BalkansCat

Since we initiated our coverage, Holcim’s (HCMLF, OTCPK:HCMLY) stock price has continued to decline. Today, the company released its half-year results, and we hope this is going to be a turning point. In the meantime, and also after the Q1 comment, our internal team was not discouraged, and we increased our investments. As a reminder, our buy case recap was based on a multiple arbitrage opportunity (thanks to Firestone’s acquisition) coupled with higher Keynesian spending (from Governments) and strong company fundamentals.

Half-year Result Comment

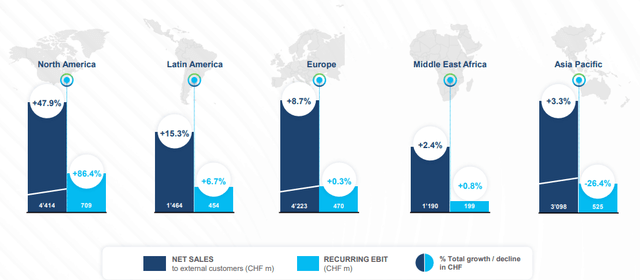

Even if the stock price result was not in line with Mare Evidence Lab’s expectations, the company delivered a strong set of numbers in the first semester, beating analysts’ estimates in almost every line. As a snap, revenue delivered the best performance in Holcim’s history, and going down to the P&L, we appreciated the fact that the company was able to pass through higher energy costs. All the regions (ex-China) contributed to the positive performance.

GEO Performance (Holcim Q2 Results)

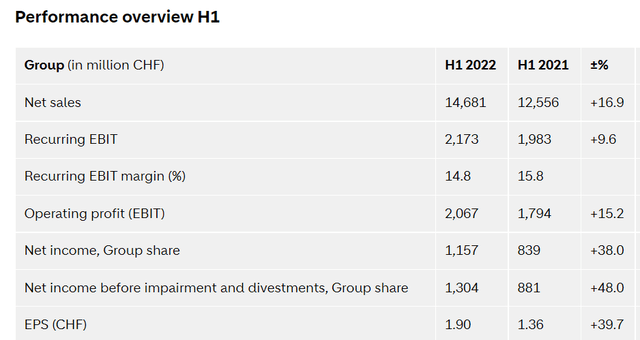

We always appreciated it when a company delivered higher increased results going down to the bottom line. This is exactly what has happened to Holcim’s half-year accounts, where EPS grew at a much higher rate than EBIT as well as compared to the growth achieved by the topline sale.

Holcim H1 Performance (Holcim Q2 Press Release)

During the Q&A call, the CEO remarked the Holcim’s “record results, from net sales to recurring EBIT and earnings per share which are setting solid foundations to deliver our ‘Strategy 2025 – Accelerating Green Growth’. Our roofing and insulation businesses stood out as growth engines, on track to reach pro forma net sales of CHF3.5 billion in 2022. This remarkable achievement gives us the confidence to revise our 2022 guidance.“

Conclusion and Valuation

To sum up and include also the most important events in the quarter, here below our main key takeaways:

- Holcim delivered a strong Q2 performance;

- The company credit rating was upgraded by both S&P and Moody’s to BBB+ and Baa1, respectively;

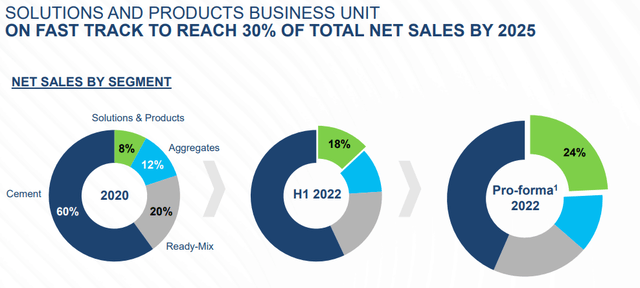

- As expected by Holcim’s Strategy 2025, the solution and product division is currently outperforming management’s expectations. Looking at the numbers, we see that the segment represents 18% of the total revenue line (figure below) and the margin significantly improved;

- After the Q2 results, Holcim increased its 2022 guidance and now expects a topline sales increase of more than 10% compared to the previous guidance of 8%.

Solution and Product Division Performance (Holcim Q2 Results)

Despite the uncertainty related to the macroeconomic events, Holcim is constantly raising the bar. We believe that our thesis still holds, and we are encouraged by the just released company results. We reaffirm our valuation based on a CHF7 billion EBITDA and a multiple of 6.5x, FCF estimates were also confirmed, and we derive a valuation of CHF67 per share, implying a current upside of more than 55%.

Be the first to comment