Dzmitry Dzemidovich/iStock via Getty Images

Tax Loss Selling Basket & Wash Sales

I have recently explained (here and here) my strategy for building a basket of beaten down stocks that are seeing aggressive tax loss selling. Today I’d like to introduce another candidate, this one that’s also seen a downgrade from Goldman Sachs.

But before doing so, let me add one nuance about this strategy. Wash sale rules prohibit recognizing a loss if one re-buys the same security, or options contract for the security, within 30 days of the sale. This means that anyone who actually would still like to own the stock, but first wants to recognize losses he or she has incurred, must wait 30 days after the tax loss sales. This informs my holding period, which is through February of the following year, because there can be buy backs by tax loss sellers from the end of January through the middle of February. By the time February closes, I think the structural aspect of the trade is over.

As I’ll discuss in detail below, DBV Technologies (NASDAQ:DBVT) is a French company focused on improving the lives of patients suffering from food allergies.

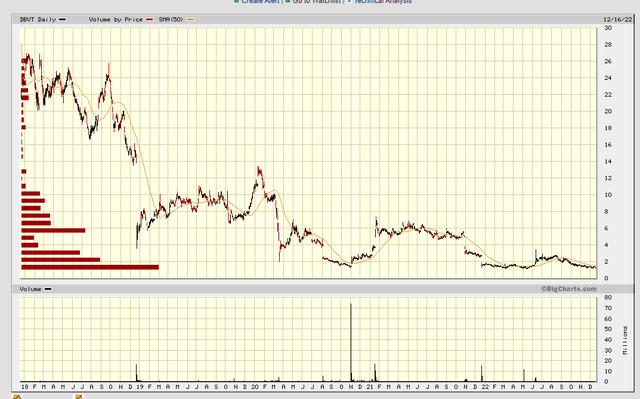

The company’s stock has been declining for a few years now, partially due to a competitor, Aimmune Therapeutics (AIMT), beating DBVT to the punch in peanut allergies. For our purposes this means that most DBVT holders are holding at a loss, and the longer they’ve held the shares, the greater the loss. These are all potential tax loss sellers in my opinion.

bigcharts.com

On the six month chart, we can see what may be the beginning of tax loss selling, though the biggest sell-off bar coincides with a downgrade of the stock.

bigcharts.com

Stock Downgrade

Seeking Alpha summarizes the Goldman Sachs’ downgrade here, including this explanation:

DBV Technologies ADR dropped in the morning hours Friday after Goldman Sachs downgraded the French biotech to Sell from Neutral citing uncertain prospects for its lead candidate Viaskin Peanut, an immunotherapy targeted at peanut allergies.

While VP has the potential to win “meaningful” market share given its favorable dosing profile and less challenging tolerability, the “timing of market entry and regulatory path forward is the key concern for us,” the analysts wrote.

In September, DBV Tech (DBVT) announced that the FDA imposed a partial clinical hold on its Phase 3 clinical trial for VP targeted at children aged 4 – 7 with peanut allergy.

Identifying the issue as “the most recent roadblock to VP’s path forward,” Goldman Sachs opines that the options available to resolve the partial hold will increase development expenses for VP.

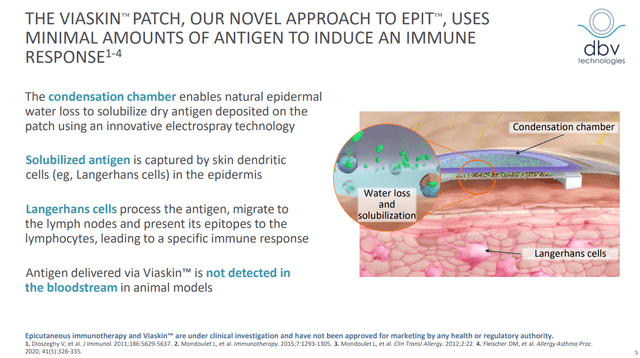

DBV Technologies

DBVT’s core technology is its Viaskin patch which it uses to train the immune system. From the company’s August 2022 corporate presentation:

Corporate presentation

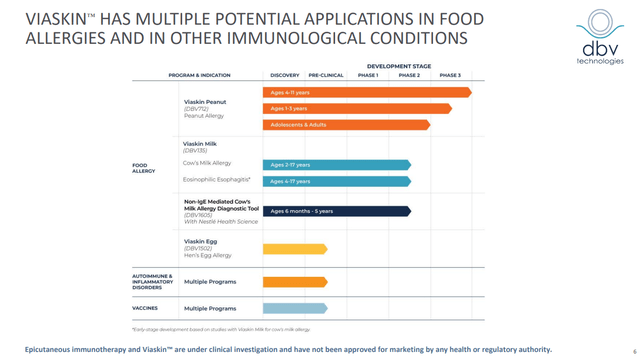

The pipeline currently includes treating peanut, milk and egg allergies.

Corporate presentation

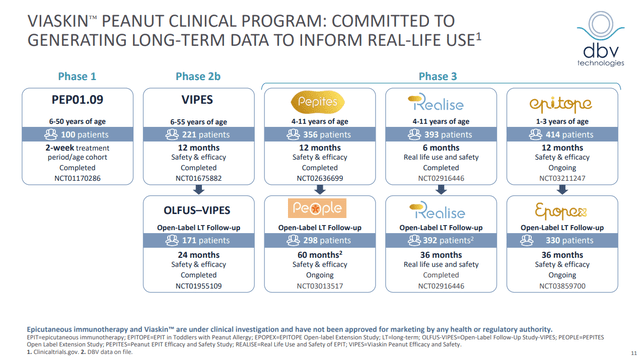

Viaskin is in several Phase III peanut trials for different age groups, those for 4-11 year olds are in the open label follow up phase, while that for 1-3 year olds is ongoing and in follow up concurrently.

Corporate presentation

DVT’s solution also offers a relatively convenient administration:

Corporate presentation

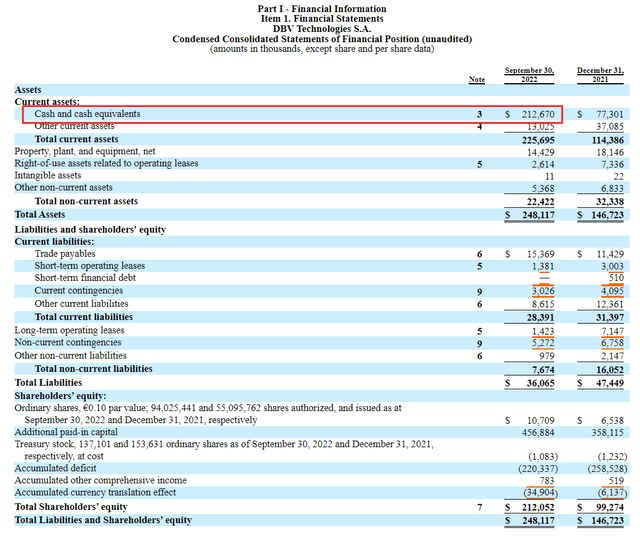

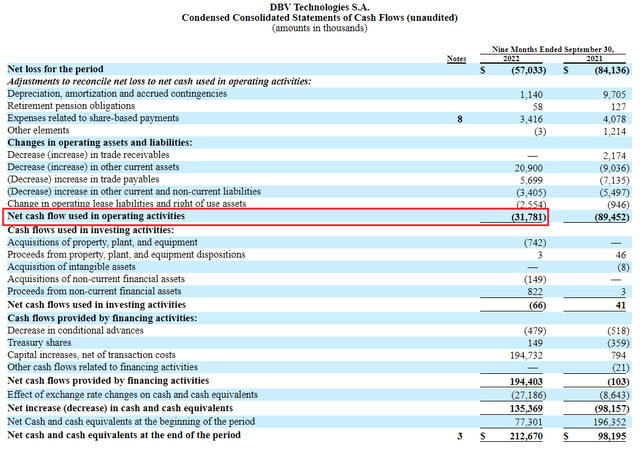

Cash Position

DBVT had $212M in cash available as of September 30, 2022. It burns about $42M a year in cash, so that should be good for a 4 year runway without needing to raise cash (note the cash flow statement below is for nine months, which I’ve extrapolated to 12 months). The company has about 94M shares outstanding, such that it has about $2.25 per share in cash and cash equivalents. Thus when trading below $1 it is trading at less than half of cash on hand.

Both of these facts, in my opinion, reduce the risk of holding DBVT for my multi-month holding period.

sec.gov 10 Q

sec.gov 10 Q

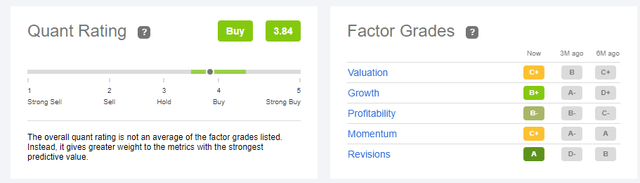

Seeking Alpha Quant Rating

DBVT currently sports a “Buy” rating of 3.84 in Seeking Alpha’s proprietary quant rating system. This too gives confidence for a multi-month buy.

Seeking Alpha

Risks

The risks of buying DBVT are multifold. First, another competitor was first to come out with an approved peanut allergy solution. There is likely room for more than one product here, but AIMT has first mover advantage.

Second, DBVT has, as of yet, no approved products so there is a risk that it never becomes commercial.

Third, the company has seen delays and a trial hold (see the downgrade info above). This too puts a purchase of DBVT at risk.

One offsetting point, however, is that DBVT trades at less than cash on hand, so some bad news is already baked into the stock price in my opinion.

Trading Strategy

I have bought a half position in DBVT and am bidding lower for the other half. I plan to sell in increments if the stock rises and to be fully out of the trade at the latest by mid-March.

Be the first to comment