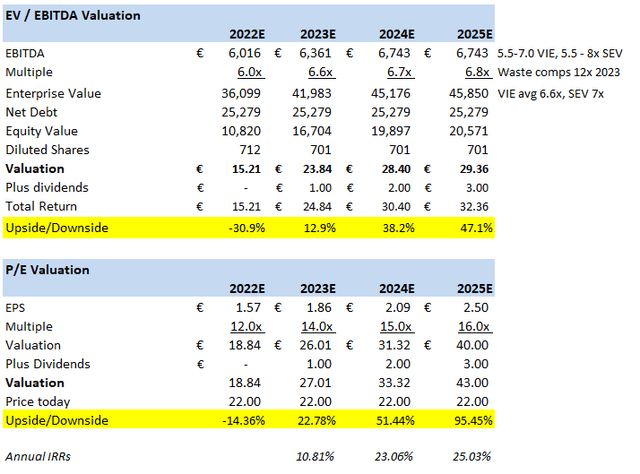

Valuation

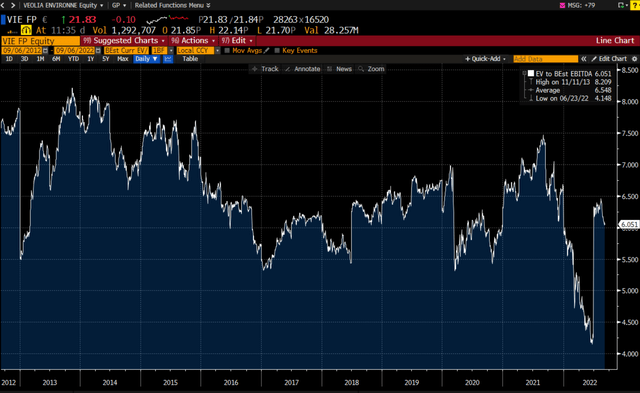

Below is a chart of Veolia’s valuation on an EV/EBITDA basis.

Veolia EV/EBITDA (Bloomberg)

The figures do not appear to factor in the merger fully in the first half of 2022 (as Bloomberg works off TTM debt, but forward EBITDA). But historically we can gauge whereabouts VIE typically trades (5.5-8x EBITDA).

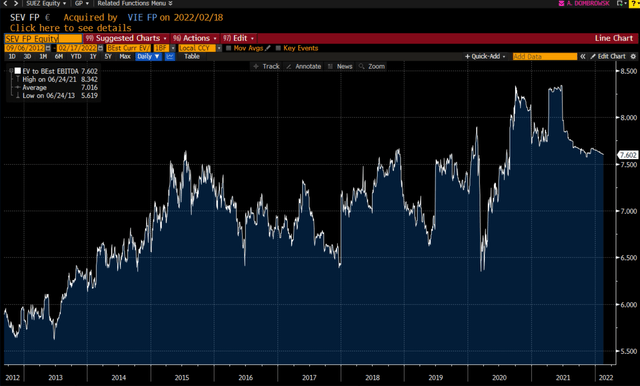

Below is how Suez traded on an EV/EBITDA basis dating back a decade.

SEV EV/EBITDA valuation (Bloomberg)

Similarly, SEV traded between 5.5x at the low to 7.6x. It was taken out at 10.5x and 8x with synergies.

Valuation (Valuation Author spreadsheet)

While we didn’t do a sum of the parts breakdown in detail, we can safely assume that it is much higher than where the stock is trading. If the Waste segment is worth 10x, then that alone implies €25 billion in value. Backing that out means that investors can get the remaining businesses (energy and water) for 4.1x 2023 EBITDA.

Or, on 2023 figures, if Waste is worth 10x and Water and Energy 6x, then we get a $32 valuation on the stock.

Conclusion

The valuation is attractive for Veolia. They operate some valuable businesses (especially waste); inflation is not a material risk for them nor would a recession hurt them too much. We give management kudos for steadily cutting costs and improving margins since 2015.

We do have reservations however. It is a European company, where the energy crisis could impact their customers/future contracts. Tax laws could change too. Recession risks appear far higher than in the US. There is a bit more capital spending at Veolia than many of our capital light recommendations. ROE’s are on the low side, but should be improving.

We’d call this a slow growth Compounder, but wouldn’t necessarily make it a large position given the current valuation and European problems today. But in the teens we would recommend adding more.

The 4.4% yield is juicy, but only paid annually in the summer (next one is June 2023). The ADR is plenty liquid in the US. Also a risk, this stock could trade like a bond given the yield (with pressure as rates rise). But it has tremendous optionality for a re-rating should Europe’s prognosis improve economically.

VEOEY has produced solid 12.8% returns over the past decade, but most of that occurred in the 2012 to 2017 time period. Lately, the stock price has been a disappointment (and why we sense opportunity).

We also are not sure how to assess the new CEO, Estelle Brachlianoff, who is 50 years old with only three months at the helm of Veolia. She joined the company in 2005 and worked her way up to COO by 2018. Overall, the company intends to reduce leverage, so a near term acquisition (typically where mistakes are made) is unlikely.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment