ajansen/E+ via Getty Images

Easterly Government Properties, Inc. (NYSE:DEA) is a real estate investment trust (“REIT”) that generates essentially all their revenue by leasing Class-A commercial properties to U.S. Government (“USG”) agencies that serve essential functions either directly or through the U.S. General Services Administration (“GSA”).

The company has numerous competitive strengths that distinguish them from other owners and operators of office and commercial properties. First, their leases with USG agencies are backed by the full faith and credit of the USG, which is important since the USG has never experienced a financial default to date.

In addition to stable rent payments, their USG leases typically have initial total terms of ten to 20 years with renewals having terms of five to 15 years. The USG’s high propensity to renew further limits the operational risk associated with non-renewals.

And given recent federal budget constraints, it’s more likely than not that the USG will continue growing its leased portfolio of assets as opposed to outright ownership. Even more, for the GSA leases, rents are paid from the Federal Buildings Fund, which are not subject to direct appropriations. This limits their political risks associated with the current polarization in government.

Following their recent earnings release, stocks were recently downgraded to a neutral rating from Compass Point, resulting in a decline of about 6% on the day of the downgrade. YTD, shares are now down over 30%.

Seeking Alpha – YTD Trading Metrics Of DEA

While their portfolio metrics remain impeccable, the company recently announced the sale of ten properties, which appears to have been completed at a valuation lower than where shares traded at the end of the quarter and not too far off from where they trade currently.

The disposition will enable the company to deleverage their balance sheet, thereby providing greater liquidity to capitalize on opportunistic future acquisitions, but the debt load is still on the higher side, and for the time being, the transaction market appears unsettled.

For income investors, shares do offer a reliable dividend payout that is currently yielding over 6.5% at current pricing. Share price upside, however, does appear to be limited in the near-medium term.

Key Portfolio Metrics

Consistent with prior periods, DEA continues to maintain full occupancy levels, 99.3%, to be exact, as of September 30, 2022. In addition to maximized occupancy, the portfolio is also anchored by a weighted average remaining lease term (“WALT”) of 10.5 years. Combined, this results in a continuing source of predictable cash flows to the company.

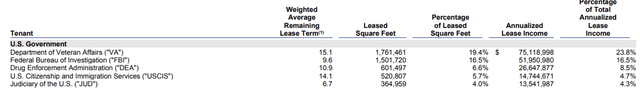

Central to DEA’s business model is their focus on mission-critical U.S. Government agencies. More specifically, there are five distinct agencies that represent nearly 60% of their total annualized lease income. And two of these five, The Department of Veterans Affairs (“VA”) and The Federal Bureau of Investigation (“FBI”), collectively account for 40% of the total themselves.

Q3FY22 Investor Supplement – Partial Summary Of Top Tenants

Leasing Activity

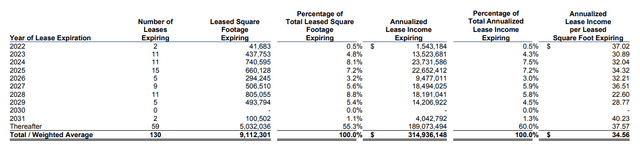

In the current quarter, DEA made notable headway in addressing upcoming expirations over the next year. For 2022, all material leases that were set to expire have been renewed following actions taken in the third quarter that resulted in the renewal of two facilities in Texas and Arkansas for an additional 17 and 20 years, respectively.

Moreover, the renewal in Texas, a drug laboratory used by the Drug Enforcement Administration (“DEA”), came at an annualized lease income per square foot of $54.63, which is well above their current portfolio rate of $33.97. In addition, the new rate is about 15% above prior levels.

Looking ahead to 2023, 11 leases are set to expire, though there are just three significant ones. In total these three leases, the largest being in Chicago, represent nearly 70% of the total square footage set to expire and 3.4% of annualized lease income.

Q3FY22 Investor Supplement – Lease Expiration Schedule

While renewal is no guarantee, it is probable due to the government’s high propensity to renew and the company’s solid track record of retaining their current tenant base.

Acquisitions And Dispositions

The external transaction market continues to be highly uncertain, with price discovery a key challenge between buyers and sellers. While DEA remains active bidders, it was noted that little is expected to get done in the next quarter or two.

Management did, however, express optimism on potentially acquiring properties at attractive prices in later periods from landlords that may come under financial distress due to current market conditions.

And despite the current lull, the company did acquire properties in both their wholly-owned and joint-venture portfolios in the third quarter. Furthermore, and more noteworthy, the company also entered into an agreement subsequent to quarter end to sell ten of their properties for a total price of approximately +$205M.

This is a significant development and one that was a main focal point of the conference call. In total, these ten properties account for about 7.3% of total annualized lease income.

At a forward run rate portfolio net operating income (“NOI”) of +$205.2M, this would represent a disposition cap rate of about 7.3%, which, curiously, is above the implied cap rate of their shares at the end of September 30, 2022. At that time, shares traded at an implied cap of 6.9% based on their forward portfolio NOI and total enterprise value.

The lower valuation on dispositions could partly be explained by the fact that many of the properties were located in more sparsely populated regions of the country, such as Montana and Utah.

In addition, many properties were smaller in size in terms of square footage, with five of the ten properties 35K SF or less.

Management also noted that the properties weren’t “bullseye” properties, which are considered properties that fulfill the right mix of mission criticality, tenant agency representation, and customized building features.

It would come as a surprise, then, that there would be this many properties in the disposition population, since the vast majority of the DEA portfolio is considered to be “bullseye.”

One could, thus, reasonably question whether there are other properties in the portfolio that would command a lower valuation than their share price. One could also ponder whether the company truly got the best deal on the sale or whether they were in more pressing need of liquidity.

Liquidity And Debt Profile

As of September 30, 2022, DEA had total liquidity of nearly +$300M, comprised of cash on hand and remaining availability on their revolving credit facility. In addition, they had +$92.5M in unsettled forward equity.

Moreover, the company is on pace to generate +$138M in full year operating cash flows. There are, therefore, no apparent liquidity issues at present.

Total debt outstanding, however, is elevated. While the overall debt load is less than 50% of their total enterprise value, net debt as a multiple of EBITDA is on the high end, at 7.4x.

As an offset, the company does benefit from a higher percentage of fixed rate holdings, which minimizes their exposure to interest rate risk. In addition, they are afforded adequate cushion on their debt servicing obligations, as interest coverage currently stands at a sufficient 3.7x.

Proceeds from their recent sale are also expected to be used to pay down outstanding debt obligations, which would bring net debt levels to 6.9x.

And notably, floating rate exposure is expected to drop from 14.1% to just 1.3%, which would be a significant reduction and a credit positive that will enable the company to capitalize on new opportunities, while also supporting their stable dividend payout.

Dividend Safety

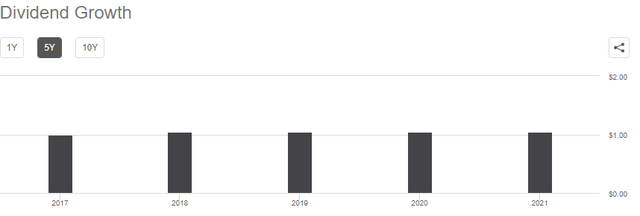

DEA’s current quarterly payout is $0.265/share, which represents an annualized yield of about 6.5% at current pricing. The payment was recently increased 1.9% to its current level in 2021. But growth has otherwise been flat through the years.

Seeking Alpha – DEA Dividend Growth History

At 83% of funds from operations (“FFO”), the dividend is adequately covered, though the payout ratio is slightly elevated compared to the sector median of 65%. In addition, on an adjusted basis, factoring in maintenance expenditures and tenant improvements, the payout is cutting it even closer at 96%, which is uncomfortably high.

Still, the company does generate sufficient operating cash flows to cover their dividend payments by 1.3x. Taken together with coverage from available funds, the payout in its current form appears safe and is even more so now than in prior periods due to the company’s recent disposition activities and subsequent intentions on deleveraging.

Reliable High Yielding Dividend But Limited Share Price Upside Potential

DEA benefits from healthy portfolio metrics with cash flows that are backed by the full faith and credit of the USG, a government that has never defaulted on their financial obligations and one that has a high propensity to renew. Long lease terms and full occupancy levels ensure that the company will have a stable flow of NOI and cash flows for years to come.

Though their debt load is slightly elevated, they maintain adequate coverage levels of their debt servicing costs and have taken significant steps to reduce their exposure risks relating to both repayment and interest.

Furthermore, proceeds from their recently announced dispositions are expected to further deleverage the balance sheet, which will in turn provide ample support to their future growth ambitions and their current dividend payouts.

While the current dividend payout yielding over 6.5% is attractive, the upside in the share price appears limited. Turning back to the dispositions, the agreement appears to have been done at a valuation that was lower than the implied cap rate of the shares at the end of the quarter and not too far off where they stand today.

Granted, the gap wasn’t large, but it did raise the question of whether other properties within the portfolio would be similarly valued if they were to be sold today. At a 7% implied cap rate, shares would be valued at approximately $15.23/share, which is slightly lower than the current share price.

Even at a 6.5% rate, shares would have an implied upside of about 10%, which may not be enough for some investors with higher risk premiums. While the stock remains a solid hold for existing shareholders, it may be of benefit to pass on new positioning in favor of alternative investment options.

Be the first to comment