borchee/E+ via Getty Images

DCP Midstream (NYSE:DCP), based out of Denver headquarters, has become a ten-bagger since we recommended it at less than $4/share in the depths of the COVID-19 induced sell off. Since then, the company has recovered substantially, and in our view the risk of a bankruptcy has long since passed. As we’ll see throughout this article, based on its valuation, the company still has strong return potential.

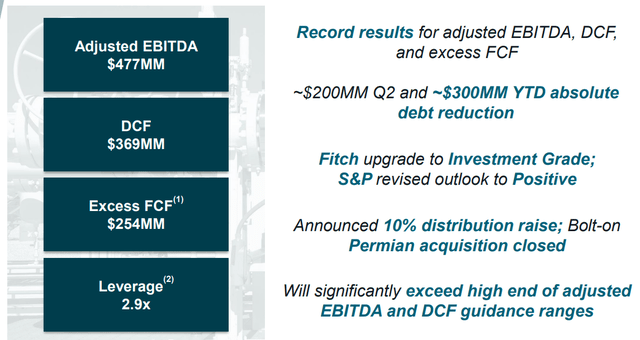

DCP Midstream 2Q 2022 Financial Performance

DCP Midstream had strong financial performance through the quarter.

DCP Midstream Investor Presentation

The company had record results across the board supporting $300 million in YTD debt reduction. The company has managed to move its portfolio towards an investment grade credit rating, announce bolt-on acquisitions, and a 10% dividend raise. The company’s current dividend yield is just over 5% and the company expects to blow its guidance out of the water.

The company’s leverage translates to roughly $4.5 billion in net debt at a 2.9x leverage ratio. With $1 billion in excess FCF annualized post distributions and growth capital, we’d like to see debt paydown continue.

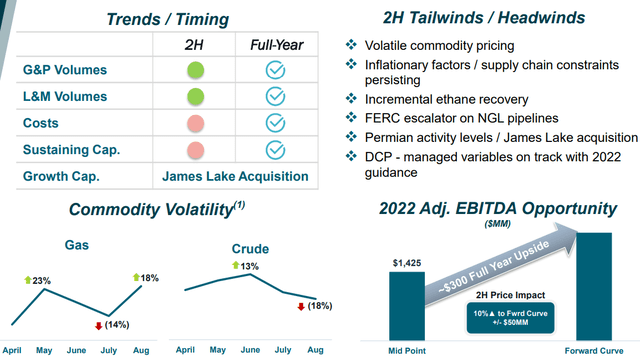

DCP Midstream Guidance

The company’s guidance is for a volatile second half of the year, however, we expect DCF to maintain strong.

DCP Midstream Investor Presentation

The company expects volatility through the remainder of the year. Gas prices have increased recently, while crude prices decreased going into August. The company does see strength in the forward curve from the midpoint of its guidance, with a substantial amount of ability to generate shareholder rewards.

The company’s annualized EBITDA from 2Q 2022 was annualized at $1.8 billion and we expect that to continue growing. That guidance will enable substantial shareholder returns.

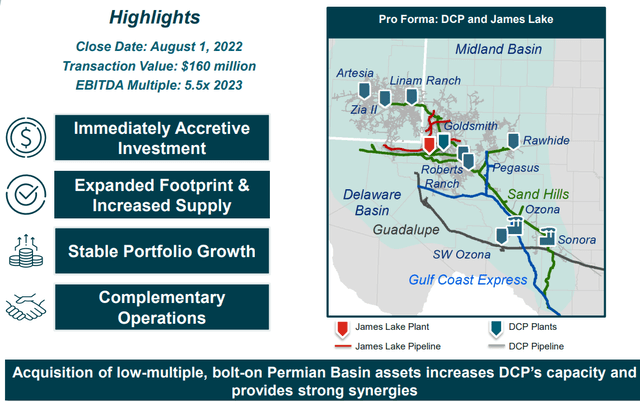

DCP Midstream James Lake

A great move that the company has made was its acquisition of James Lake.

DCP Midstream Investor Presentation

The company’s James Lake transaction close was just over a week ago at a $160 million transaction value. The acquisition is seen as immediately accretive with roughly $30 million in new EBITDA, enough to increase the company’s overall EBITDA by 1.5%. The asset is incredibly well integrated into the company’s existing assets.

We love bolt-on acquisitions. They normally have incredibly strong synergies from when they were operating independently, along with increased cash flow with asset integration. It’s a great way to spend growth capital especially in a market where prices are still slowly recovering.

DCP Midstream Shareholder Returns

Putting this all together, the company has the ability to generate reasonable shareholder returns. The company has a reasonable dividend yield of just over 5% that it can continue paying. The company’s growth capital express is roughly 2-3% that it can continue paying. These two factors together provide high single-digit shareholder returns.

That alone makes the company a valuable investment. However, the company also has a 15% FCF yield on top of all of this. It’s currently using this for debt paydown; however, we’d like to see some share repurchases as well. Regardless of how the company spends this cash, we expect double-digit overall shareholder returns.

Thesis Risk

The largest risk to the thesis is a drop of volumes. The company is incredibly heavily integrated into the Delaware Basin and volumes are expected to continue increasing. However, a change in prices could result in decreasing volumes, which could hurt the company’s ability to provide continued shareholder returns.

Conclusion

DCP Midstream has a unique portfolio of assets and the company has recently used opportunistic growth investments to build on that. The company has a dividend yield of more than 5%, one that it can comfortably afford, and it’s continuing to opportunistically spend in growth capital. That alone helps make the company a valuable investment.

Additionally, the company has roughly $1 billion in additional FCF. The company is currently using that for debt paydowns; however, it can use it for shareholder rewards from a variety of avenues. However, the company spends its money, we see it as a valuable investment for the long run.

Be the first to comment